- The Financial Times – Fitch flags risks of forced sales for bond mutual funds

The rapid growth of corporate bond funds could present a threat to financial stability, according to Fitch Ratings, if a combination of investor runs and deteriorating trading conditions sends shockwaves through markets. Concerns over the growth of corporate debt funds and the implications for “liquidity” — a gauge of how easy it is to buy and sell financial securities — have been rising since the financial crisis. Figures such as Blackstone’s Stephen Schwarzman and economist Nouriel Roubini have warned that the mismatch between how easy it is to pull money out of a fund and how hard it can be to sell the underlying bonds could exacerbate or even cause another market crunch.

Summary

Comment

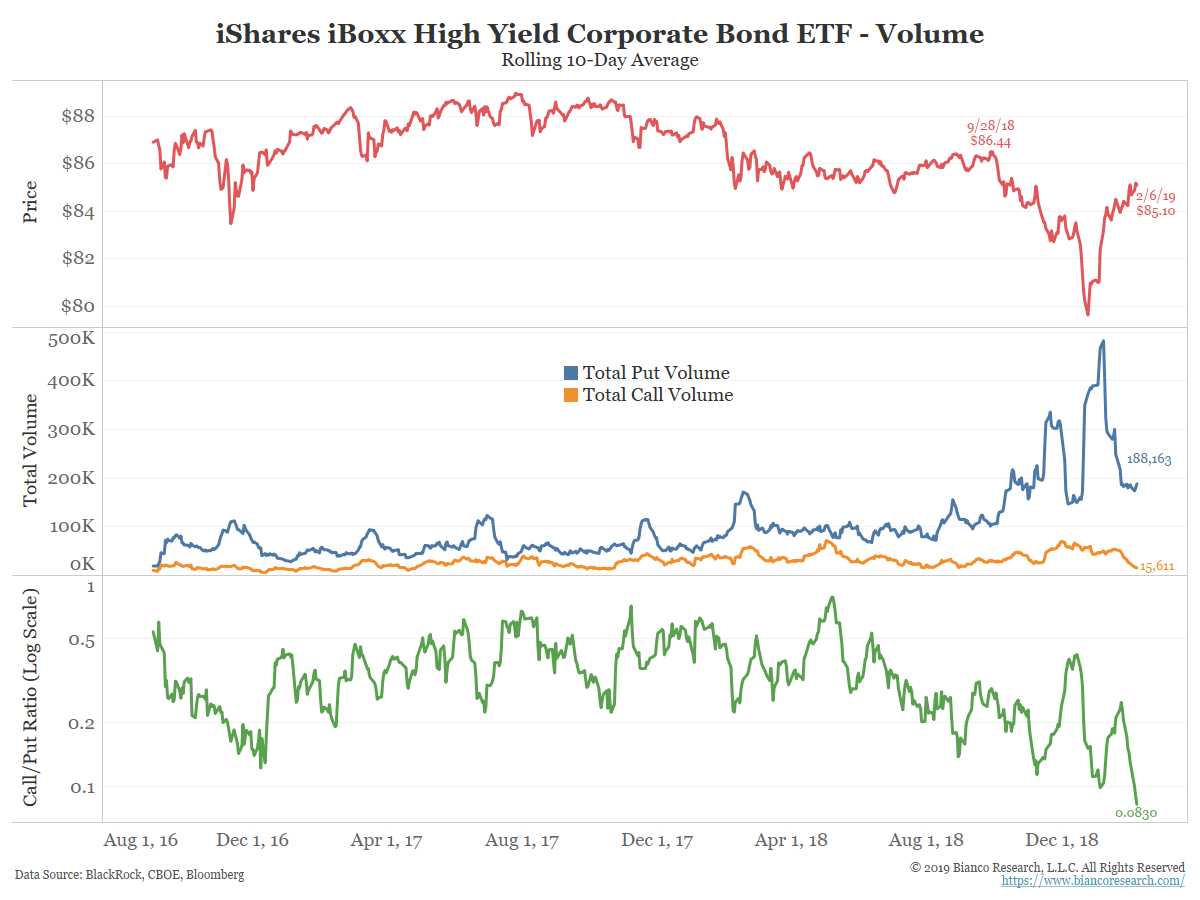

The idea of money managers using ETFs and indexed products to hedge positions in high yield bonds has been a consistent theme of ours. It is a strategy that works so long as liquidity exists. But, as the story above suggests, it could cause many headaches during times of high volatility.

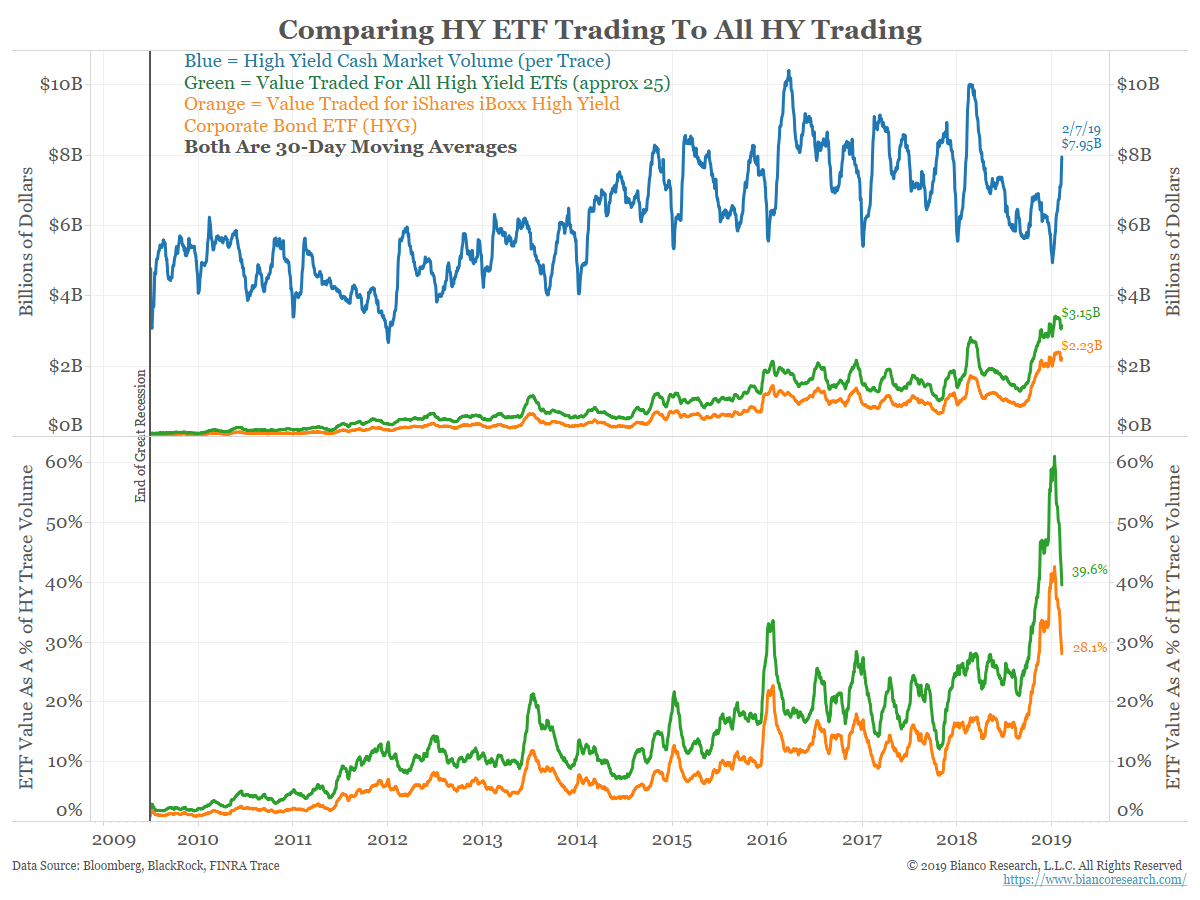

The top panel of the chart below shows trading in high yield ETFs (green and orange) versus cash bond trading (blue). The bottom panel shows ETF trading as a percentage of the underlying market is at almost 40%. While this is off its recent peak of more than 60%, it is still elevated.

This past equity downturn highlights the potential for problems due to an increased reliance on high yield ETFs and puts. If money managers are trading ETFs and puts instead of the actual cash market, dislocations will eventually occur. Disaster was avoided this time around due to January’s massive bounce in risk markets.

We still believe high yield’s “indexation” represents a risk. As we stated earlier this month:

This represents a risk as the [high yield] bonds that make up these indices are too different to assume they can trade as one. When stresses rise enough, these bonds could go their separate ways, making index level strategies ineffective.