Summary

Comment

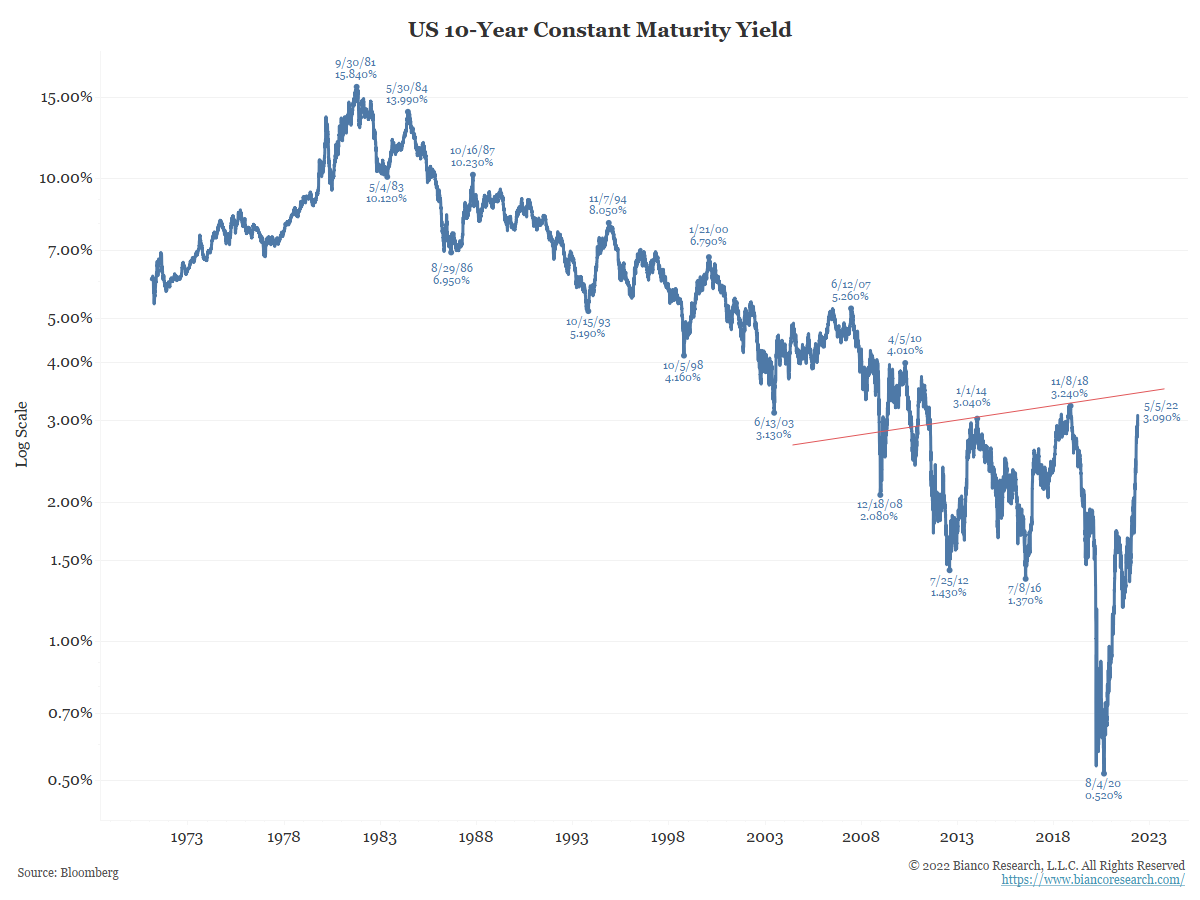

The 10-year is currently at 3.09%. Should it exceed 3.24% and move toward 3.40% (the red trend line), basic technical analysis suggests the secular trend in interest rates is now higher and the bull market officially ended in mid-2020 at 0.52%.

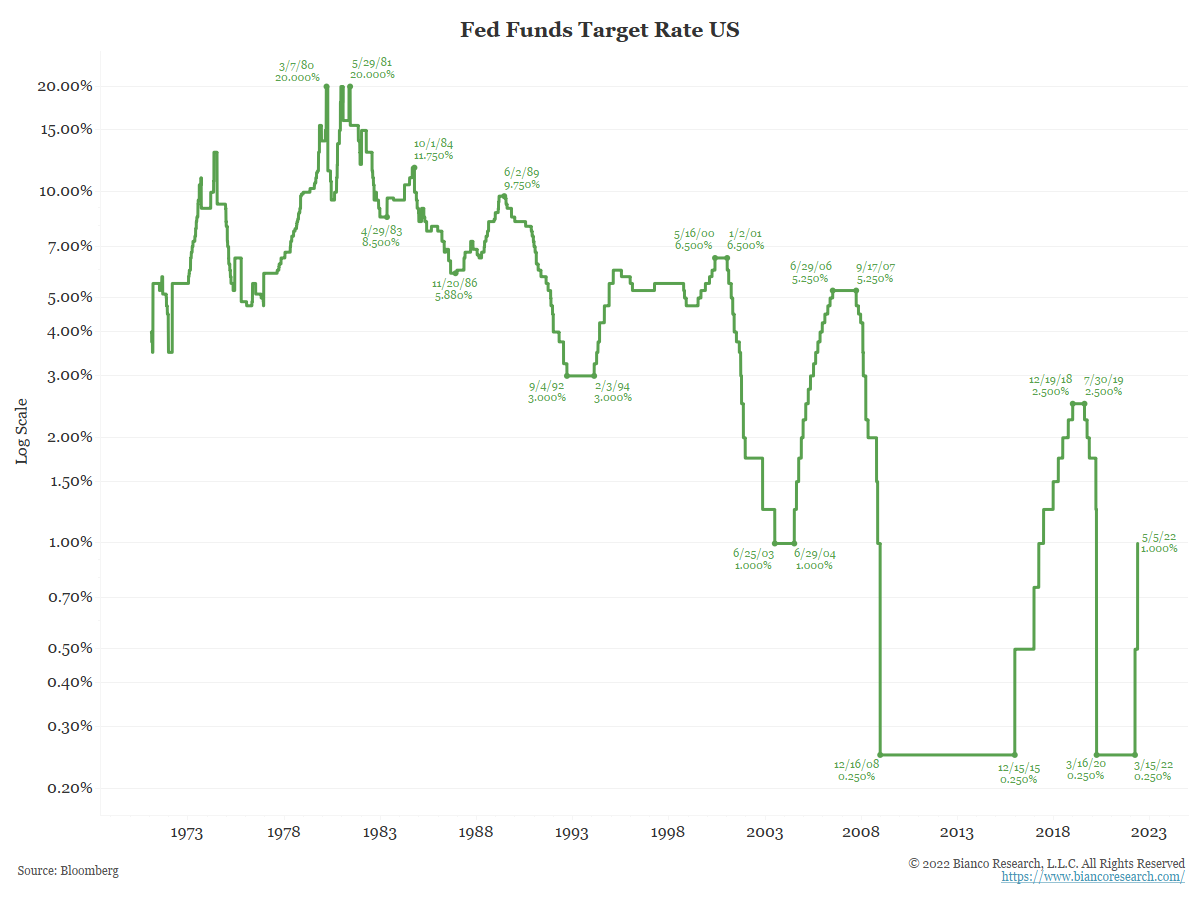

The next chart shows 50 years of the federal funds rate, again on a log scale.

Since the 20% peak in 1981, every hiking campaign in the last 41 years ended at a lower high than the previous hiking campaign.

The last campaign ended December 19, 2018, at 2.50% (upper end of the 25 basis point range).

Currently, the federal funds rate is 1.00%. Jay Powell suggested the next couple of meetings would see 50 basis point hikes. So this gets the funds rate to 2% by the end of July and sets the stage for the first “higher high” hiking campaign since the 1970s.

Interest rates seemed poised for their first higher high in almost 40 years. Should this happen, it would suggest interest rates are in a secular uptrend.