- The Financial Times – Year-end repo rates surge despite Fed’s efforts to ease the strain

The cost of borrowing cash overnight on the last day of the year has surged despite the Federal Reserve’s injection of billions of dollars into markets in an attempt to ease strains, raising concerns that investors may be in for a volatile final few weeks of 2019. The so-called repo rate paid by investors to borrow cash overnight in exchange for Treasuries and other high-quality collateral rose to 3.95 percent on Thursday, for pre-agreed contracts kicking in on December 31. That is up from just over 3 percent a month ago, according to data provided by Curvature Securities, and well in excess of the current overnight repo rate of around 1.6 percent.

Summary

Comment

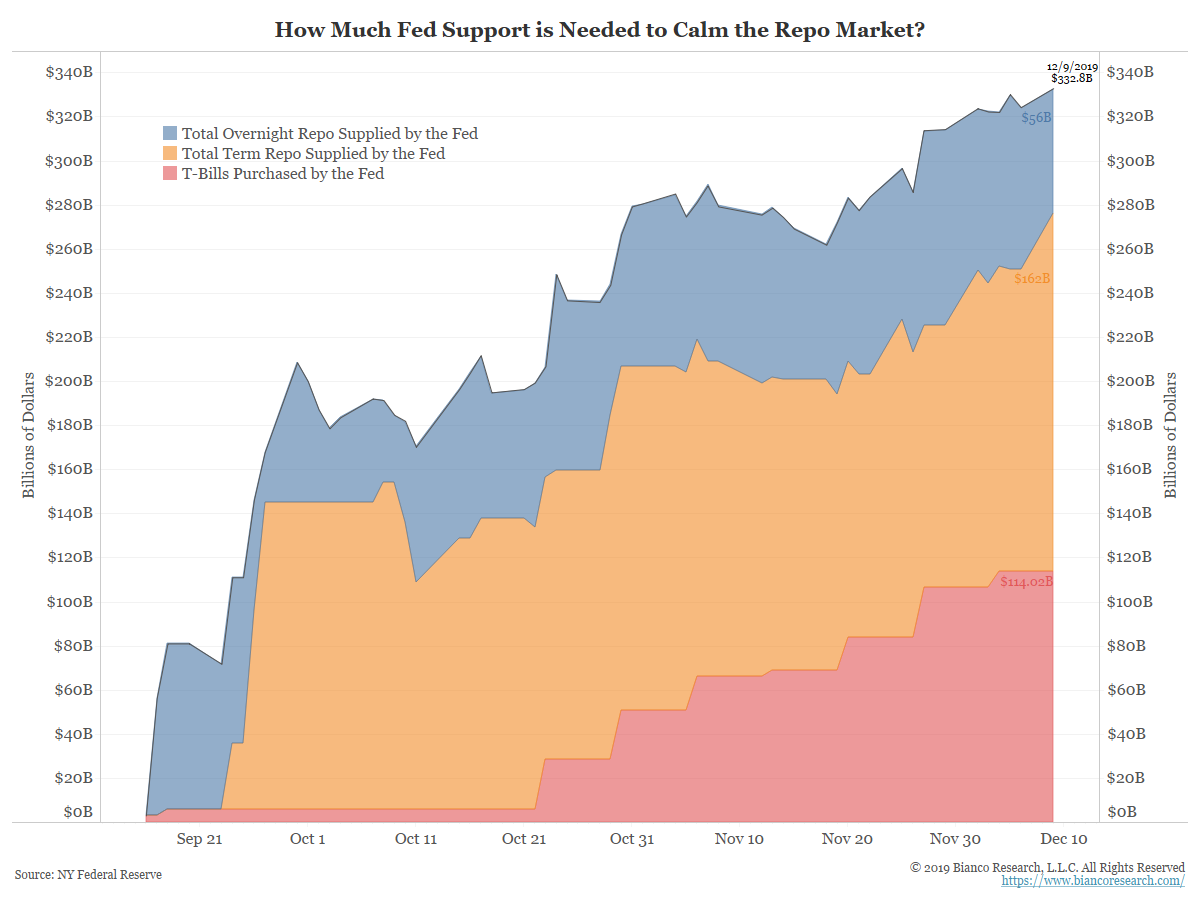

This morning the Fed offered the third of three term repo operations that matures after year-end. Banks submitted $43 billion in bids for the $25 billion offering. As the chart below shows, the Fed’s support of the repo market now stands at over $330 billion.

The Fed is scheduled to update its repo operation calendar on Thursday (Dec 12), which should include all its operations that will offer funding through year-end.

Jon Hill at BMO Capital Markets expects the overnight and term repo portions of the chart above (blue and orange), now at $218 billion, to go substantially higher by the end of the year.

By my tracking, if they keep the size of the four 14-day terms repos unchanged at $35B each, that’s $140B more, and the three long terms at $25B each is another $75B. If they keep the maximum overnight size repos at $120B, that gives us: $335B offered over year-end

Add to this the Fed’s T-bill purchases (red) and the total repo market support could hit $500B by December 31.

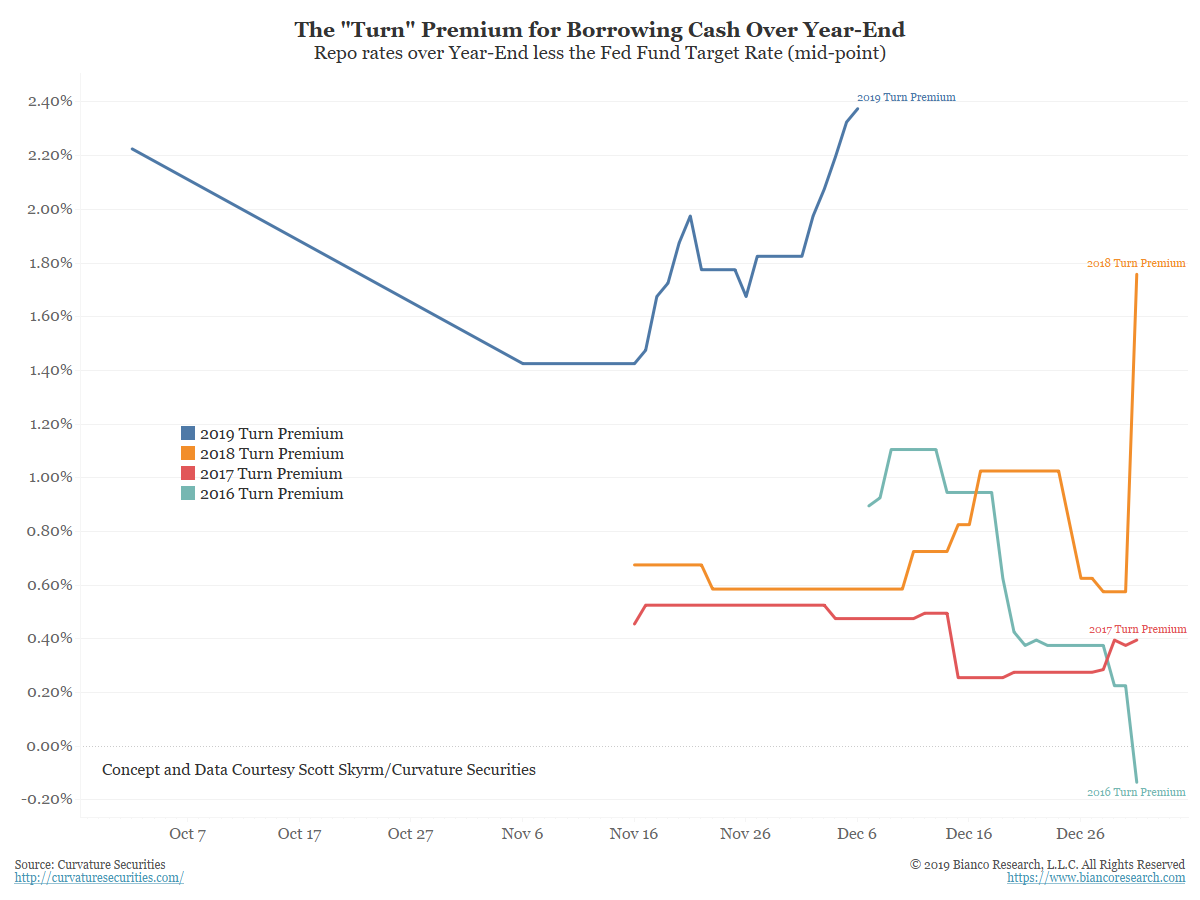

The market is giving every indication it is going to need this level of support. The next chart is courtesy Scott Skyrm at Curvature Securities. He tracks the market’s price to obtain a term repo over the “turn” of the year. We show those levels as a premium over a benchmark, in this case the midpoint of the federal funds target rate.

The Fed began reducing its balance sheet in 2016. As that has been happening, the turn premium has been getting progressively wider.

Most concerning is the Fed has been offering massive repo support since September and the turn premium for 2019 (blue above) is still extremely high.

In other words, the private sector seems to have largely exited the market around the turn. It is up to the Fed to keep this market functioning.

We have no doubt the Fed will support the repo market in any quantity necessary. Perhaps more interesting is their handling of the situation after the turn. How much of this support might be pulled back in the first two weeks of January?

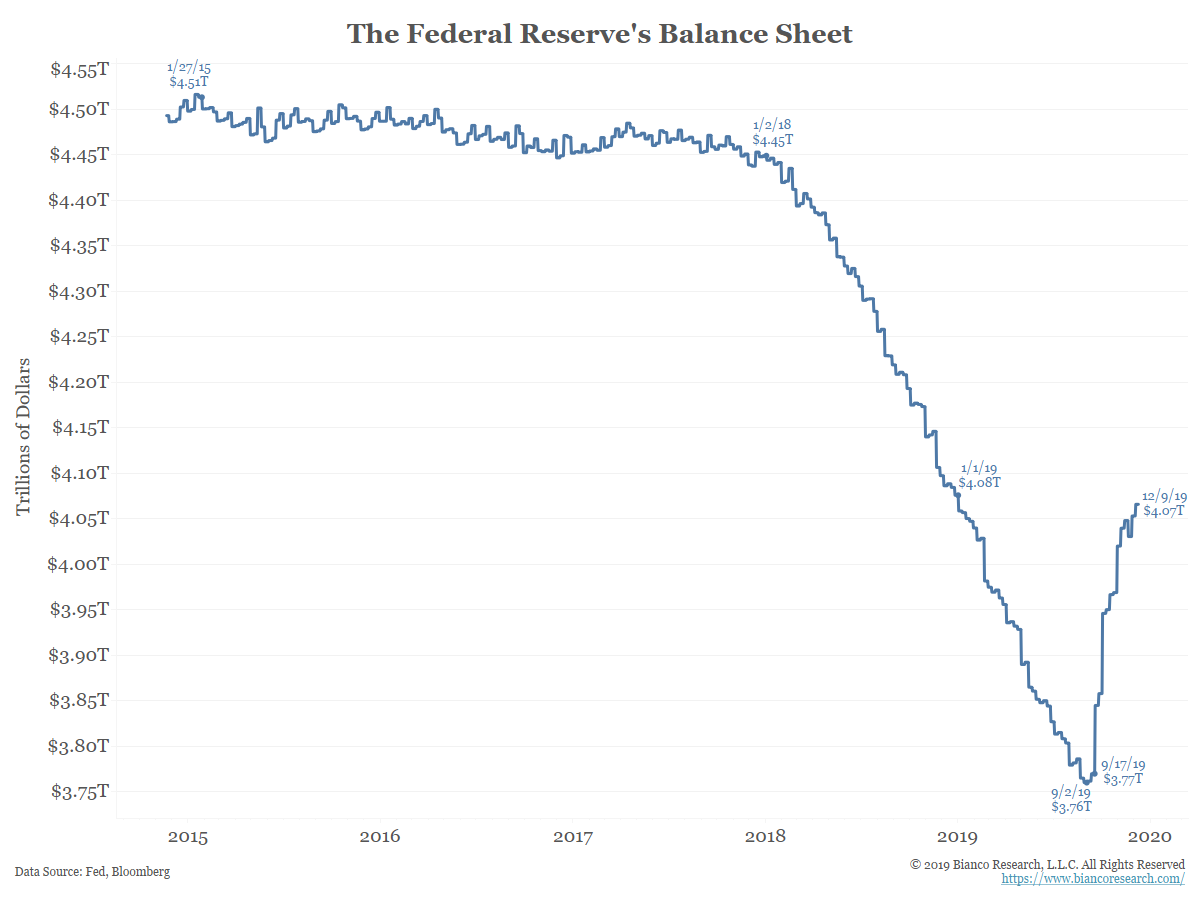

The Fed continues to maintain this is a temporary issue, but thus far they have added over $300 billion to their balance sheet.

So, the tale of the tape will be the first half of January. How much of this support goes away?

Conclusion

In its simplest form, the repo market is a collateralized loan. Post securities (mainly government securities) and get money. Even though the loan is collateralized, no one wants to be stuck with a default. So these loans have a credit component where premiums or over-collateralizations are required by some borrowers over others.

This is not always important, but it is when markets get volatile and liquidity issues arise.

The Fed views all banks as equal. Everyone that is a designated primary dealer can get the same terms, no questions asked.

For now, this is not a problem. The repo market has been medicated into submission by the Fed’s support. But the longer the Fed goes this way, the greater it becomes a potential problem. After three months, the Fed should be discussing a way to return this market back to normal, back to the banks making a credit decision in handing out repo loans. Instead, they are still studying the issue, which means they still don’t understand the problem. They are also getting in deeper and deeper as the private sector seems to be withdrawing.

This market is too important to remain in this state. None of this is a problem now, but should Fed support become more permanent, there will be issues the next time the market undergoes a stressful period.