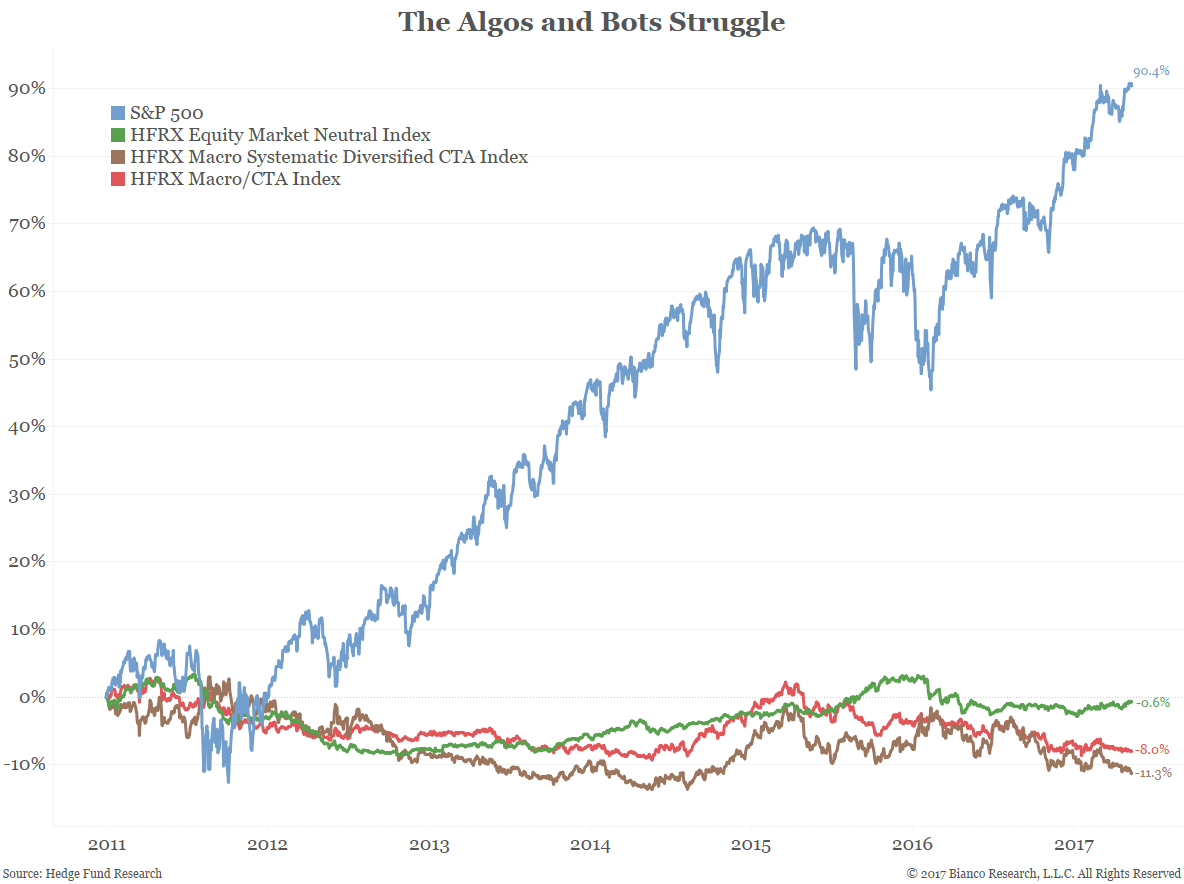

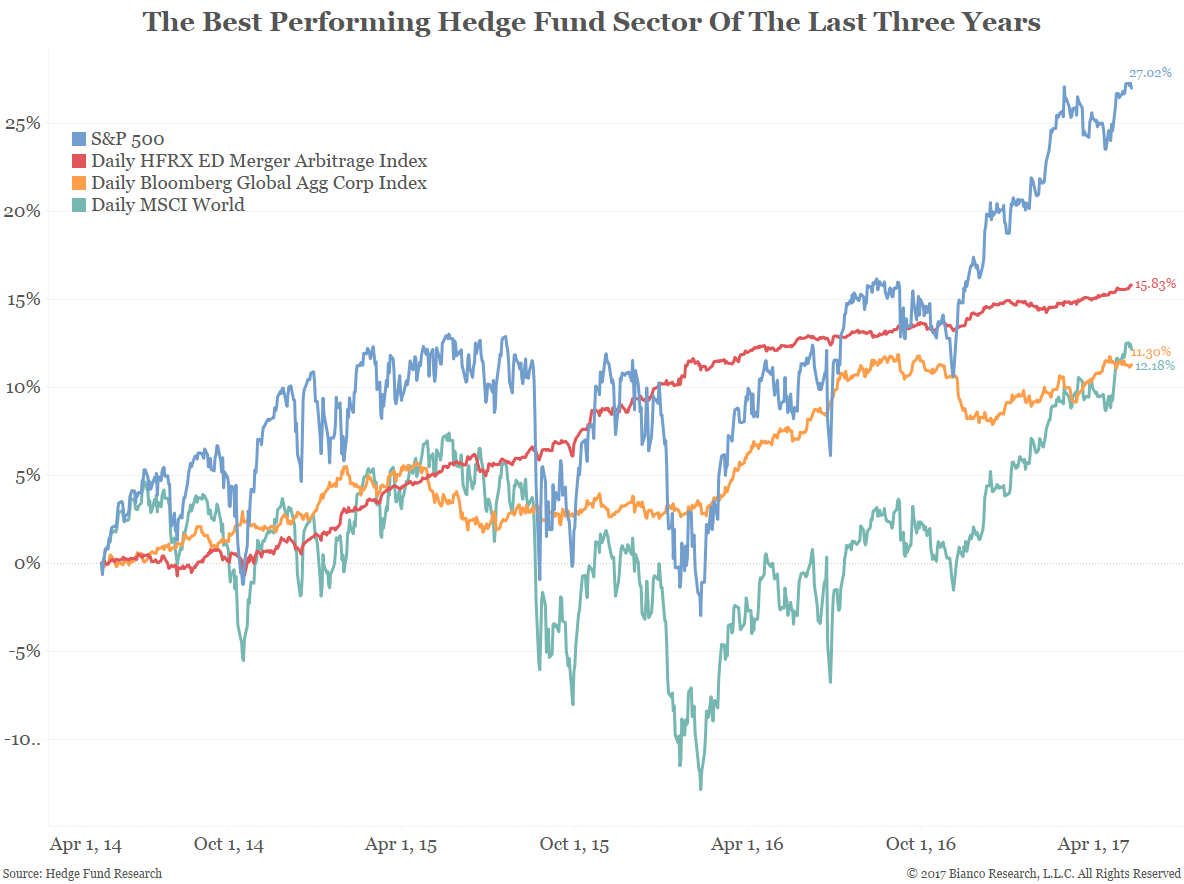

Merger Arbitrage (Human) vs Algo Hedge Fund Returns: The two charts below show the ends of the spectrum. The first chart shows the “algo and bot” driven hedge funds are doing poorly relative to the S&P 500 (blue). The second chart shows arguably a human-based activity, merger arbitrage. Of the more than 30 categories HFR tracks, this is the best performing category over the last three years, beating the global bond market (orange) and the MSCI world index (light green), but lagging the S&P 500 (blue).

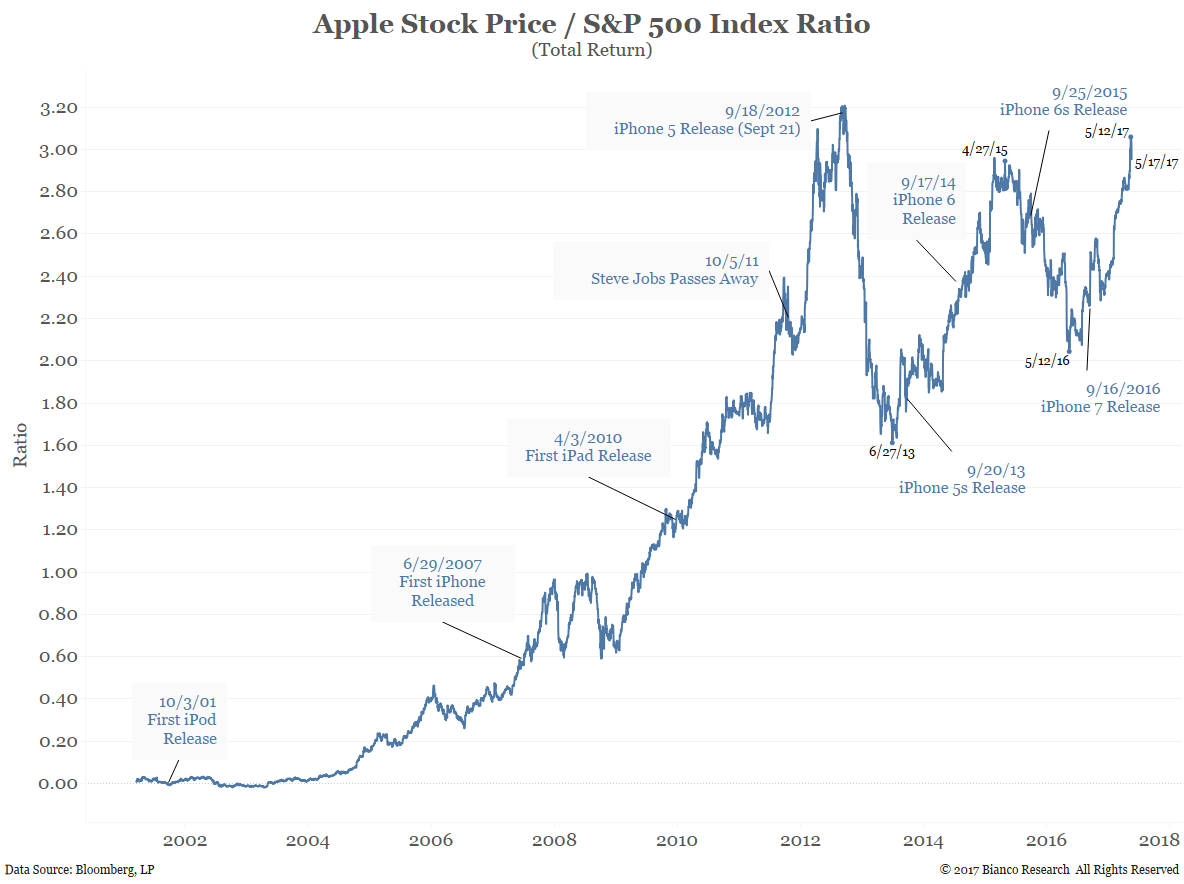

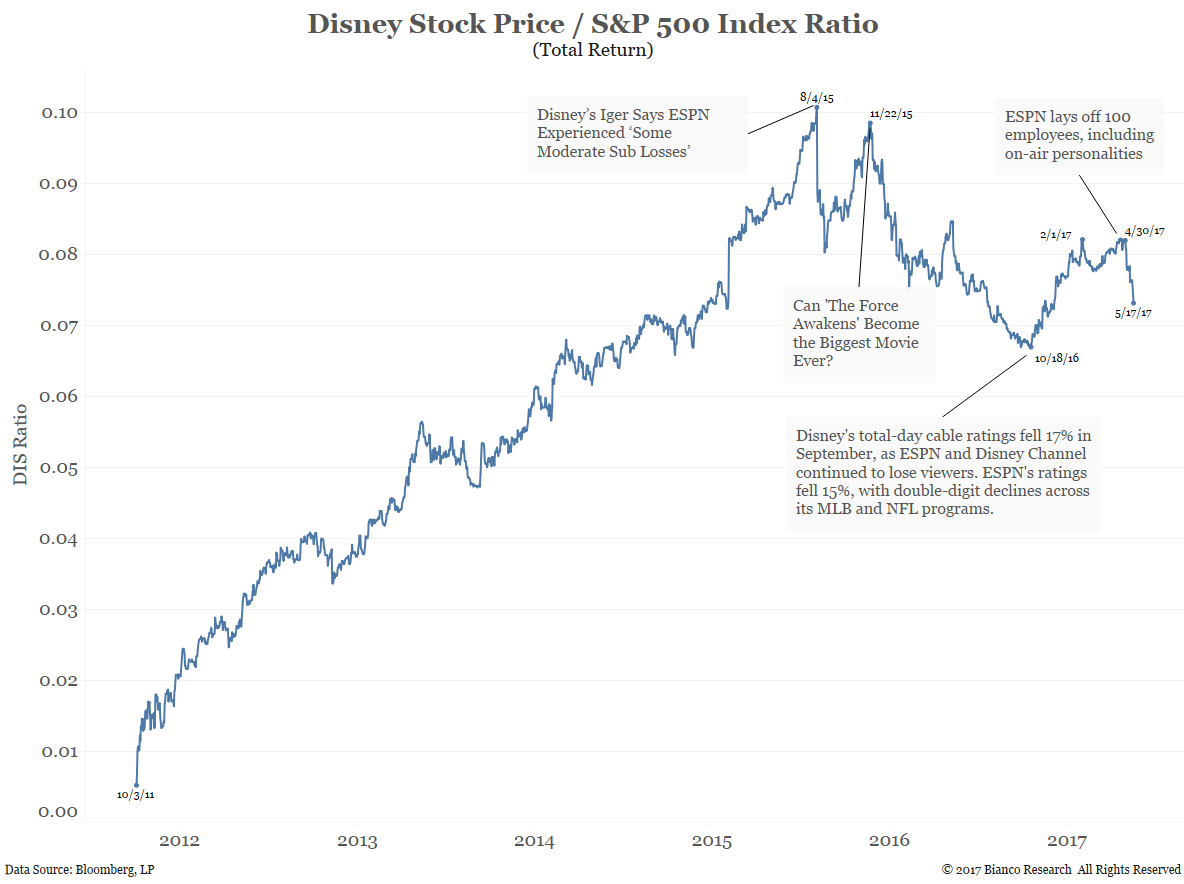

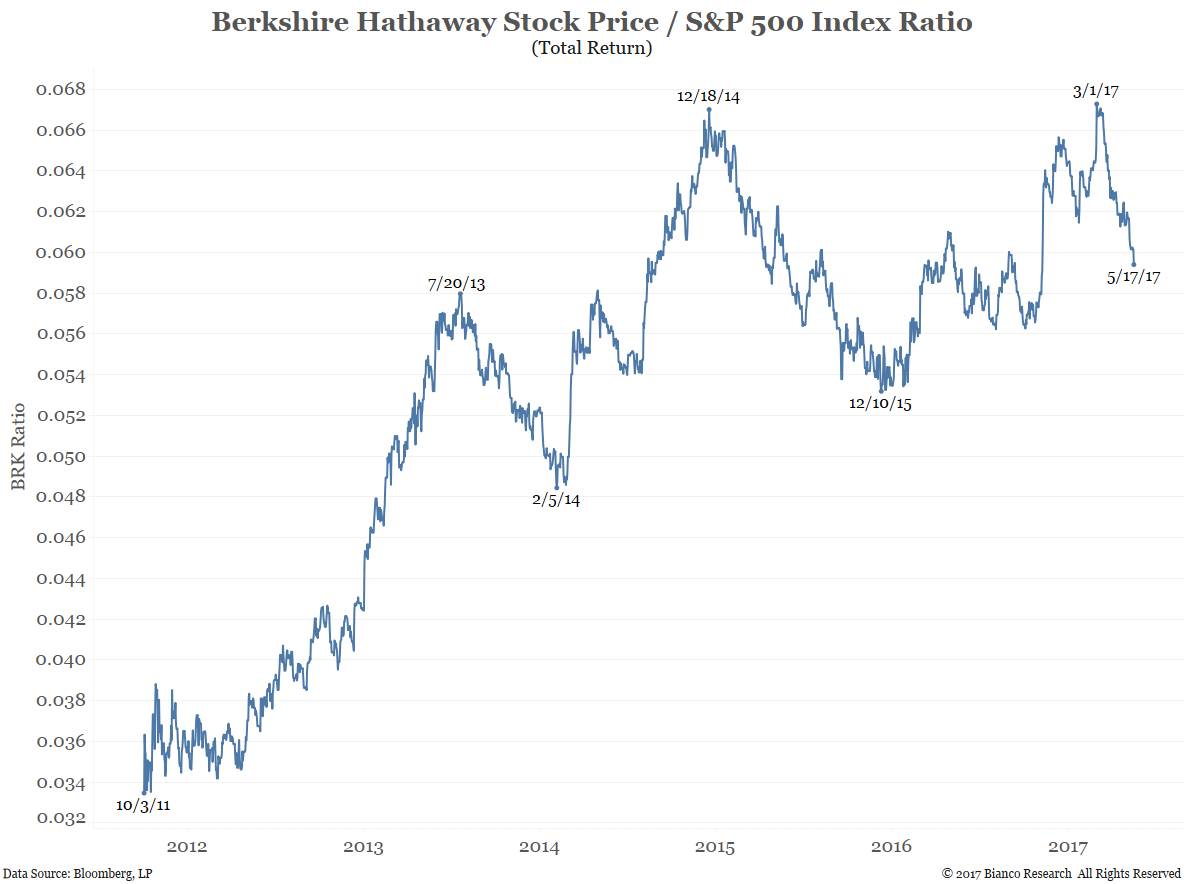

Apple, Disney and Berkshire Hathaway are regarded as three most highly thought of stocks to hold for the long-term. The charts below show a ratio of the stock price to the S&P 500 on a total return basis. All three have peaked years ago against the S&P 500 and collectively have been in-line to under-performing the S&P 500 for many years. Is this yet another reason to give up on stock picking and buy a passive index fund?

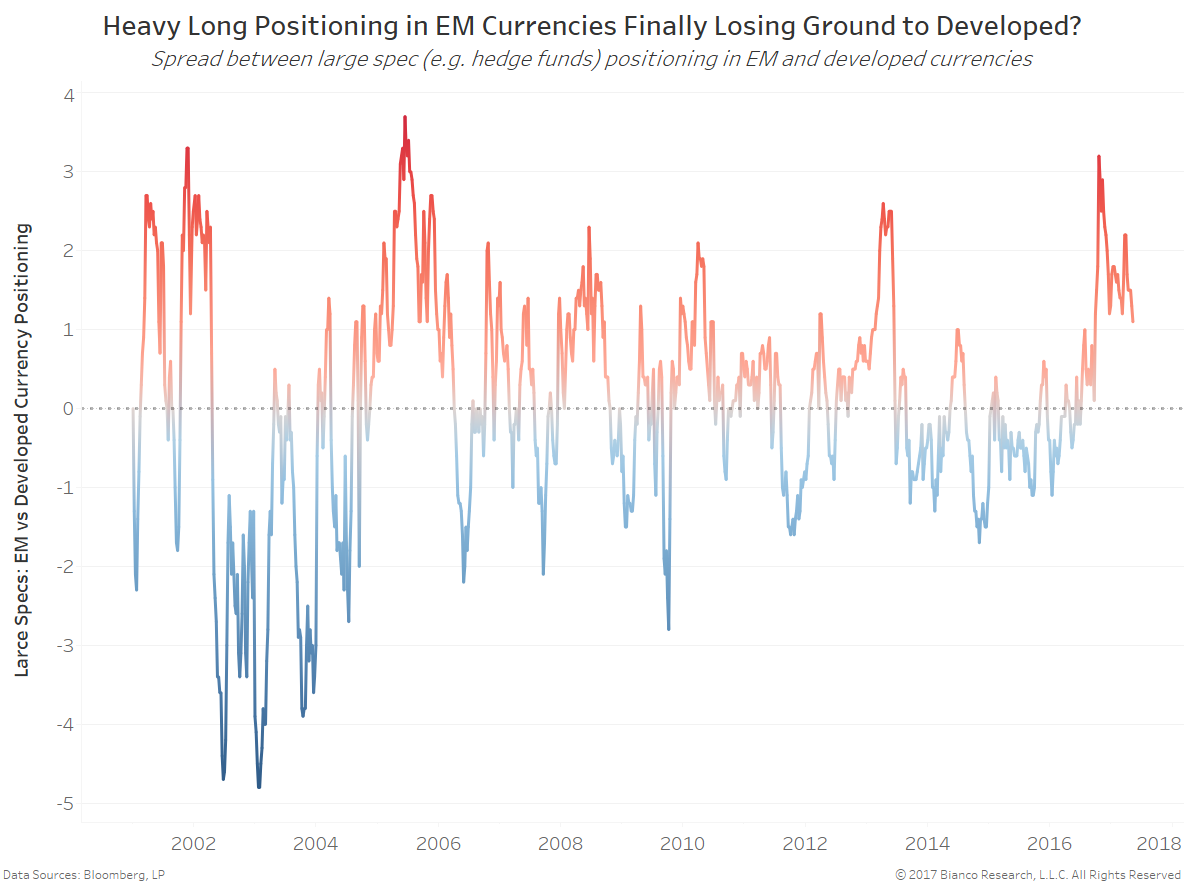

Heavy Long Positioning In EM Currencies Finally Losing Ground To Developed Currencies?

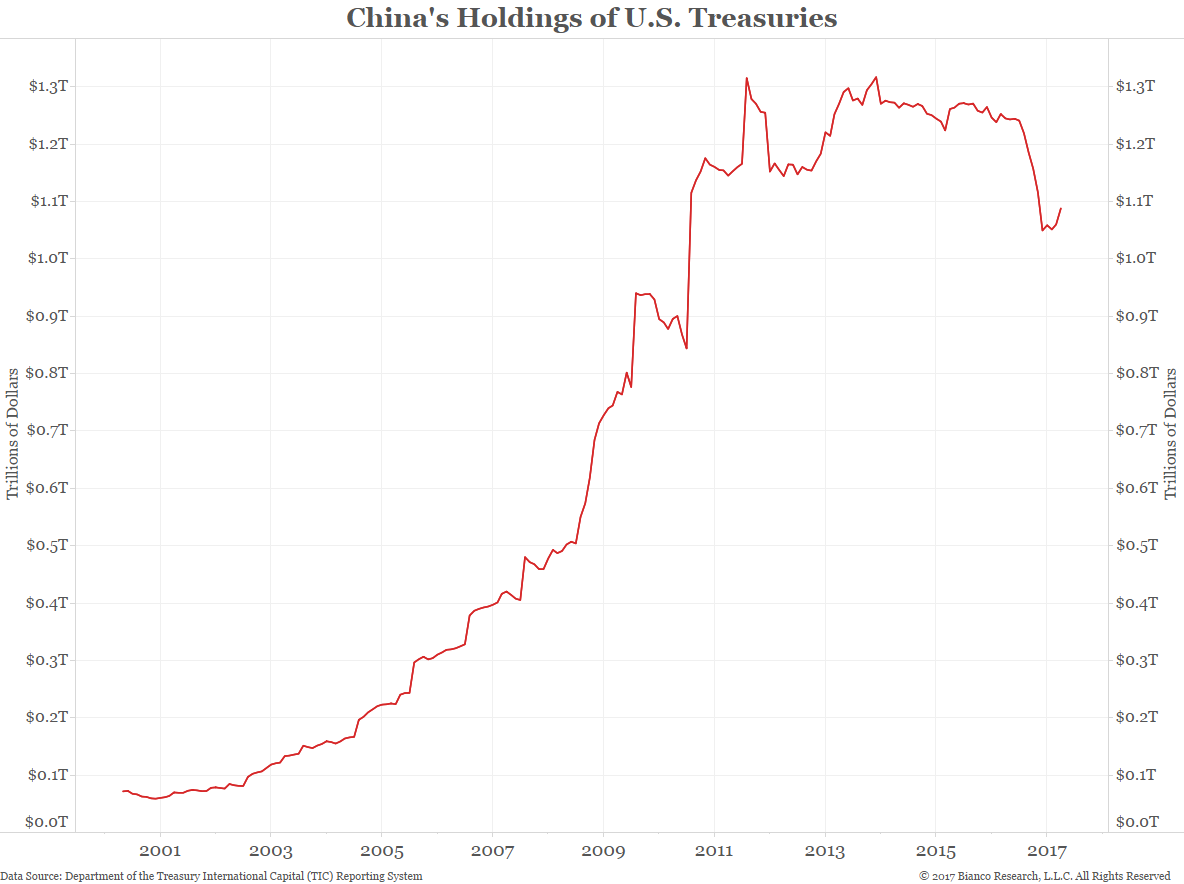

China Increased Its US Treasury Holdings To $1.09 trillion in March.