- Bloomberg.com – The Fed Is Losing Its Grip on U.S. Interest Rates Once Again

Fed funds is unusually close to the low end of policy range

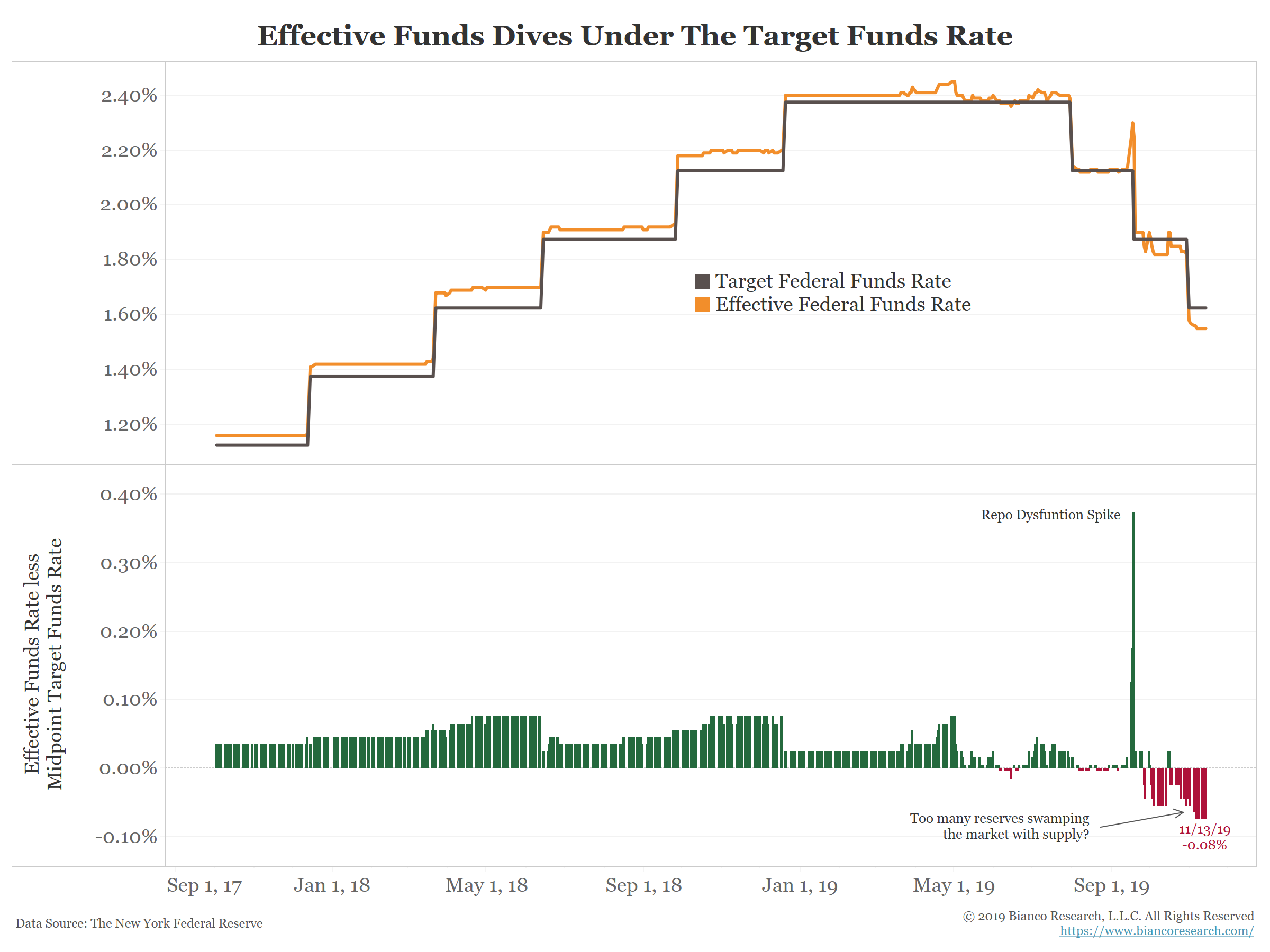

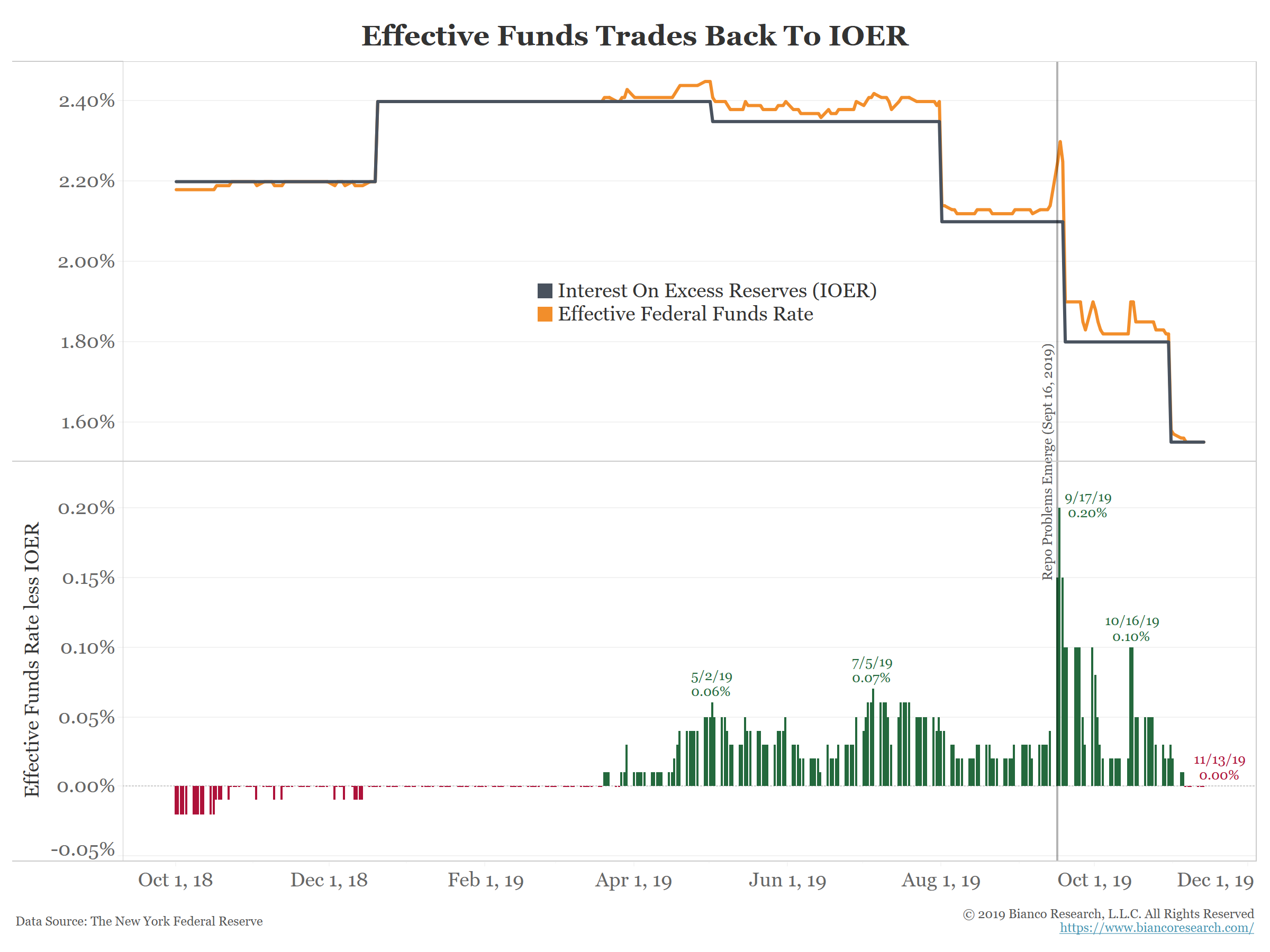

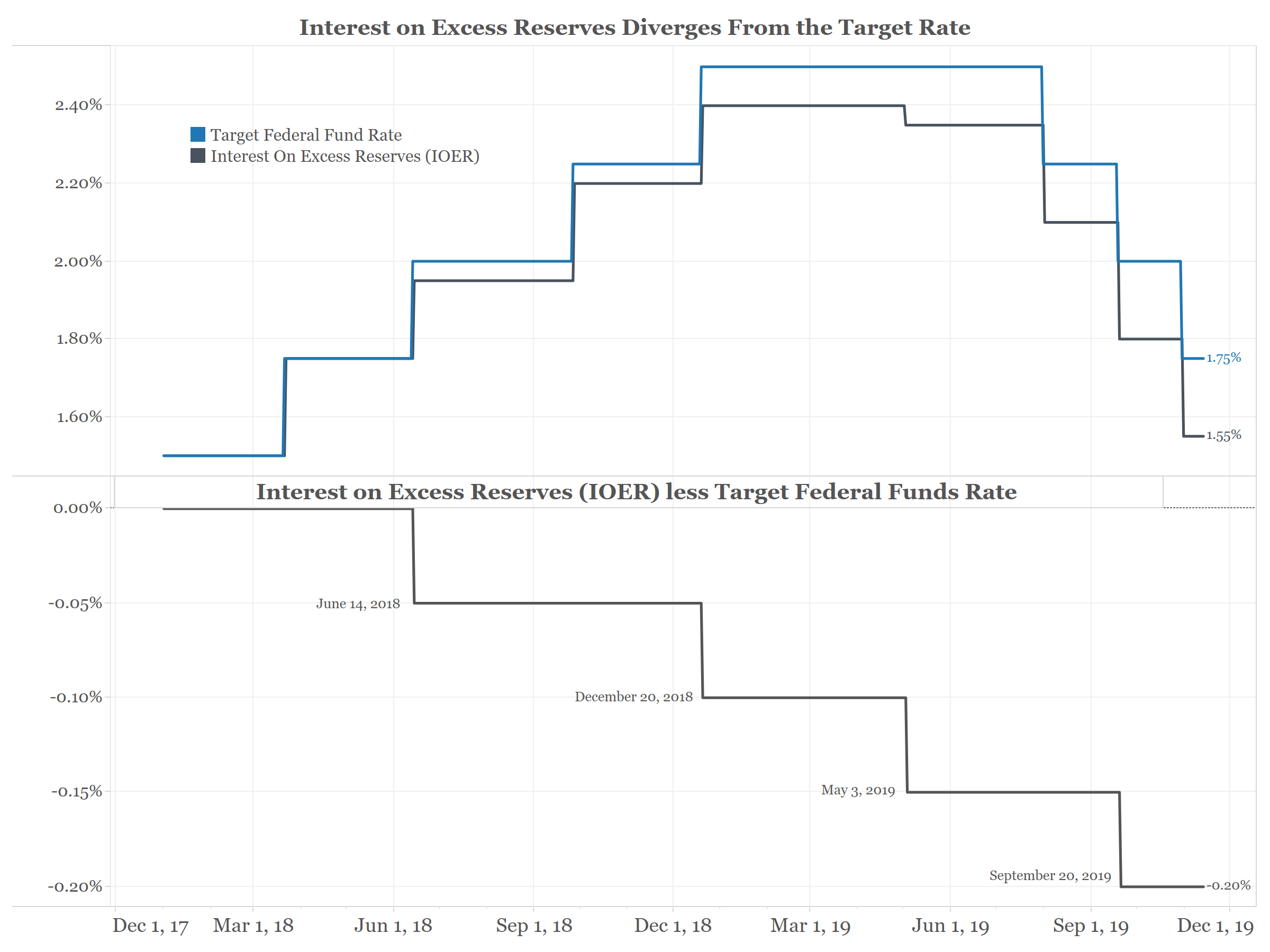

This could prompt yet another tweak to a rate called IOERAlthough the Federal Reserve has calmed money markets during the past two months, success has a downside: The main interest rate that officials try to wrangle is getting close to the edge of the range they’re targeting. Actions including the Fed’s recent repo-market liquidity injections and Treasury-bill purchases have pushed the effective fed funds rates down to 1.55%. That’s still within the 1.50%-to-1.75% band where central bankers want it to be, but it’s unusually near the lower boundary. Some are worried it could dip below.

Summary

Comment

So What Does This All Mean?

The Fed never understood the post-crisis over-regulation of bank reserves, especially the 2016 G-SIB rules, were restricting available reserves for the repo market. The market sent warning signs with the widening effective/IOER spread. The Fed dismissed these signs and cut IOER by small increments (five basis points) to keep repo’s close cousin, the effective funds rate, near the mid-point of the target range. This worked for a while.

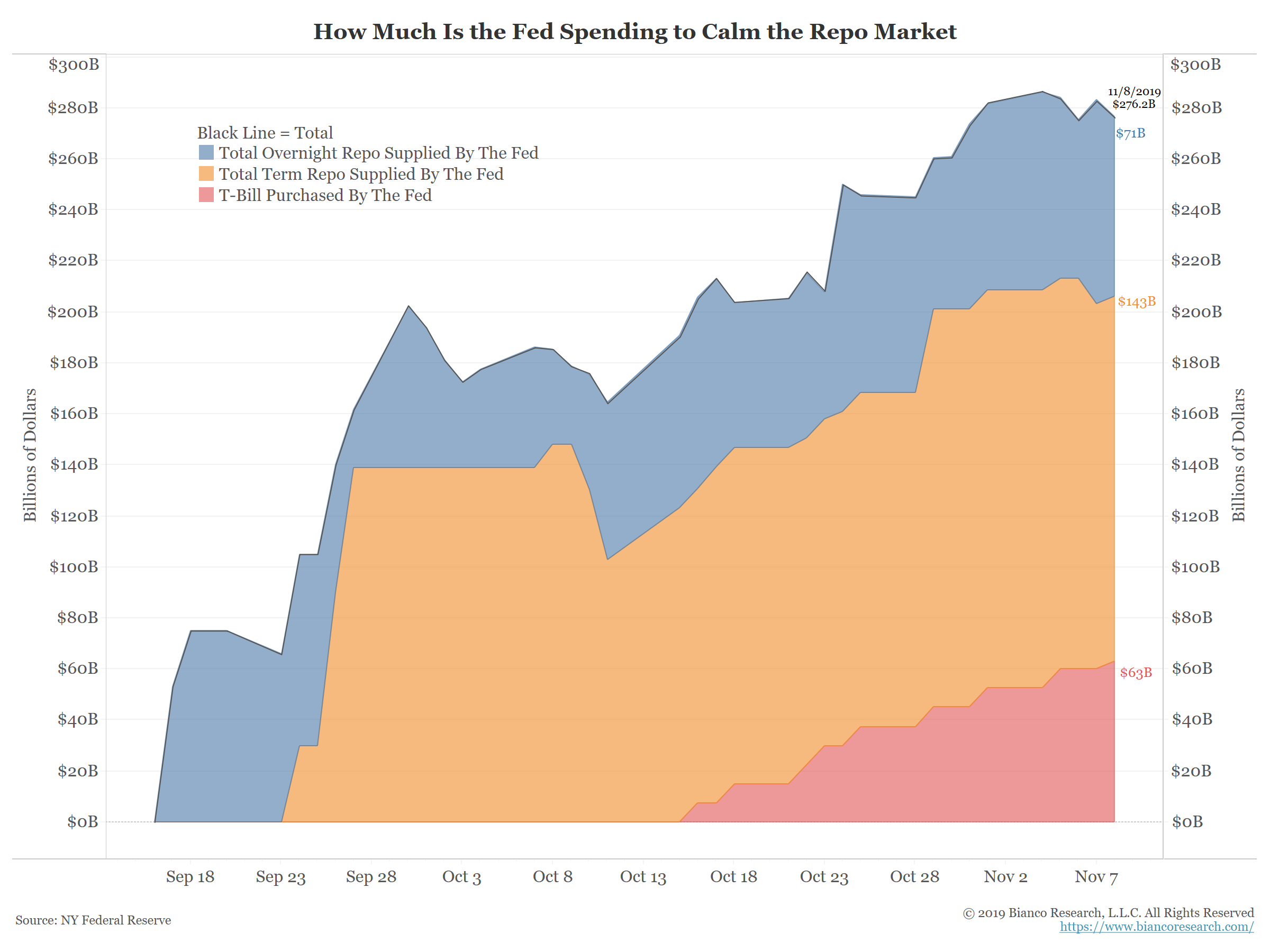

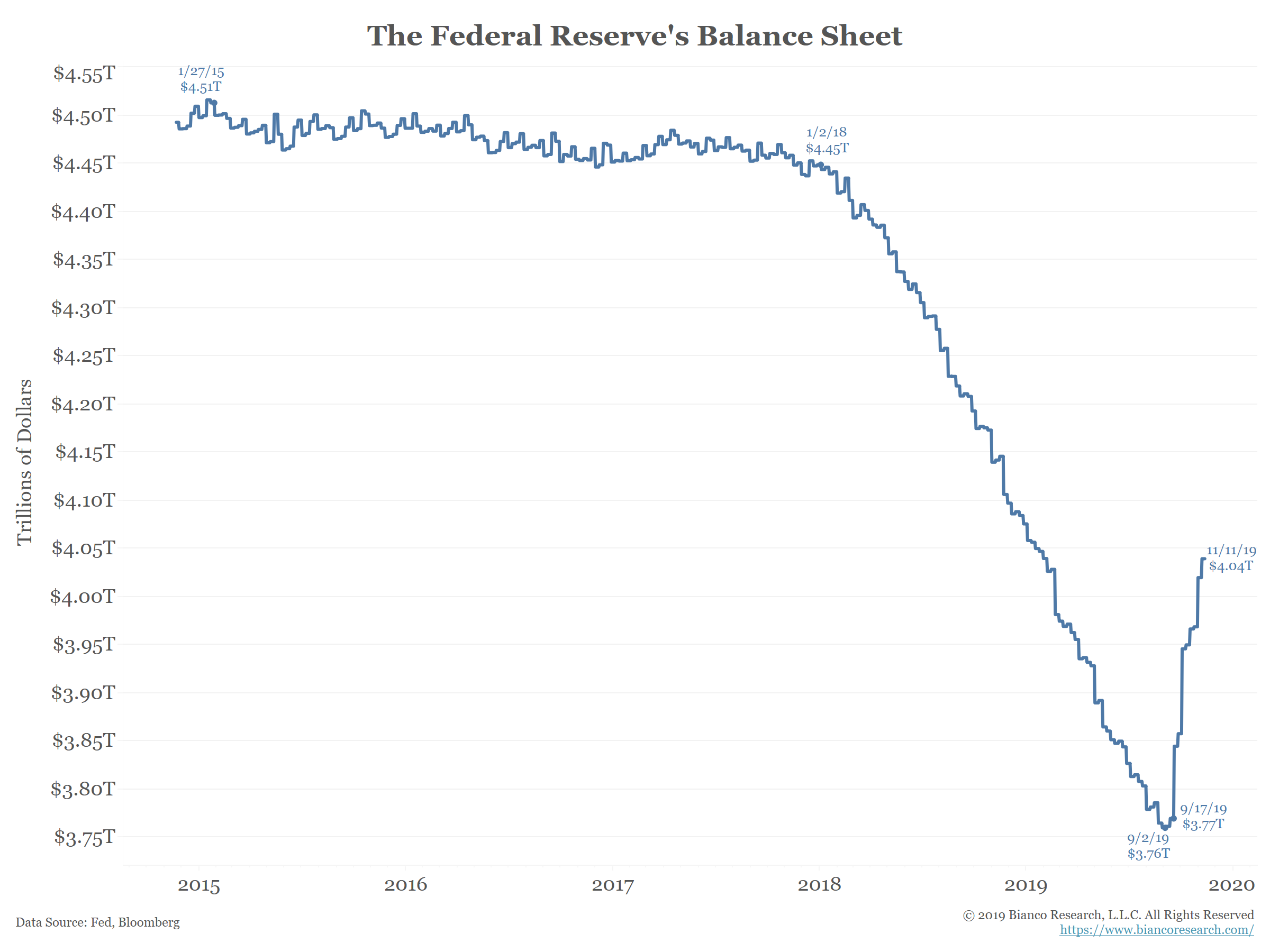

Then, in mid-September, the repo market broke as the shortage of reserves became too great to ignore. Rather than address the regulations that were creating some of these issues, the Fed opted to flood the market with nearly $300 billion of newly created reserves.

The Fed has effectively calmed the repo market by subsidizing it. This subsidy is not likely to go away anytime soon, as year-end liquidity squeezes are right around the corner. Given the Fed’s involvement in this market is likely to continue, the effective funds rate could fall even further relative to IOER. This will be seen as a good thing by many, but it is reliant on the Fed’s continued involvement in the repo market.

This repo saga is not over. More chapters are being written.