- CNBC – Plunging stock market futures hit ‘limit down’ — Here’s what that means

* Contracts on the S&P 500 dropped 5%, reaching a “limit down” band made by the CME futures exchange to prevent further losses.

* No prices can trade below 5%, only at higher prices than “limit down.”

* The Dow Jones Industrial Average futures plunged more than 1,000 points, also triggering the limit down level.

Summary

Comment

The past week has seen unprecedented market movements and action taken by central banks. We have also seen unprecedented action by governments.

Given the events that took place in 2008, this is saying a lot.

We’ll save detailing what happened for another time. Instead, we’ll focus on what it means and what to focus on next.

Two titanic forces are at play. First, the economy is at a real risk of collapsing. This is not hyperbole. Goldman Sachs has already revised its Q2 GDP forecast to -5%.

We fear this might look optimistic in a few weeks. Yes, this virus-driven economic collapse is temporary, one or two quarters, but the risk is very real that long-lasting damage is being done that will hamper the economy for years.

The other titanic force is world central banks and governments going “all in” to keep markets from falling further. They have effectively done everything they can.

This better work.

This better stimulate risk markets to hold last week’s low. If risk markets continue to fall, effectively there is nothing left that central banks can do. They can always invent more programs, but they already fired their most potent weapons.

Many will argue that the Fed should buy corporate bonds and/or equities, but this requires Congress amending the Federal Reserve Act. Considering Congress has still not passed virus relief, this will not happen fast enough and is not advisable as it could make things worse.

Simply put, if this does not work, the central bank “put” no longer works. So stop devising new ways to exercise it and move on to other actions.

So that leaves one tool left should risk markets continue to fall through last week’s low – close financial markets before they collapse.

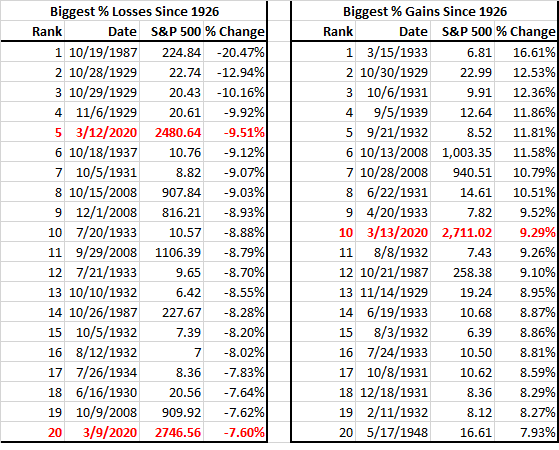

The S&P 500 has already declined more than 25% in just 16 days. We have never seen this big a decline this fast. Should stock prices fall to new lows and corporate bond prices decline accordingly, it risks chaos in financial markets.

Margin calls will force involuntary liquidation. The inability to properly price illiquid securities like high yield bonds and emerging market securities may prompt funds to halt redemptions. People’s money may be trapped. Covenants will be triggered, forcing unwanted restructurings or change of control. Pension fund minimum funding requirements are at risk of being violated.

Regulators and government officials would be left with no choice but to close markets until the full extent of the economic damage could be determined and properly priced. This might be a prolonged shuttering of many weeks, akin to what is unfolding in the broader economy.

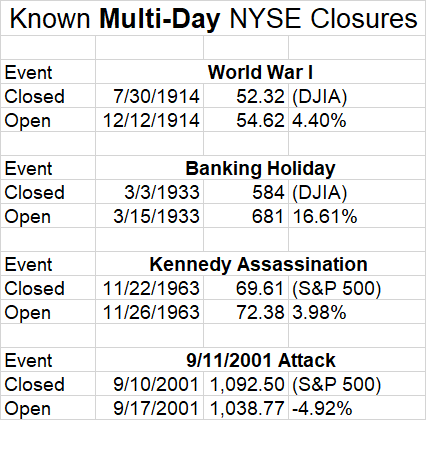

In the last 110 years, the NYSE has seen multi-day closings just four times for non-weather or infrastructure failure reasons.