Comment

Where Do Short Rates Peak?

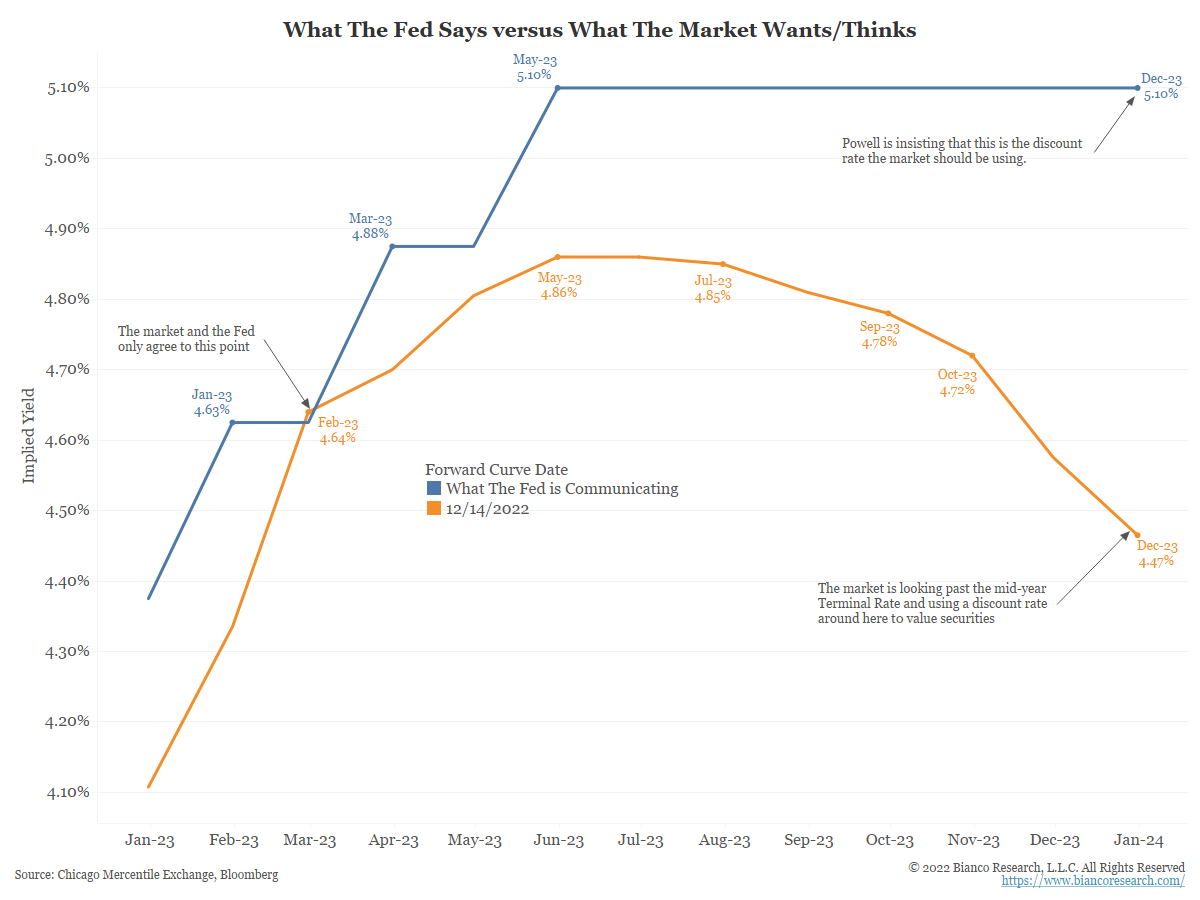

The chart below shows the divergence between what the Fed is communicating (blue) and what the market is pricing in (orange). The Fed is saying the terminal rate will be 5.00% – 5.25%. The market thinks it is closer to 4.86%.

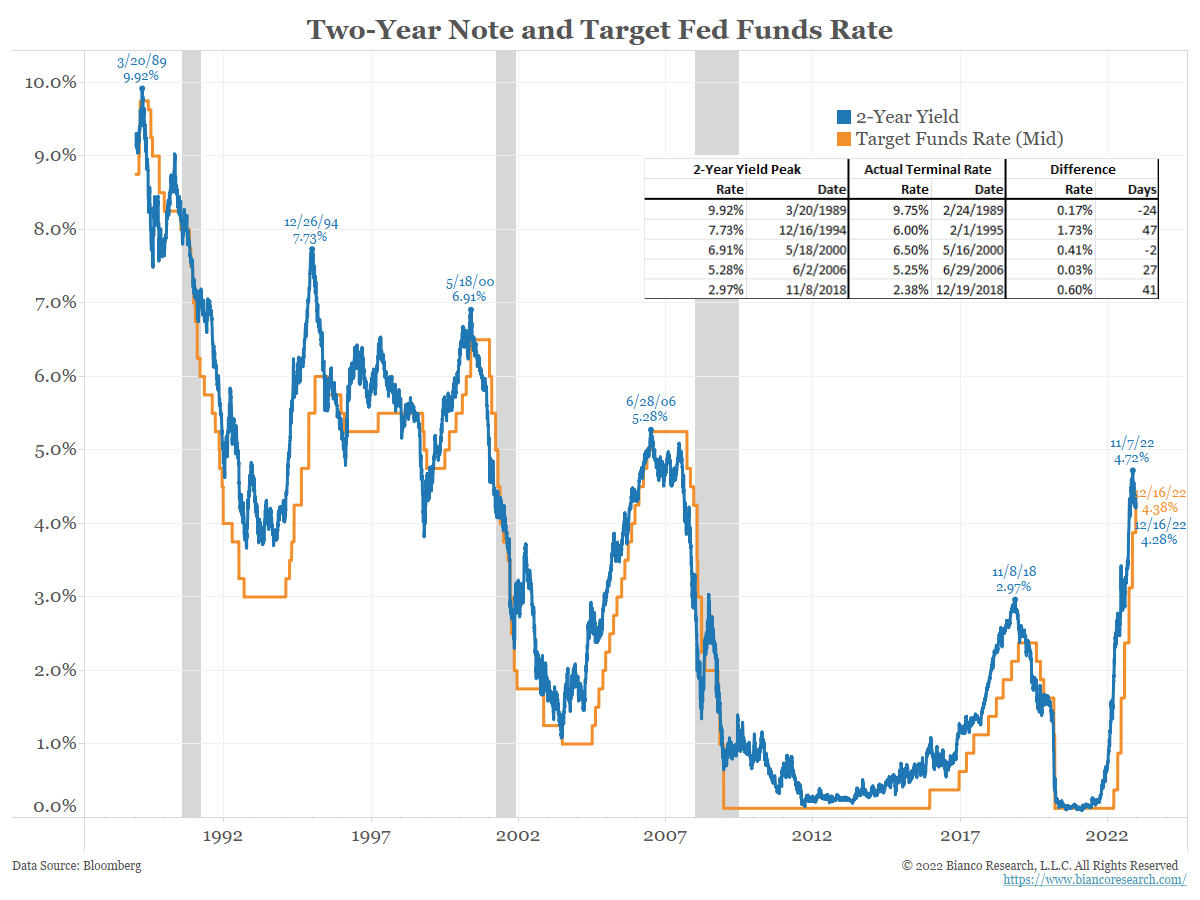

If the Fed is right and they are going to a 5.00% – 5.25% terminal rate, what does that mean for market-based interest rates such as the 2-year note?

The orange line below shows the target funds rate. The blue line shows the 2-year yield.

As the table shows, the last five rate hike cycles ended with the 2-year yield above the terminal fed funds rate. So, if the Fed’s projection of a 5% funds rate is correct, then history suggests the 2-year yield should be higher than this terminal rate, or at least 5.25%.

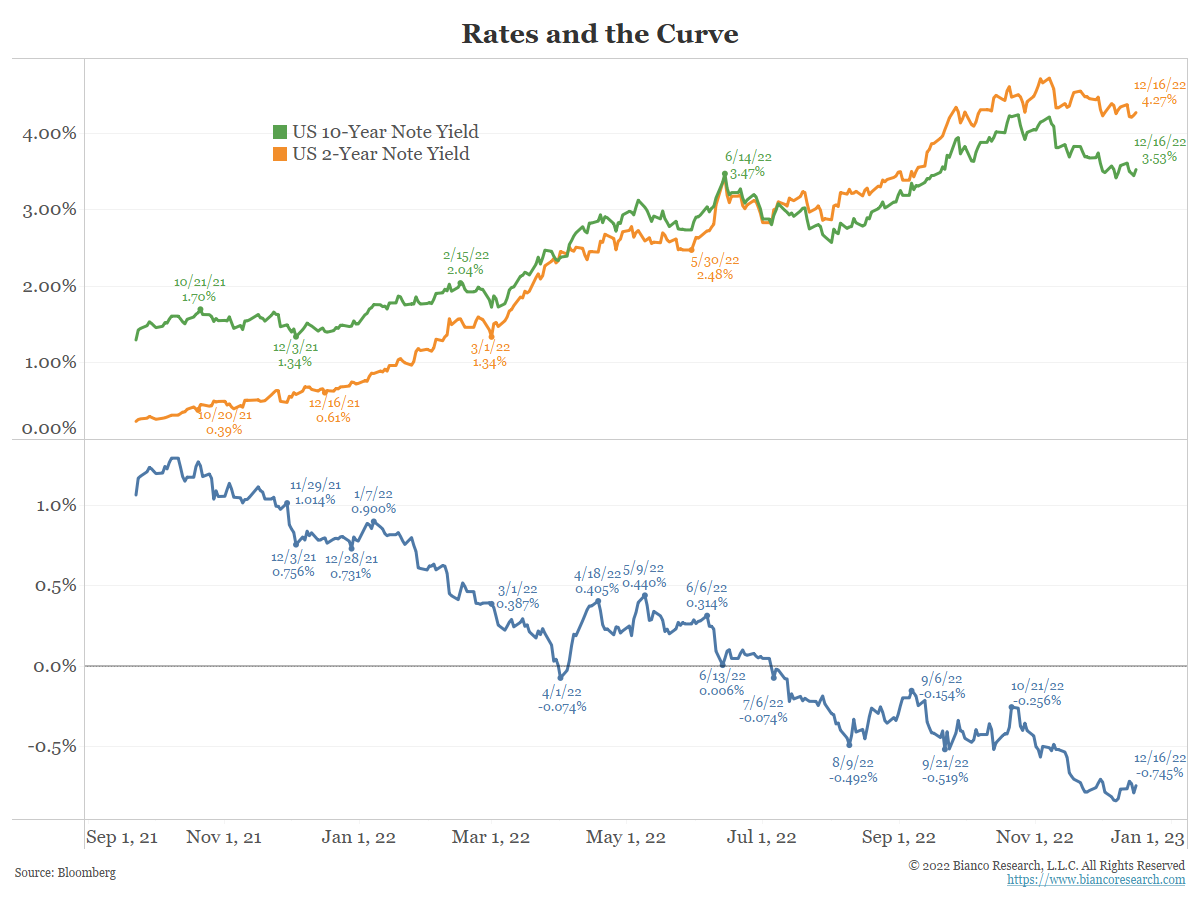

What Does This Mean for Long Rates?

So we look for long and short rates shift higher in parallel as the Fed continues to hike to their 5.00% – 5.25% terminal rate. If one is looking for a target, 2-year yields should reach 5.50% and 10-year yields should hit 4.50% by spring.

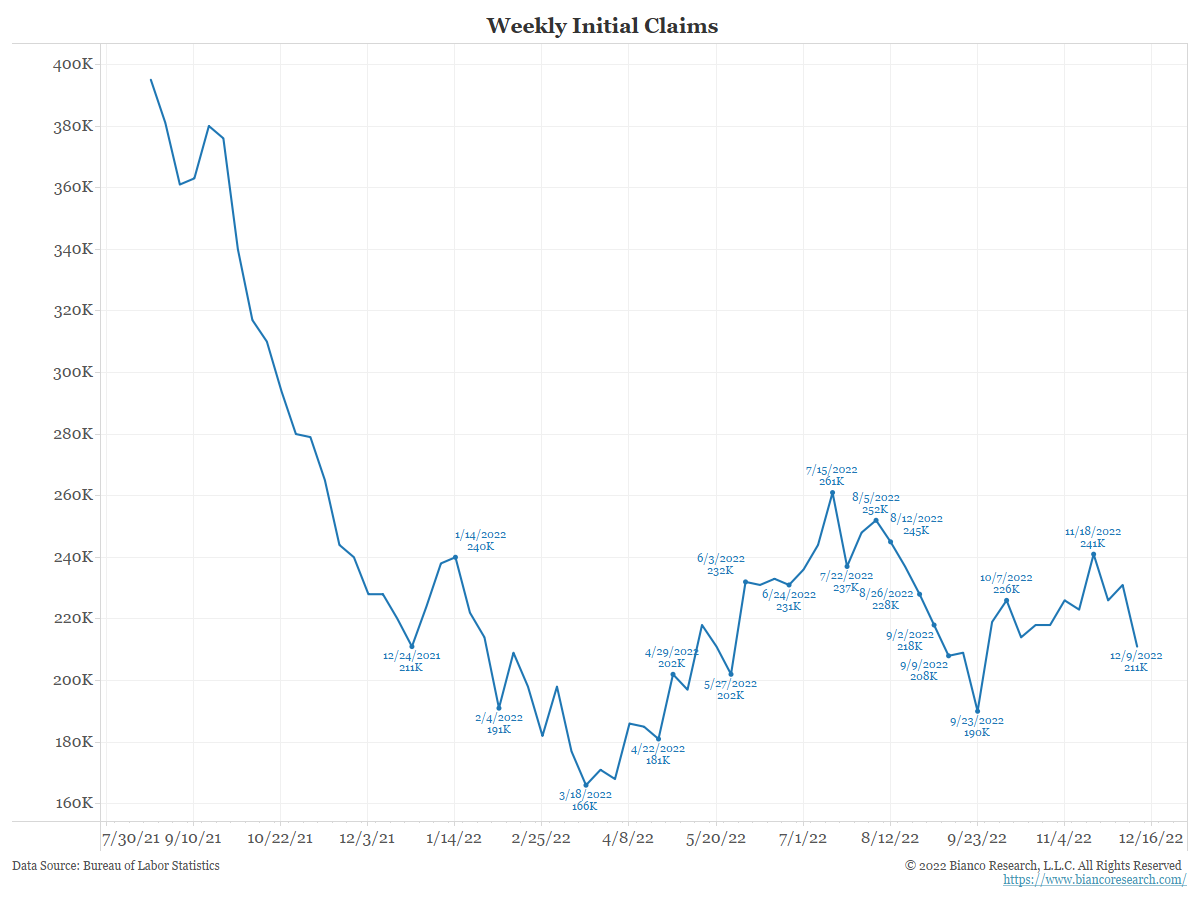

The Economy Is Not Breaking

Conclusion