Summary

Comment

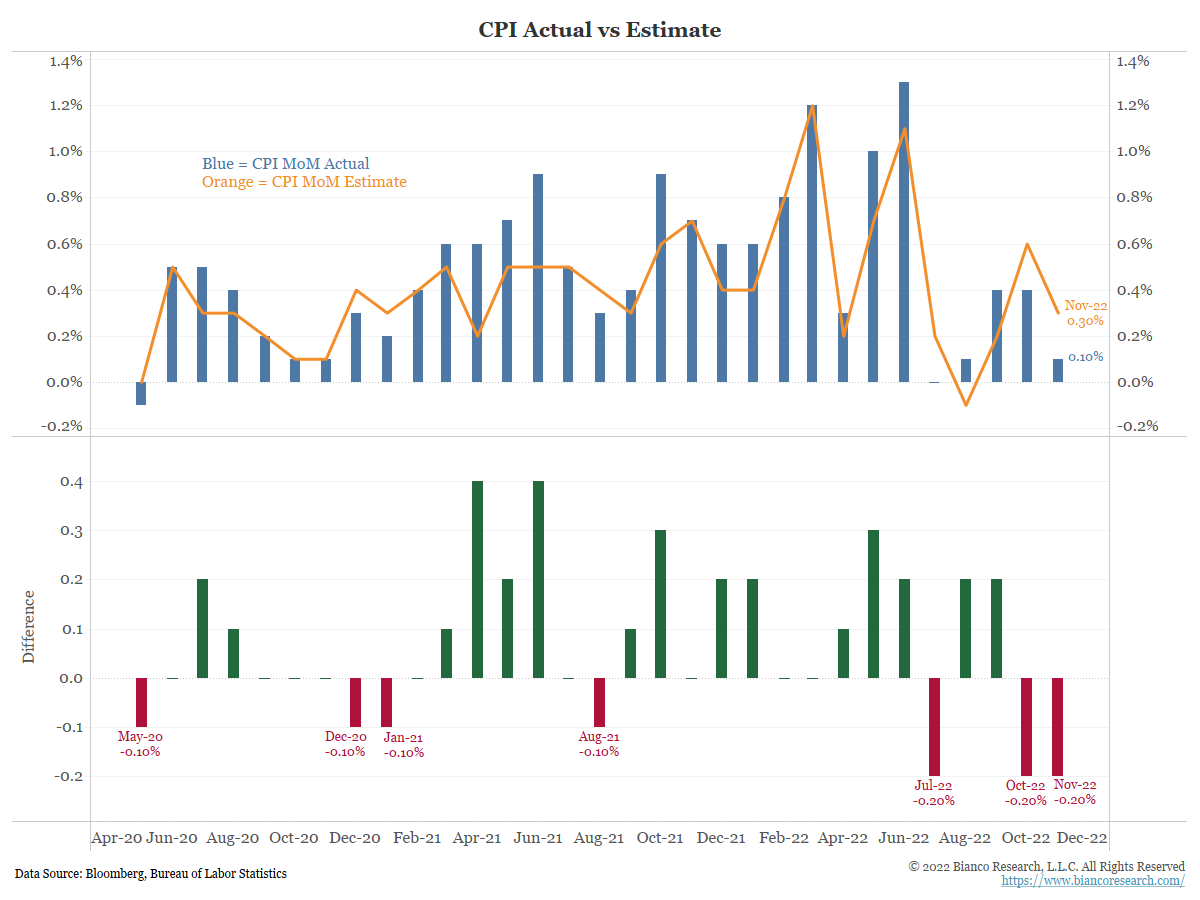

As the chart below shows, month-over-month headline CPI (blue bars) came in below the median Wall Street forecast (orange line) again in November. This now marks the third time in the past five months that Wall Street proved too high, breaking a trend of projections that were consistently too low over the past couple of years.

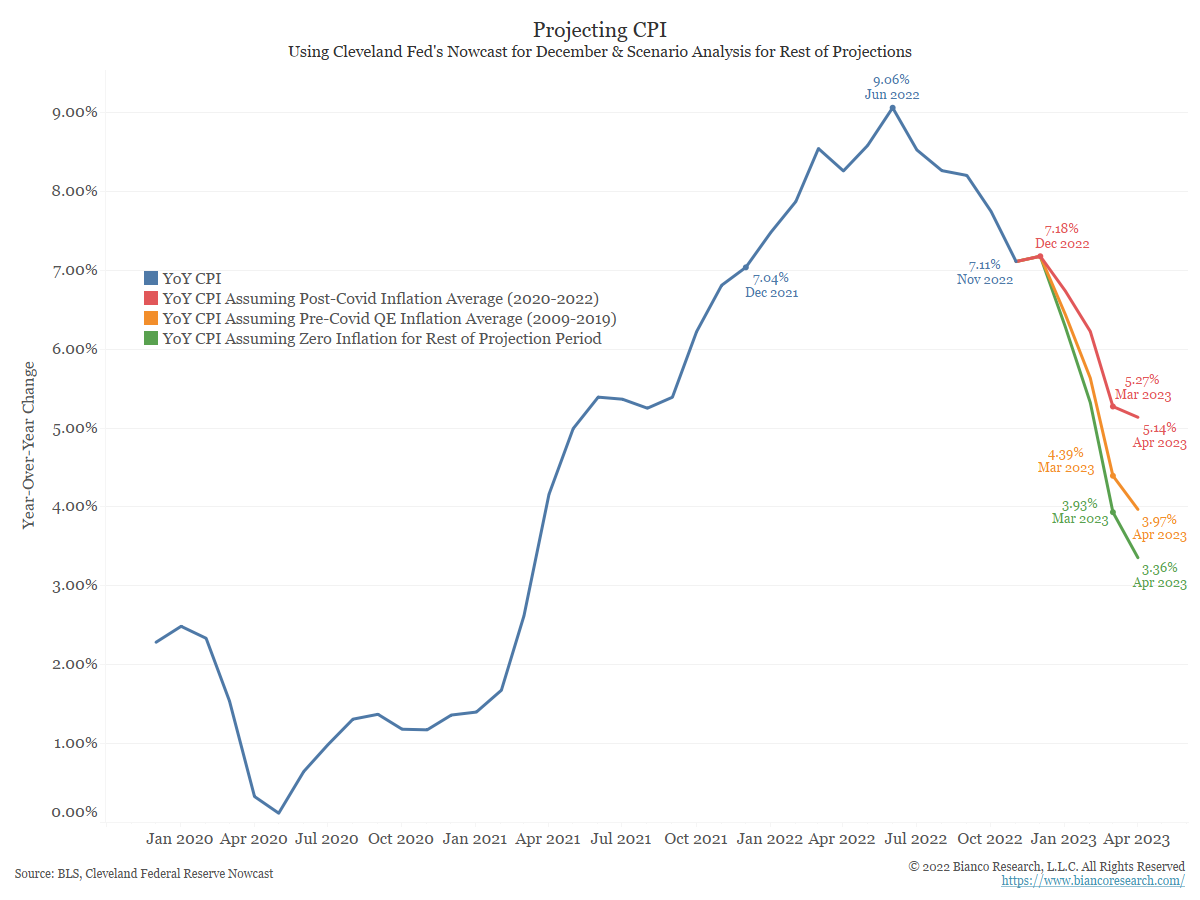

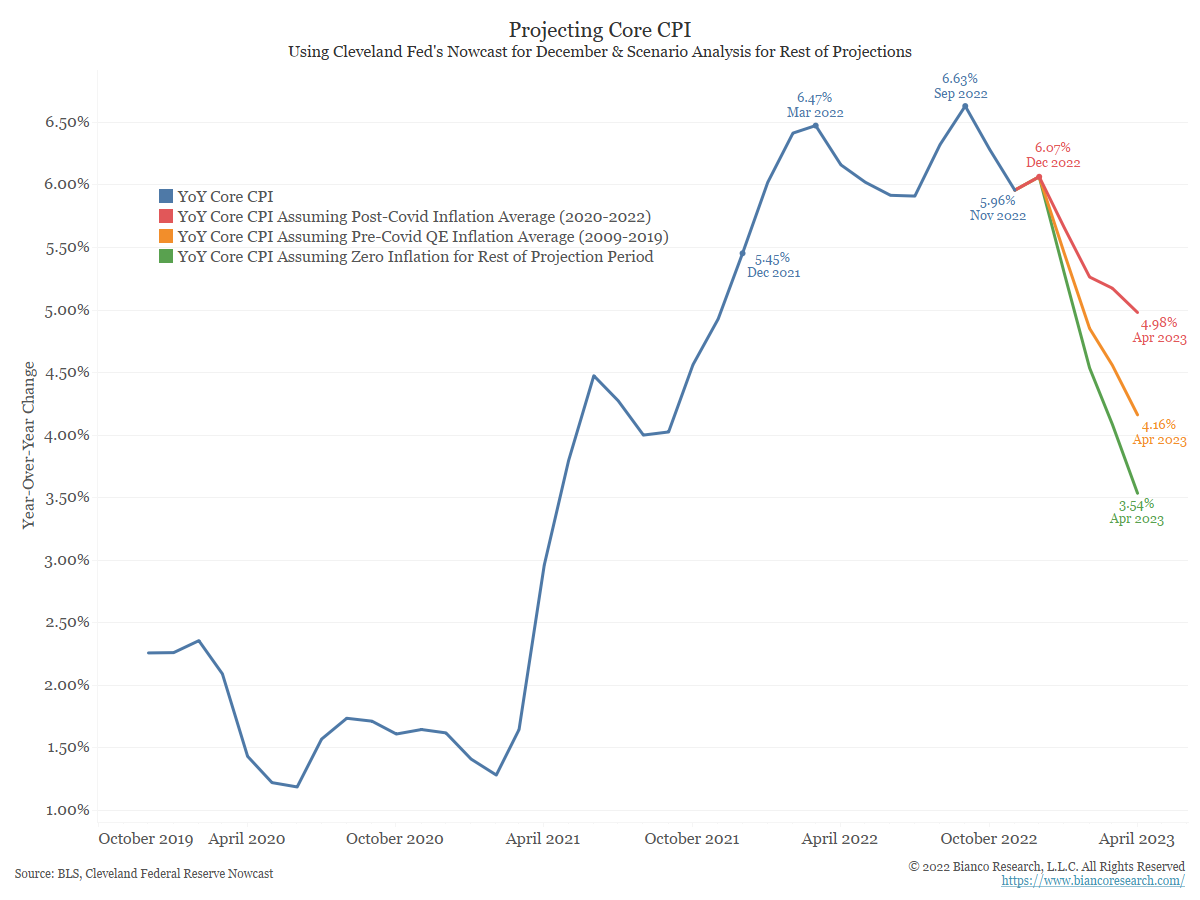

So how does today’s lower-than-expected CPI release change the year-end scenario analysis we originally offered in July?

The blue line in the chart below shows year-over-year CPI, which rose by 7.11% in the twelve months through November 2022. For the scenarios below, we assume the Cleveland Fed’s CPI Nowcast of 0.37% month-over-month inflation for December will be correct.

The red line shows CPI would be 5.27% by the end of Q1 2023 if the month-over-month releases equal the average seen since the pandemic began in 2020. The orange line shows CPI would be 4.39% at the end of Q1 if the month-over-month releases equal pre-pandemic QE-era inflation. Finally, the green line shows CPI would 3.93% by March 2023 if the month-over-month releases show 0% inflation between now and then.

As we wrote last month, this is the period where the rubber meets the road on inflation. Based on the month-over-month numbers being so high a year ago, any shortfall on the inflation front will lead to a quick decline in the year-over-year numbers. That is precisely why risk markets took off this morning on the low inflation print.

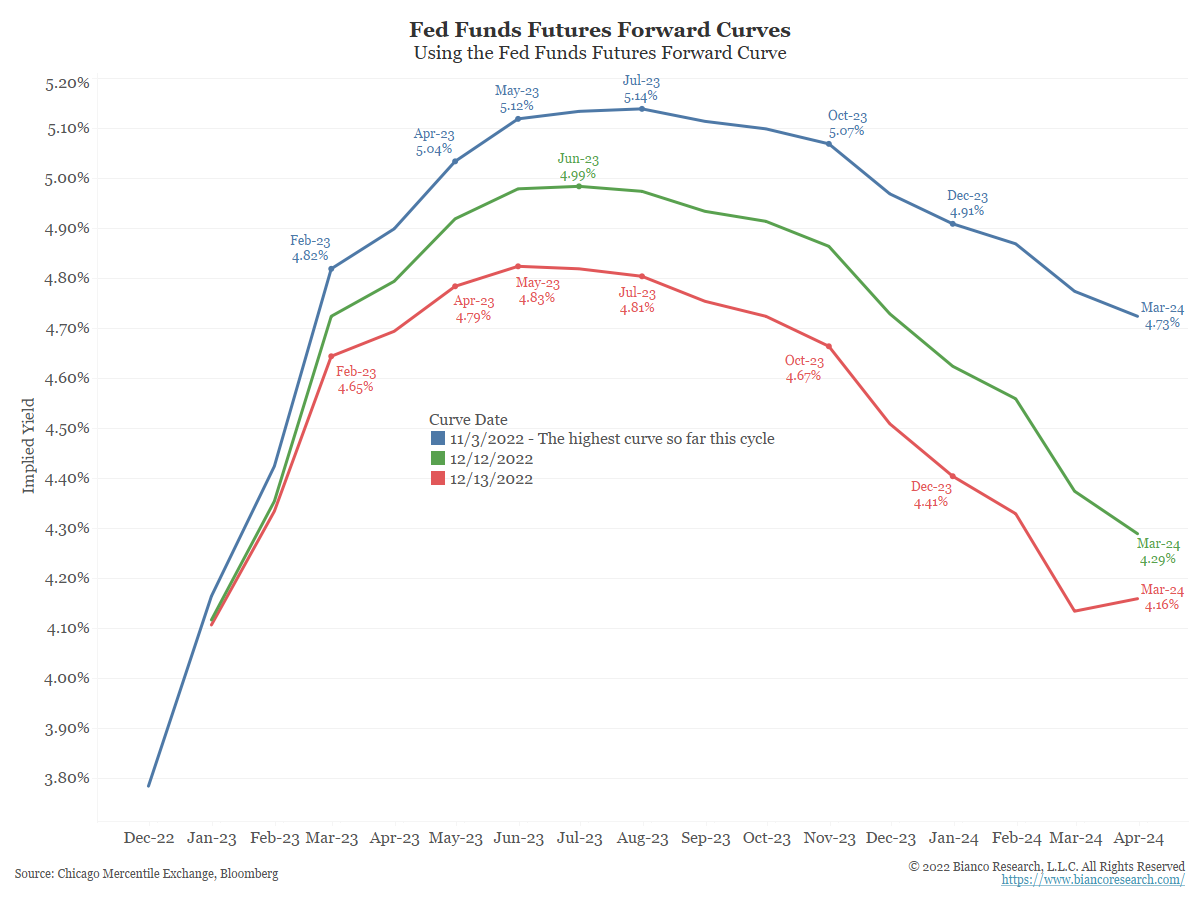

So how has the market’s opinion on the Fed’s likely course changed in the wake of today’s positive inflation news? The chart below shows the fed funds forward curve as of three dates. The blue line shows the highest point the curve reached in this cycle (November 3), with the terminal rate projected to be as high as 5.14%.

The green line shows the curve as of yesterday’s close, with a terminal rate of 4.99%. After this morning’s CPI release, the red line shows traders are now projecting the terminal rate to ‘only’ reach 4.83%.

Interactive Visual