- CNBC – Used-car prices are down from record highs, easing the impact of inflation

“It’s potentially becoming a bit deflationary in that regard,” Smoke said, adding that doesn’t necessarily mean there’s going to a massive price correction. “This is not a commodity market that people are speculating, and used vehicles are assets that actually provide utility to folks.” “We had an unusual circumstance over the last two years that stimulated demand, and we have limited supply,” he said.

- CNBC – With limited inventory due to a computer chip shortage, 82% of consumers are paying above sticker price for a new car

For car shoppers, the current inventory squeeze means it may be worth waiting to make a purchase if possible until the market stabilizes, Edmunds said. If you cannot, however, there are some ways to try getting a better deal than you may otherwise — it just will involve some legwork. “If you know you need a new vehicle soon … doing extra research is critical to get an advantage,” said Ivan Drury, senior manager of insights at Edmunds. Additionally, being flexible can help, Drury said. If possible, consider alternative vehicle types or brands and be willing to compromise on color and features.

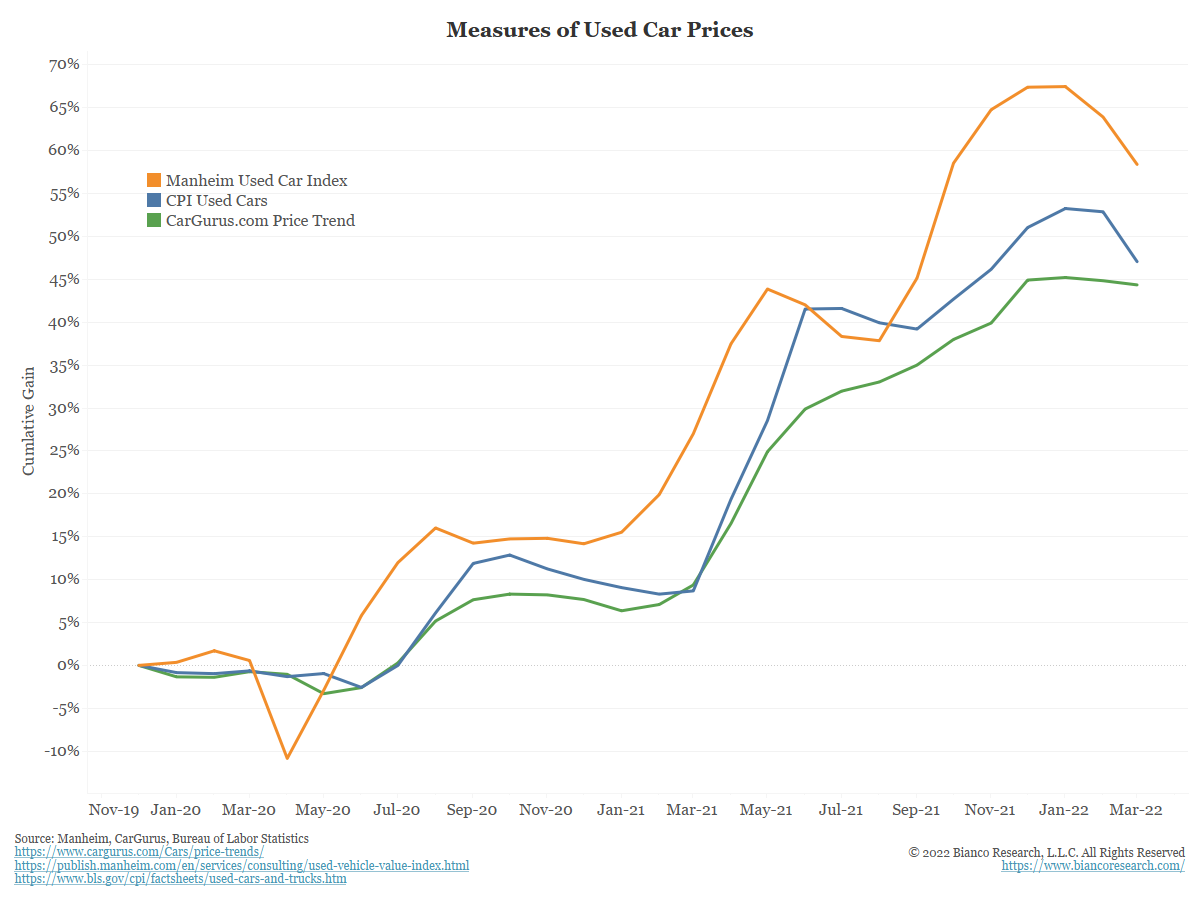

Cargurus releases data on a daily basis. Its latest reading for May 8 was a new all-time high and it is still in an uptrend.

A fair criticism of Cargurus is it is not actual sales but listing prices. We would respond by saying the trend matters more than the actual level. Even with that being said, most cars in 2022 are selling for more than the list price.

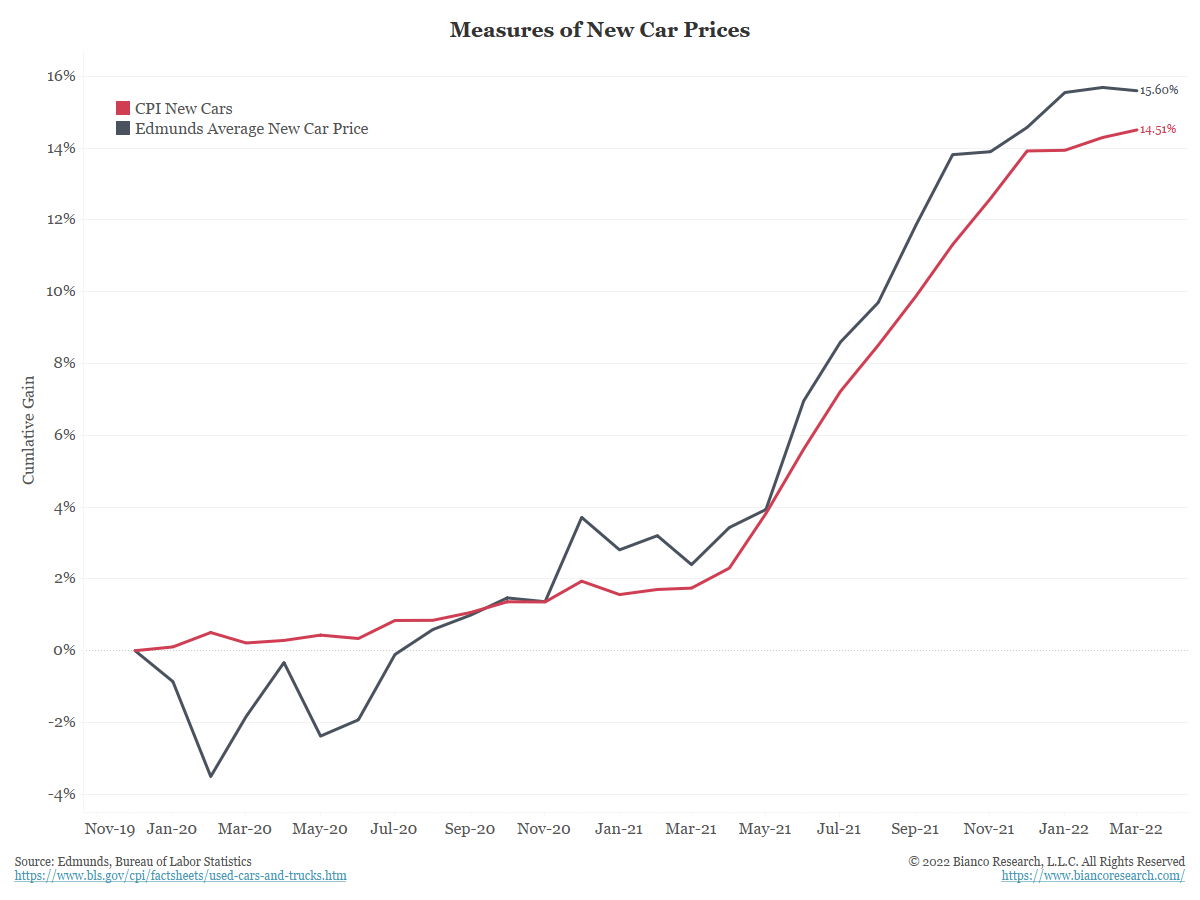

And New Cars?

The next chart shows data on new car prices from Edmunds. New car prices have pared some of their acceleration but have yet to turn markedly lower. The CPI component of new car prices closely tracks this index.

As the story from February above notes, consumers continue to pay far above sticker prices for new vehicles.

Conclusion

Have prices peaked? We are hearing lots of commentary calling for a mundane inflation print on Wednesday as several components seem to be rolling over with a peak in inflation behind us. While this is a likely outcome, we would not point to peaking car prices as a big driver in inflation heading lower.

Summary

Car prices account for 9.2% of CPI. A peak in car prices is being heralded by many as a sign that inflation is peaking. While inflation may be heading lower this month, real-time measures of car prices show the market is not slowing to the degree many believe.

Comment

According to the BLS, the sample used to calculate changes in used car prices comes from a JD Power survey:

The current CPI sample of used cars and trucks was chosen with a data set from the J. D. Power Information Network, a network of car dealers who report sales of used vehicles to the J. D. Power Company. From the universe of 2 through 7-year-old vehicles, a sample of 480 vehicles was chosen based on probability proportionate to sales.

For a more real-time estimate of used car prices, many watch the Manheim Used Car Index (orange below) and CarGurus Price Trend Index (green below).

Manheim’s index is based on sales from their wholesale auto auctions that are only open to professional buyers. Thousands of vehicles are used as source data. Note that Manheim does not do adjustments for depreciation or quality changes and its index comes out monthly.

Cargurus is an index of millions of list prices for used cars. These are the prices shown to the public. Cargurus does not track actual sales prices, but the average list prices currently available. Like Manheim, they do not adjust for depreciation or quality.

Both of these series are shown below. The box denotes the latest April readings. They have diverged with Manheim (orange) falling and CarGurus (green) rising. Typically used car CPI (blue) splits the difference.