Summary

Comment

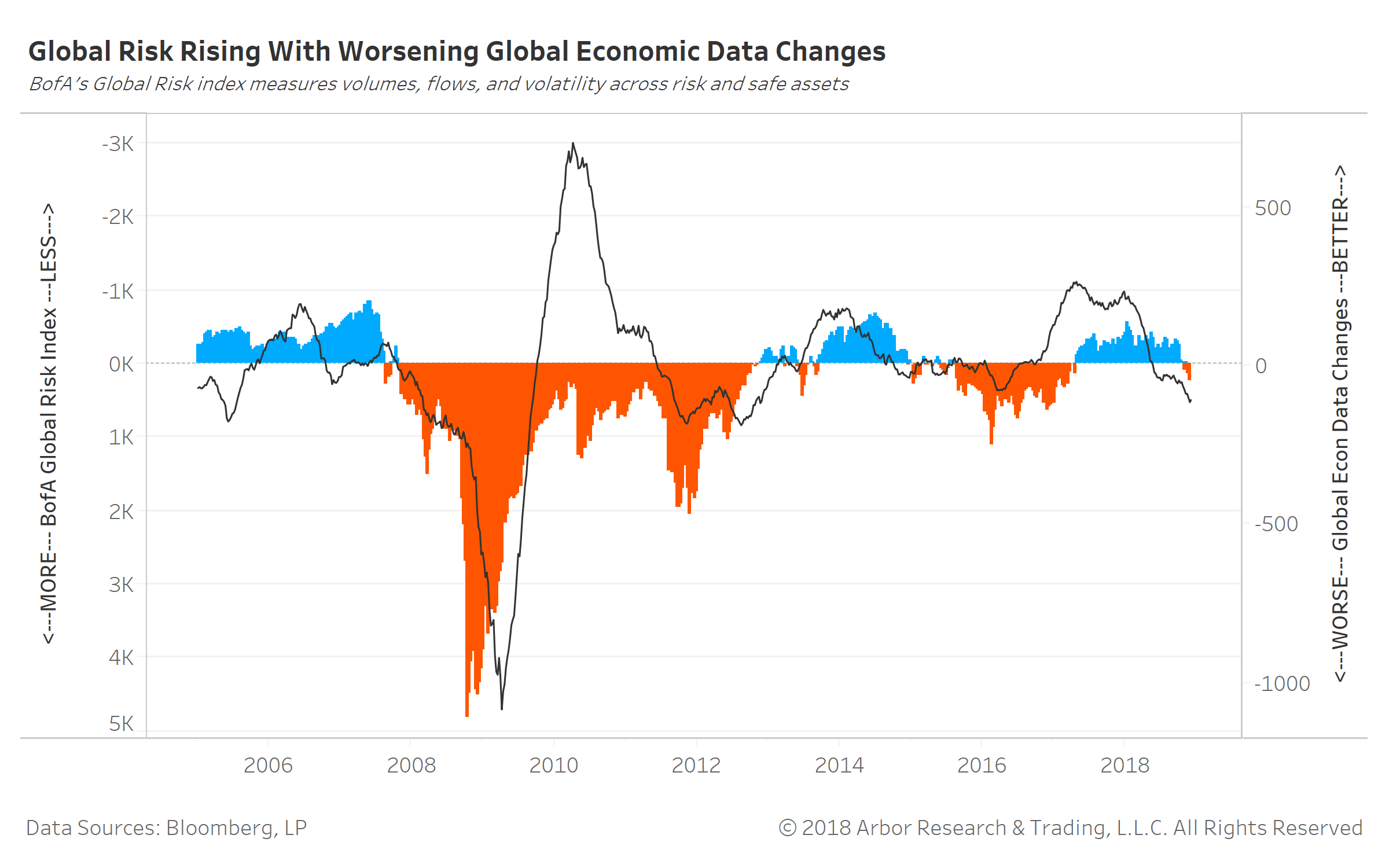

The chart below shows the connection between BofA’s Global Risk (left axis) and Citigroup Economic Data Change (right axis) indices. BofA’s Global Risk index, which is reversed in the chart below, measures fund flows and volatility differences between risk and safe assets. The Citigroup Economic Data Change index measures incoming releases from across the globe relative to their one-year averages.

Global growth continues to slow with nearly 4 out of 5 economies producing below-average economic data changes. Not surprisingly, volatility has risen across risk assets and fund flows have become mostly risk-off.

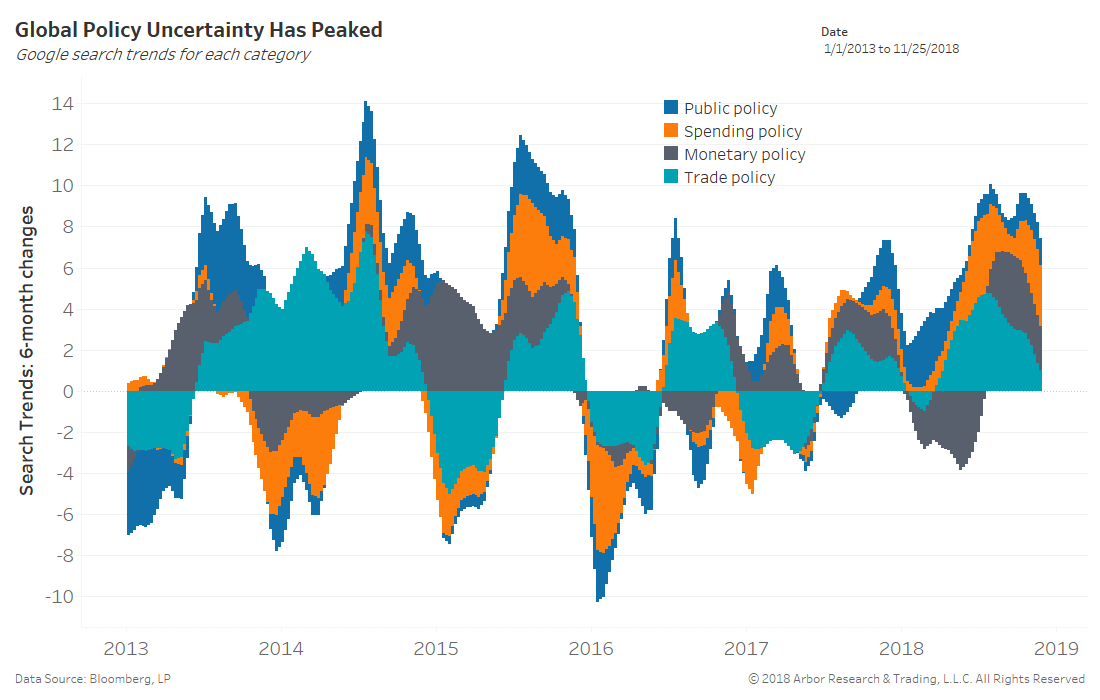

The next chart shows the rolling six-month changes in Google search trends from across the globe for each policy concern. Waves of policy uncertainty as measured by the composite of these search trends tends to lead shifts to higher market volatility.

Policy search trends are finally beginning to crest led by trade (light blue). However monetary (black) and spending (orange) policies remain elevated given concerns over their direction in 2019.

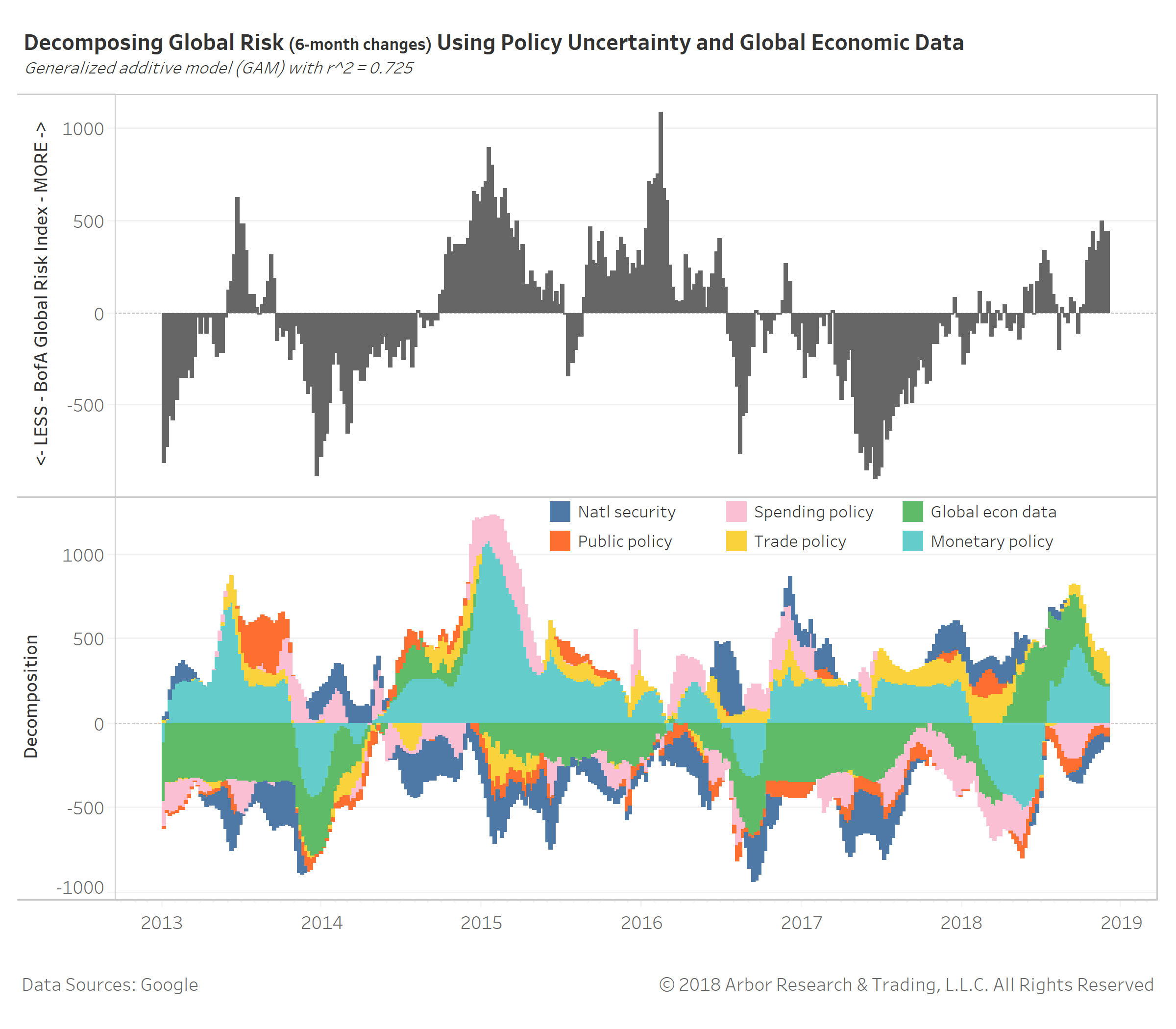

We decompose six-month changes in BofA’s Global Risk index (top panel) using these policy search trends along with global economic data changes. The decomposition in the bottom panel shows just how dominant monetary policy uncertainty has become in addition to economic data changes.

Trade policy has offered only a modest impact on overall global volatility and fund flows. We believe markets may put too much weight into trade breakdowns or breakthroughs, extrapolating ultra short-term reactions like this morning to a longer-term outlook.

Global economic data changes continue to deteriorate and monetary policy uncertainty remains heightened as a result. A slew of Fed officials speaking today and this week will be very closely watched for any confirming dovish biases of Powell and Clarida’s comments from last week. Check back for our natural language processing of these speeches for any substantial clues.