- The Atlanta Journal-Constitution – ‘New restaurant world’ begins Monday

Gov. Brian Kemp issued guidelines April 23 for restaurants to resume dine-in service on Monday, forging ahead with his plan to ease coronavirus restrictions and reopen some businesses. The majority of metro Atlanta restaurant owners are not expected to open doors to on-premise dining as early as Monday, but some have stated that they will forge ahead, using Kemp’s latest executive order to guide them. … Kemp’s latest order requires restaurants to adhere to 39 guidelines, including screening employees for signs of illness, requiring all staffers to wear face coverings at all times, and limiting capacity to no more than 10 patrons per 500 square feet. Party sizes at tables are limited to no more than six. - The Associated Press – Masks, temperature checks mark ‘new normal’ at restaurants

Restaurants in Georgia and Tennessee and Anchorage, Alaska, welcomed diners back, albeit for a different dine-in experience than before the pandemic forced restaurants to close or limit their services to take-out and delivery. In Louisiana, the governor said restaurants will be allowed to seat people outside starting Friday, though without wait service at the tables. In Georgia, dine-in service and movie screenings were allowed to resume a few days after some other businesses, including barbershops, gyms, tattoo shops and nail salons, began seeing customers Friday.

- Atlanta Inn Town – State health commissioner admits Georgia didn’t meet criteria for reopening businesses

State Department of Health Commissioner Dr. Kathleen Toomey admitted that Georgia did not meet all the federal guidelines for reopening businesses and restaurants during a press conference held by Gov. Brian Kemp at the Capitol this afternoon, April 27. - The New York Times – ‘I Am Beyond Disturbed’: Internal Dissent as States Reopen Despite Virus

Several mayors and employers have asked residents to ignore the Georgia governor’s declaration that some businesses can resume operation while the coronavirus lingers.

The decision by Gov. Brian Kemp to begin restarting Georgia’s economy drew swift rebukes on Tuesday from mayors, public health experts and some business owners, with skeptics arguing that the plan might amplify another wave of coronavirus outbreaks.

“That could be setting us back,” Dr. Anthony S. Fauci, the director of the National Institute of Allergy and Infectious Diseases, said in an interview on Tuesday, referring to Georgia and other states planning to reopen in coming days. “It certainly isn’t going to be helpful.”

Summary

Comment

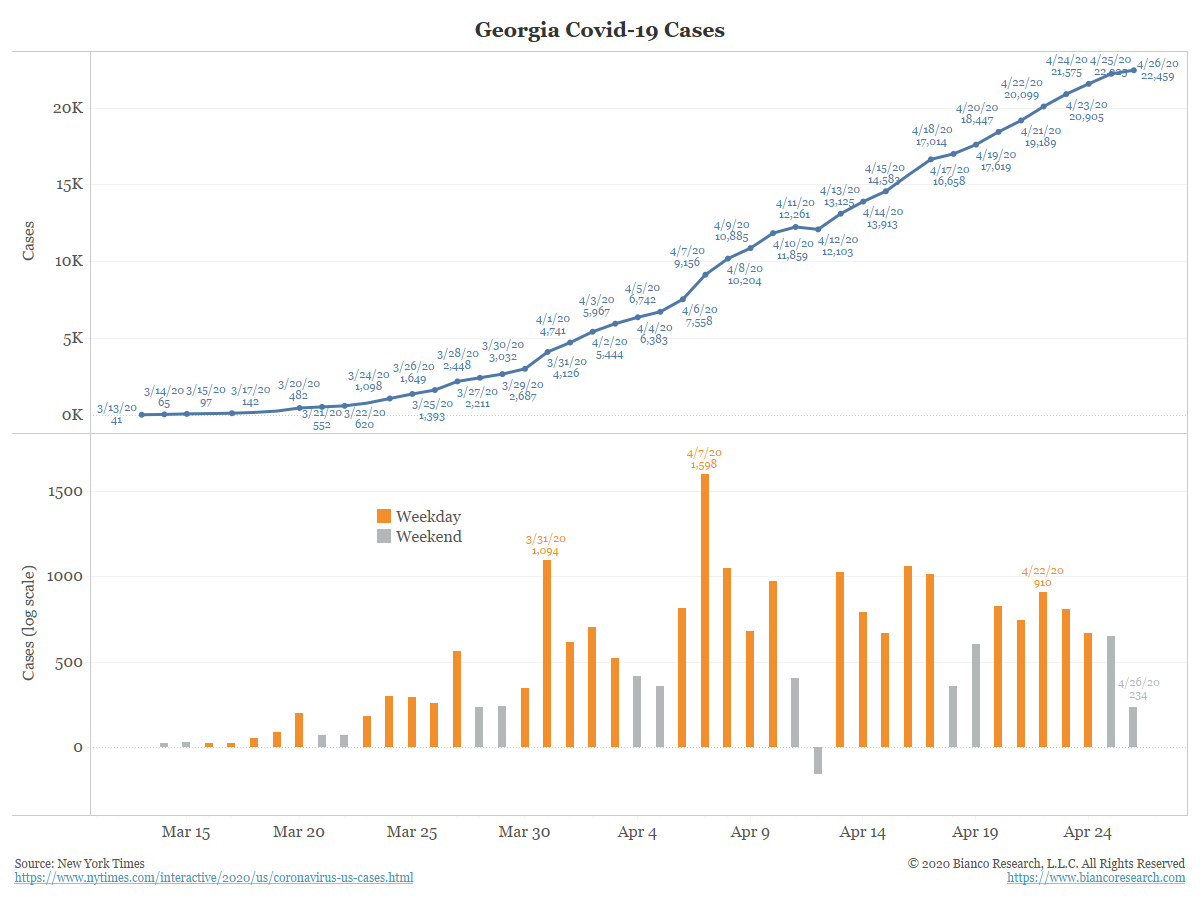

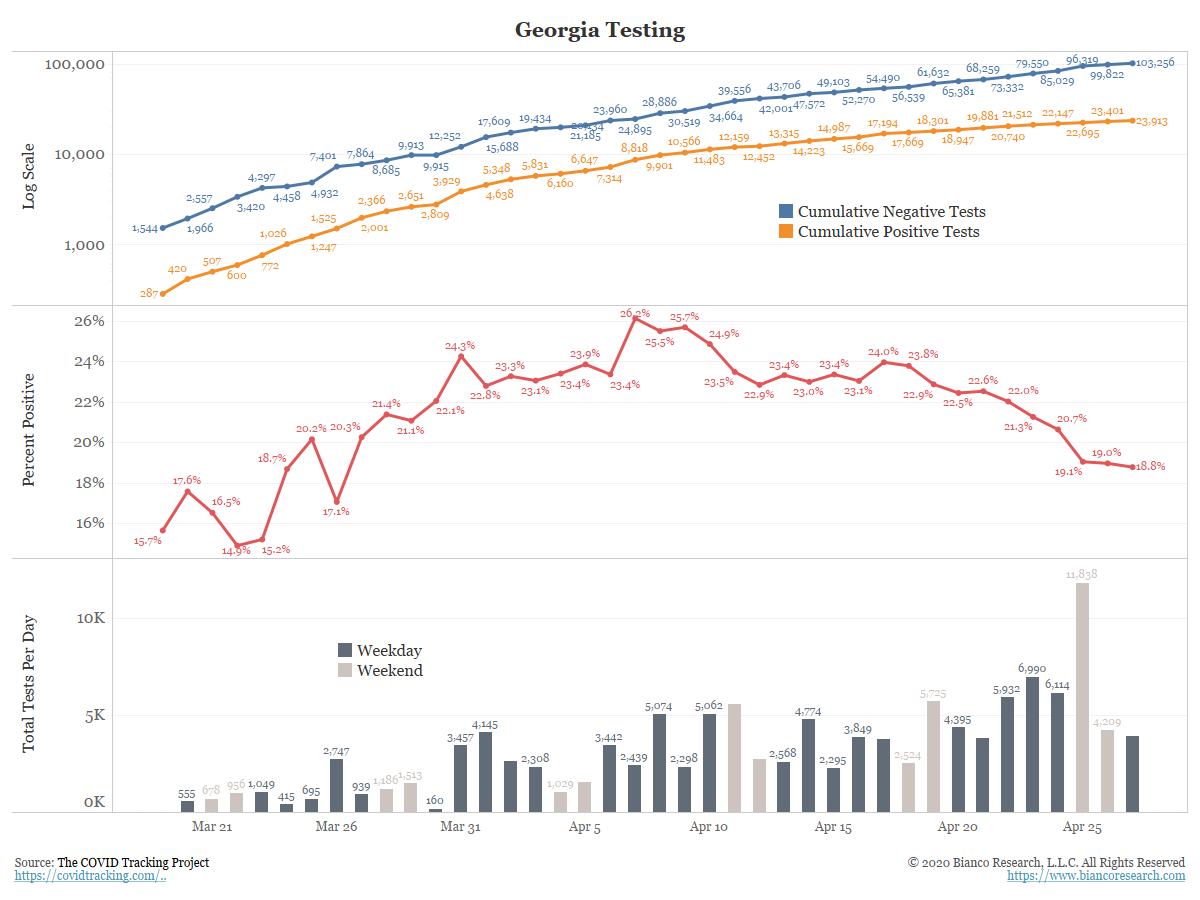

Nevertheless, businesses in Georgia are reopening. How do we measure this?

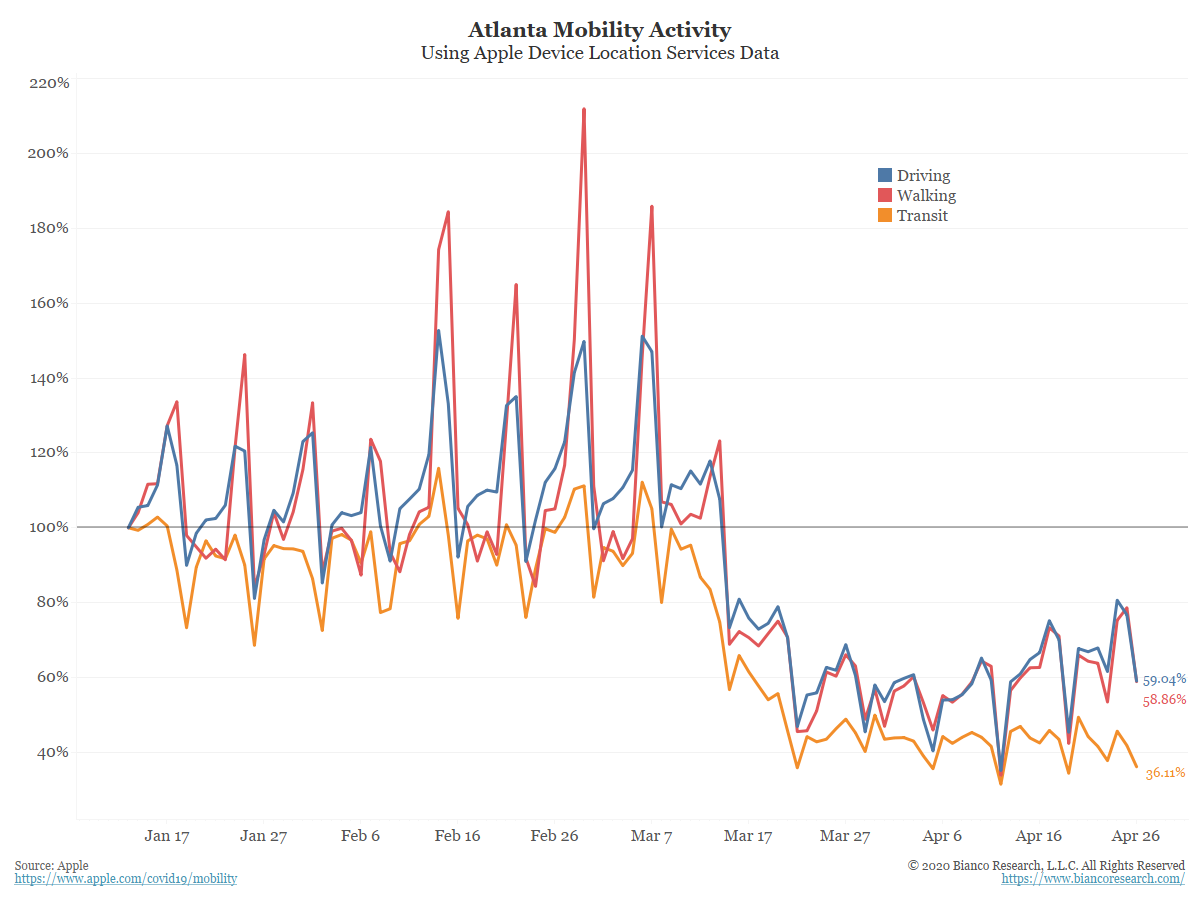

One way is to look at mobility. Apple now provides mobility data based on the movement of its devices from location data services. It is updated every day and broken down into driving, mass transit, and walking. The data is offered on a global level all the way down to a county level (sadly, China is missing from this data set).

Below is the mobility data for the state of Georgia. Going into this reopening, mobility activity is running about 60% of the pre-virus data.

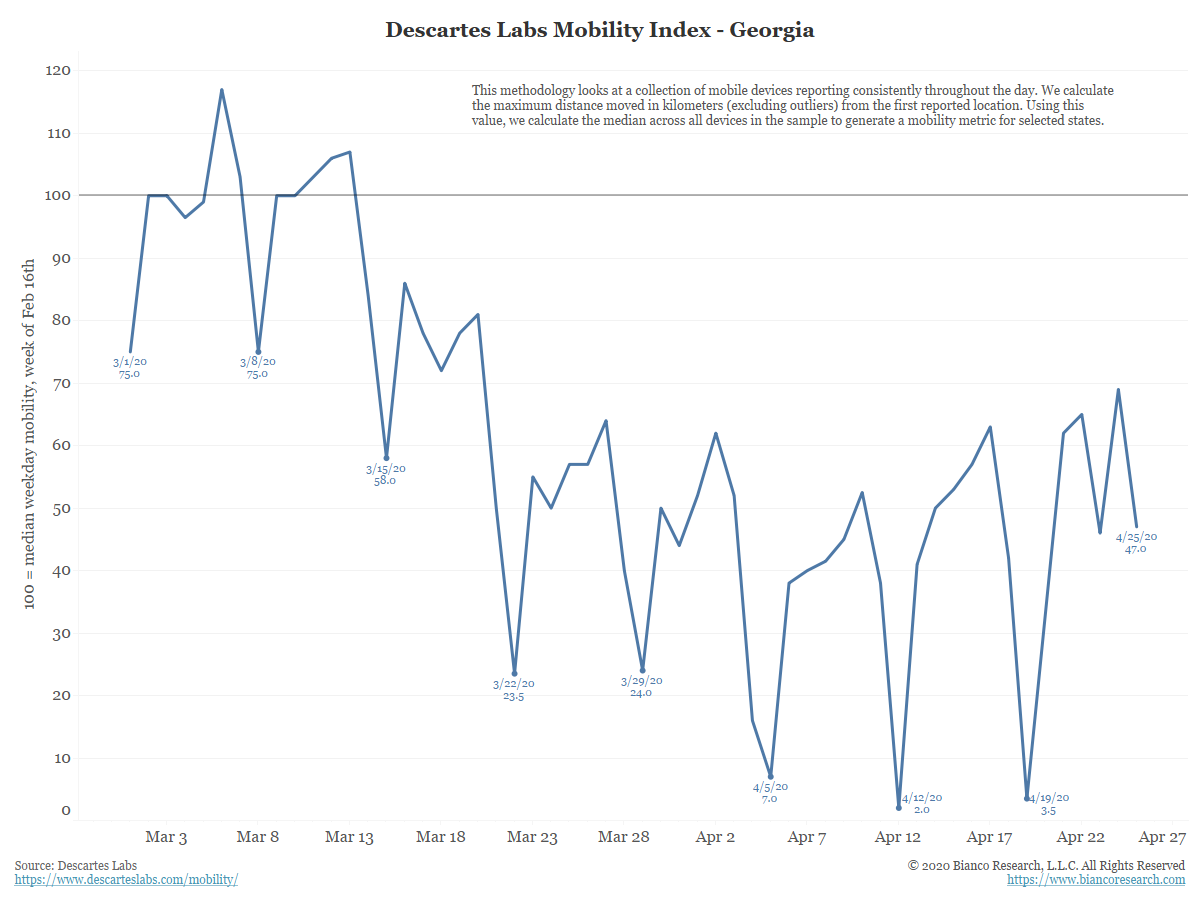

Similarly, Descartes Labs has collected location data services data from several mobile providers. They calculate a mobility index by giving a mobile device a starting point every morning, measuring the maximum distance a person gets from that point each day. They index the data versus a pre-shut day, February 16. This data is only offered for the U.S., broken down by county.

Note that mobility typically falls on weekends (highlighted dates) as people stay closer to home.

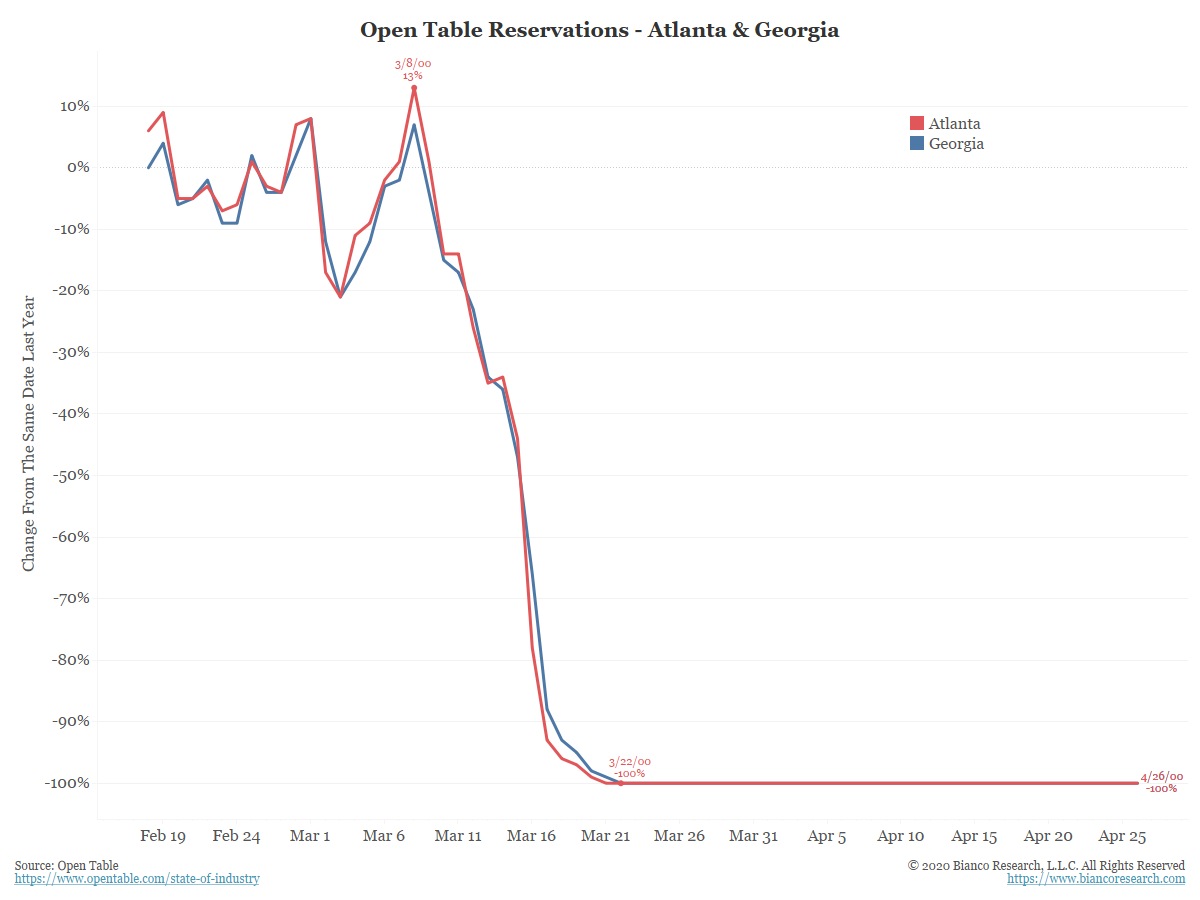

Another measure that will be worth monitoring is OpenTable reservation data. The chart below measures restaurant reservations being made versus levels from one year ago.

With the economy shut down, OpenTable is taking no reservation, so it reports -100%. As Georgia/Atlanta starts to reopen, this should offer a window to how much their economy is returning to “normal.”

What Should We Expect?

The inclination may be to proclaim, “we’re back!” at the first uptick in mobility or restaurant reservations.

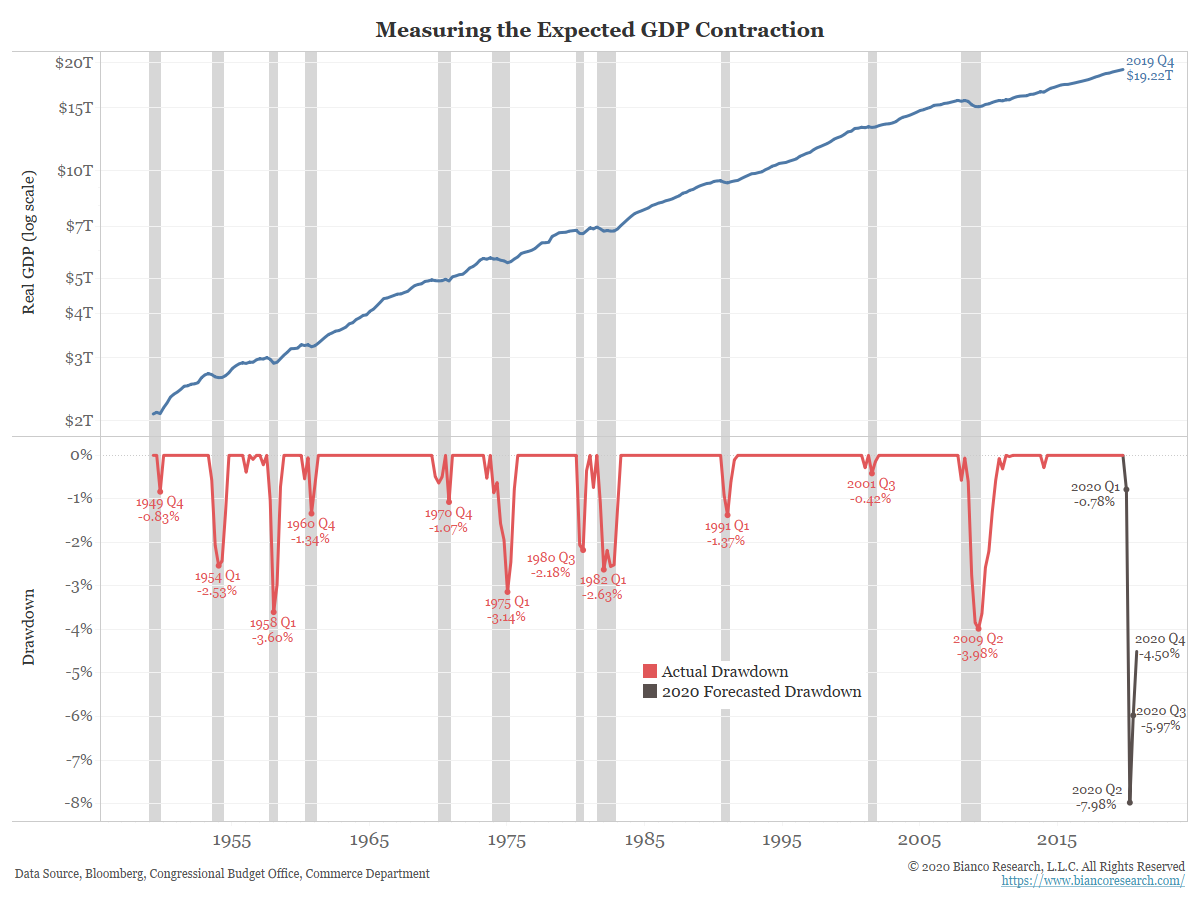

The chart below shows real GDP back to World War 2. The red line (bottom) is the drawdown in economic activity during recessions. Note that the worst post-WW2 recession was the last one from 2007 to 2009. At its worst point the economy, on an after-inflation basis, contracted only 4%. Or, we managed to hold on to 96% of real economic activity. Yet that was enough to create a bad recession, a 56% correction in the stock market, social unrest (Tea Party, Occupy Wall Street) and heightened political polarization.

The black line shows what is expected based on consensus Wall Street forecasts. At its worst point, Q2 2020, the economy is expected to contract 8%, or twice as much as the worst point in 2009. It is expected to finish the year 4% off its peak.

Conclusion

The mobility and reservation measures above are high-frequency data that can tell us a lot about the economy as businesses re-open. But these are not direct economic measures.

The GDP data needs to get back 96% of pre-virus economic data to avoid a recession on the order of the Great Recession. We would argue to do this, mobility and reservations need to return to nearly 100% of pre-virus activity. If they rebound to 80% of pre-virus data, this will not be enough to avoid a bad contraction.

The question is not whether businesses will ever open again. The more important question will be, “how close will the economy get to pre-virus levels?” Watch the high-frequency data above to gauge expectations.