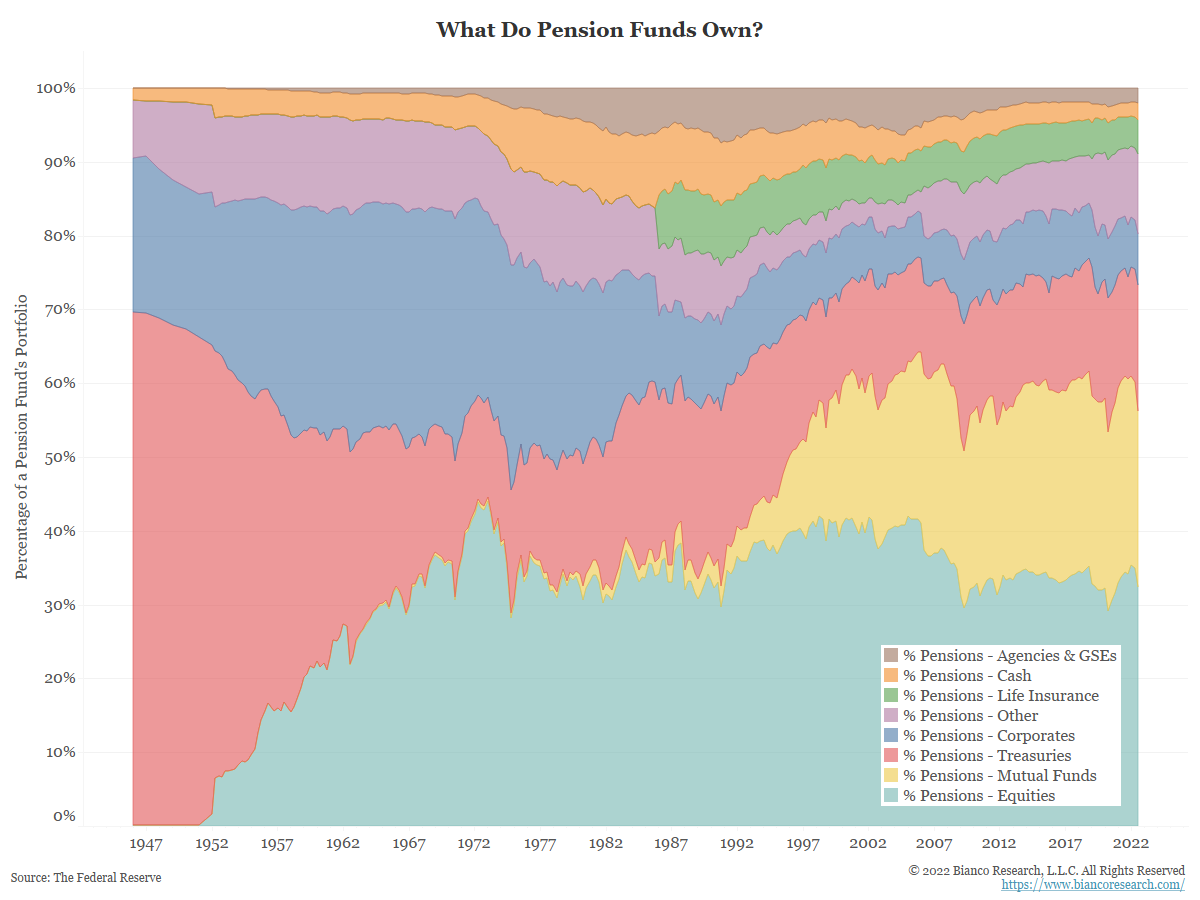

Pension funds have faced increased funding gaps over the past couple decades. As the chart below shows, pension managers have continued to increase their exposure to stocks in an effort to keep up. Stocks are the biggest single investment at pension funds, making up 32% of all assets. Mutual funds likely add to their equity exposure, making up an additional 24% of assets. Looked at another way, pensions appear to be mimicking a 60/40 portfolio, with various fixed income assets making up the remaining non-equity portion of their holdings.

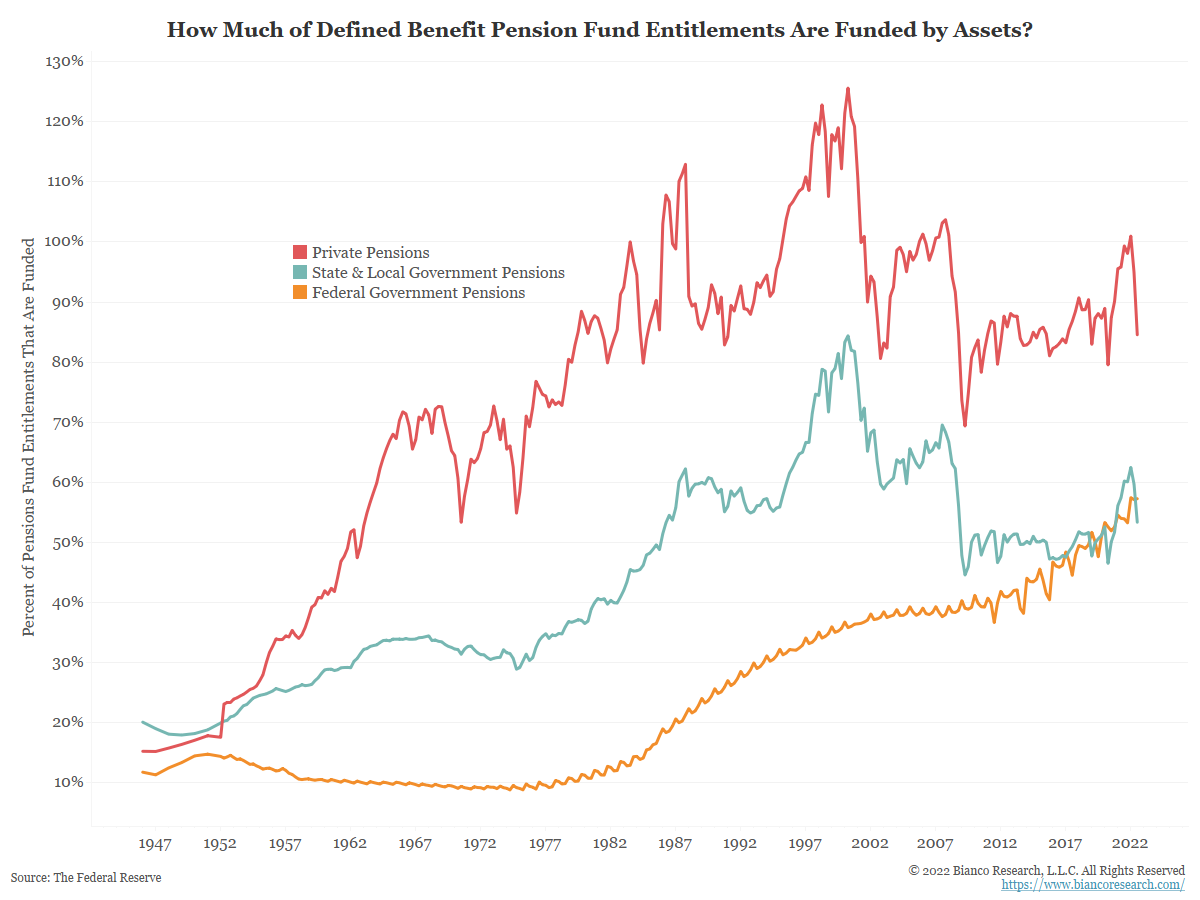

It should also be noted that the funding gaps are a very different story at private pension funds versus government pension funds. As the chart below shows, almost 85% of private pension fund entitlements are funded by assets. Public pensions, on the other hand, are roughly 53% to 57% funded.