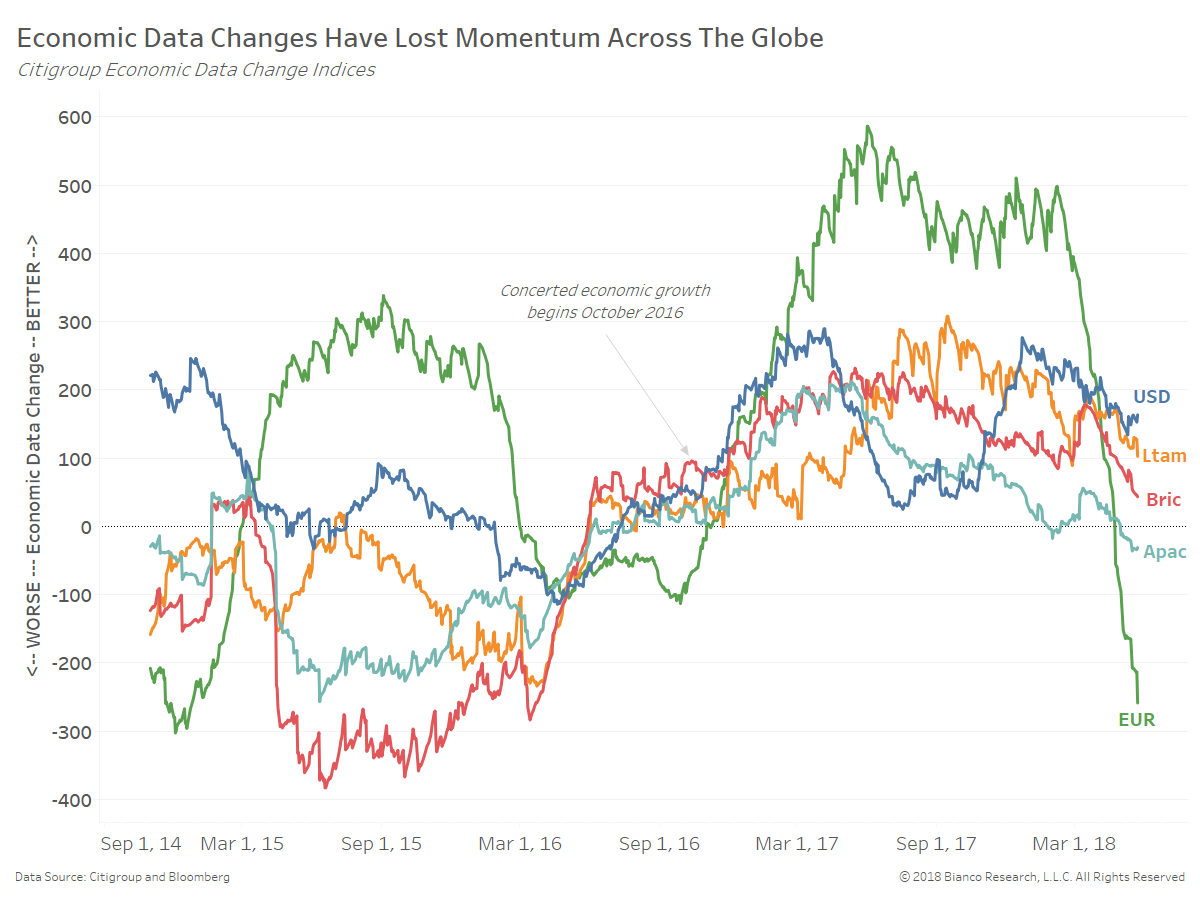

The chart below shows Citigroup data change indices by region since 2015. These indices measure the relation of current releases to one-year averages.

The Eurozone is leading a return to below=average growth with nearly all other regions rolling over into the summer of 2018.

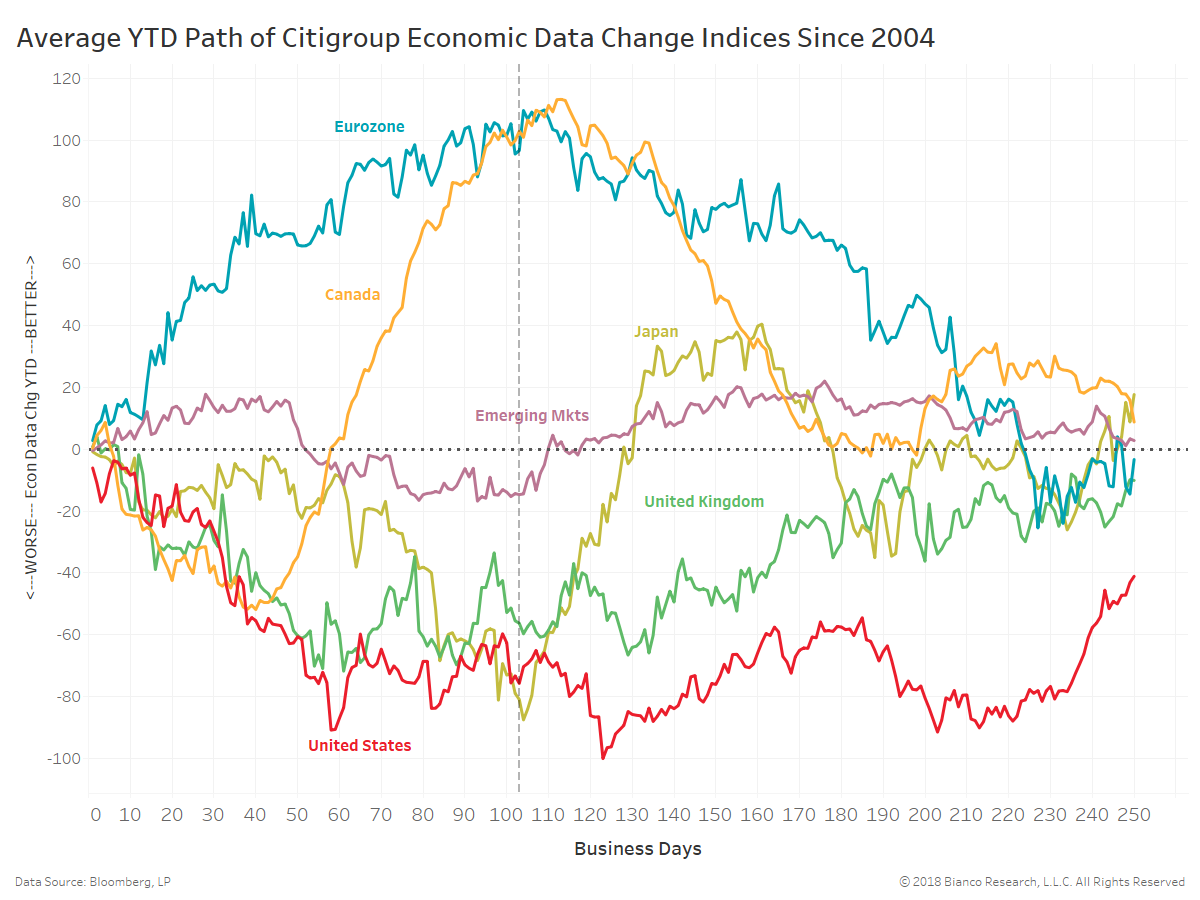

Unfortunately, the Eurozone typically sees economic data changes peak to start the summer. The chart below shows the average year-to-date path of Citigroup economic data change indices since 2004.

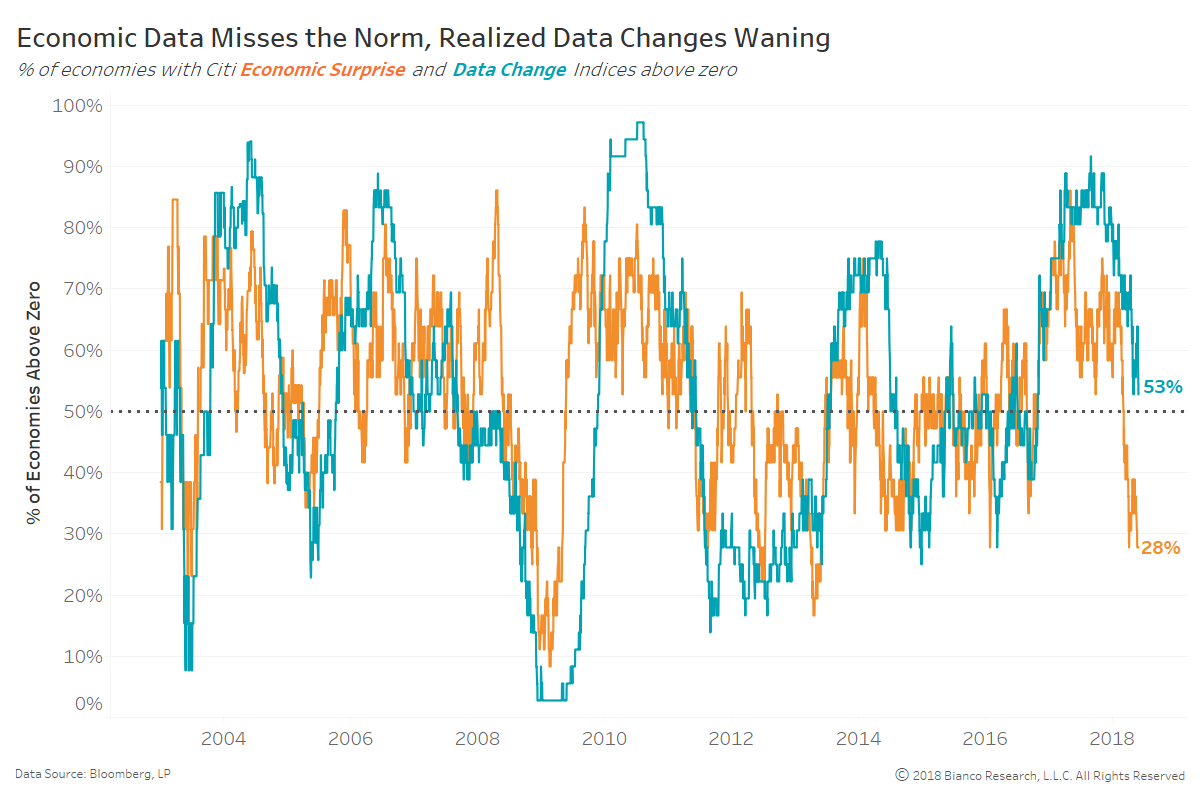

The chart below is a favorite of ours showing the percentage of economies producing data surprises (orange) and above-average realized data growth (green). Only 28% of economies are producing data beats. The percentage of economies producing above-average data changes has dropped from a peak of 92% in August 2017 to 56% as of today (May 30).

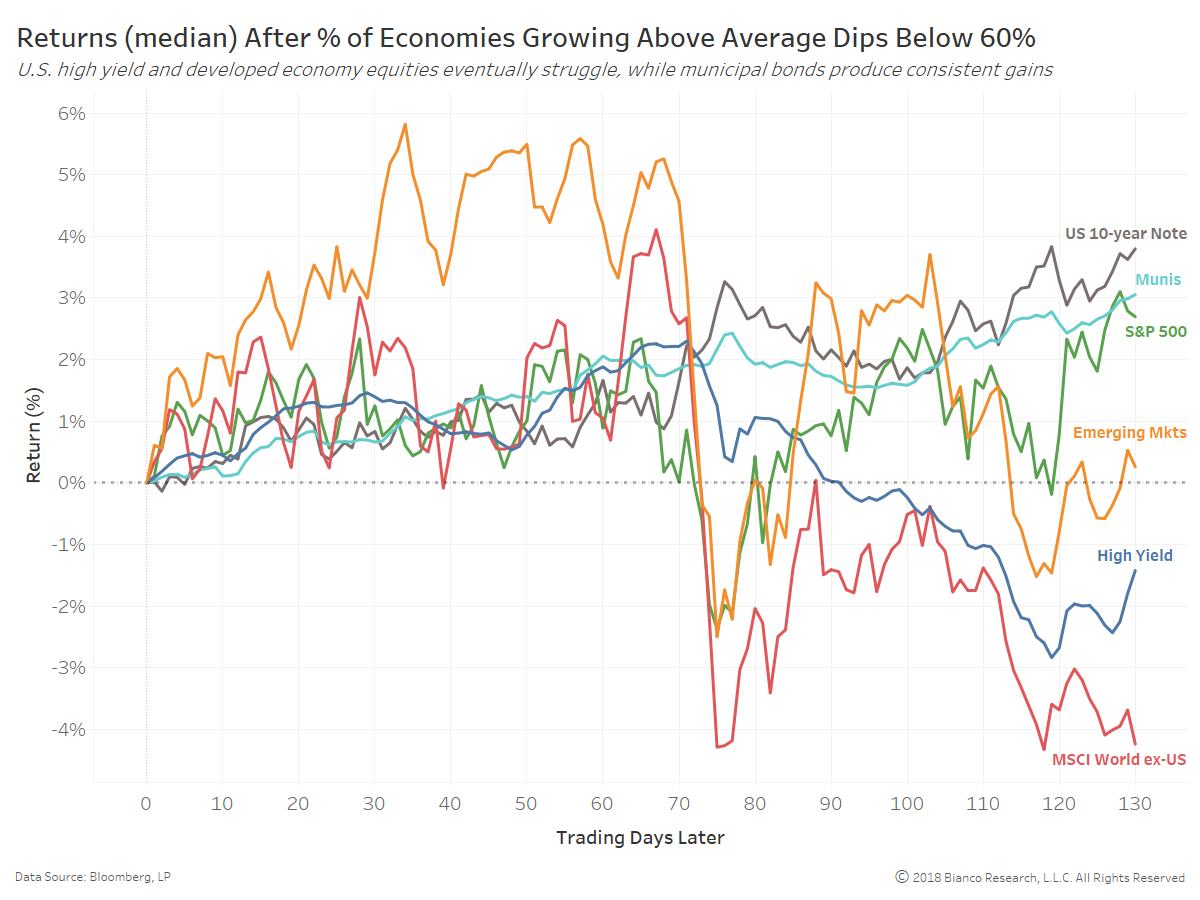

Drops below 60% of economies producing above-average data changes have marked jumps in volatility and trouble for risk assets. The chart below shows the aftermath of these past events for major asset classes.

All but emerging market equities (gold) produced tepid returns over the following quarter (first 63 days below). However emerging markets, developed equities ex-US (red) and U.S. high yield (blue) all quickly ran into trouble the following quarter (through day 130).

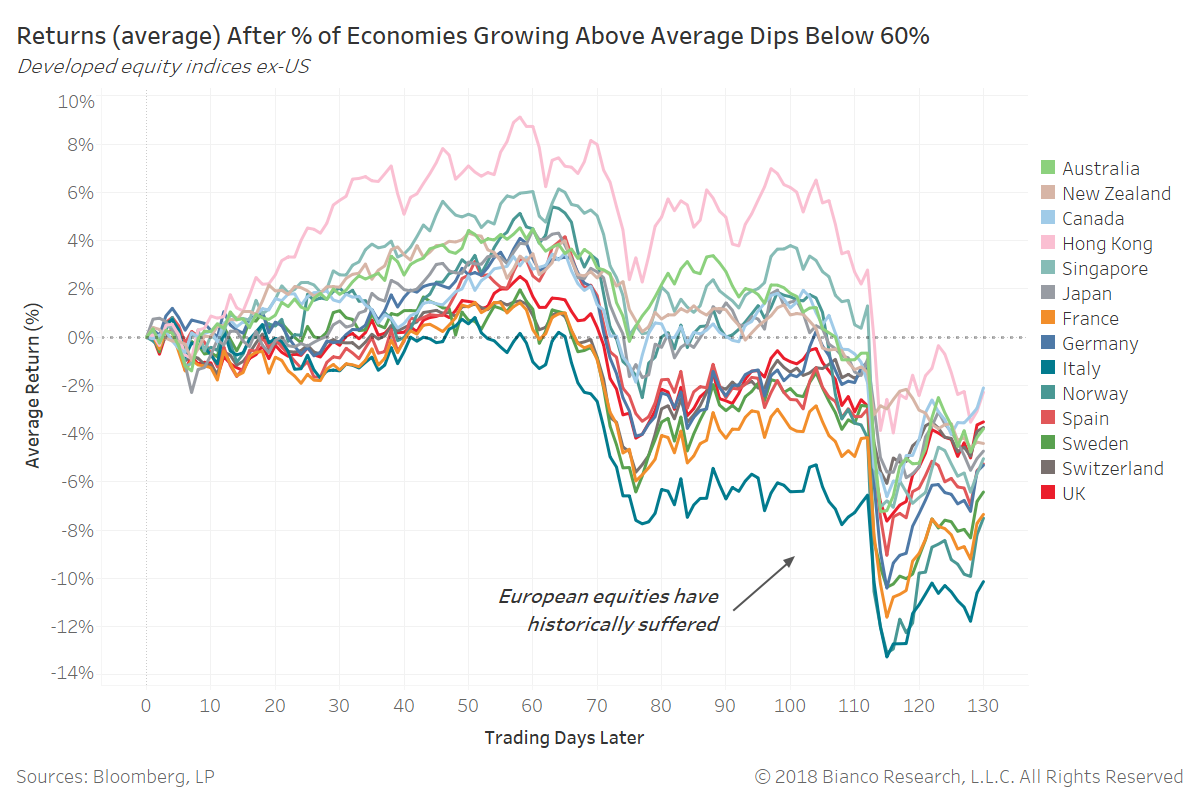

The next chart breaks out cumulative returns produced by developed equity indices found within the MSCI World ex-US index. European equities have historically performed worst, while commodity-heavies like Australia and Canada outperform.

The Eurozone’s swift tumble to below-average economic data changes have led to the end of global synchronized growth. Whether or not the U.S. and emerging markets follow suit will very likely dictate flows through year-end.

What about the consumer?

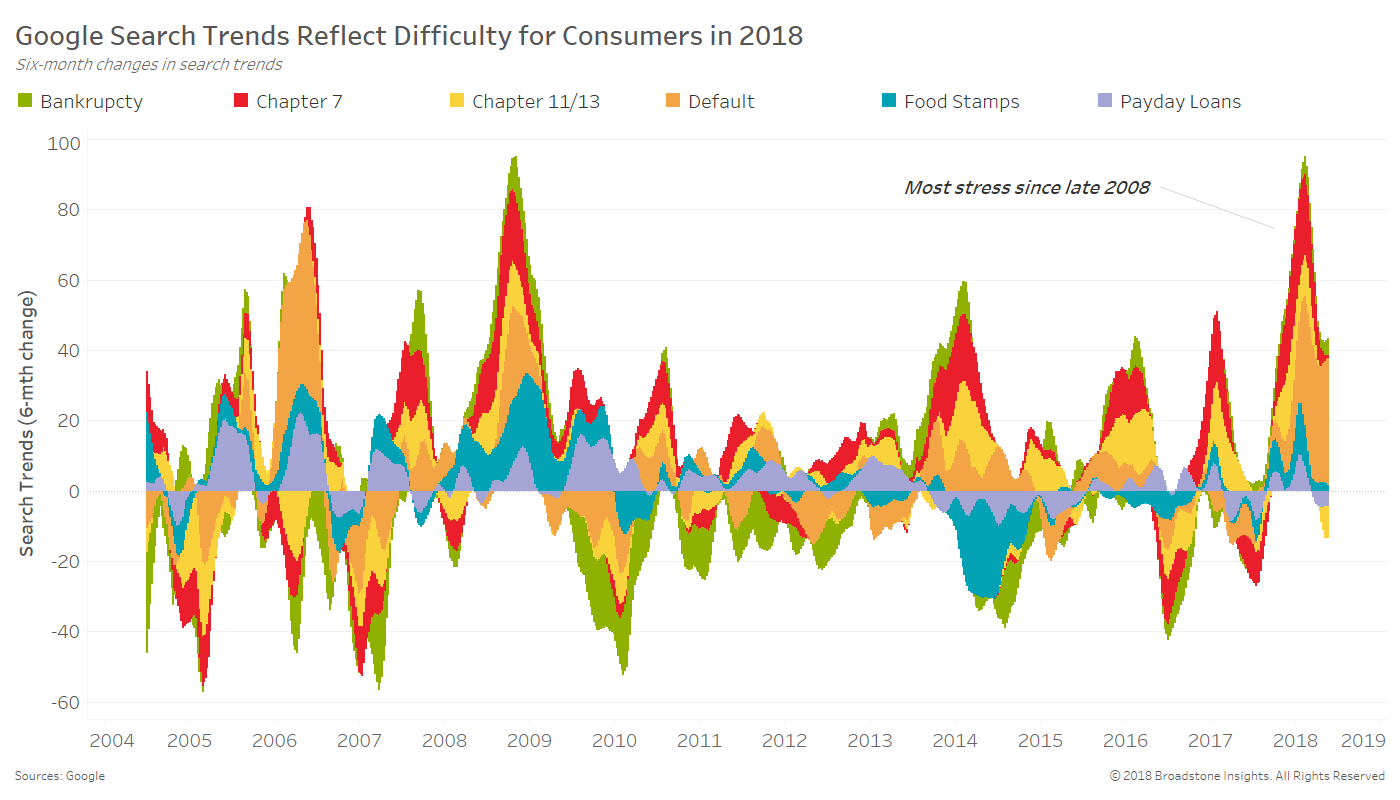

Our focus has also transitioned to assessing consumer stress and spending using Google search trends. The chart below shows the six-month changes in search trends for bankruptcy, default, food stamps, and payday loans. The rebound in these stress-revealing searches recently reached the highest since 2008.

We believe a lack of wage growth and consumer spending may become the biggest impediment to the Fed’s hopes for consistent tightening through 2019.

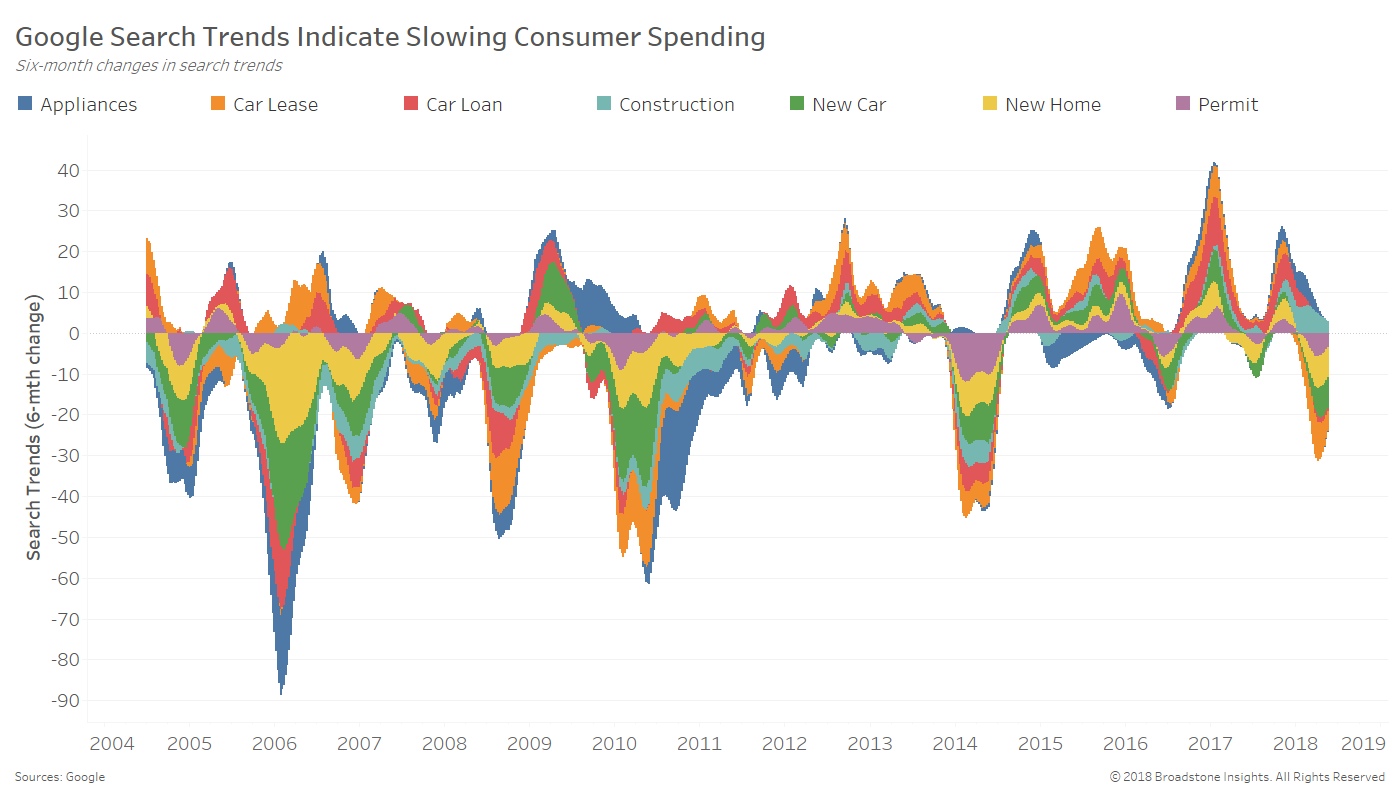

Similar changes in Google search trends are shown below, but this time for larger ticket items ranging from appliances to new homes. Consumers had shown strong spending potential from late 2014 through 2017. However trends have shifted significantly lower to frequencies not seen since early 2014.

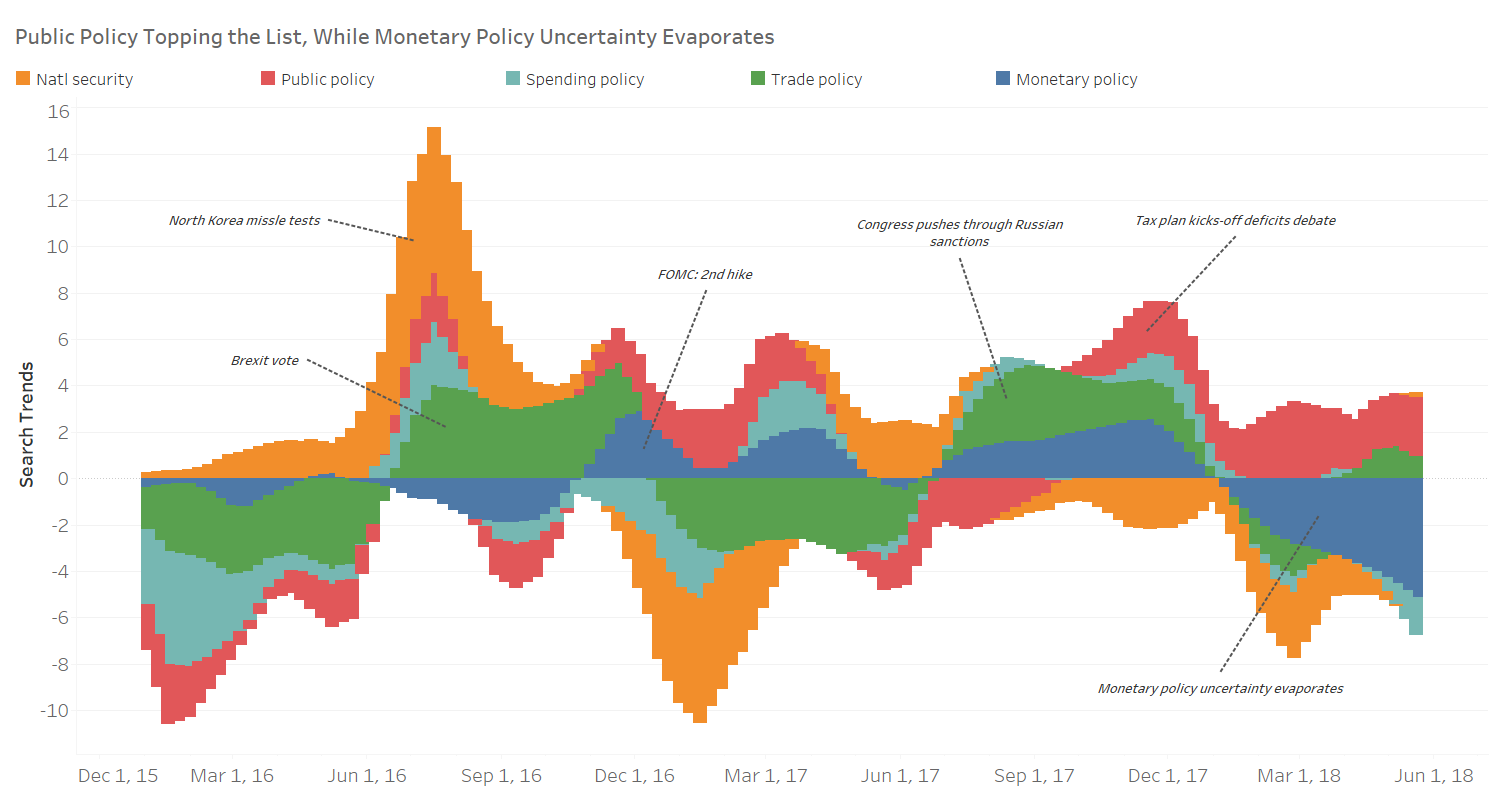

We have lambasted traditional surveys in recent months, while placing greater weight on the alternative data of search and news trends. The chart below shows changes in Google search trends for an array of policy-related themes: national security, public policy, spending policy, trade policy, and monetary policy.

National security, trade, and monetary policies have taken a back seat to public policy. We continue to believe central banks outside the U.S., especially the peripherals like Argentina, are facing rising uncertainty. The Federal Reserve likely has wiggle room for further tightening policy barring an abrupt rise in uncertainty.

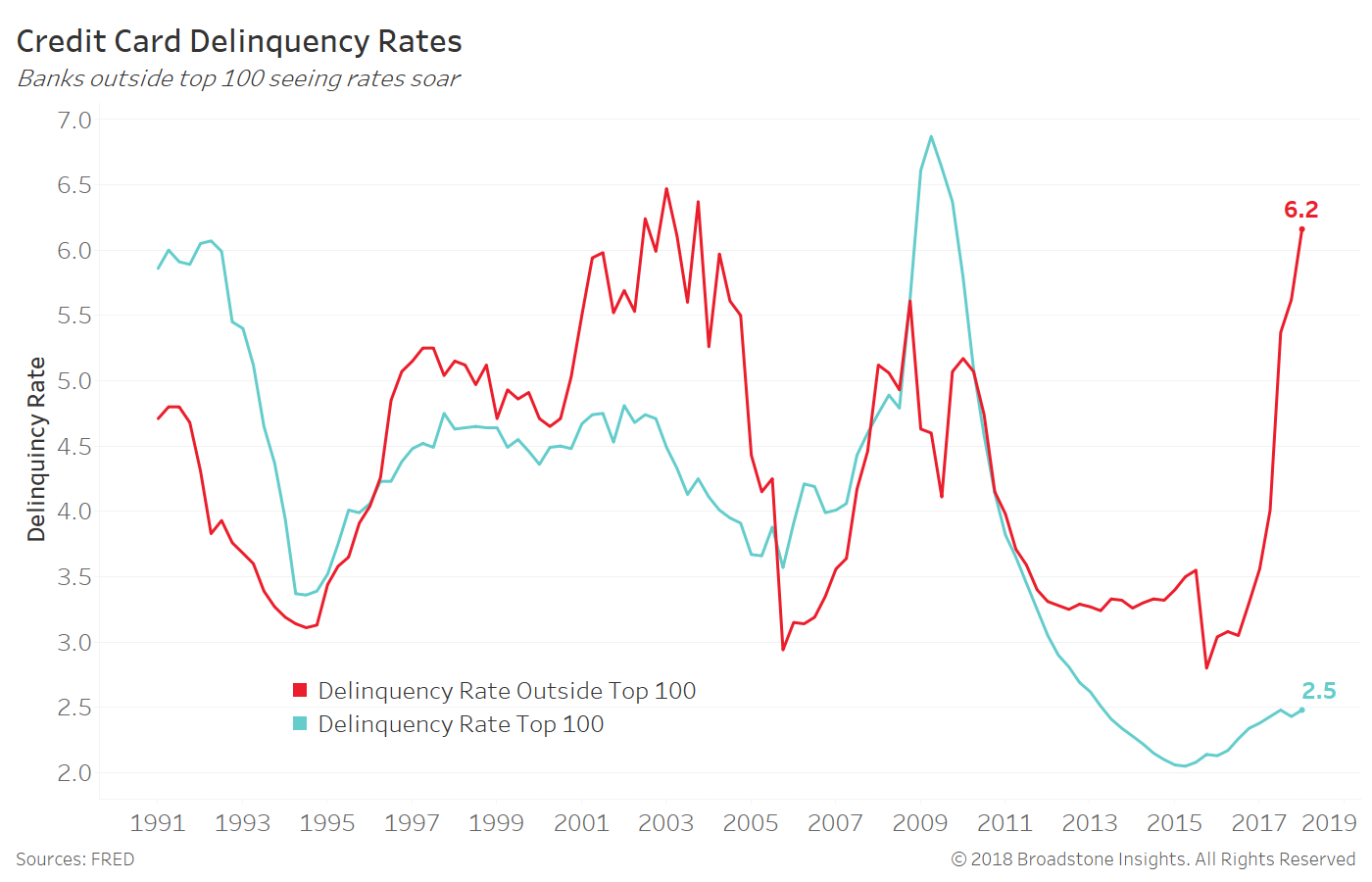

The chart below shows delinquency rates on credit card balances for top 100 (blue) and outside the top 100 (red) banks. Recent worsening in stress and spending search trends have driven delinquency rates higher for smaller banks having likely loosened credit requirements. On the flip side, larger banks have attracted customers by providing greater incentives like money back and other rewards.

These smaller banks saw delinquency rates of 6.2% in Q1 2018, the highest since October 2003.

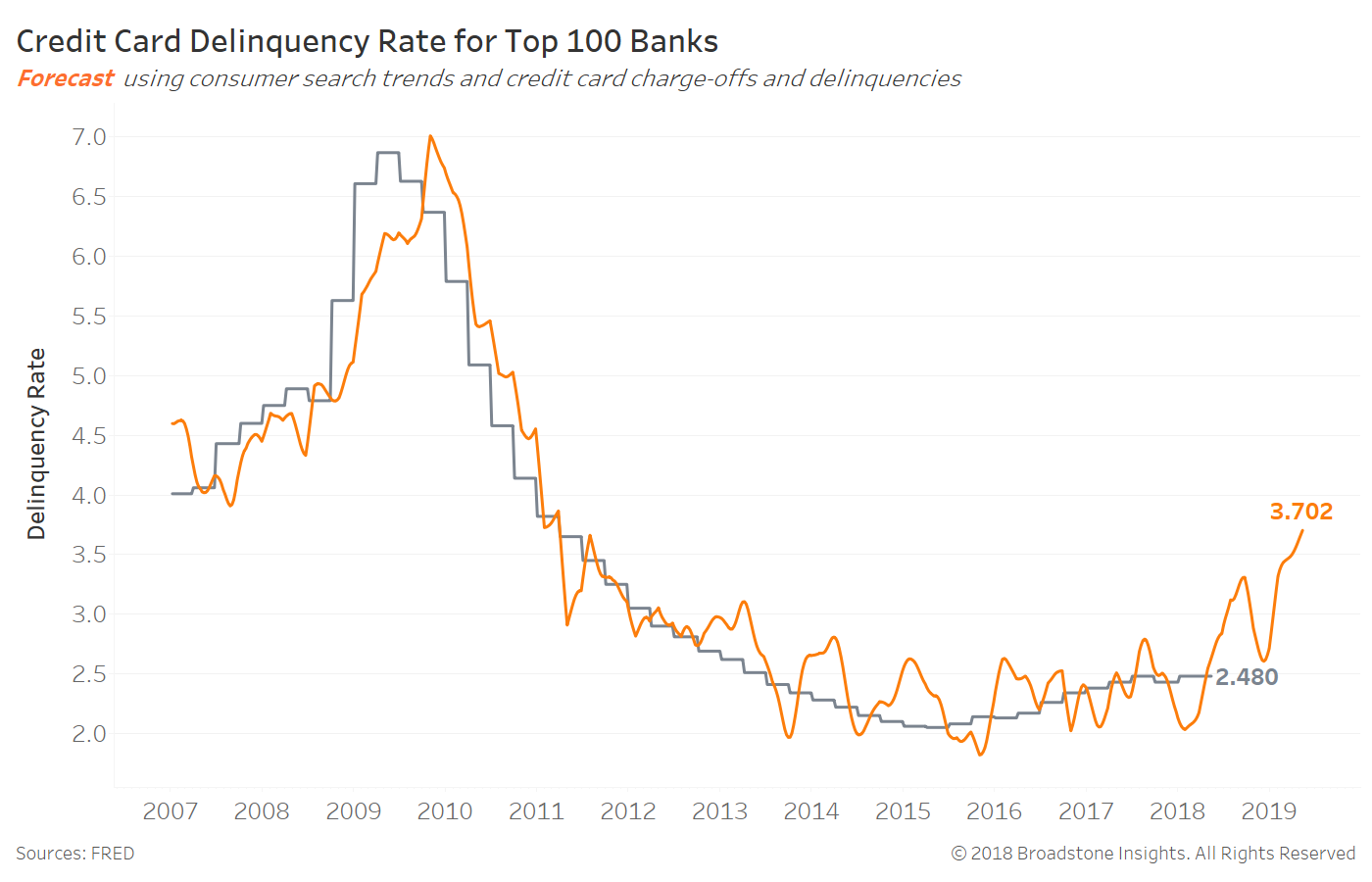

The next two charts offer forecasts for charge-offs and delinquencies for these top 100 banks. The models (elastic net regression) are fed the consumer search trends shown above and time series of charge-offs and delinquencies.

Charge-offs are expected to modestly rise over the next year toward 4.2% from 3.7%.