- FiveThirtyEight – Are We Headed For A Recession Or Not?

Why our usual economic indicators aren’t pointing in a clear direction.

Maybe the lesson is that we’re flying blind, or that our navigation of the economy can only be so precise. No matter the outcome, though, we’ll know in the coming months and years whether our economic engines have made a hard — or soft — landing on the proverbial tarmac.

Summary

Comment

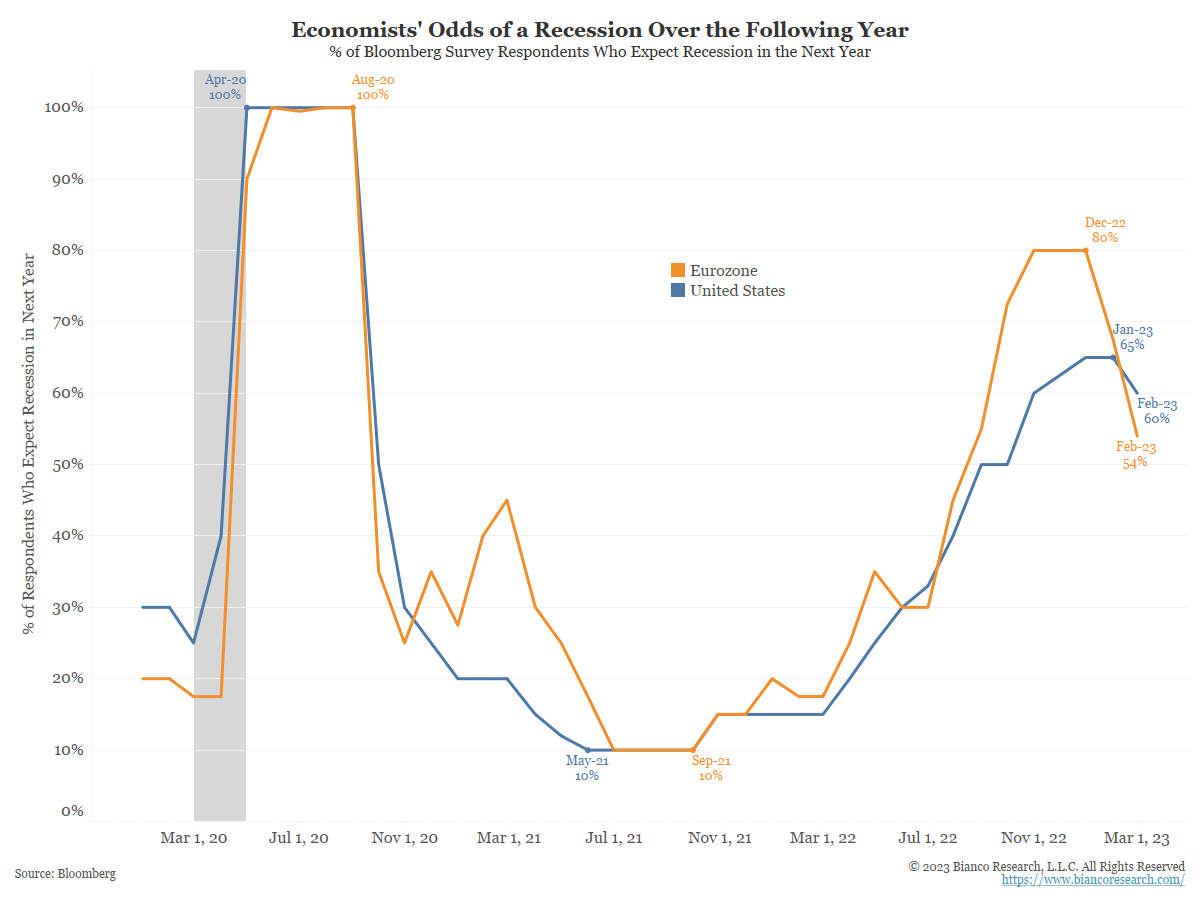

Still Expecting a Recession

Each month Bloomberg asks economists to assign a probability an economy will see a recession in the ensuing year. The median forecast for each month is shown below. While expectations for a recession are falling, odds are still above 50%.

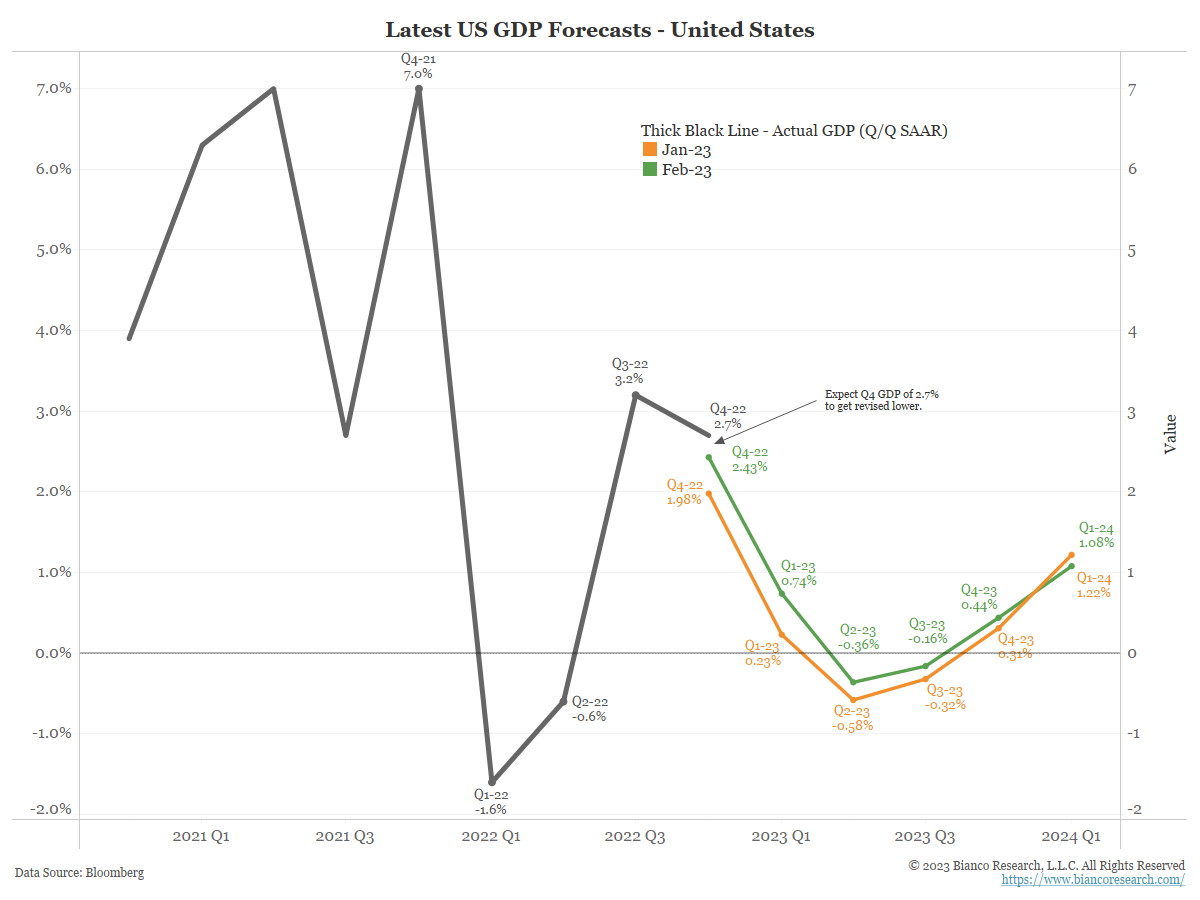

A look at GDP forecasts offers further detail on economic expectations. Economists believe Q1 GDP will come in lower than Q4 and that Q2 and Q3 GDP will be negative.

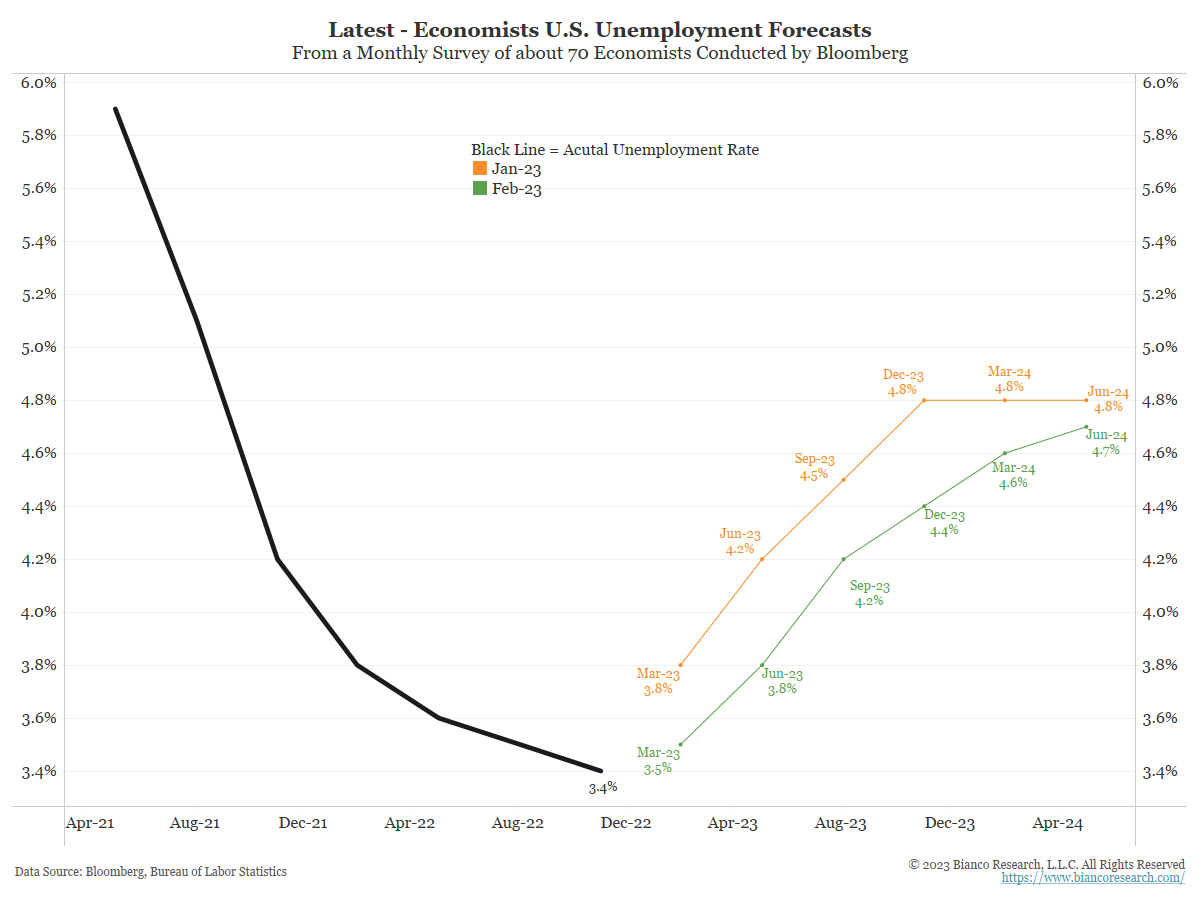

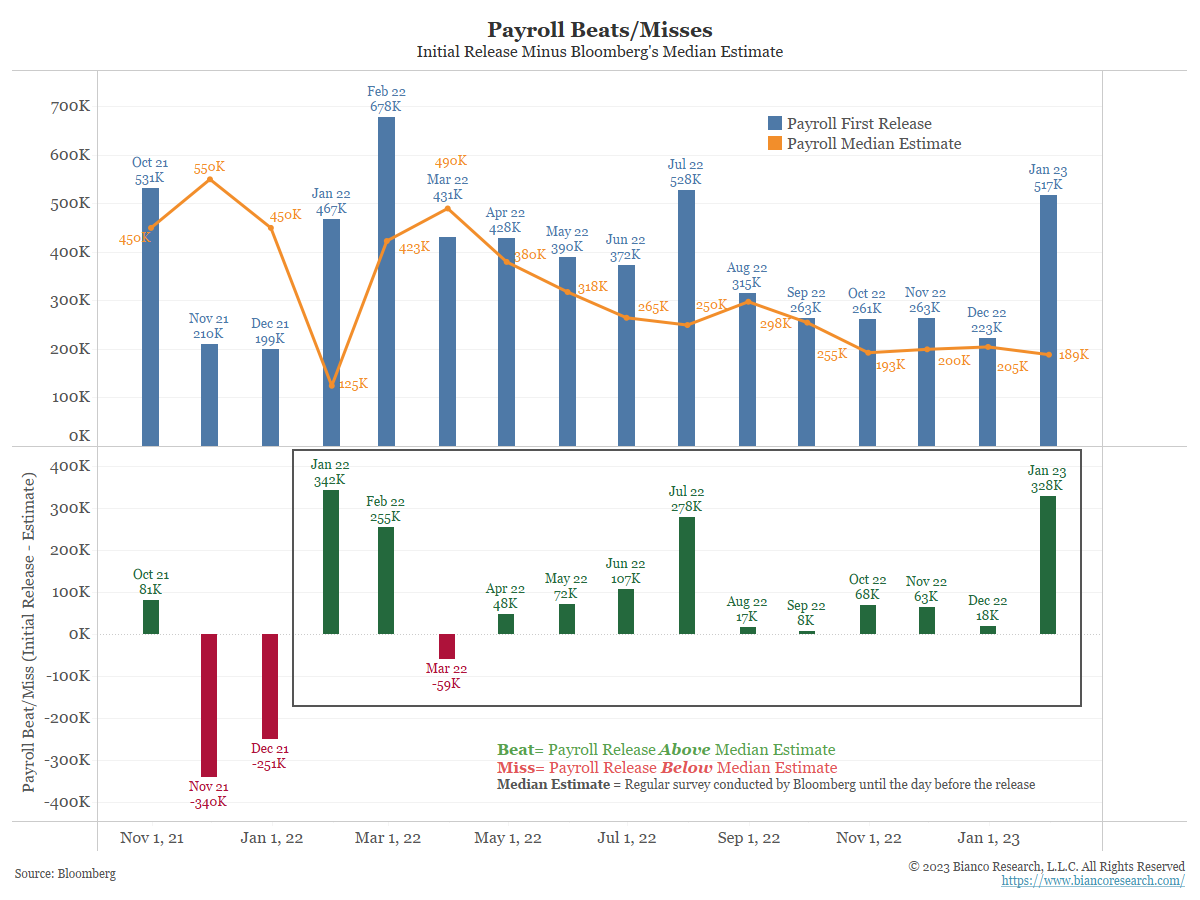

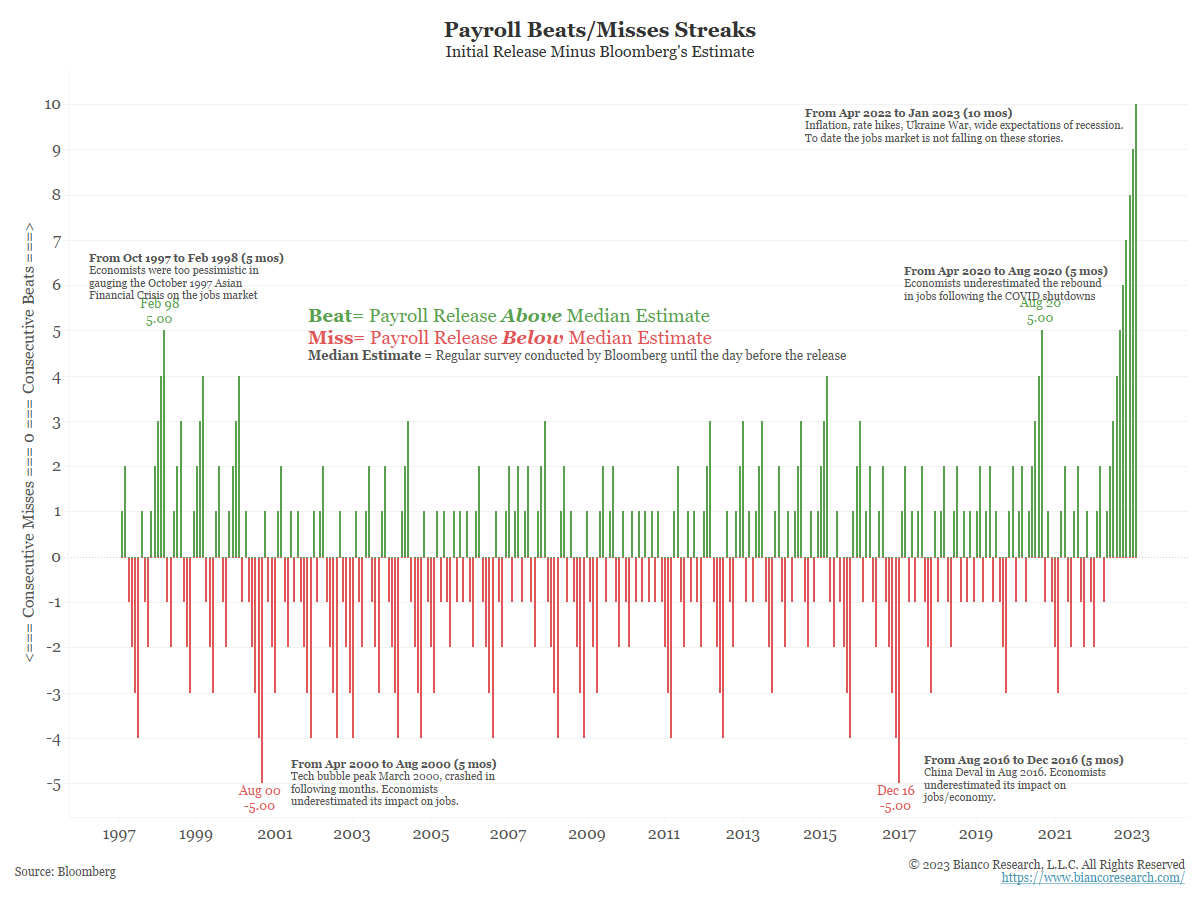

It is worth noting economists have consistently underestimated the labor market over the past year. Nonfarm payrolls beat expectations in 12 of the past 13 months and the past ten months in a row.

The consensus is getting their forecasts wrong in the same direction every month. This suggests they are missing something about the labor market. But instead of trying to figure out what that is, they remain undeterred and continue to forecast an immediate and significant rise in unemployment, starting almost immediately.

Inflation Is Really Transitory

On the inflation front, the consensus continues to do what they have done throughout the entire post-Covid period, completely missing the rise in inflation.

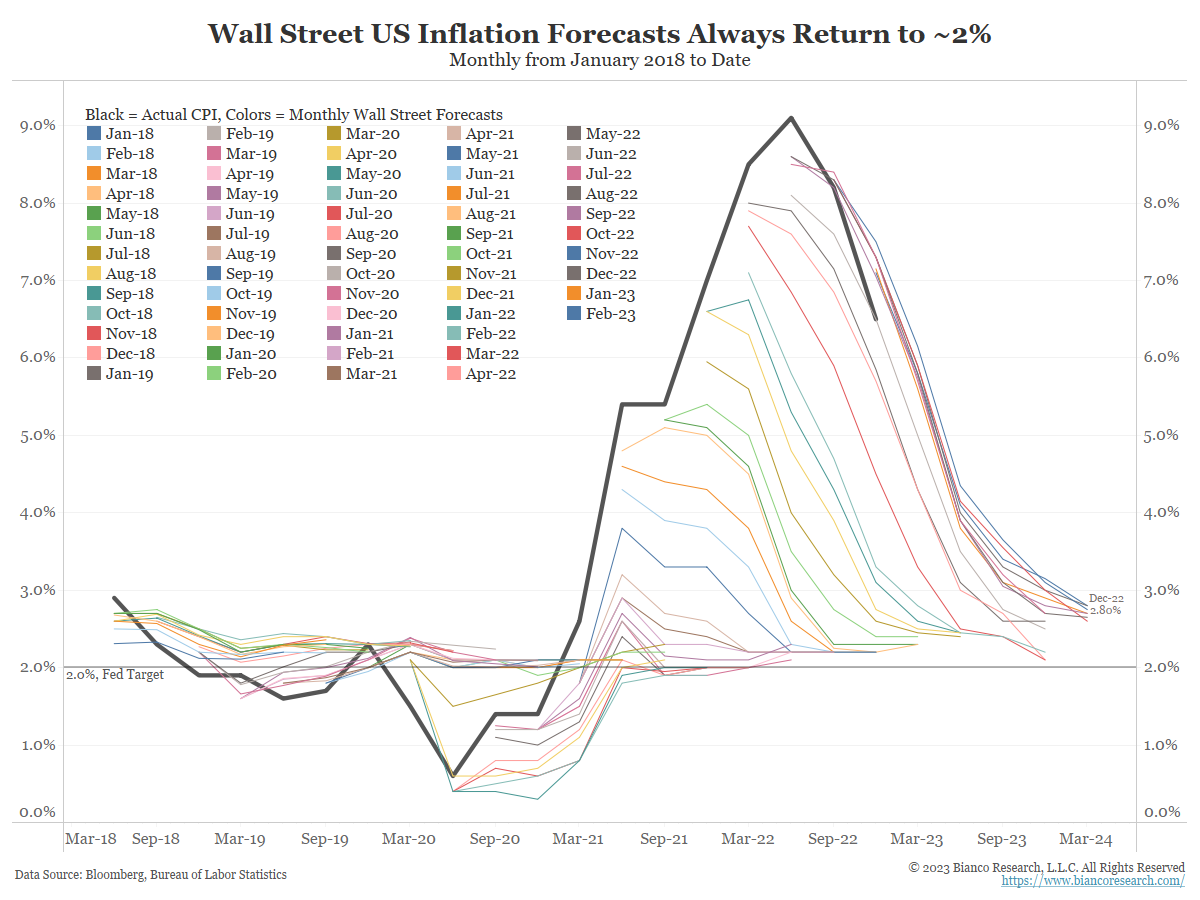

The black line in the next chart shows actual inflation. The various colored lines are the monthly forecasts of inflation back to January 2018.

The story has been the same. Economists always expect inflation to peak immediately and return to the long-run rate of 2% soon.

This was the forecast when inflation first lifted off 2% in late 2020. It was the forecast every month until it peaked at 9% in 2022. It remained the forecast every month since the peak.

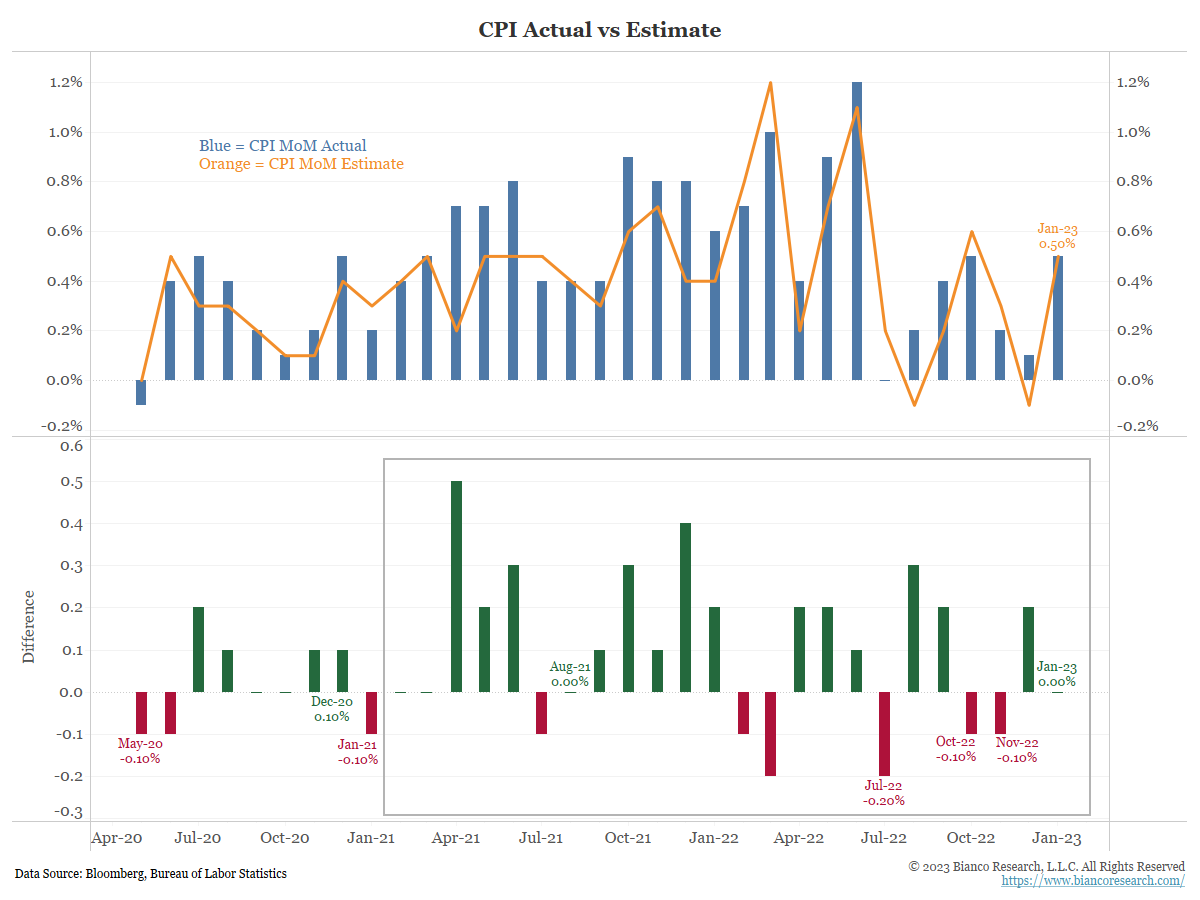

This consistent error is also evident in monthly inflation forecasts. The rectangle in the bottom panel of the chart below shows that monthly CPI has matched or beaten the consensus in 18 of the last 24 months. It has missed in just six of the last 24 months (red bars).

Much like the payroll report, the forecasting errors are consistently in the same direction, suggesting economists are missing something.

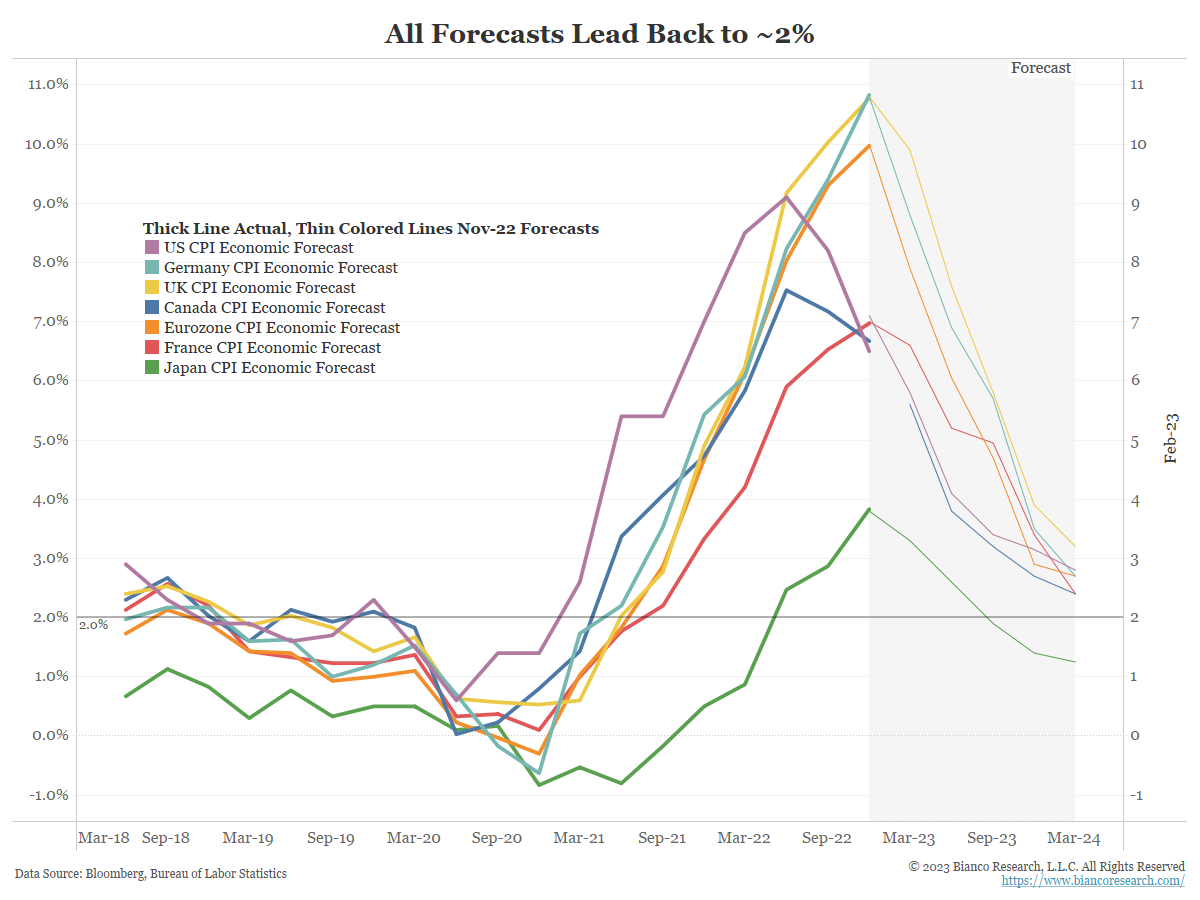

Finally, as the next chart shows, the view is much the same globally. Inflation is expected to return to 2% soon.

So, what is the consensus missing?

Regular readers should be familiar with our view that we are in a post-pandemic economy. As we explained last month:

The Covid shutdown/restart will define the economy for a generation, if not longer. Like most pandemics throughout history, it changed behavior/culture. It mostly did so by speeding up trends that were already in place.

We do not profess we know how the post-Covid economy works. However, applying 2019’s rules to this labor market/economy is not working because we had a history-defining event in a Covid shutdown/restart. Things have changed.

We ended the five-day office work week! That alone should tell you this is a really big deal.

We laid out our case for persistent inflation in a podcast/commentary in September:

Inflation was held down by four “bubbles” – cheap labor, cheap goods, cheap energy and better technology. The three “cheap bubbles” have burst and technology alone cannot offset the loss of the other three. This means persistently high inflation going forward.

We also pointed out why the Fed needs to be aggressive with Fed policy in another podcast/commentary:

This suggests the era of cheap labor is over, with new record low unemployment giving way to higher wage growth and booming wage growth to switch jobs (orange). The pillar of low and stable inflation, around 2%, cheap labor, can be questioned.

But note these are our arguments, not the Federal Reserve. The Fed does not argue for or against these ideas. Instead, they avoid the long-term issue altogether.

Simply put, we believe too many economists are hanging onto a pre-pandemic view of the world. The world has changed. Using the same rules from 2019 is leading many astray.