Summary

Stronger gains in inflation are being found near technology hubs like San Francisco, likely where job markets and wages are improving most. Consumer demand for discretionary goods and services have yet to rebound as much as non-discretionary, durable goods. The jobs market is still upbeat, which we hope will finally lead to wage pressure. This analysis dives into Google Domestic Trends to determine when this shift is occurring.

Comment

The chart below shows CPI less food & energy by metro from 2006 to current. We have often cited technology as a headwind for inflation. However technology hubs, namely San Francisco, Atlanta, Los Angeles, and Seattle, are seeing higher core inflation and producing a positive skew to overall inflation.

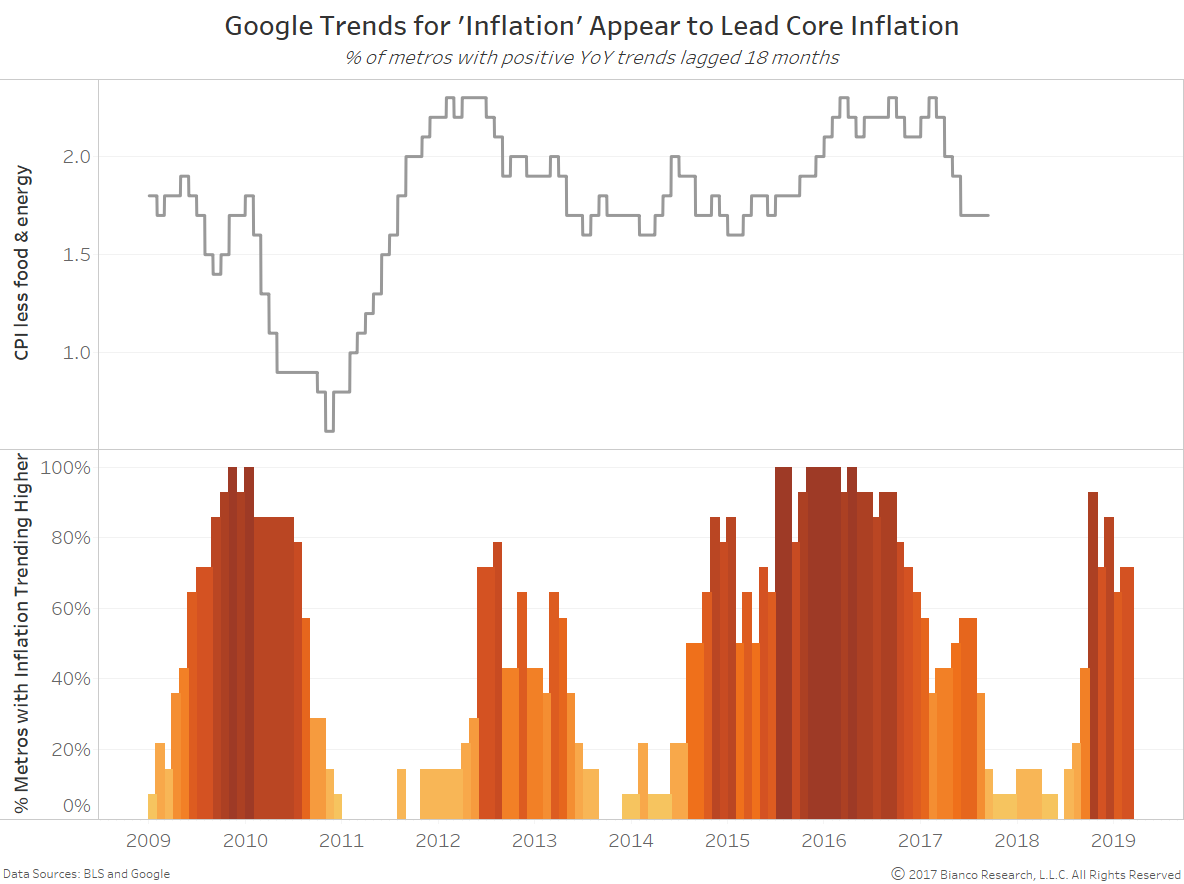

The chart below shows YoY changes in google trends for ‘inflation’ by metro area. Over 70% of these major metro areas show growing interest and potentially concern about inflation.

The percentage of metros seeing inflation (bottom panel) trending appears to lead core inflation (top panel) by approximately 18 months. The Federal Reserve often cites expectations of businesses and consumers as a driver of inflation.

But, consumers need jobs, higher wages, and ultimately higher spending to help fuel inflation. We measure consumer behavior via Google domestic trends. Google domestic trends offer a window into consumer behaviors via rigorous analysis of Google searches.

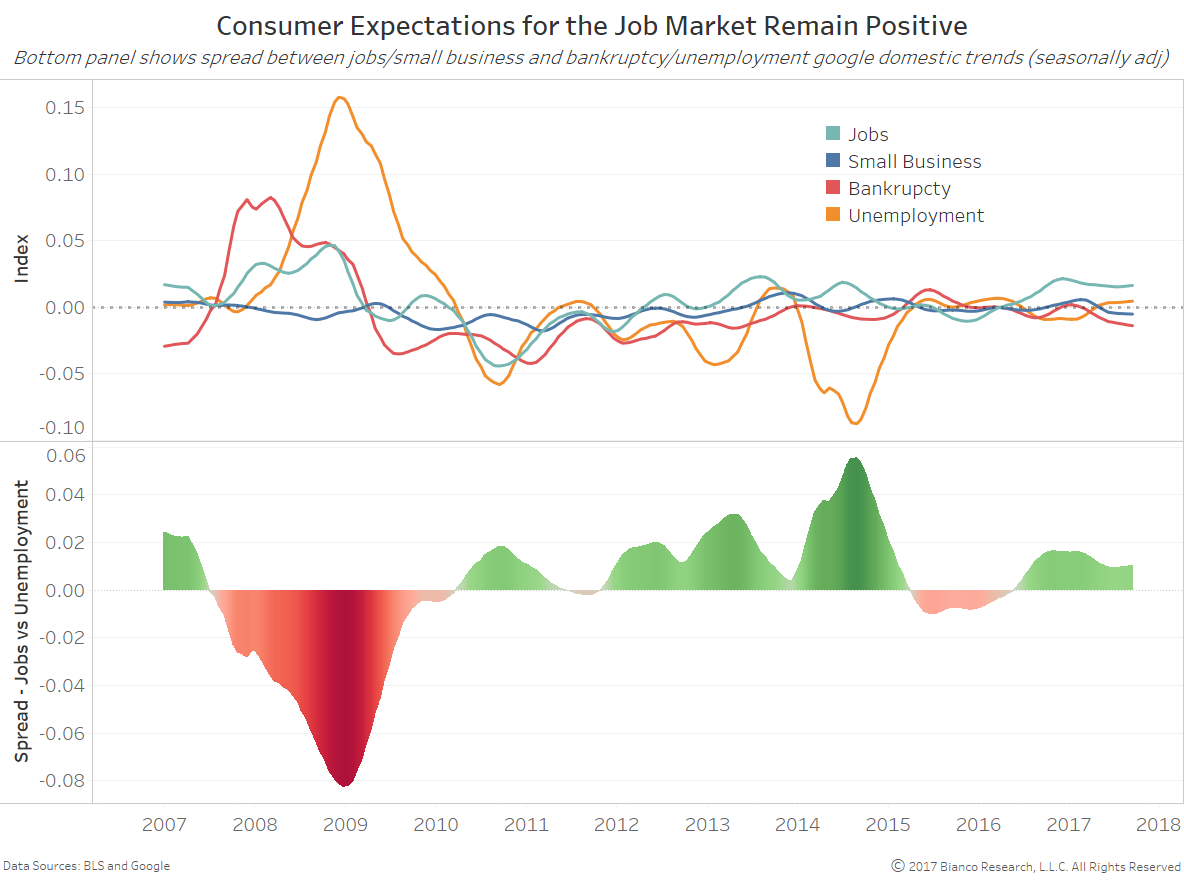

Consumers remain upbeat concerning the job market as evidenced by a rising spread between job and unemployment-related search trends (chart below).

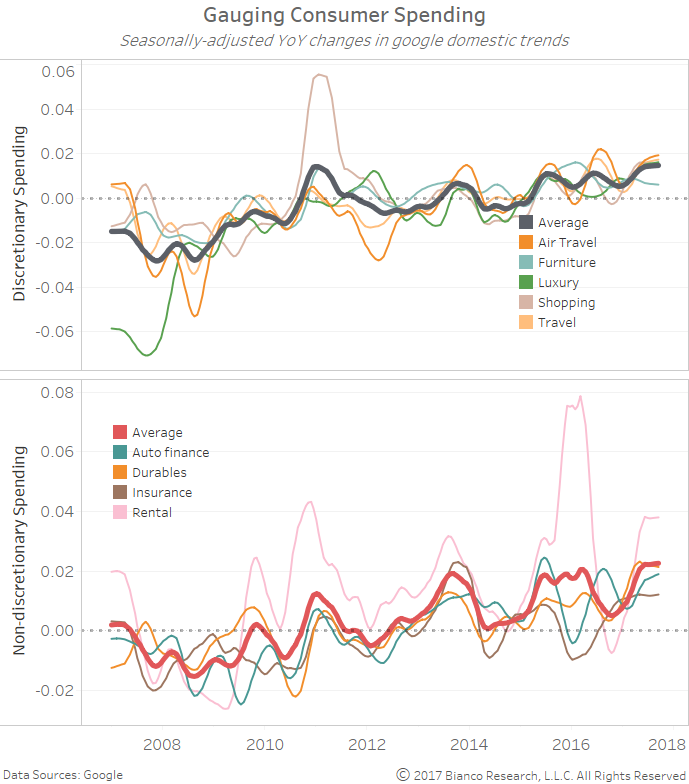

Unfortunately, consumers are not yet seeing a strong rise in discretionary spending (e.g. travel and luxury goods) when compared to the basics (e,g, durables and insurance). The top panel in the chart below shows seasonally-adjusted YoY changes in trends attributed to discretionary spending. The bottom panel shows the same, but for non-discretionary spending.

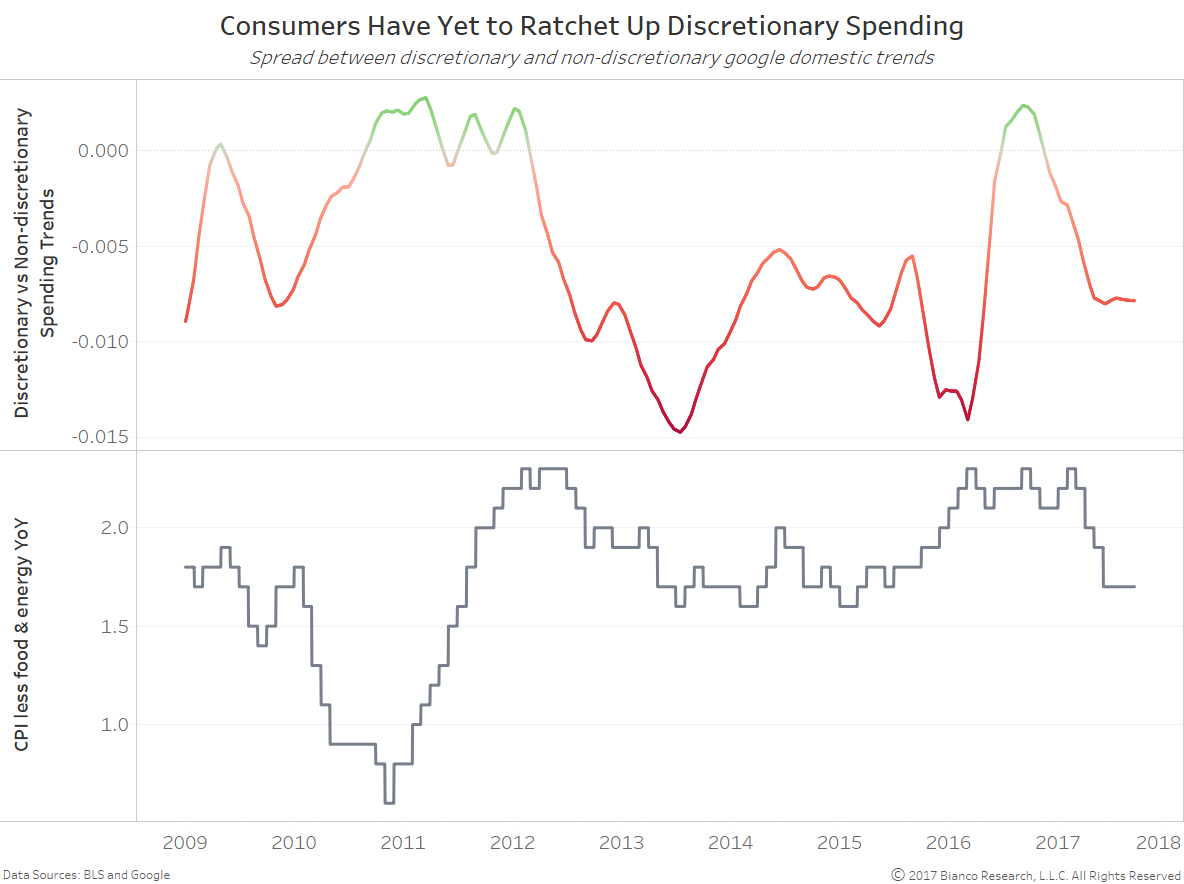

The spread between the discretionary and non-discretionary indices above is a leading indicator for core inflation. A rebound in consumer behavior toward greater spending is likely needed to reflect improving wages.

All in all, we are awaiting a rebound in both witnessed inflation and then increased discretionary spending before fully committing to a robust environment for inflation.