Summary

Comment

- Bull Flattener = Falling rates and a flattening yield curve. This means the two-year yield is falling slower than the ten-year yield.

- Bull Steepener = Falling rates and a steepening yield curve. This means the ten-year yield is falling slower than the two-year yield.

- Bear Flattener = Rising rates and a flattening yield curve. This means the two-year yield is rising faster than the ten-year yield.

- Bear Steepener = Rising rates and a steepening yield curve. This means the ten-year yield is rising faster than the two-year yield.

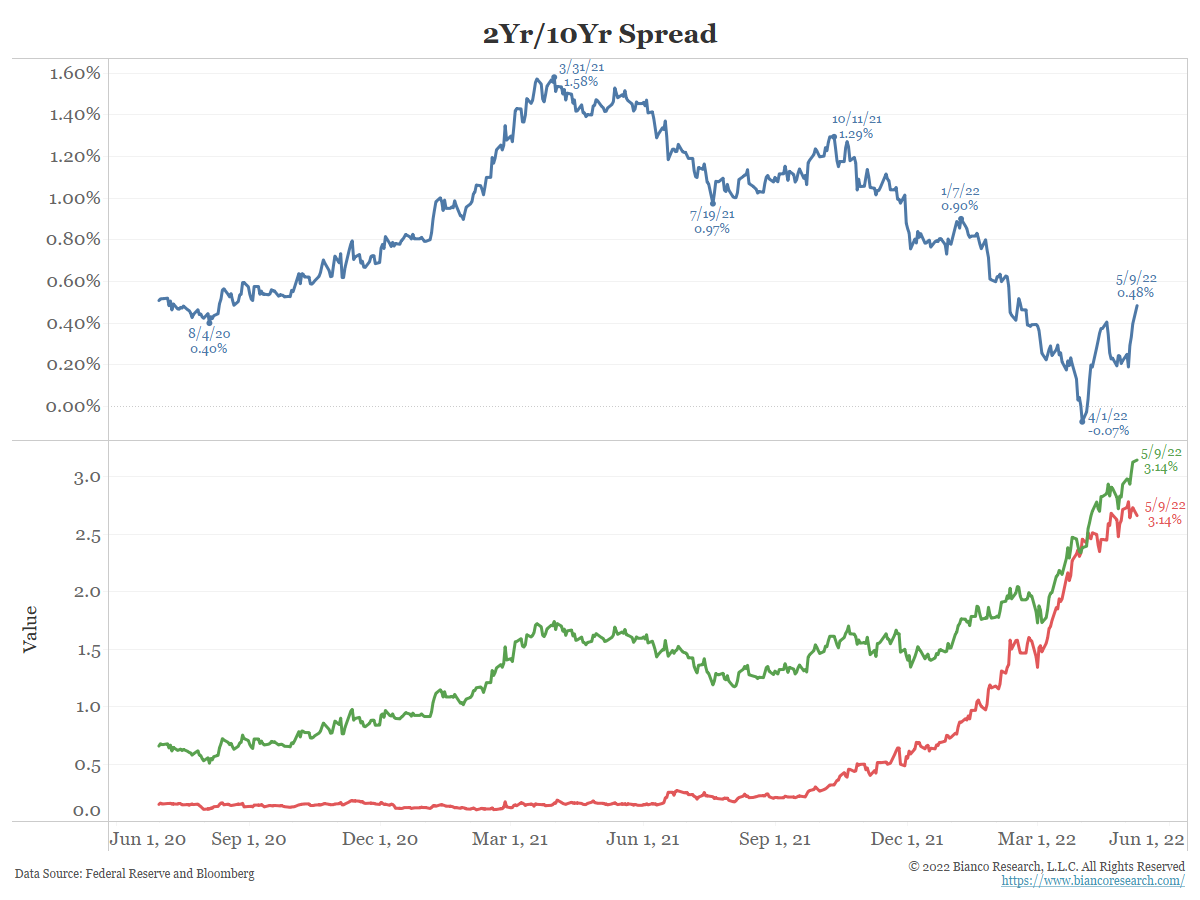

Since early April, the bond market has been in a bear steepener. After briefly inverting for a few days in early April, the yield curve has been steepening as yields have risen nearly 75 basis points.

What is the bear steepener telling us? To answer this, we have to put the yield curve into economic perspective. To be clear, these rules apply right now, in this cycle. The same cannot be said of past environments.

Regarding the Bull/Bear trend on interest rates:

- If the market thought inflation was under control, rates would be falling as this belief would attract bond buyers.

- If the market was unsure whether inflation was under control, yields would be rising as deeply negative real rates (inflation well above nominal rates) would motivate bond selling.

Regarding the Flateener/Steepener trend of the yield curve.

- If the Fed was on top of inflation, short rates would be rising faster, flattening the yield curve. Rising short rates would signal confidence an aggressive Fed would hike rates enough to get a handle on inflation. Long rates would not rise as much in the hope inflation was peaking.

- If the Fed was behind the curve, and the market lost confidence in the Fed’s ability to rein in inflation, long rates would rise faster as bond investors would abandon these securities until positive real yields (long rates above inflation) returned.

So, what does the bear steepener tell us? Bluntly, the market does not believe inflation is peaking and it does not believe the Fed has a handle on it. In other words, the Fed is behind the curve.

Why might the market feel this way? The Fed is sending inconsistent/mixed messages, threatening their credibility. The following passage shows Jay Powell’s opening paragraph at last week’s presser:

This sounds hawkish and we should see the curve flatten as Jay Powell is suggesting they will get aggressive. But then he contradicted his initial statement:

- The Federal Reserve – Transcript of Chair Powell’s Press Conference, May 4, 2022

So 75 basis point increase is not something the committee is actively considering. What we are doing is we raised 50 basis points today. And we said that, again, assuming that economic and financial conditions evolve in ways that are consistent with our expectations, there’s a broad sense on the committee that additional 50 basis increases should be on, 50 basis points should be on the table for the next couple of meetings.

- Bloomberg – Fed Officials Defend Policies, Say Forward Guidance Is Working

Waller, Bullard say Fed guidance has had a substantial impact

Barkin declines to take 75 basis-point hike off the table

“Credible forward guidance means market interest rates have increased substantially in advance of tangible Fed action,” Bullard said in remarks prepared for a conference organized by the Hoover Institution at Stanford University. “This provides another definition of ‘behind the curve,’ and the Fed is not as far behind based on this definition.”

As we stated above, we see higher rates as a sign the market is worried about the Fed being behind the curve, not that forward guidance is working.

Then Minneapolis Fed president Neel Kashkari insinuated inflation will fall back to 2% without the need for much monetary policy intervention.

- CNBC – Fed’s Neel Kashkari confident inflation can come down, but not without some pain

* Minneapolis Fed President Neel Kashkari said Monday he’s confident inflation will come back to the central bank’s 2% target.

* He said he underestimated how persistent price increases would be and said rate increases to tame inflation will hurt low-income people.Acknowledging that he was on “team transitory” in believing that surging prices wouldn’t last, he said persistent supply-demand imbalances have generated the highest inflation levels in more than 40 years. While the Fed’s monetary policy tools can help tamp down demand, they can’t do much to get supply to keep up. “I’m confident we are going to get inflation back down to our 2% target,” he told CNBC’s “Squawk Box” in a live interview. “But I am not yet confident on how much of that burden we’re going to have to carry vs. getting help from the supply side.”

- Bloomberg – Fed’s Barkin Declines to Take 75 Basis-Point Hike Off Table

Comments in MNI interview about potential jumbo-sized move

Kashkari says rates may need to rise above neutral level

- Bloomberg – Fed’s Bostic Says No Need to Move Faster Than Half-Point Hikes

Bostic: 50 basis points ‘is already a pretty aggressive move’

Atlanta Fed chief sees move to neutral range, then assessing

“I really think we need to be getting somewhere into the neutral range,” Bostic said, referring to a policy that neither stimulates nor contracts the economy. “For me I am looking at somewhere between 2-2.5% as our neutral range. Then let’s wait and see what’s happening.”

Conclusion

Fed officials are all over the place in their opinions on monetary policy, calling into question the FOMC’s resolve and credibility in fighting inflation.

This is the message of the bear steepener.