- The Financial Times – Investors bet on interest rate cuts in 2023 despite Fed signals

Bond traders expect US central bank will reverse course in fourth quarter as economy slows

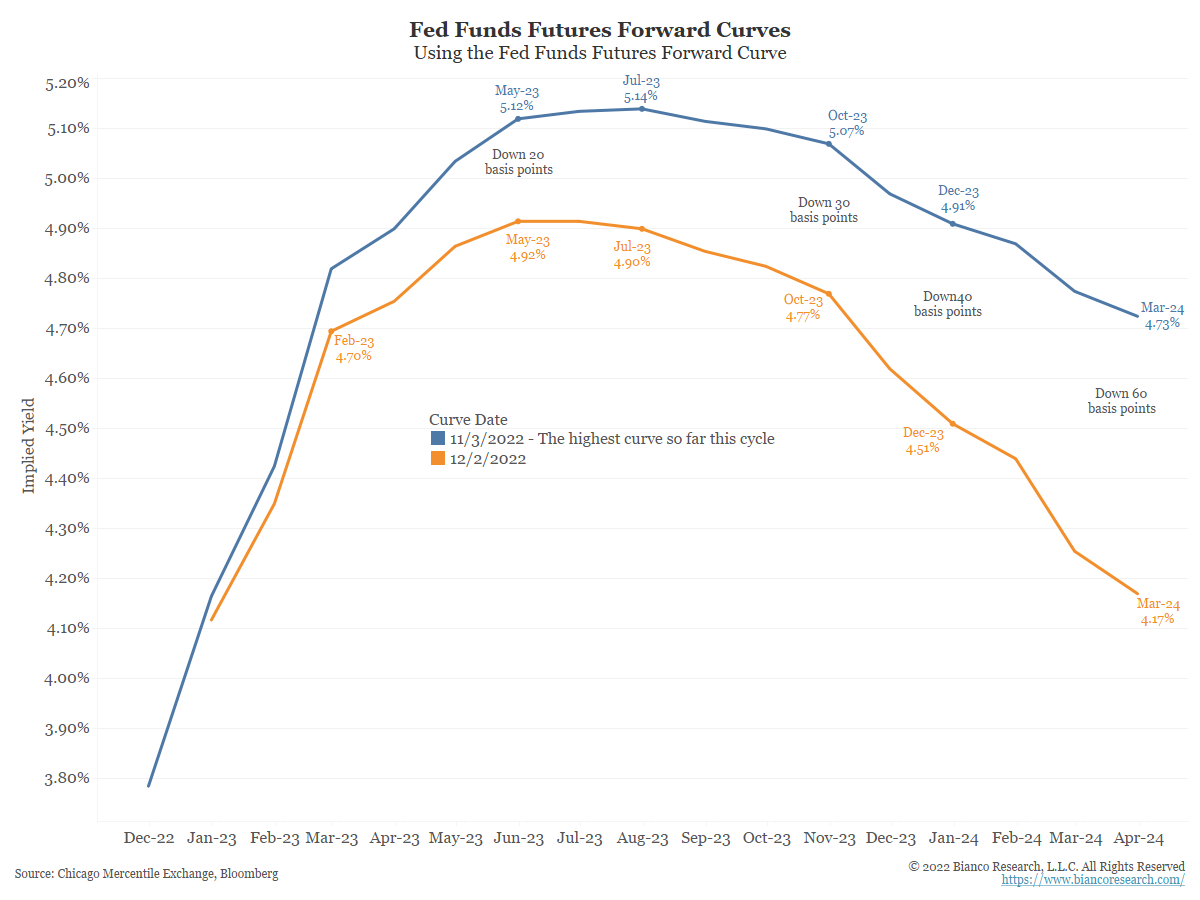

Investors predict the Federal Reserve will cut rates when faced with a slowing economy next year, betting the US central bank is far closer to ending its historic monetary tightening campaign than it has signalled. … I think it’s safe to say the committee is not expecting to cut rates next year. So how do we explain the difference between that outlook and what we’re expecting?” said Matt Raskin, head of US rates research at Deutsche Bank, which has forecast that the Fed will be forced to cut interest rates by 0.5 percentage points in December 2023.“I think it boils down to market participants expecting a recession next year while the committee still has a softish landing in their forecasts.”“The markets are trying to have their cake and eat it too, hearing Powell say he doesn’t want to overtighten, while ignoring the second half of the sentence where he says they will hold rates in restrictive territory,” said Calvin Tse, head of macro policy for the Americas at BNP Paribas. “The market has taken this too far.” - The Wall Street Journal – James Mackintosh: Economists Think They Can See Recession Coming—for a Change

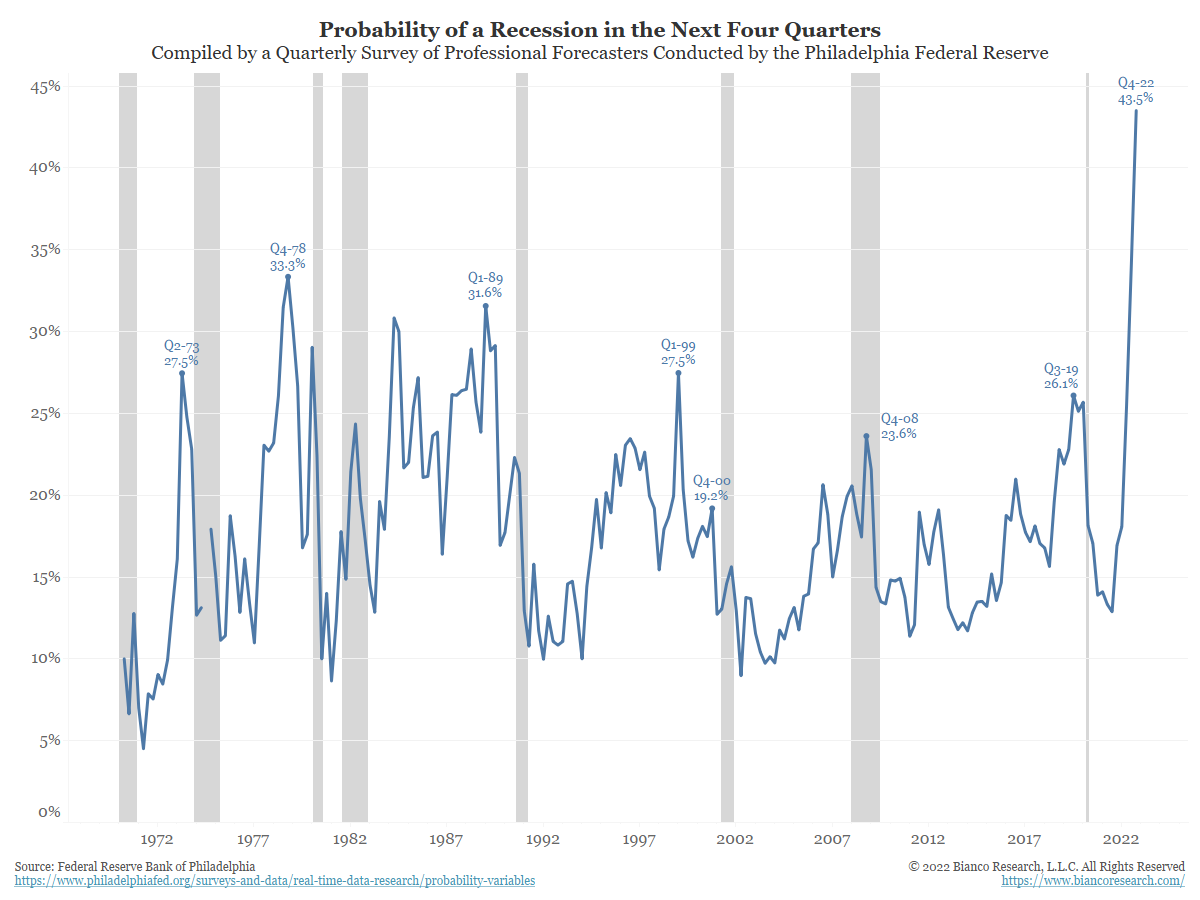

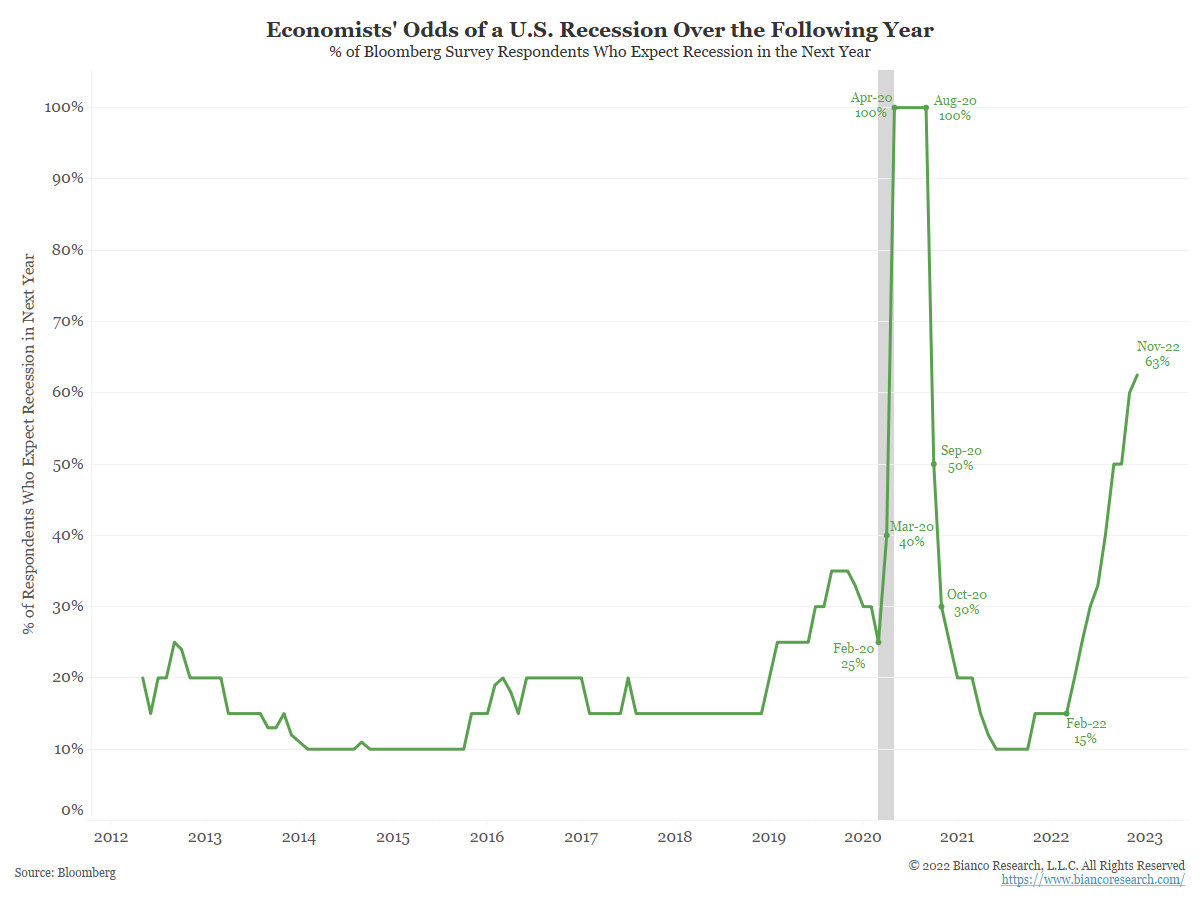

They might be wrong again, but investors need a lot to go rightThe regular Wall Street Journal survey finds economists think there is a 63% chance of recession in the next year. And a survey of economists and investors by the Federal Reserve Bank of Philadelphia shows expectations that gross domestic product will fall in three or four quarters are by far the highest since it started in 1968. Just because economists are convinced of their predictions doesn’t mean they are right, of course. Since that Philly Fed survey started, not a single recession was spotted a year in advance. Economists missed the 1990, 2001 and 2008 recessions completely.

Summary

Comment

On Wall Street, forecasting doom and gloom has typically been the fastest way to unemployment. History is littered with ex-employees who warned of problems, even if they were proven correct.

Currently, however, Wall Street is forecasting one its gloomiest outlooks in history. Driving these forecasts is the belief the Fed is trying to rein in inflation by inducing a recession, which might not be wrong. The reason so many are comfortable in predicting tough times ahead is the belief this gloom will result in a bullish outcome for stocks.

The market is so driven by liquidity that a downturn in economic growth, profits, and increased unemployment might get the Fed to pivot and cut rates. It is though this will lead to soaring risk markets.

As the chart above shows, the market is anticipating the Fed will cut rates late in 2023 and into 2024. It is this hope that has risk markets rallying.

The sections below detail the gloomy economic forecasts common on Wall Street.

Expect A Recession

The latest Philadelphia Federal Reserve quarterly survey of professional forecasters shows the probability of a recession in the next year is the highest in the 50+ years this survey has been conducted.

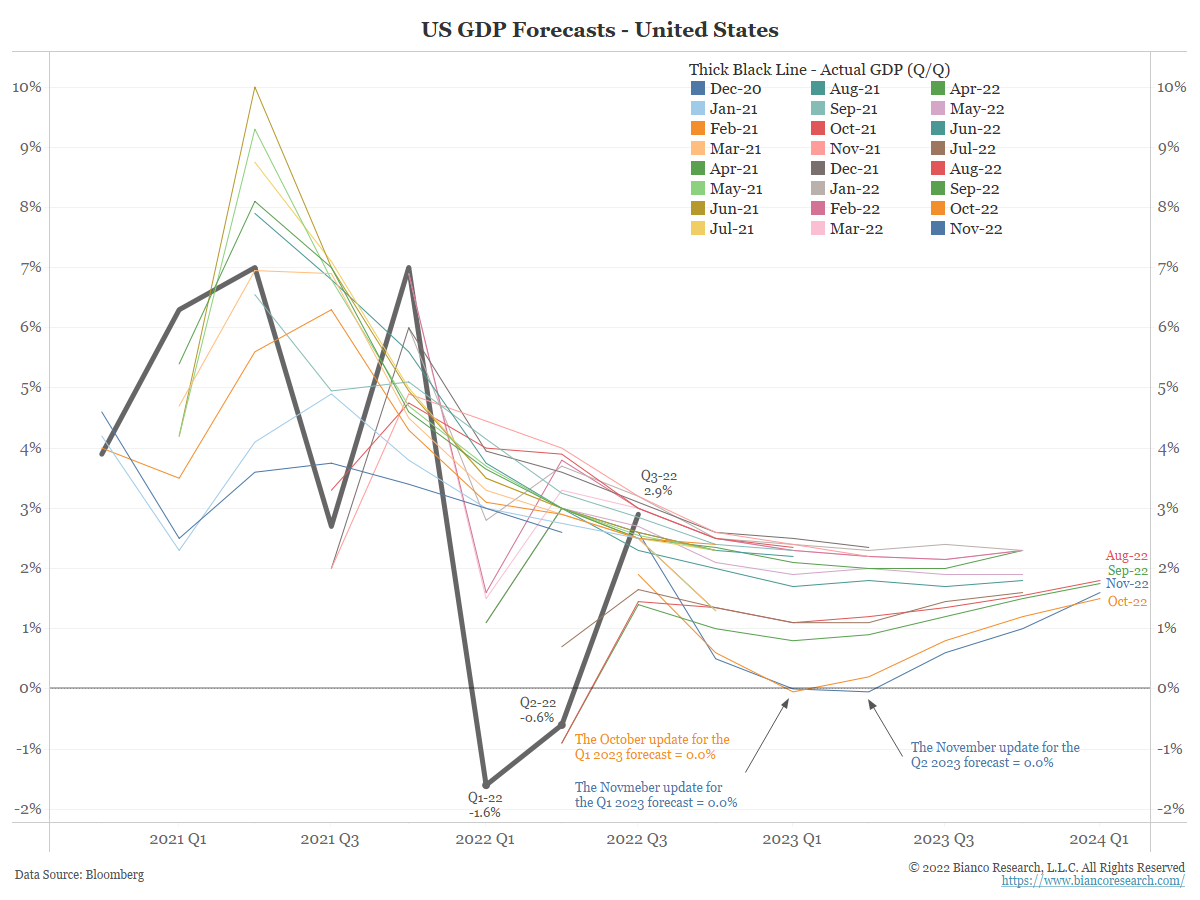

Bloomberg also asks economists for their median GDP forecast for the next six quarters. The thick black line is actual GDP and the various colored lines are the monthly forecasts. Labeled are the monthly updates for October 2022 in orange and November 2022 in blue.

The median forecast for Q1 2023 GDP is 0%. The November update for Q2 2023 GDP has joined the Q1 2023 forecasts at 0%.

High Unemployment and the Sahm Rule

But economists are doing more than just predicting a recession. They also expect a big rise in unemployment.

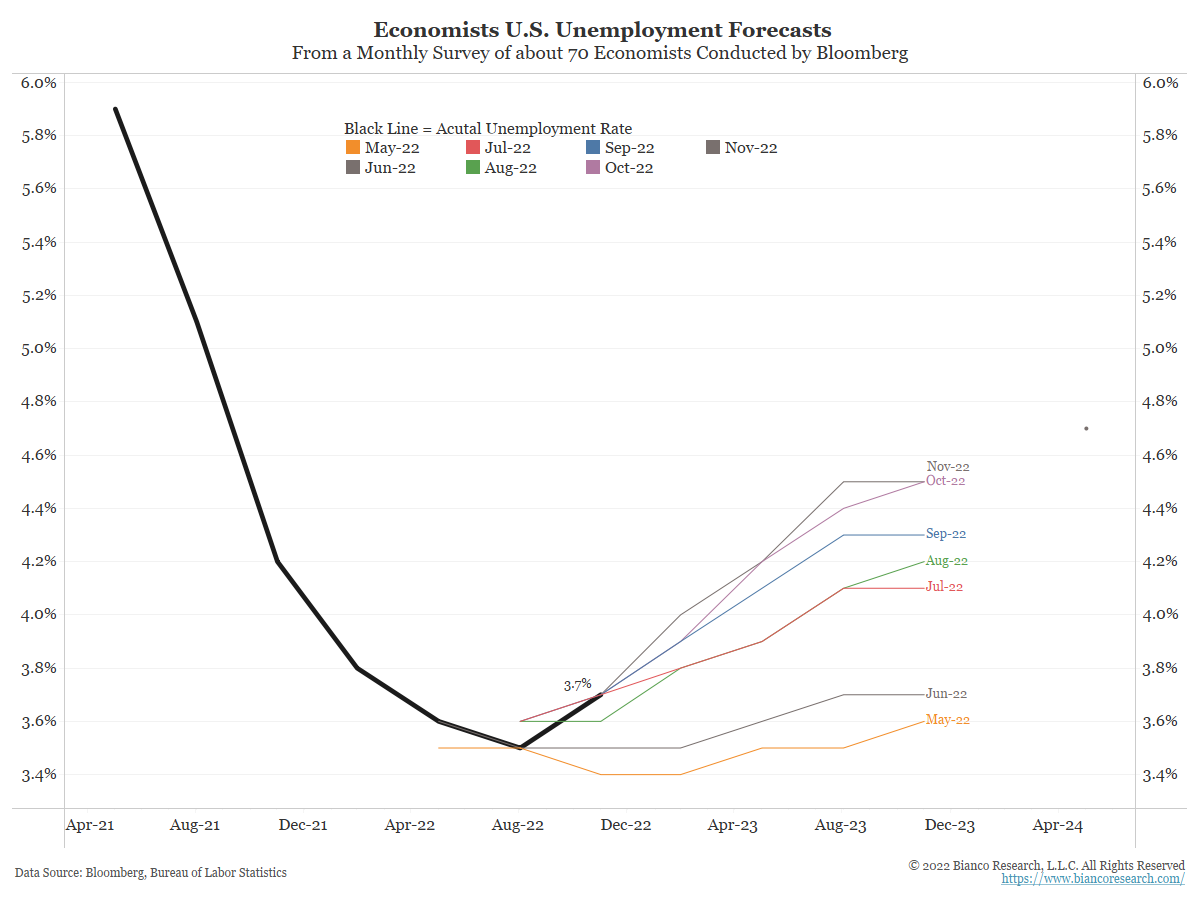

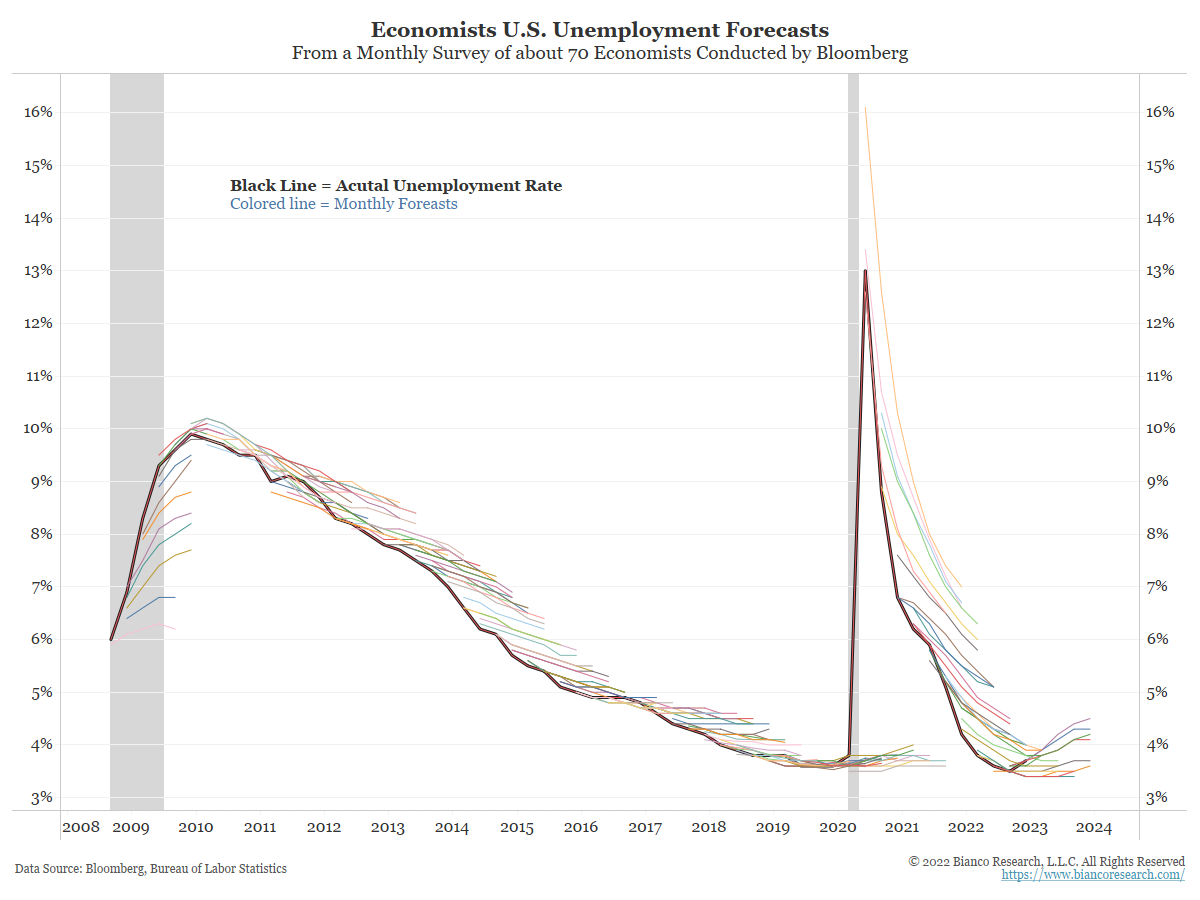

The next chart shows the results of Bloomberg’s survey of economists on the unemployment rate. The thick black line is the actual unemployment rate. The colored lines are the median monthly forecasts back to May.

Over the last six months, economists have steadily increased their year-end 2023 unemployment forecasts. In May (orange) unemployment was expected to end next year at 3.6%. By November (purple) this forecast ballooned to 4.5%.

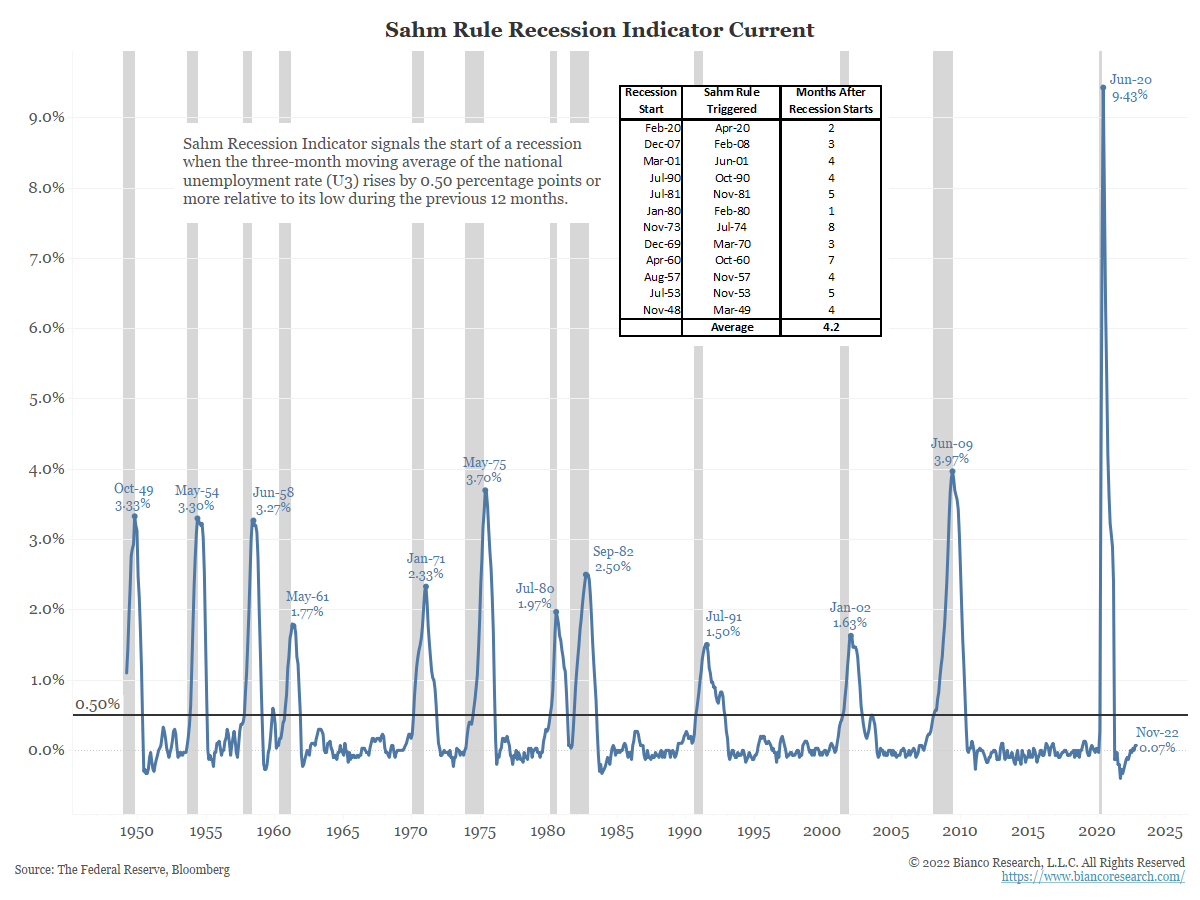

Former Fed economist Claudia Sahm, author of the Stay-at-Home Macro blog, invented the “Sahm Rule” that states when the three-month average of the unemployment rate rises more than 0.5% (horizontal line below), the economy is already in recession. This has worked without fail for the last 75 years, or the last 12 recessions.

As the table on the chart below shows, the Sahm Rule is useful as a recession typically starts around four months after the three-month average of the unemployment rate rises by 0.5%. By contrast, the Business Cycle Dating Committee, the official body that dates recession, takes well over a year to make the same call.

If the unemployment forecasts above are accurate, the Sahm Rule will again be triggered in 2023.

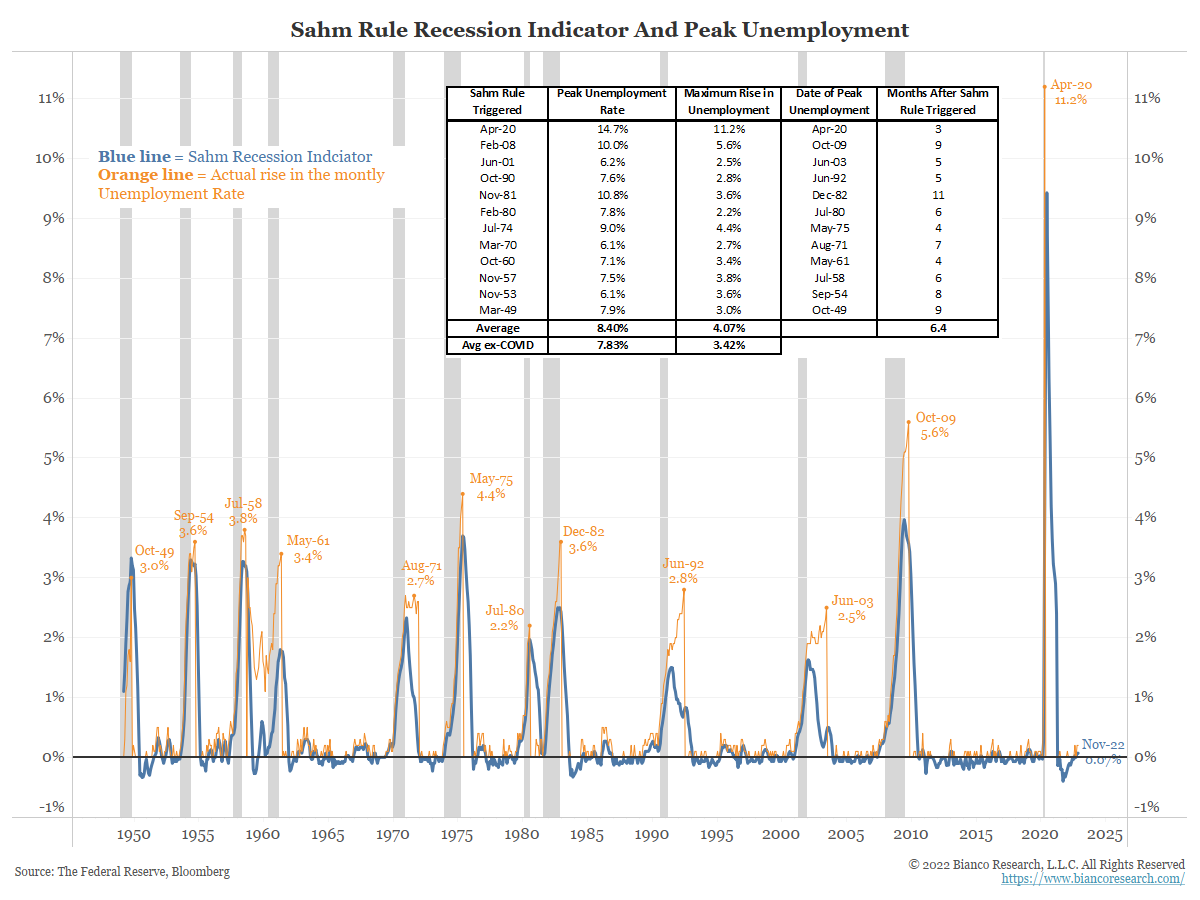

And if the Sahm Rule is triggered, the next chart shows the peak in the unemployment rate (orange line) is 4% above its pre-recession low (3.4% if the Covid spike is excluded). This peak occurs an average of six months after the Sahm Rule is triggered. The peak unemployment rate averages 8.4% (7.8% excluding Covid).

Restated, if the forecasts above are correct and the unemployment rate reaches 4.5% by the end of 2023, then the Sahm Rule suggests the economy is probably in recession territory. Furthermore in this scenario, we should expect the unemployment rate to rise another 3.4% to 4%, more than doubling its low of 3.5% set this past fall. In other words, the unemployment rate could approach 6% to 7%.

This would qualify as a bad recession.

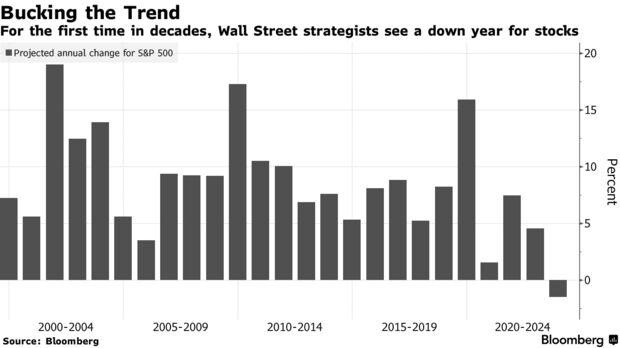

Strategists Bearish on Stocks

- Bloomberg – Wall Street Turns Bearish on Stocks After Bad Year

Average forecast points to another drop for S&P 500 in 2023

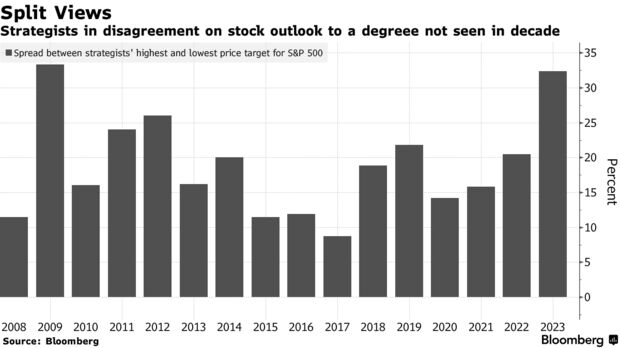

Gap in highest, lowest targets is widest in more than a decade

The average forecast of handicappers tracked by Bloomberg calls for a decline in the S&P 500 next year, the first time the aggregate prediction has been negative since at least 1999. Most of them turned progressively more dour as the worst year in the market since the financial crisis moved toward its end.

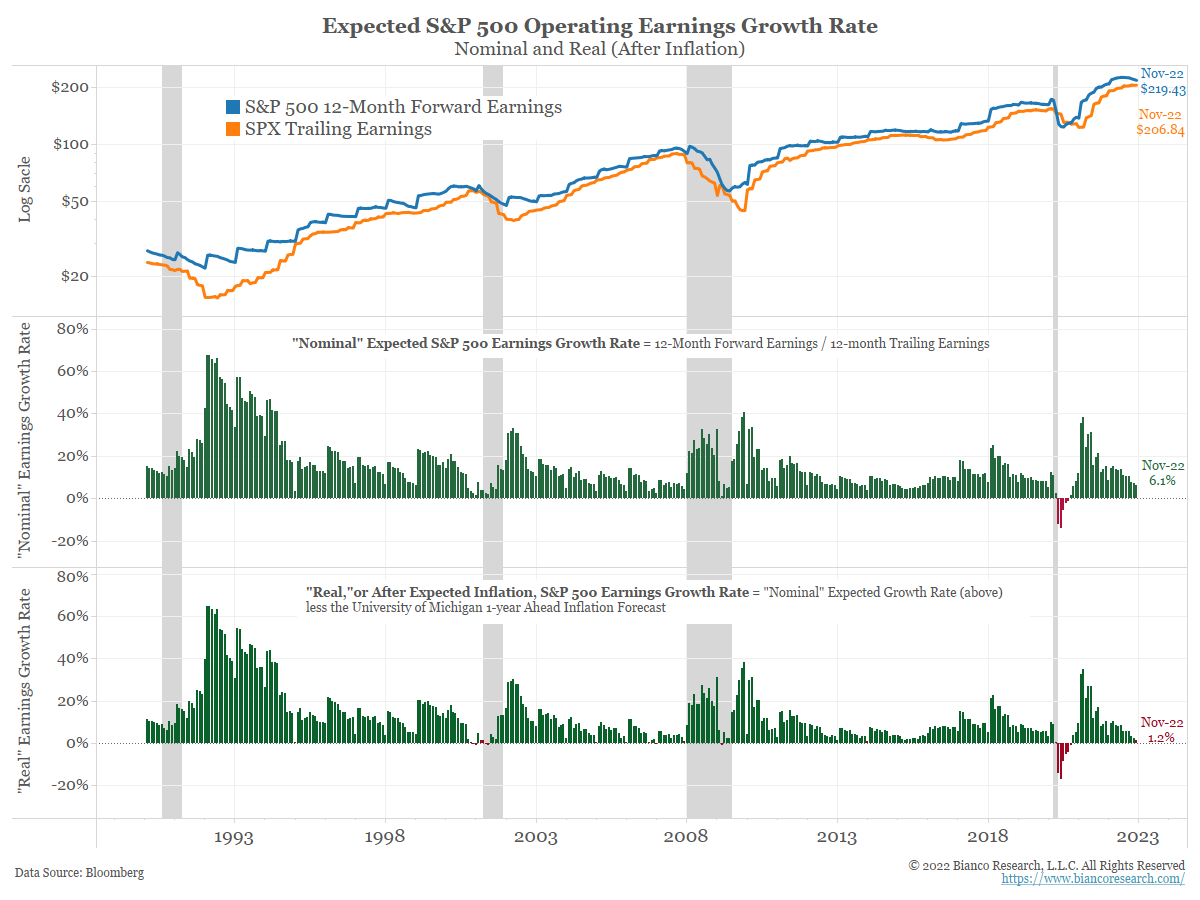

And the median earnings forecasts of Wall Street analysts are not much better.

The next chart shows the S&P 500’s expected operating earnings growth rate over the next 12 months. This is derived by dividing the 12-month forward earnings forecast (blue line, top panel) by the 12-month trailing earnings (orange line, top panel). The operating earnings shown here are “bottoms up,” meaning they are the aggregation of the median forecast for each of the S&P 500 companies by Wall Street analysts.

The middle panel shows the “nominal,” or before-inflation forecast for S&P 500 earnings over the next 12 months. It is falling and down to just 6.1%.

The bottom panel takes the nominal forecast above and subtracts the 12-month expected inflation rate. For this, we use the University of Michigan’s survey of 1-year ahead inflation forecast. We chose this because it is the only such measure that goes back to 1990, the start of the earnings data show.

On an inflation-adjusted basis, the next 12 months of S&P 500 earnings are expected to grow at just 1.2%. This measure has only been lower on two occasions, the Covid shutdown of 2020 and the tech implosion of 2000. In both cases, the economy was already in recession.

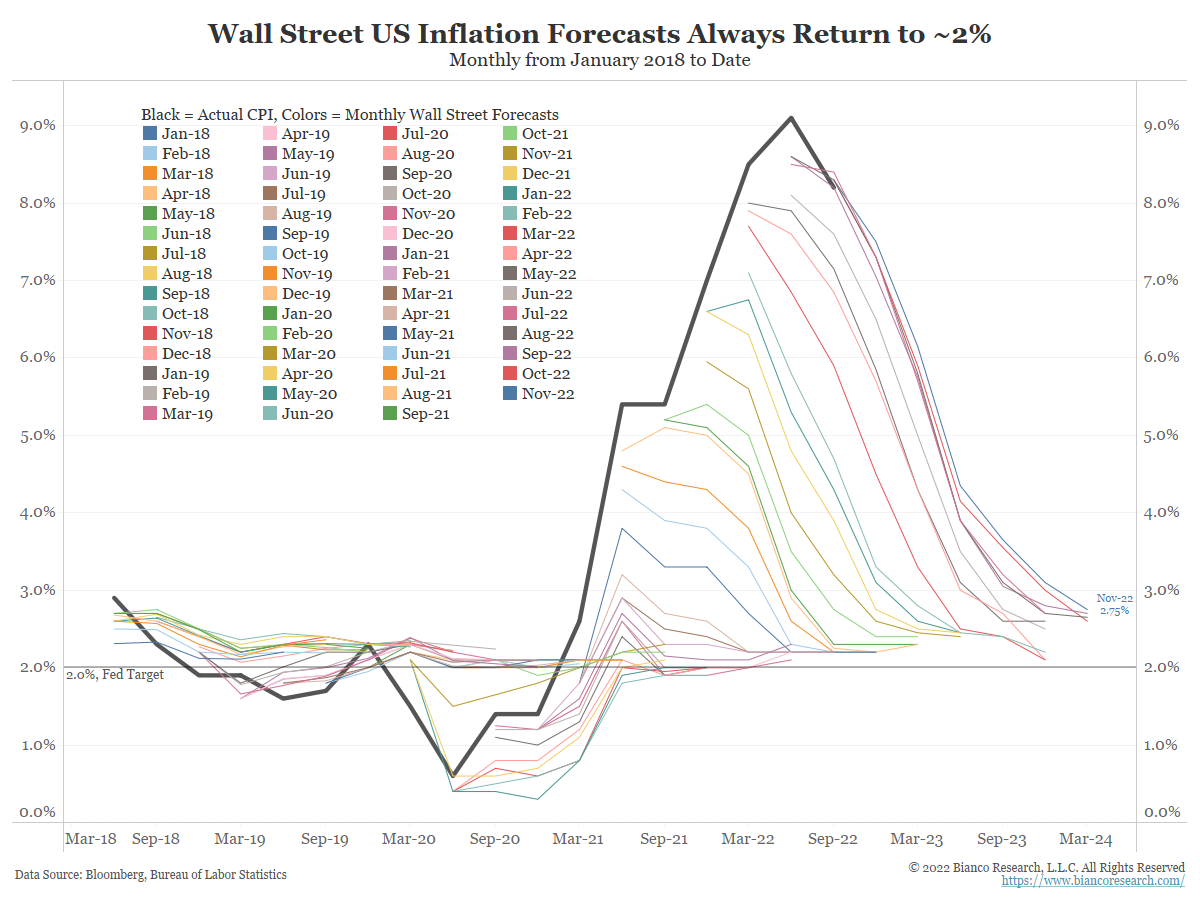

Inflation

The next chart shows actual inflation in black and the monthly forecasts (various colors) back to 2018. Wall Street still believes inflation is transitory and they continuously forecast it returning back to the Fed’s target of 2%. Why?

It is the combination of believing the Fed is credible in fighting inflation and expecting a recession. Soaring unemployment, a falling stock market, and the worst after-inflation earnings in at least a generation should also combine to sap demand from the economy and lower the prices for goods and services, or inflation, as well.

Conclusion

Sum it up and many are expecting 2023 to be a lousy year, maybe worse than 2022.

We believe the following tweet from Kevin Paffrath highlights the hope of many on Wall Street.

Welcome to 2022 where the bull story is everything goes bad and the Fed cuts and we all get rich.

The market is a liquidity junkie, it needs cheap money more than good earnings/growth. https://t.co/Jyw0S9y2OM

— Jim Bianco biancoresearch.eth (@biancoresearch) December 4, 2022

All of the gloom and doom detailed above is really bullish.

The stock market is so dependent on cheap money and liquidity that if any/all of the forecasts above come to pass, the Fed will have to pivot next year and cut rates. And despite a terrible economic backdrop, the argument follows this will spark a massive stock market rally.

At the top, we noted Wall Street typically fires analysts for pessimistic calls. So, why do have so many gloomy forecasts now?

Welcome to 2022, where bad news on the economy is good news for the markets as it means the Fed will cut rates and spark another liquidity-driven rally. So, in a perverse way, all the gloom and doom we detailed above is good for investments!

See what 15 years of QE/money printing/Fed puts/0% and negative interest rates have done to investors’ psyches and markets! They have been trained to buy broad-based ETFs and expect the Fed to print them to riches.

So what is the bearish story for stocks in 2023? None of this happens. The economy avoids recession, companies have positive earnings, and the Sahm Rule is not triggered. Of course, this might also mean inflation stays “persistent,” giving the Fed cover to continue hiking rates beyond the 5% terminal rate currently priced into the fed funds market.

The other bearish story is the economy turns down so hard that even cheap money cannot save it. 2023 is going to be interesting!