CDS Spreads Have Widened

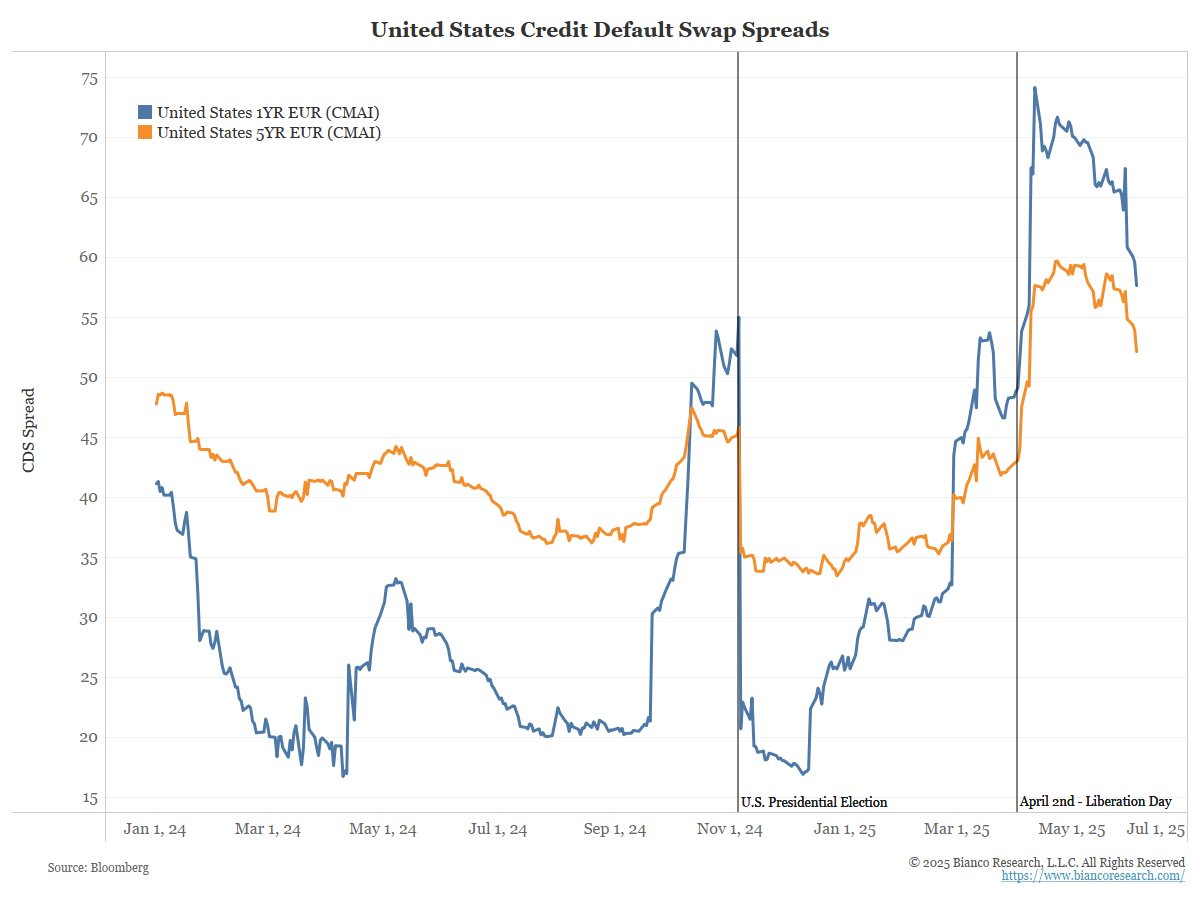

United States Credit Default Swap (CDS) spreads have widened in the first half of 2025. The chart below displays the 1-year and 5-year CDS spreads for the United States.

We have labeled two key moments in the past eight months: last year’s presidential election and Liberation Day (April 2nd), when President Trump announced his broad-based tariff rollout.

Understandably, events such as the two labeled above may cause a widening of spreads because they invoke uncertainty about the nation’s future. However, we would argue that these widening spreads are more representative of the looming debt ceiling debate than an assessment of the overall credit quality of the United States.

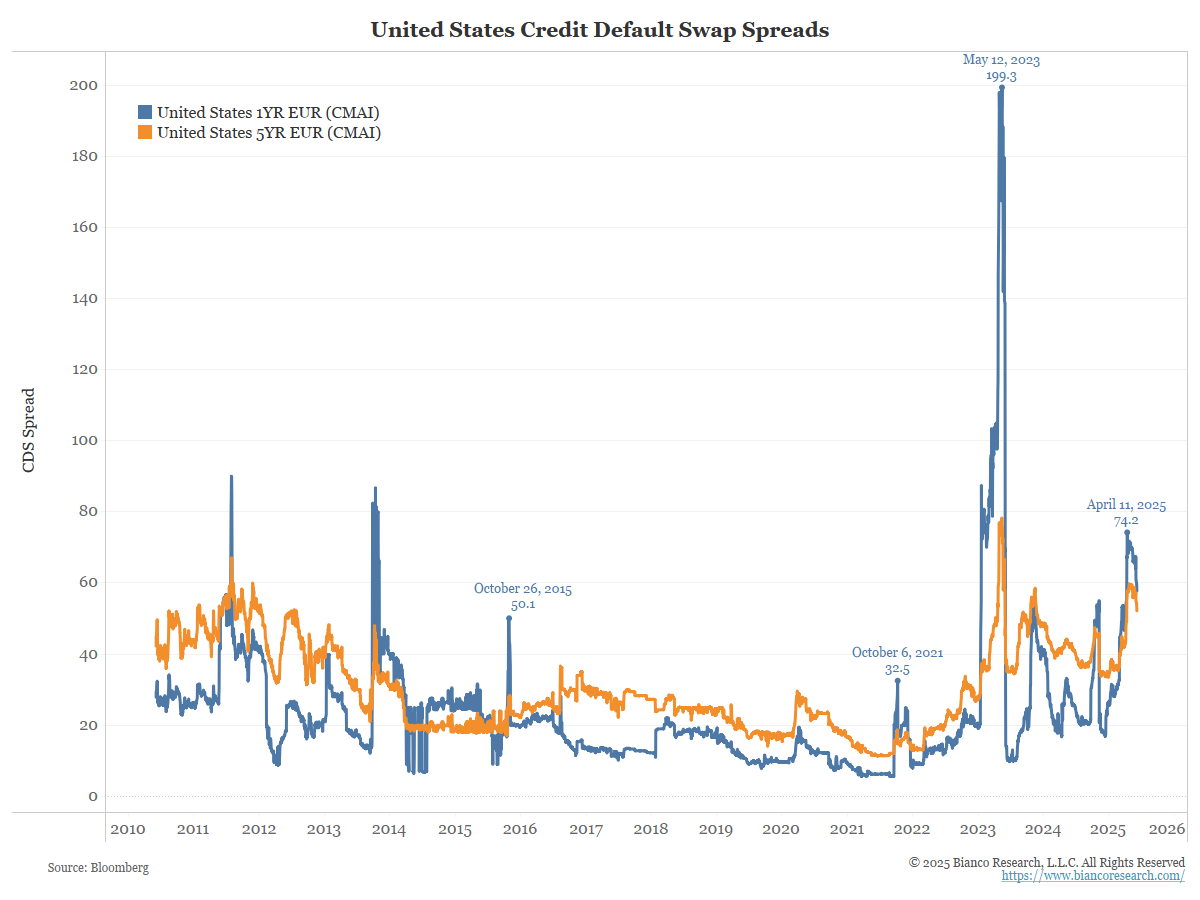

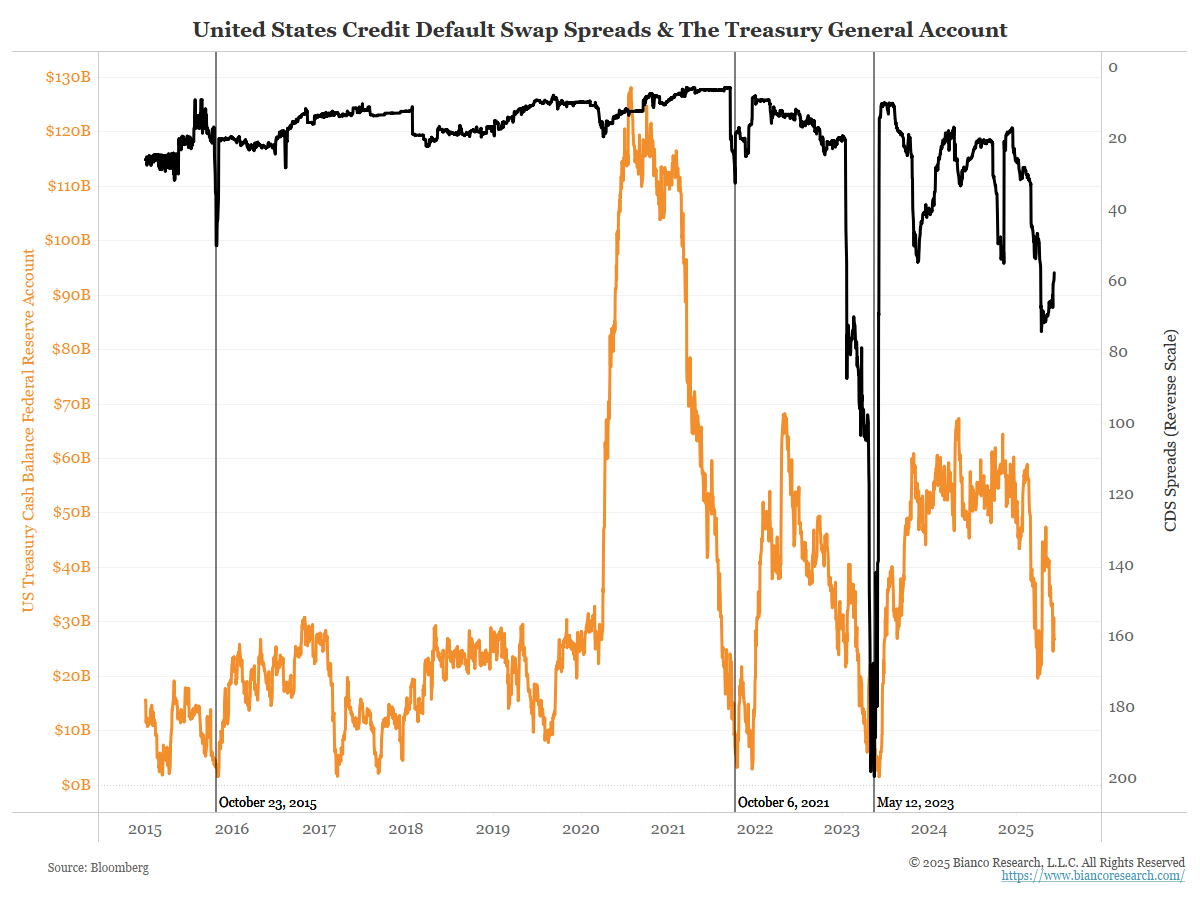

Examining a longer period of CDS spreads reveals notable spikes around specific dates over the past decade.

We will revisit why this occurs, but first, what’s happening with the debt ceiling is a critical factor in understanding this.

Debt Ceiling Debate

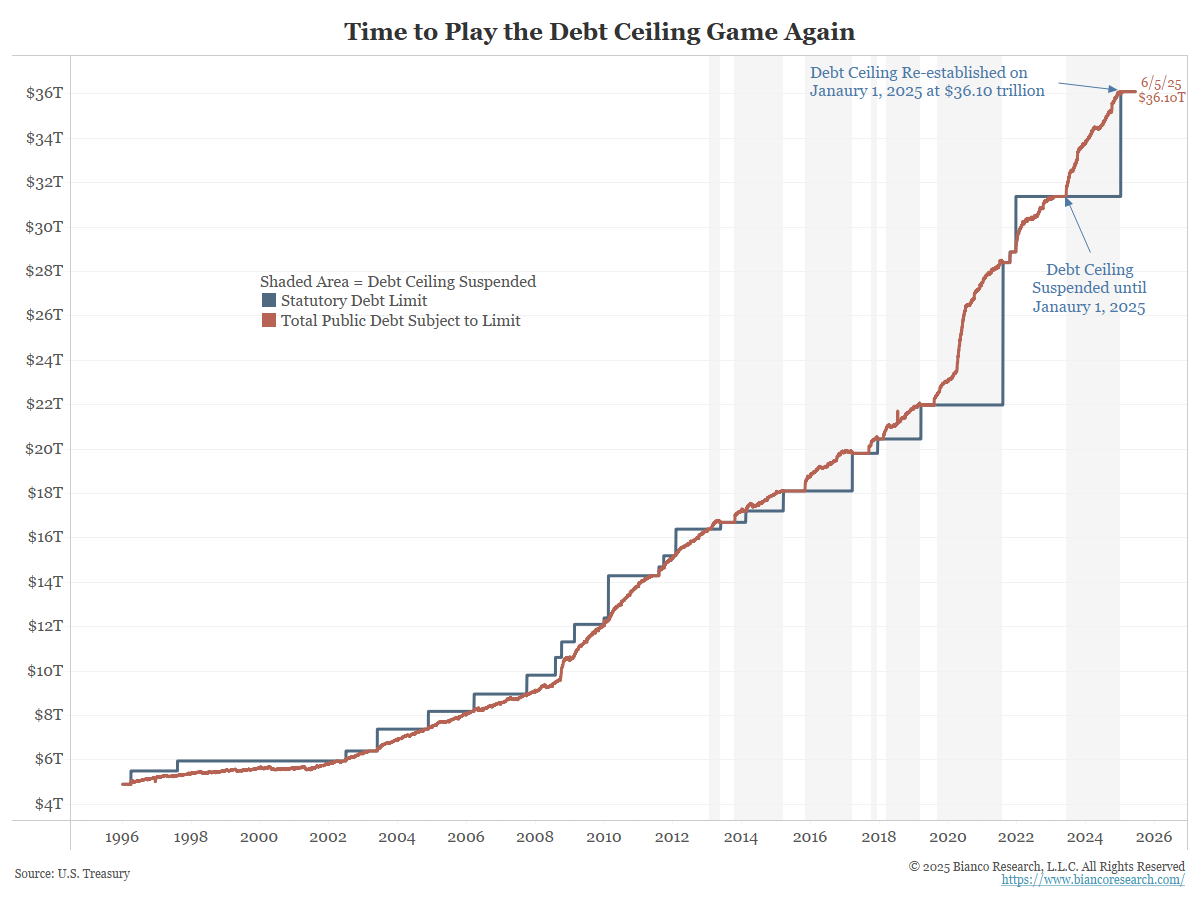

The drama regarding the debt ceiling is effectively about a ‘potential U.S. default.’ As Congress works on its tax bill, it is also responsible for ensuring that a debt ceiling resolution is passed to allow the U.S. to continue making timely payments on its debt.

On January 1, 2025, the federal government reached its debt limit of $36.10 trillion. After that date, no additional money could be borrowed.

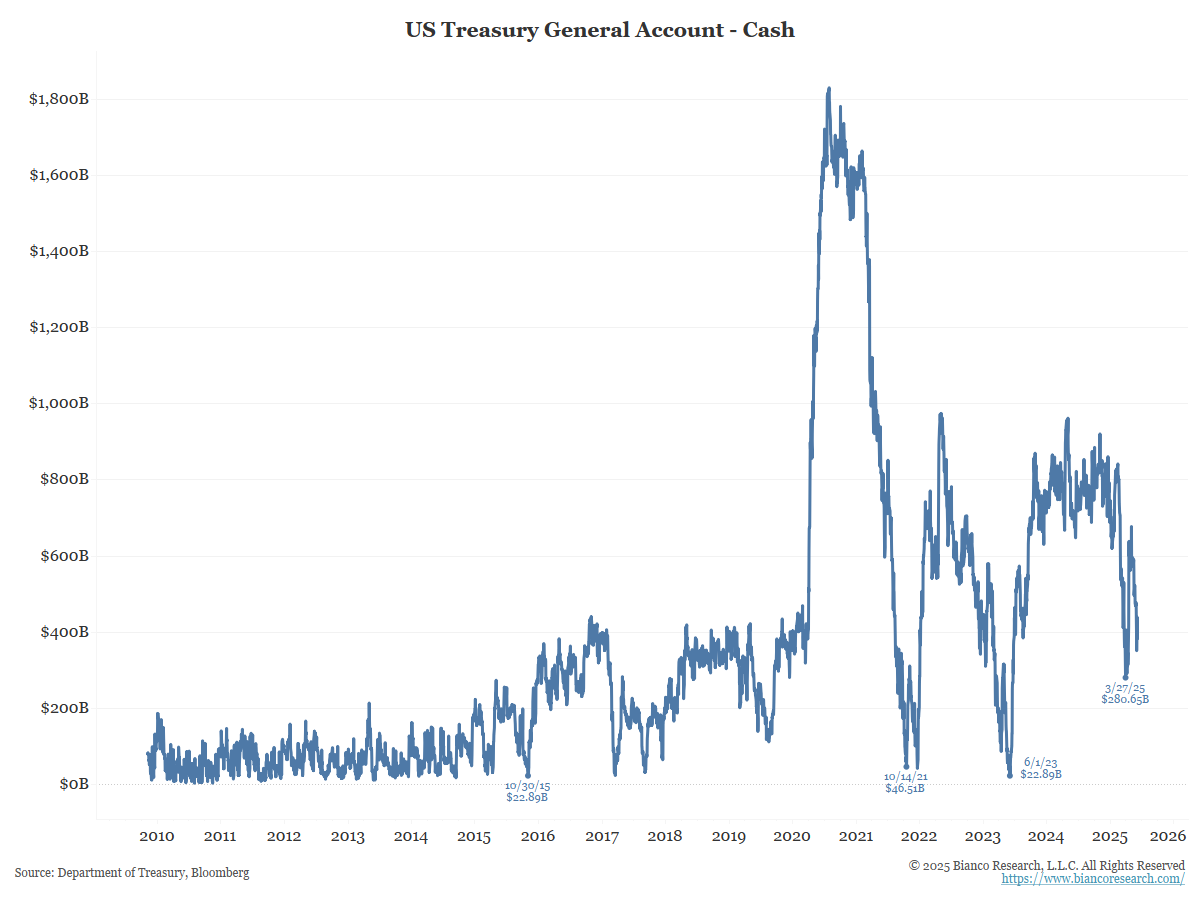

The Treasury General Account, which is effectively the government’s checking account for paying its bills, can be drawn down to stretch out borrowing until a resolution is passed. In the chart below, we have labeled four specific examples of this occurrence. When the balance of the TGA approaches $0, the debt ceiling situation becomes more pressing and Congress must act to avoid default.

This is almost always resolved in some last-minute deal in which politicians run the theatrical gambit of “look at what we accomplished right at the buzzer.” The resolution doesn’t change the fact that, in the days and weeks leading up to Congressional action, the risk of default becomes increasingly elevated, especially as the Treasury exhausts the TGA.

This, in turn, can cause widening spreads for U.S. debt. The four labeled examples of a drawdown of the TGA closely correspond to the spikes in CDS spreads mentioned above.

The chart below shows an overlay of the TGA and U.S. 1-year CDS spreads (note we left out the most recent labeled point on the chart below because a resolution has yet to be reached).

The large spikes in CDS spreads tend to occur in the weeks leading up to the bottoming out of the TGA.

Stated a different way, when the TGA is drawn down to near $0, the United States is approaching the “X-date“, which indicates a risk of default.

What You Own When You Buy a CDS

What would happen if Congress fails to pass a resolution before the X-date? In theory, this would mean the United States has experienced a technical default, which is meant to trigger a credit event.

In practice, though, things work a bit differently. Mechanically, credit events are determined by the ISDA Credit Derivatives Determinations Committee (DC), a group of industry experts.

Take, for example, Greece’s 2012 bailout. The committee ruled that a credit event had indeed occurred, but only after a lengthy process:

- Financial Times – Isda Greece credit event? There is

“Now that a credit event has occurred, what happens next? Market participants conduct an auction through which the recovery value of Greek debt is determined. This recovery value determines the net payouts made under CDS contracts when a credit event occurs. The DC determined that an auction will be held in respect of outstanding Greek sovereign CDS transactions on March 19.”

Regarding Greece, the CDS process was conducted in an orderly manner. If the United States were to face a similar situation, things could become complicated.

There is concern that a credit event trigger would not be as straightforward. The possibility that the determinations committee might be swayed is a valid concern. Imagine a member of the committee receiving a call from Treasury Secretary Scott Bessent or Donald Trump himself; would that influence the decision regarding the credit event?

Another important consideration is currency exposure from the contract itself. A U.S. CDS contract pays out in euros. This makes sense given that if you are betting on a credit event in a specific nation, you are unlikely to want that nation’s currency as payment.

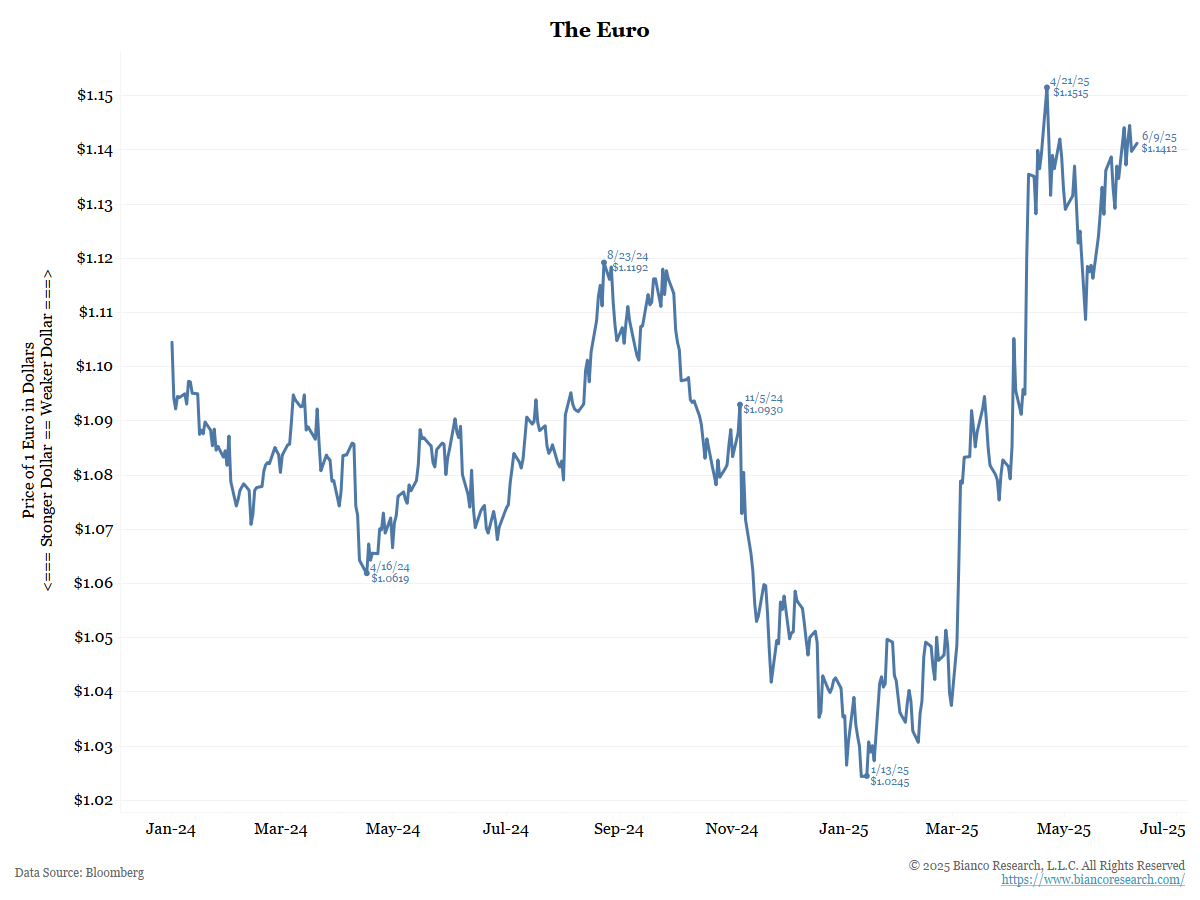

The euro has strengthened against the dollar through the first half of the year.

A strengthening euro vs the dollar will also widen the US CDS spread, because, as stated above, it pays in a stronger currency. This is a secondary consideration, but given 2025’s massive move in the U.S. dollar, this becomes a bit more of an influential factor.

Why Is This Important for CDS Markets?

CDS is an insurance contract that protects the holder against a credit default or other credit event. The market likens CDS to health insurance, fluctuating in value with the perceived health of the underlying credit.

It’s not too hard to see that problems would arise if doctors began claiming dying patients were, in fact, healthy. This would eventually constitute a mispricing of the risks associated with the patient for the insurance company.

This is a cause for concern in the CDS market. Suppose Congress were to fail to pass a resolution to the debt ceiling before the X-date and the United States entered a technical default. Would the ISDA Determinations Committee label this as a default of the largest economy in the world? Or would political/outside pressure dissuade that decision?

While this is a hypothetical situation, it highlights a clear risk in the CDS market for sovereign debt, particularly regarding the United States.