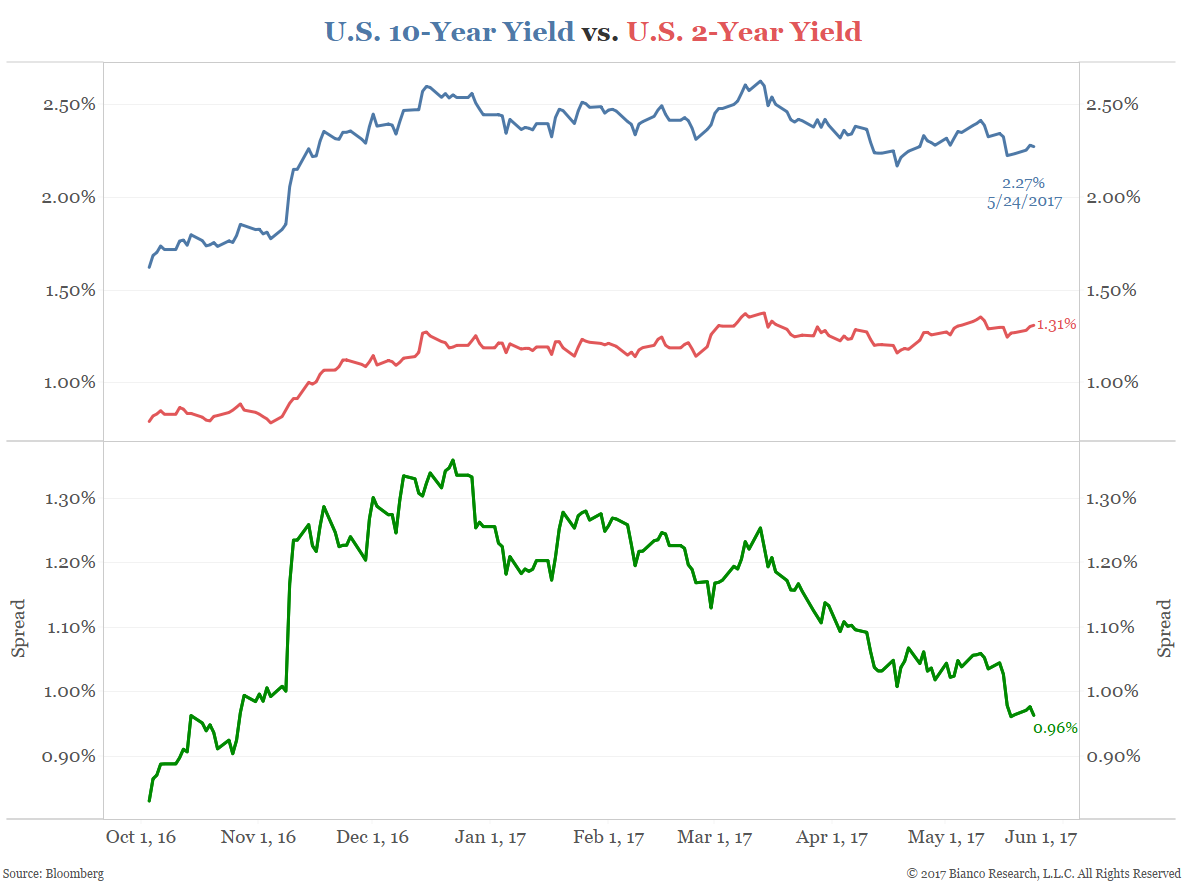

- CNBC – Bond market warning? A closely watched economic indicator just hit a postelection low

The short end of the yield curve is “rising on expectations of tighter monetary policy, while the low end is more correlated to growth … so I think the case could be made that the curve continues to narrow,” Oppenheimer technical analyst Ari Wald said Monday on CNBC’s “Trading Nation.” Yet this doesn’t worry Wald, who noted that the yield spread turned fully negative before each of the four most recent recessions. “We don’t think the flatter curve is a warning,” he said. “As long as banks can borrow short[-term debt] and lend long[-term debt], we think the economy can do just fine and the stock market can do just fine.” “The flattening ties into the fading of expectations for some kind of fiscal push this year,” Caron said Monday on “Trading Nation.” “This is the broader representation of a resetting of expectations, in the United States at least, and the expectation for maybe slower growth than what we expected just after the election.”