Summary

Comment

If the Fed does not deliver on the market’s forward guidance, it risks opening the trapdoor on the stock market and unleashing a historic stock market collapse.

The Fed’s hand has been forced unless they want to pick now to break this cycle and live with the consequences.

Yield Plunge

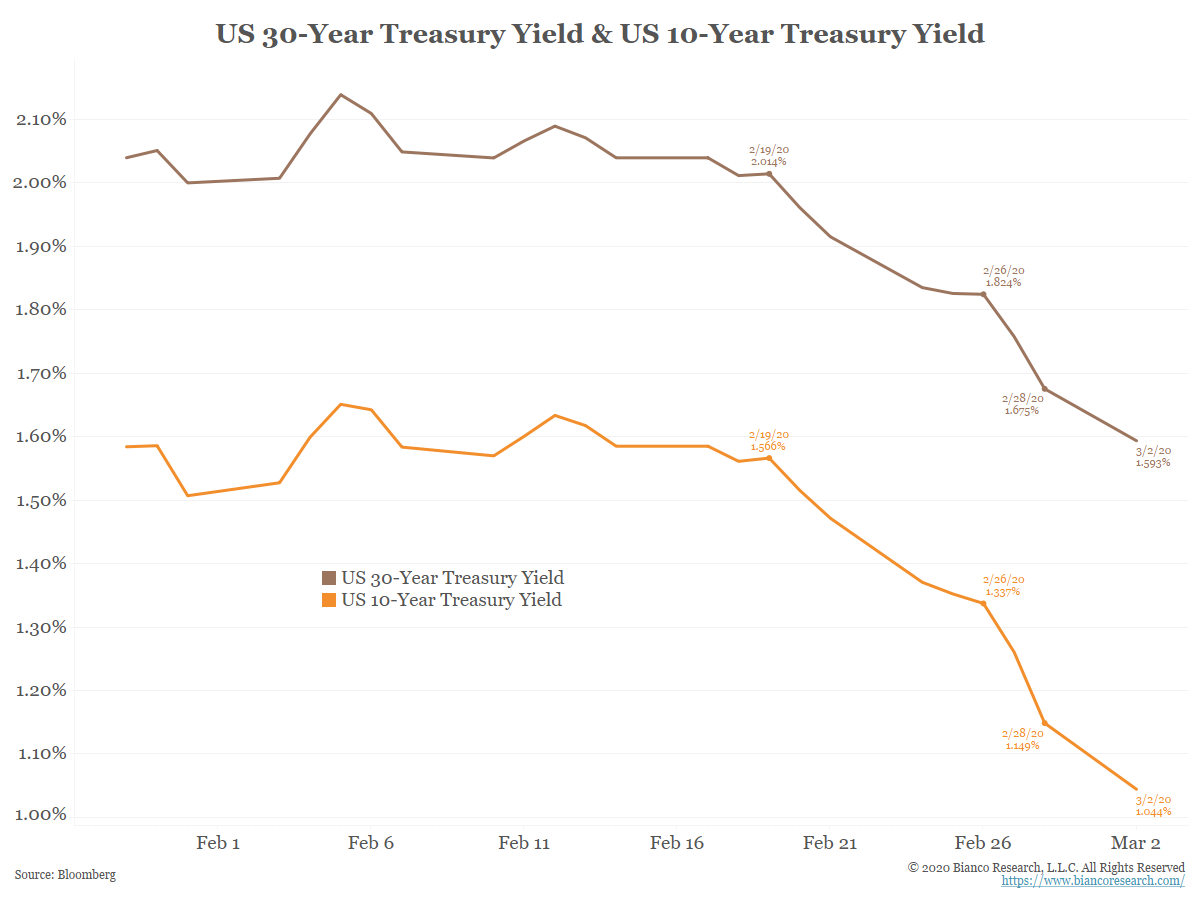

When markets reopened Sunday night:

- 30-year =1.59% down 8 bps

- 10-year = 1.04% down 10 bps

- Both are down 50 bps the last EIGHT trading days.

For the first time since the financial crisis, the funds rate is the highest yield on the Treasury yield curve (IOER, 1.60%).

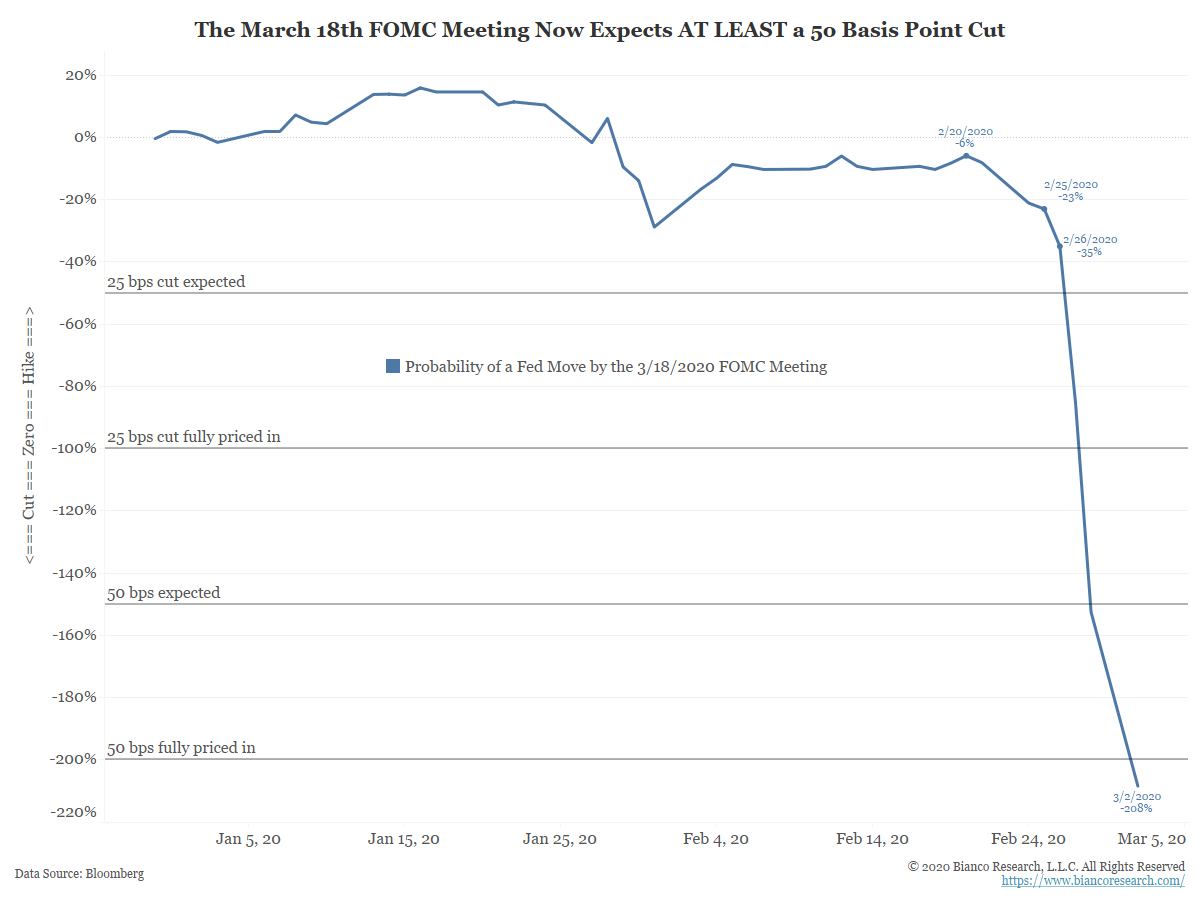

Fed funds futures are also plunging tonight. Each monthly contract is down between 10 and 18 basis points, which is a huge move.

The March contract is saying the effective rate will average 1.25% for the entire month.

The funds rate is currently 1.58%.

For the funds rate to average 1.25% in March, the Fed likely needs to cut rates as early as tomorrow morning.

Conclusion

Why is the market expecting a rate cut tomorrow? Our guess is this market is expecting thousands of positive infection cases in the US over the next month, leading to huge disruptions. Think tens of millions idled from work, school kids home for weeks, if not the rest of the school year.

So, it is penciling in a plunge in Q2 GDP. It is also possible that March infections and disruptions push Q1 GDP lower.

In other words, the market sees a recession as a real risk.