Summary

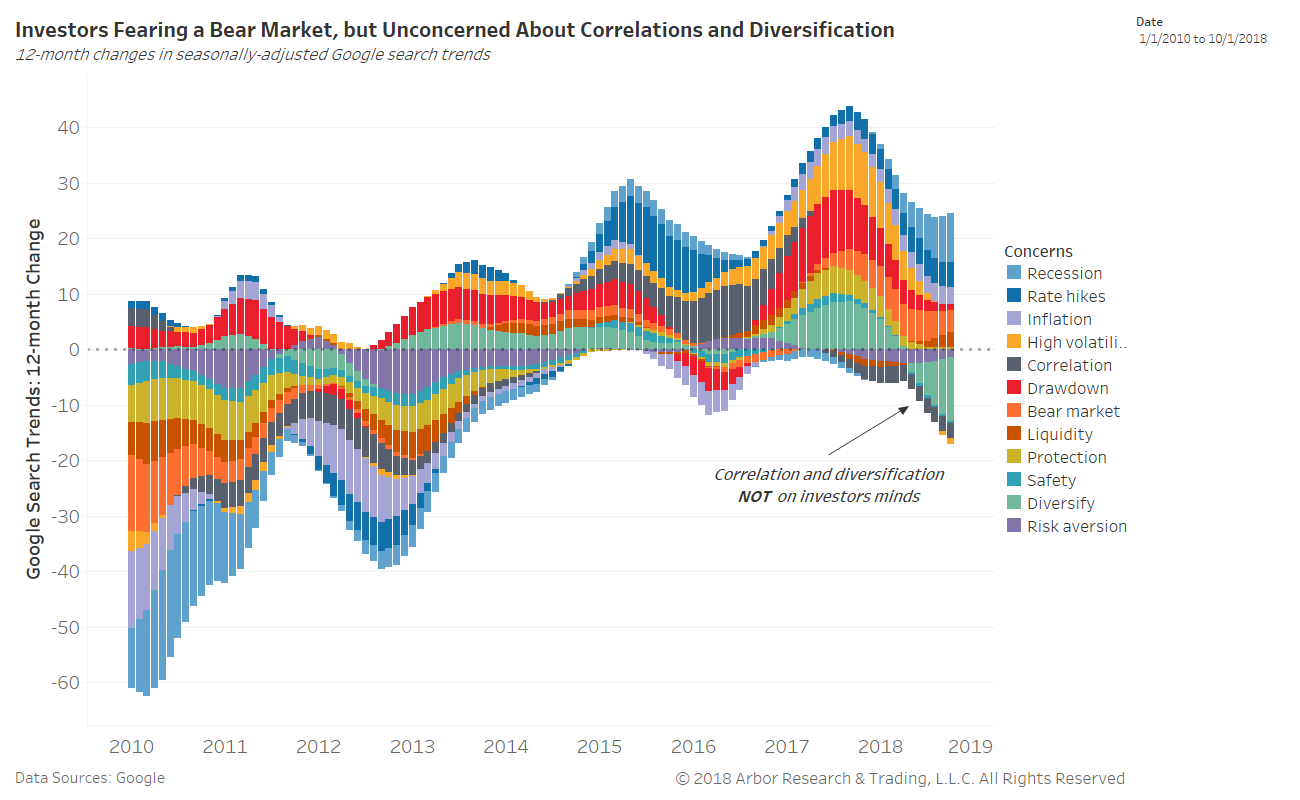

The next chart shows the fears of investors by measuring Google search trends (six-month, seasonally-adjusted changes) within investment channels. Fears of a bear market and/or recession remain on the rise, but a need to diversify or seek protection are steadily declining. This cognitive dissonance may mean investors believe the ‘Trump put’ or ‘Fed put’ still exists when they likely do not.

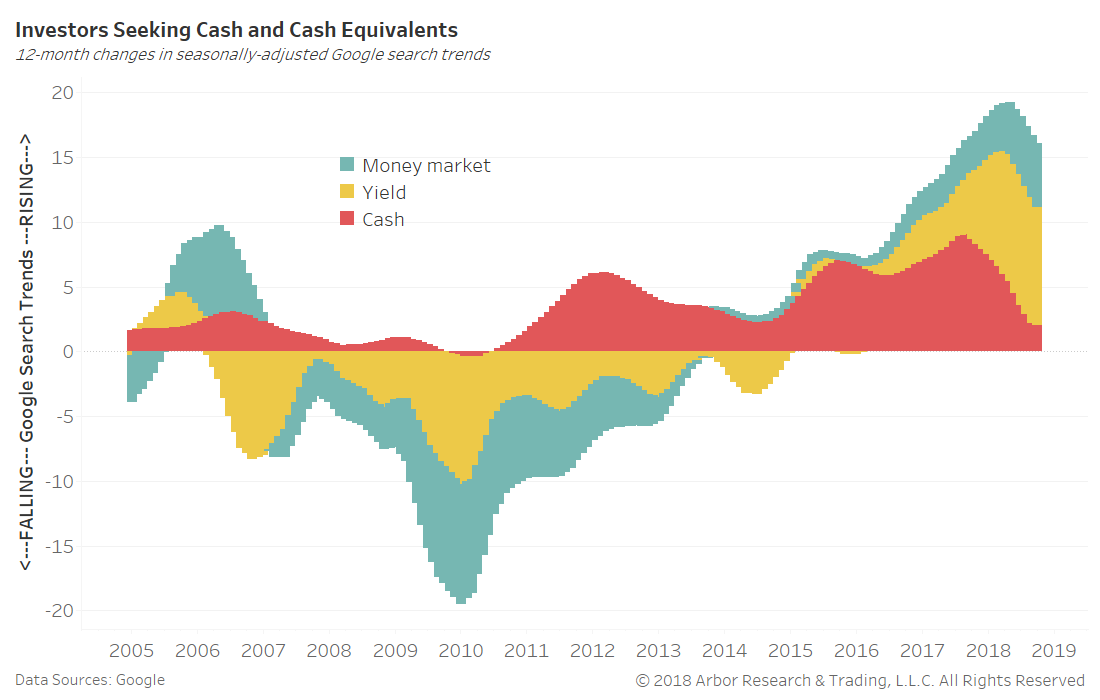

Most notably, investors have been seeking cash and cash equivalents due to rising short-end yields. Retail money market accounts have ballooned to their largest balances since January 2010. The new risk-off has resulted in investors de-risking by allocating greater and greater percentages of assets to ultra-short-term duration.

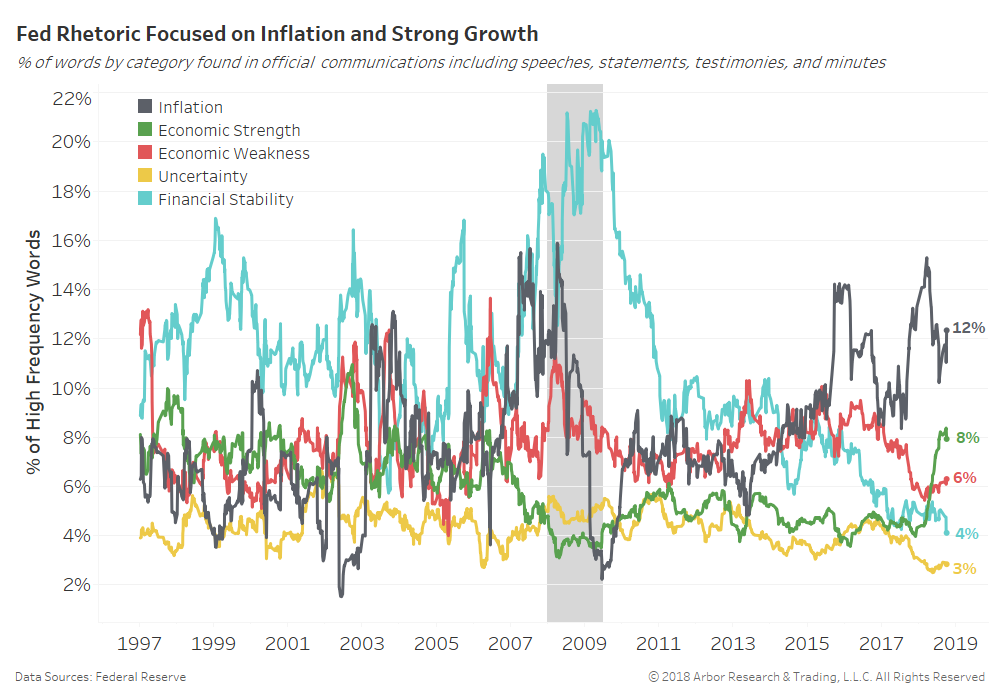

The chart below shows the percentage of official Federal Reserve communications (speeches, statements, minutes, and testimonies) allocated to each topic from inflation to financial stability.

The Federal Reserve is the odd man out when it comes to uncertainty because they frankly do not see any. Powell et al have uttered words of concern or uncertainty (yellow) at nearly their least frequent pace in history.

Inflation remains a top concern, but official have made a very concerted effort to congratulate U.S. economic growth in recent months (green). Financial stability (light blue) barely makes it on their radar.

The financial media, consumers and the Federal Reserve do not have the same concerns or issues on their radar screens. Uncertainty is rising across financial media and investors.

Comment

In this piece we compare economic concerns across three venues: 1) financial T.V. news programming, 2) Google search trends, and 3) Federal Reserve communications.

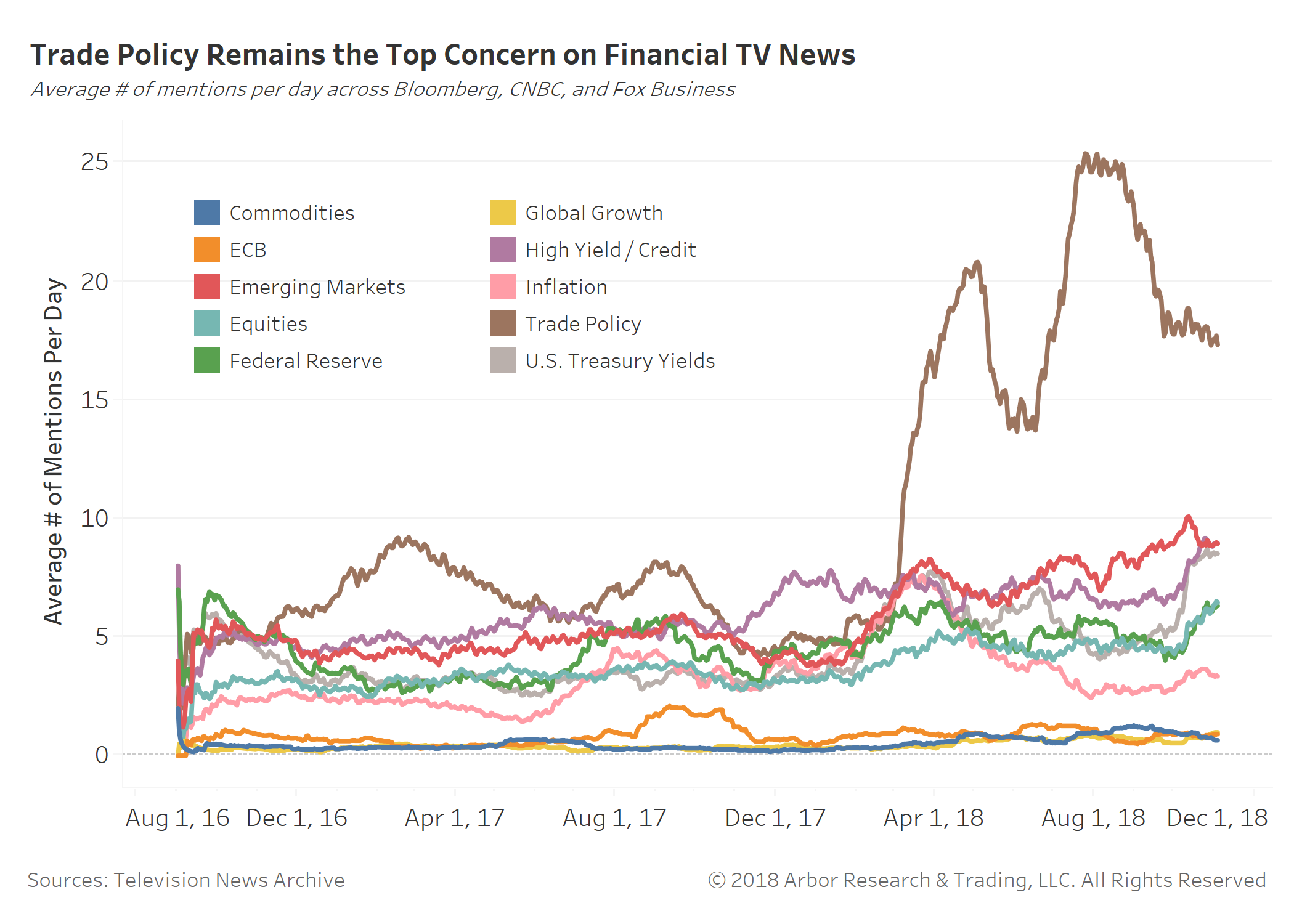

The first chart shows the average number of mentions per day by topic across financial T.V. news programming (Bloomberg, CNBC, and Fox Business). Trade policy concerns (brown) have left all others behind since March 2018. We have a difficult time finding many segments failing to utter ‘tariffs,’ ‘trade war,’ or ‘China / U.S. frictions.’

However, note all concerns but commodities, ECB, and global growth are on the rise in recent weeks. Emerging markets, high yield, and U.S. Treasuries are essentially tied for the second greatest concern. We can thank a steadfast Federal Reserve and tightening financial conditions.