- The Wall Street Journal – Fed Unveils Major Expansion of Market Intervention

Central bank will begin lending operations to unclog corporate and municipal-debt marketsThe Fed said the purchases of Treasury and mortgage securities that it approved one week ago are essentially unlimited, and it said it would buy $375 billion in Treasury securities and $250 billion in mortgage securities this week. The central bank also said it would begin purchasing commercial mortgage-backed securities issued by government-supported entities, which primarily consist of debt on apartment buildings.

- The Federal Reserve – Federal Reserve announces extensive new measures to support the economy

The Federal Reserve’s role is guided by its mandate from Congress to promote maximum employment and stable prices, along with its responsibilities to promote the stability of the financial system. In support of these goals, the Federal Reserve is using its full range of authorities to provide powerful support for the flow of credit to American families and businesses. These actions include: -

- Support for critical market functioning. The Federal Open Market Committee (FOMC) will purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy. The FOMC had previously announced it would purchase at least $500 billion of Treasury securities and at least $200 billion of mortgage-backed securities. In addition, the FOMC will include purchases of agency commercial mortgage-backed securities in its agency mortgage-backed security purchases.

- Supporting the flow of credit to employers, consumers, and businesses by establishing new programs that, taken together, will provide up to $300 billion in new financing. The Department of the Treasury, using the Exchange Stabilization Fund (ESF), will provide $30 billion in equity to these facilities.

- Establishment of two facilities to support credit to large employers – the Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance and the Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds.

- Establishment of a third facility, the Term Asset-Backed Securities Loan Facility (TALF), to support the flow of credit to consumers and businesses. The TALF will enable the issuance of asset-backed securities (ABS) backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA), and certain other assets.

- Facilitating the flow of credit to municipalities by expanding the Money Market Mutual Fund Liquidity Facility (MMLF) to include a wider range of securities, including municipal variable rate demand notes (VRDNs) and bank certificates of deposit.

Facilitating the flow of credit to municipalities by expanding the Commercial Paper Funding Facility (CPFF) to include high-quality, tax-exempt commercial paper as eligible securities. In addition, the pricing of the facility has been reduced.

- New York Federal Reserve – Statement Regarding Treasury Securities and Agency Mortgage-Backed Securities Operations

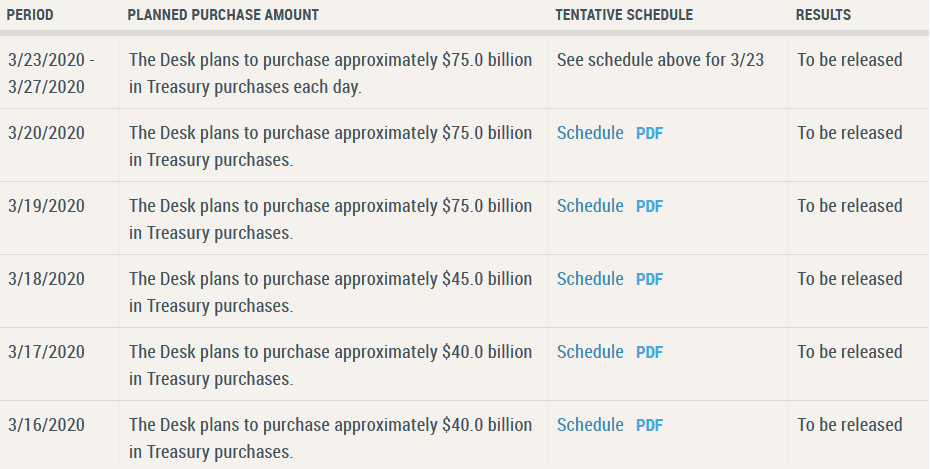

Consistent with this directive, the Desk has updated its plans regarding purchases of Treasury securities and agency MBS during the week of March 23, 2020. Specifically, the Desk plans to conduct operations totaling approximately $75 billion of Treasury securities and approximately $50 billion of agency MBS each business day this week, subject to reasonable prices. The Desk will begin agency CMBS purchases this week. The Desk stands ready to adjust the size and composition of its purchase operations as appropriate to support the smooth functioning of the Treasury, agency MBS, and agency CMBS markets.

- They will buy corporate bonds. To get around the Federal Reserve Act, they will purchase them in a Special Purpose Vehicle (SPV) that the Treasury (read taxpayer) will invest in. The Treasury will take the first loss so the Fed is not risking a loss.

- They will buy corporate bond ETFs in the SPV.

- The dusted off the 2008 TALF program. This will allow them to purchase securities backed by credit card and auto loans.

- They expanded the money market facility to buy short-term munis.

- They are establishing a “Main Street” lending facility. The Fed says details will follow.

Summary

Comment

This morning the Fed announced many new measures aimed at supporting the economy and markets. One aspect of this announcement was an update to their Treasury and agency purchases. Roughly one week ago they announced a Treasury and MBS purchase program with the intent to buy $500 billion and $200 billion in securities, respectively. This morning they said these purchases would be unlimited, essentially open-ended QE. For the time being, it appears the Fed will buy $75 billion of Treasuries each day this week:

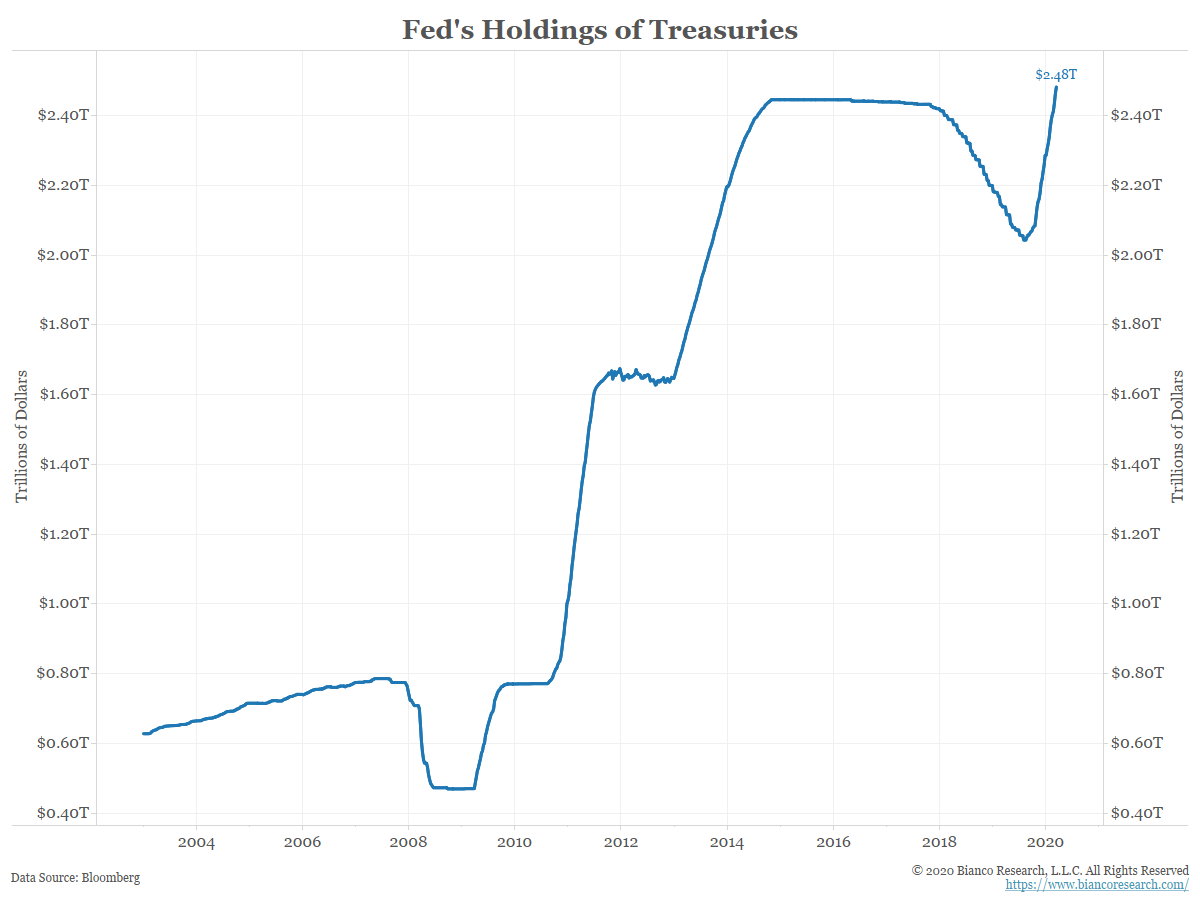

Considering the Fed’s Treasury holdings currently stand at $2.48 trillion, another $375 billion in purchases amounts to a 15% increase in holdings in just one week.

We take “subject to reasonable prices” to mean that if the market does not set bond prices where the Fed wants them, the Fed will announce what the price should be. They would then use their unlimited balance sheet to make it happen. This goes by the name “Yield Curve Control.”

Along with the update to Treasury and Agency purchases, the Fed also announced the following measures:

Bottom Line

We think HSBC’s Steven Major got it exactly right on Bloomberg TV this morning. He suggested the handshake might be a thing of the past.

The world has permanently changed. Stop thinking about mean reversion. We are not going back. We are headed to a new reality.

Markets understand this and they are rapidly re-pricing to a post-virus world at historic speed. This is causing all kinds of problems as the markets move on from the old pre-virus reality.

The Fed is attempting to stop this repricing from going any further. They essentially announced they are nationalizing the markets. They will set the price and provide the credit. They are hoping to stop the completion of the post-virus repricing.

Will these new measures work? Can the Fed stop the entire financial world from repricing to what it perceives as fair value? It is difficult, if not impossible, to know where the market sees fair value at this point.