- Bloomberg – Tim Duy: The Economy’s Too Robust for the Fed to Bow to Markets

Growth would need to slow to around 1.8 percent before the central bank considers slowing the pace of interest-rate hikes.The nasty sell-off in equity markets has raised doubts about the Federal Reserve’s willingness to follow through with its plan to boost interest rates again in December. It shouldn’t. The odds that market participants place on a rate hike had dropped to around 65 percent from a high of more than 80 percent a few weeks ago. The decline comes even as central bankers give little reason to doubt that another rate hike is coming. New York Federal Reserve President John Williams, a permanent voting member on the Federal Open Markets Committee, reiterated this week his expectation that the Fed would “be likely raising interest rates somewhat but it’s really in the context of a very strong economy.”

- The Wall Street Journal – Greg Ip: Amidst Roaring Economy, Troubled Markets Sound Alarms

By most measures the U.S. economy is in excellent health. Yet stocks are sinking, yields on corporate bonds are rising and commodity prices are tumbling—all typical precursors of a slowdown or recession. The dichotomy is rooted in two unusual features of the world today. First, while the U.S. is surfing a wave of fiscal stimulus, growth in the rest of the world is slowing. That’s undercutting prospects for companies that do business abroad. Second, the Federal Reserve is steadily withdrawing the unprecedented monetary stimulus that buoyed the economy and almost every asset class over the last decade. The question is whether markets, in adjusting to these new realities, will overreact to the point that they endanger the expansion, on track to become the longest ever next summer. The answer for now appears to be no, but the trends are troubling.

- The Wall Street Journal – Real Time Economics: What Are Markets Telling Us About the Economy?

Stan Druckenmiller is a legend among hedge fund managers, as lieutenant to George Soros and head of his own firm. The market has him worried. “The defensive stocks have been going straight up since May. All the economically sensitive stocks have been going down since May. They’re predicting we’re in a very, very late cycle,” he said Tuesday. The signs are the “same stuff I screamed about in 2007.” He’s not saying the Fed shouldn’t tighten, ever; but it should wait, and “see what happens.” The time to tighten was a few years ago; now, it’s more dangerous: “The leveraged loan market is two times what it was in 2007.” He pins the blame on the Fed’s quantitative easing which “encouraged more malinvestment…than at any time I can ever remember. We’re in the most economically disruptive period since the 1880s and there’s been no bankruptcies. As quantitative easing turns to quantitative tightening, all these zombies are going to be exposed.”

Summary

Comment

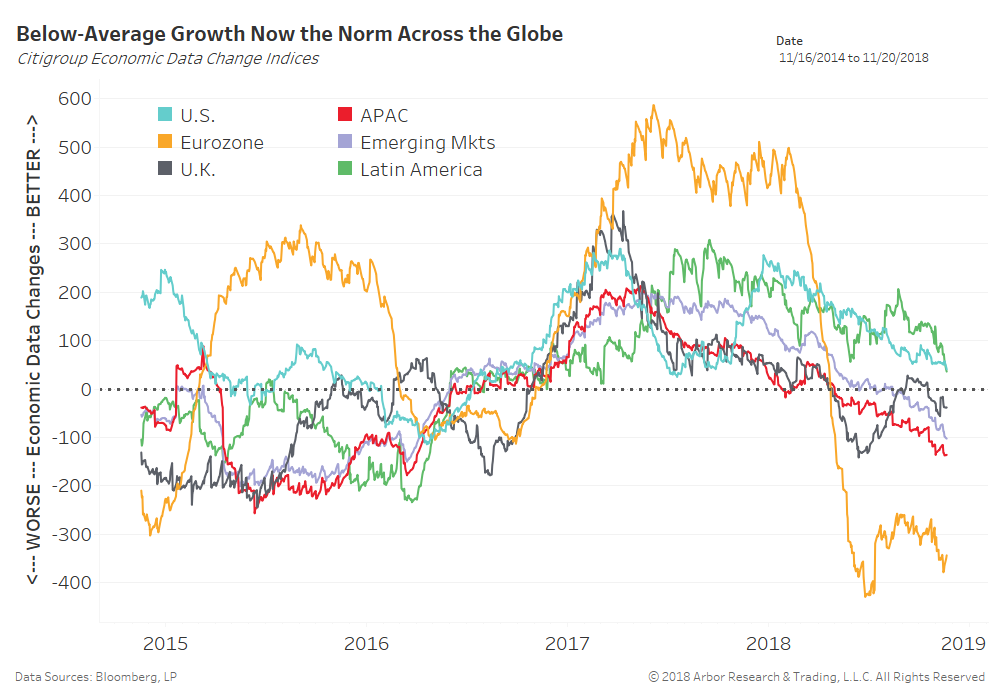

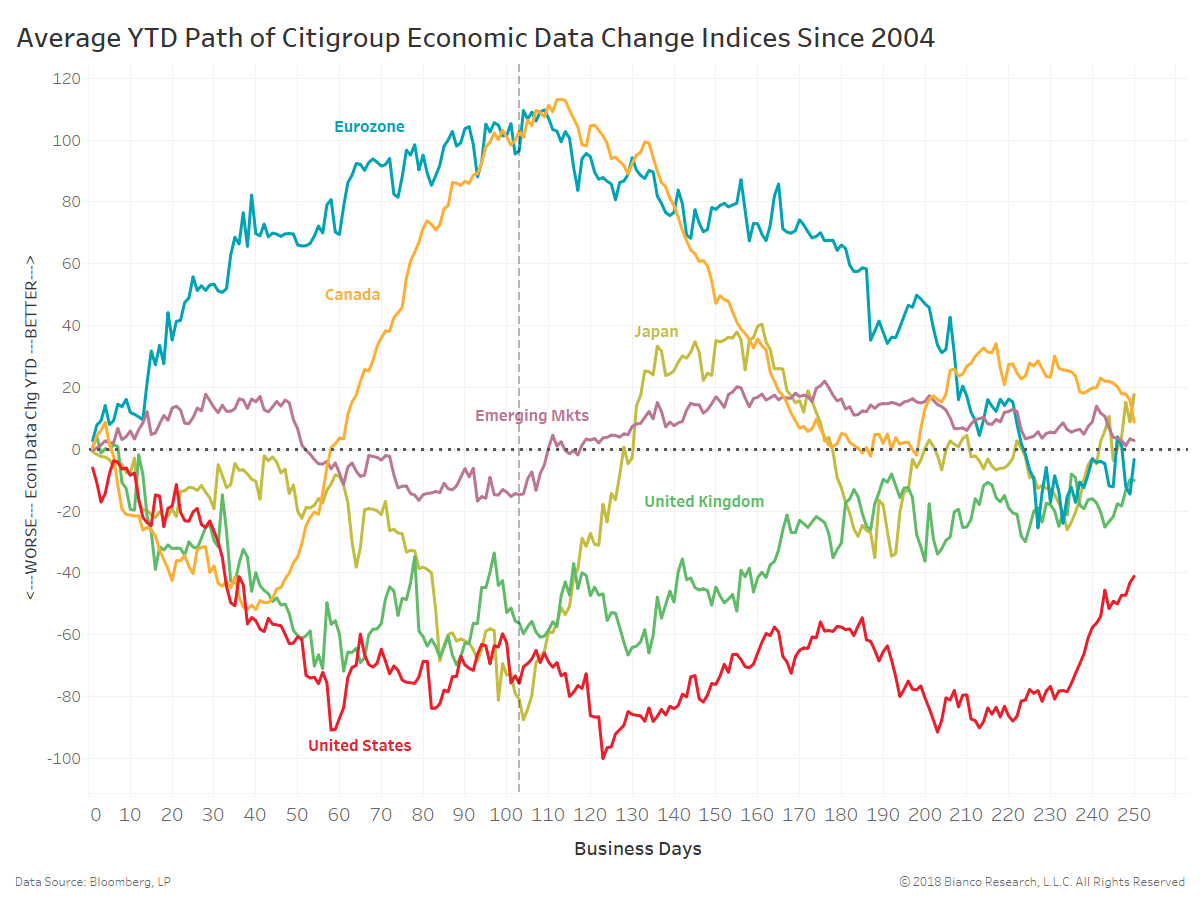

The chart below shows the Citigroup Economic Data Change indices for each region, which measure incoming data releases as they relate to one-year averages. The Asia Pacific, emerging markets, Eurozone, and United Kingdom have all fallen below zero, indicating below-average growth.

Notably, Latin America’s pace of economic improvement is tempering and nearing a break to below-average growth. This would leave the United States the lone survivor.

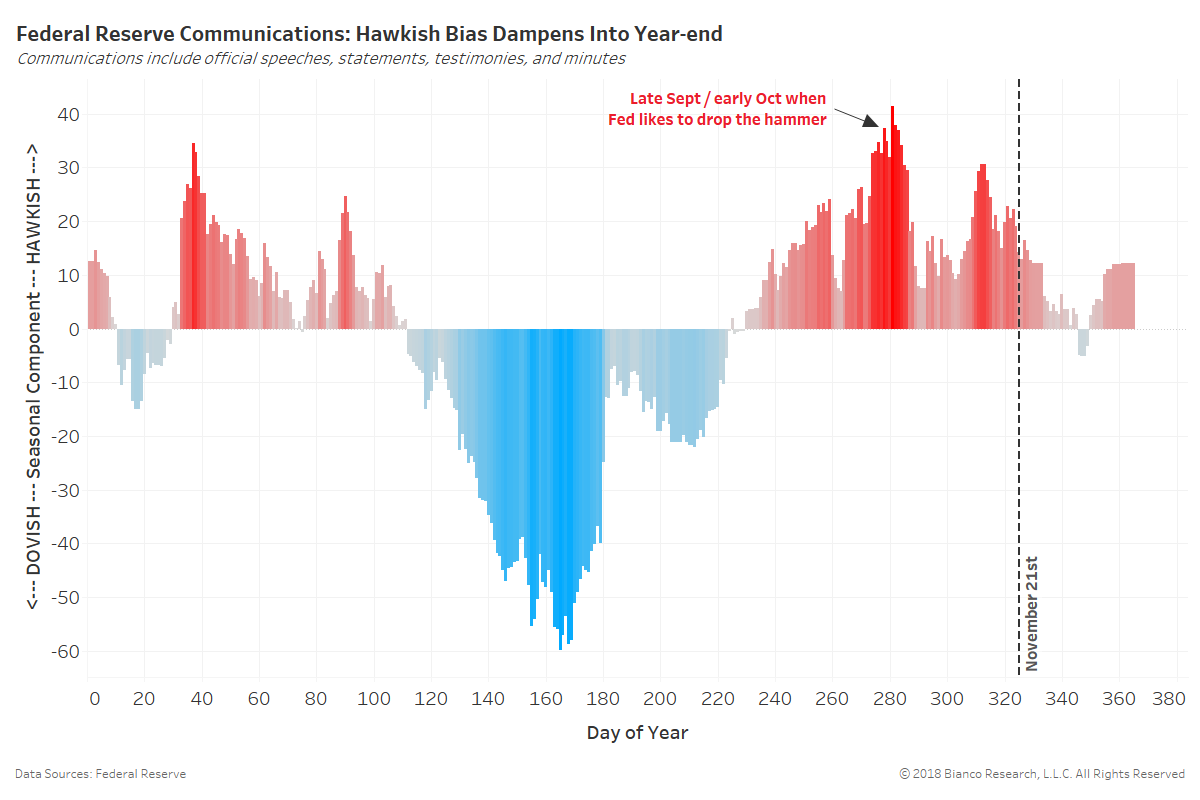

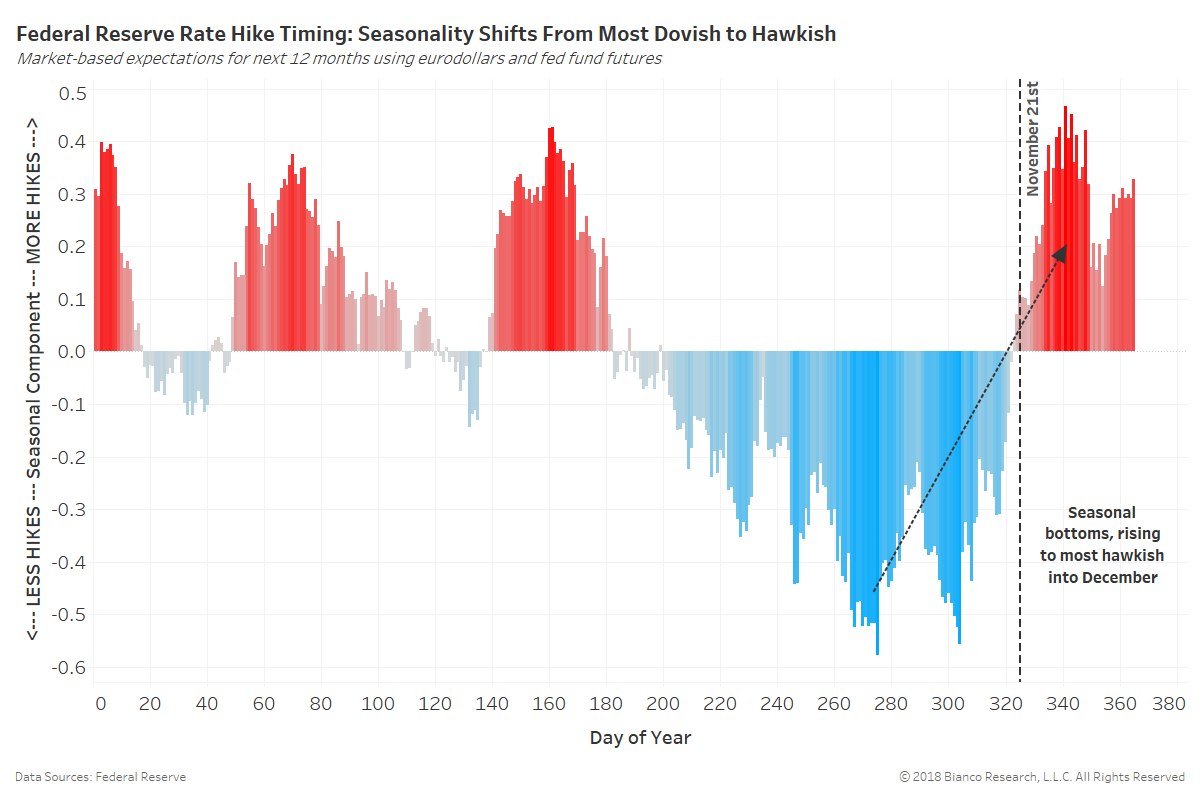

We are exiting the most seasonally dovish period according to market-based rate hike timing. Markets have historically become increasingly hawkish into year-end, possibly encouraged by a belly full of turkey and sweet potatoes.

The Federal Reserve and markets are as data dependent as ever, heavily focused on U.S. releases given slowing data outside its borders. All in all, volatility should remain heightened around key releases as the opportunity to dial down the hawkish rhetoric will be there.