- Bloomberg.com – McCarthy Turmoil Is Grim Omen for Debt Limit, Spending Talks

Demands by conservative hard-liners raise risk of US default

Any financial storm would strike a vulnerable US economyThe turmoil that has for three days stalled the start of the new Republican House majority offers a warning that disarray in Washington risks igniting a US debt crisis capable of roiling financial markets later this year. The deadlock between establishment Republicans and dissident conservatives over choosing a House speaker laid bare the depth of division within the party, and the powerlessness of GOP leaders to force a compromise on recalcitrant members.

Summary

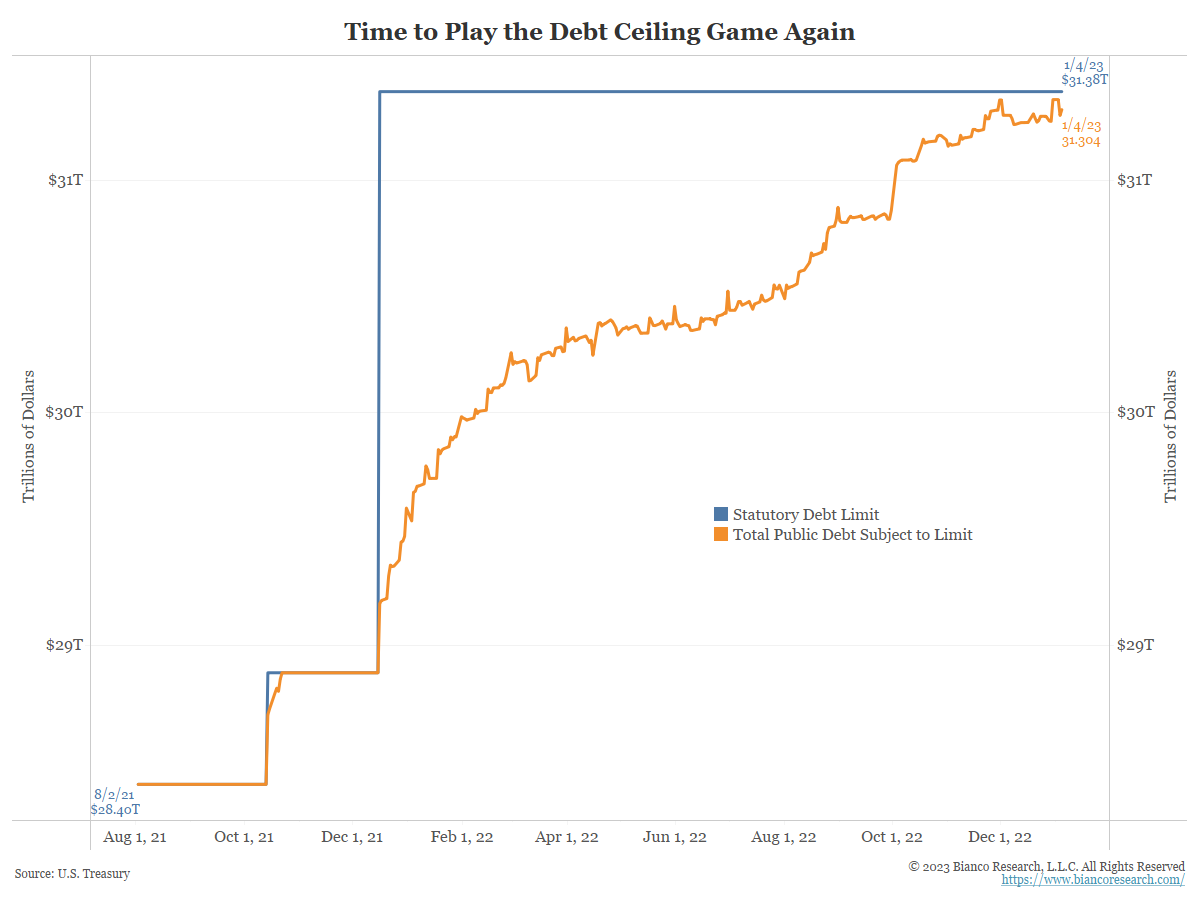

The federal government will reach this ceiling shortly. At that point, the Treasury Secretary has a series of maneuvers, referred to as “extraordinary means,” to keep funding the federal government without breaching this level.

These maneuvers can last for months, but not indefinitely. The best guess is that this summer/fall, the Treasury Secretary will have exhausted these maneuvers and the debt ceiling will have to get raised.

If the debt ceiling is not raised, the government cannot fund itself and starts shutting down operations and furloughing employees. Disruptions follow.

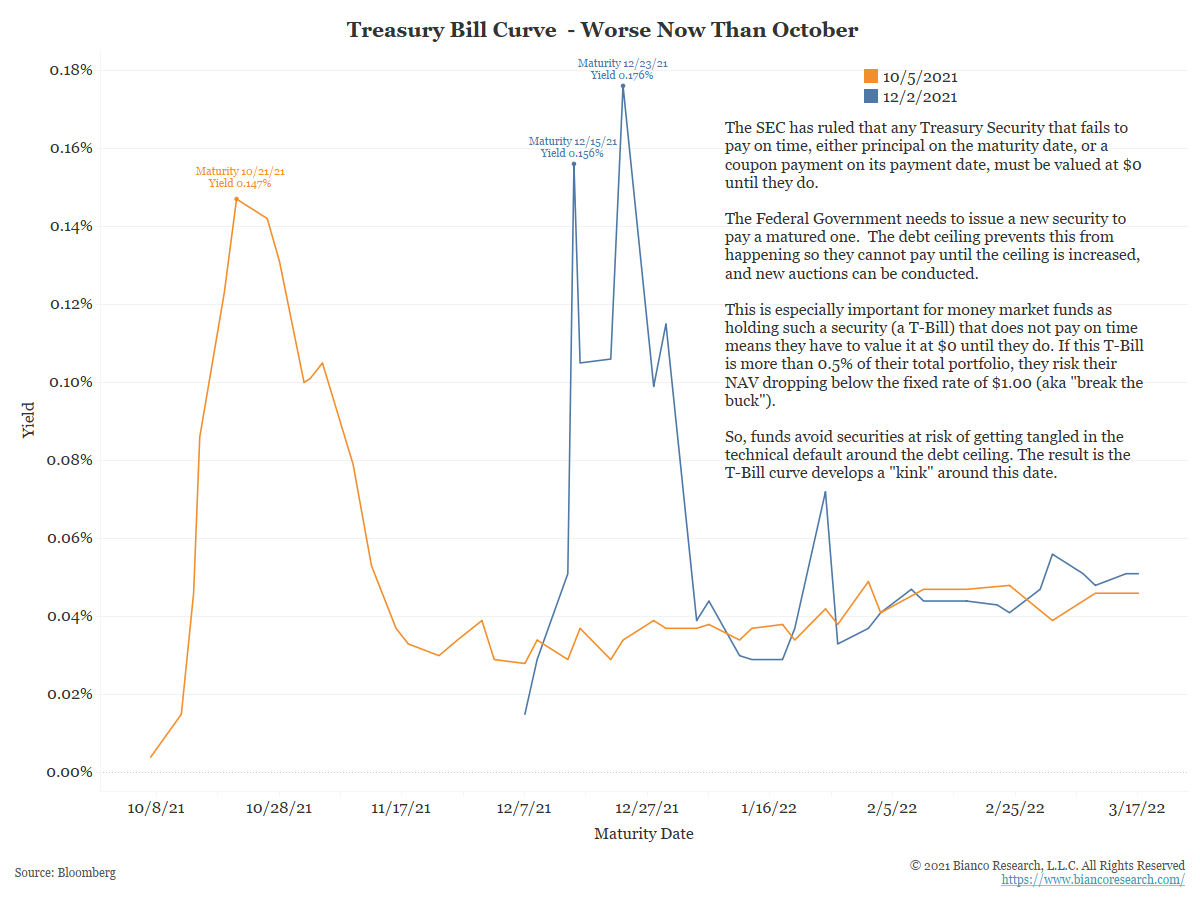

The problem for financial markets is the repayment of debt. To pay matured Treasury securities, new ones have to be issued. But this cannot happen when the debt ceiling has been reached and extraordinary means have been exhausted.

Zero Value

When principal payment cannot be made on the maturity date, the SEC ruled those securities must value at zero until payment is received.

All of this is a big issue for the Treasury bill market. They are issued at a discount to par and repaid at par. The inability to repay principal is a big problem for holders of Treasury bills, especially money market funds, as the bills are valued at zero until payment is made.

For money market funds, marking these securities to zero risks pushing their Net Asset Value (NAV) below $1.00.

If we learned anything from the 2008 global financial crisis, the public has come to expect money market NAVs to always remain above $1.00 no matter what. Any “breaking of the buck” unleashes a crisis on markets.

So, when concerns over the government’s ability to repay T-bills arise, money funds will avoid the bills set to mature around the time the debt ceiling is reached, and extraordinary means have been exhausted.

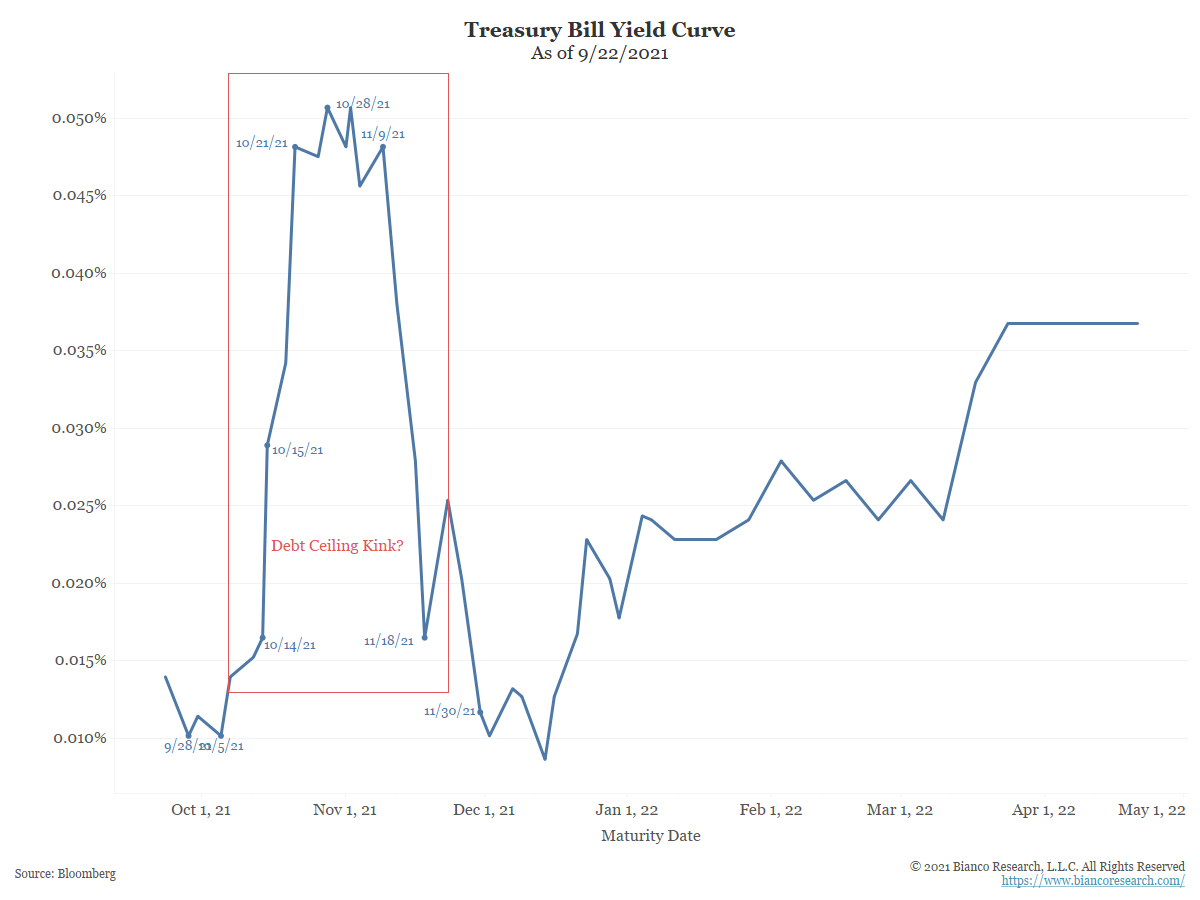

A Kink in the Curve

At this point, the securities at risk trade at a much higher yield than those around them. This is referred to as a “kink” in the Treasury bill curve.

One such example of this showed up during the 2013 debt ceiling fight. This also happened in October 2015. It happened again in August 2017.

But, most notably, it happened in August 2021, as the next chart shows.

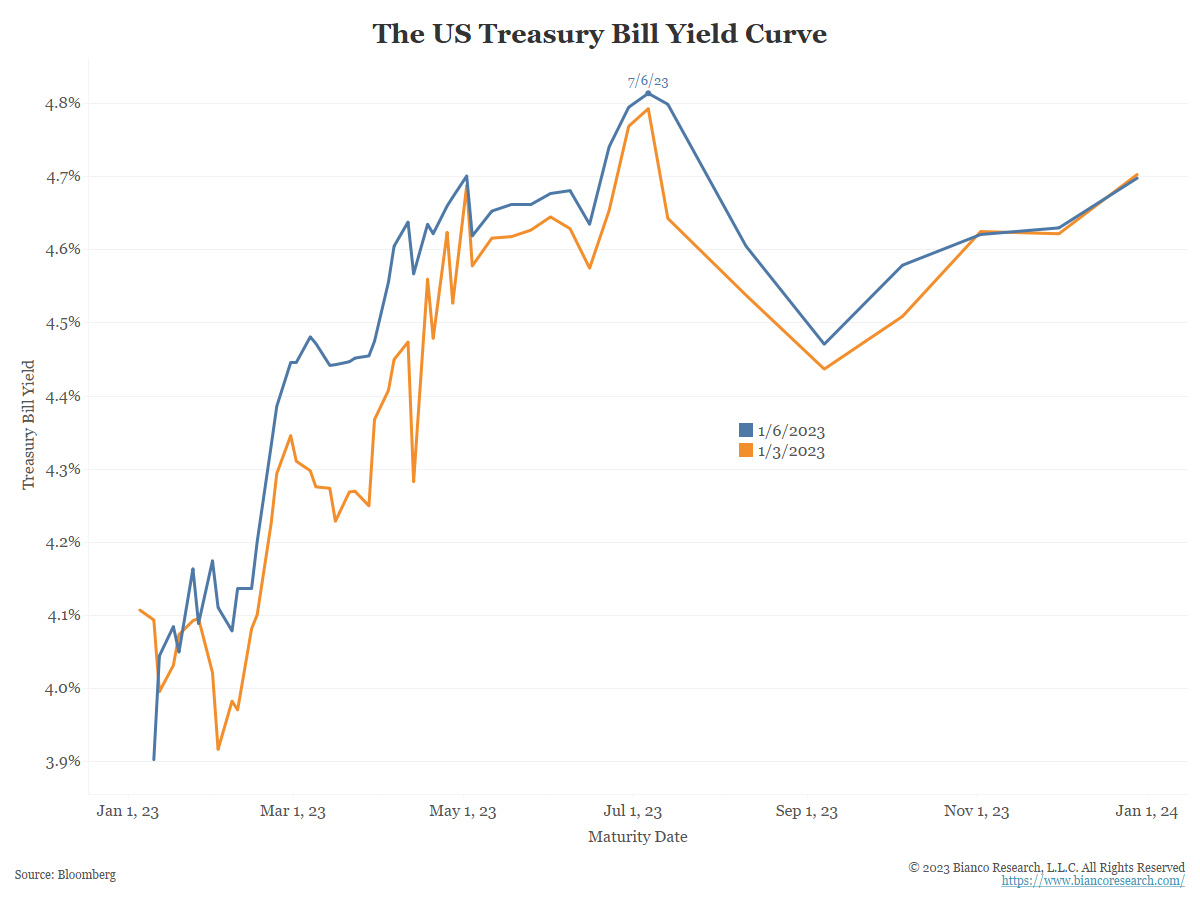

Currently No Kink

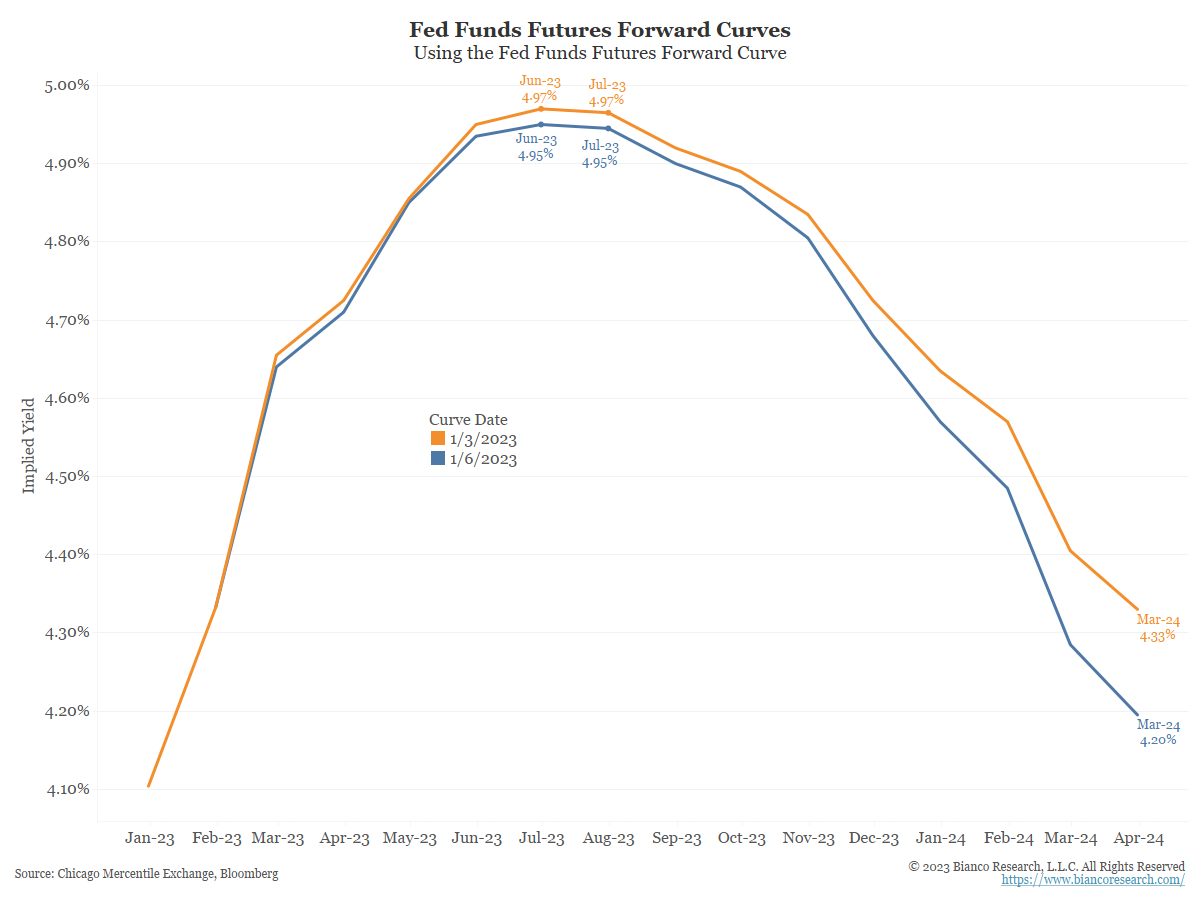

Compared to the previous examples shown above, there is no kink in this yield curve. There is an upward slope to July. This only reflects the market’s expectation of the path in the funds rate, as the forward fund futures chart shows here.

Conclusion

The market is not thinking any of the histrionics in Washington this week has materially altered the likelihood of a debt ceiling fight and default later this year.

This is not to dismiss the issue. Future events could change this dynamic, causing the Treasury bill curve to start pricing in a potential default. But the market seems to be saying the events around voting for a new Speaker this week was not such a catalyst.

The press is looking for ways the drama over electing a Speaker of the House might impact the real world. They seem to have settled on it being a warning that a technical debt default is more likely, as the highlighted passage above notes.

But there is a way to measure the likelihood of debt default in the Treasury bill market, and it is not showing much concern.

The Debt Ceiling

As the chart below shows, the debt ceiling (blue), set by law, is currently at $31.38 trillion. The current level of debt outstanding (orange) is just under this level at $31.3 trillion.