- Bloomberg.com – Coronavirus May Drag China GDP Down to 4.5% in First Quarter

Bloomberg Economics’ model sees slowing from 6% last quarter

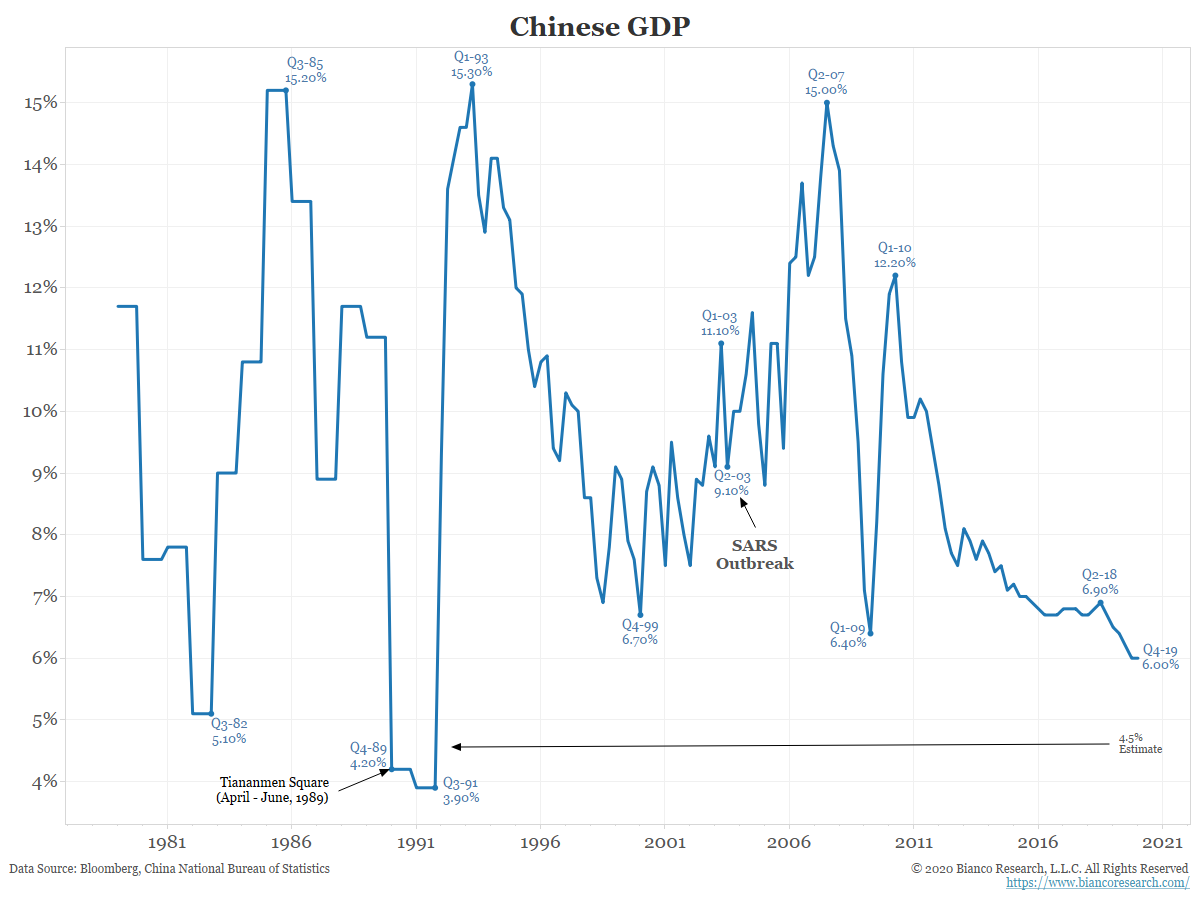

Virus fallout could knock 0.1 point from U.S. and euro areaChina’s economy may grow just 4.5% this quarter, down from 6% in the prior three months, if the coronavirus inflicts a severe yet temporary impact on output, according to Bloomberg Economics. Such a slowdown would be 1.4 percentage points beneath the forecast made before the outbreak of the virus which is now threatening to hurt demand and supply chains in China and beyond, economists Chang Shu, Jamie Rush and Tom Orlik wrote in the report, which was published on Thursday.

- The Financial Times – Goldman warns of coronavirus ‘spillover’ to US economy

US GDP growth is set to take a hit this year as the effects of a coronavirus-driven slowdown in China ripple across international markets, according to Goldman Sachs. Economists at the bank said they anticipate a 0.4 percentage point drag on US annualised growth during the current quarter, on the back of a halving of tourism from China and a knock to the country’s imports of US goods. Goldman expects US growth to rebound in the second quarter once travel restrictions are eased, leaving full-year growth down around half a percentage point.

- The Financial Times – Russia closes China land border to prevent spread of coronavirus

First case of person-to-person transmission in US confirmed as infection rate continues to riseRussia has ordered the closure of its huge land border with China as Moscow scrambles to prevent the deadly coronavirus infection spreading from its southern neighbour. There have been no confirmed cases of the respiratory illness in Russia but Vladimir Putin’s government is anxious to prevent the virus from crossing a land border that stretches for more than 4,000km. Moscow has already blocked Chinese tour groups from entering the country.

- Time Magazine – Coronavirus Grounds Flights to China From 3 Continents. How Scared Should Travelers Be?

Airlines in Europe, Asia and North America are cancelling flights to and from China as the novel coronavirus, which originated in the Chinese city of Wuhan, has infected at least a few thousand people in China and dozens beyond its borders. - The Financial Times – Coronavirus cases in China exceed Sars as public anger rises

US warns citizens not to travel to China after WHO declares global emergencyAt a press conference on Friday Carrie Lam, Hong Kong’s chief executive, said the territory would extend school closures until at least March 2 and that civil servants would work from home to reduce the chance of spreading the infection. She appealed to the private sector to reduce the need for commuting to work. The rapid spread of the virus has fuelled discontent over the Communist party’s management of the outbreak, especially claims that local authorities concealed information on the disease in the early weeks of the epidemic. The government is considering electronic tracking bracelets to track people returning from Hubei who would need to undergo home isolation.

Summary

Comment

By Western standards, this still sounds like heady growth. But, as the next chart shows, 4.5% growth was last seen during Tiananmen Square and is among the lowest levels reported since the Chinese economy opened to the West in the late 1970s.

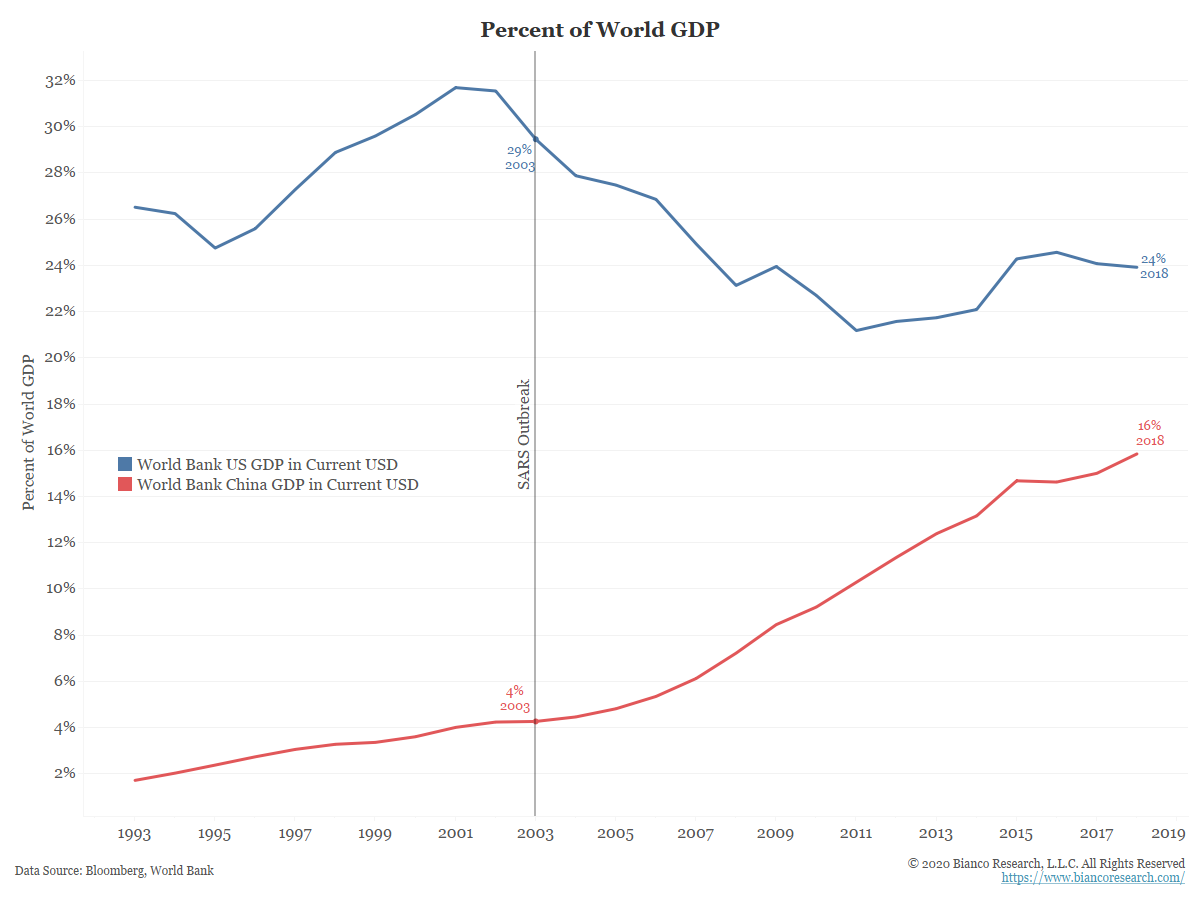

When the SARS virus was spreading in 2003, it knocked 2% off China’s GDP (chart above). At the time, it was considered a very big deal, as the April 2003 Economist cover shows to the left.

The chart below shows China’s share of world GDP going back nearly 30 years. In 2003, the Chinese economy only accounted for 4% of world GDP and the US economy was 7.5x larger than China. Today China is 16% of global GDP and the US economy is only 1.5x larger.

While the human impact cannot be overstated in either case, China now plays a much bigger role in the world economy. From an economic standpoint, the coronavirus is much more a global problem. Goldman Sachs is already estimating that, if the Chinese economy slows due to the coronavirus, it will knock 0.4% off the US economy’s growth rate (story above).

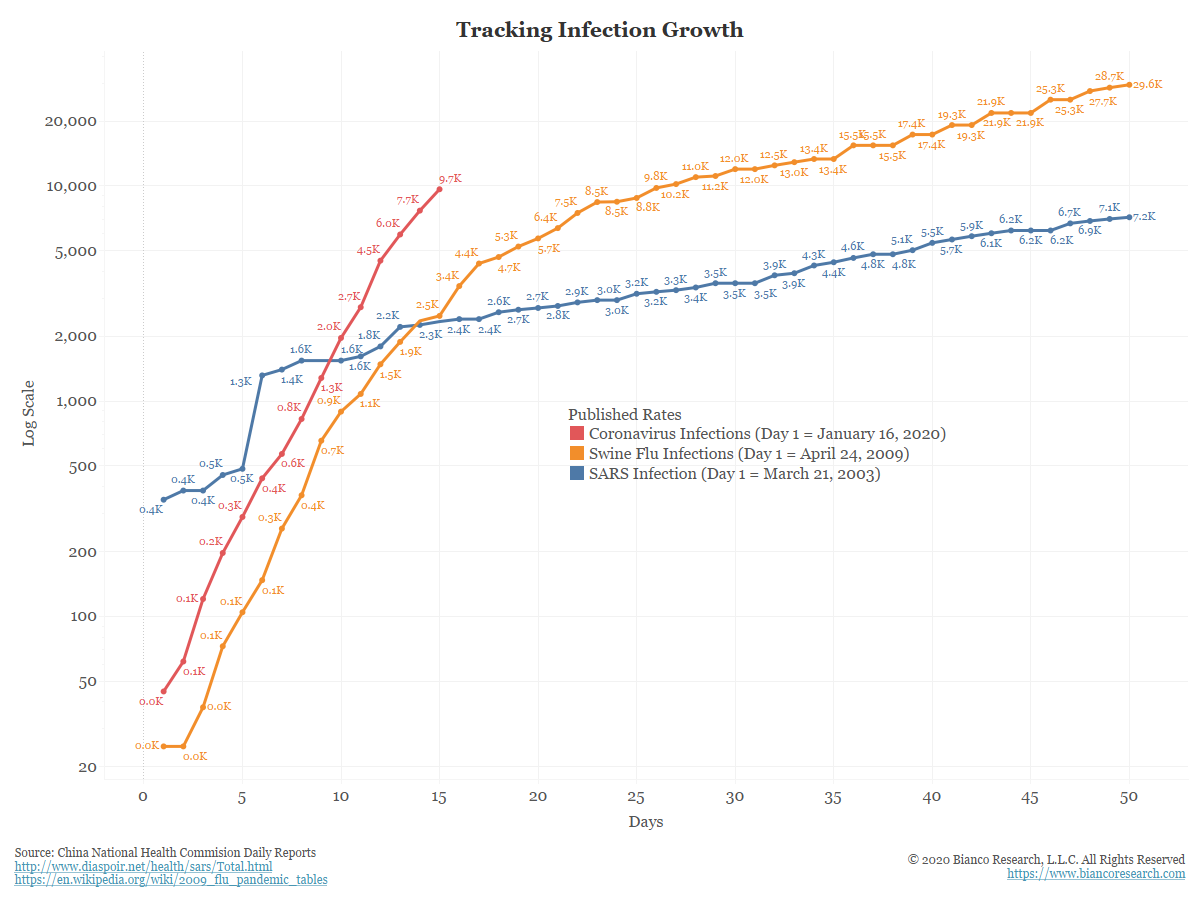

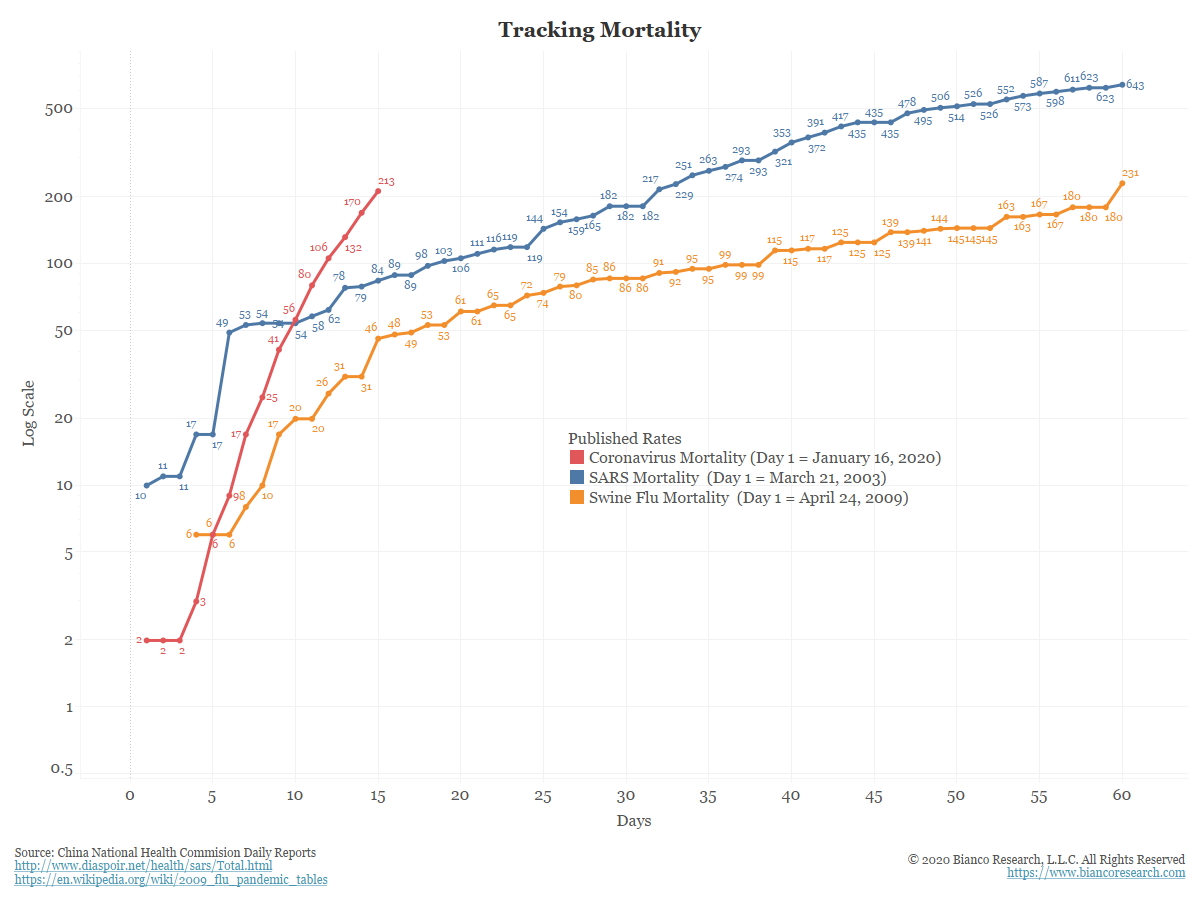

Today (January 30) is day 15 since health officials started publishing data about the coronavirus. The chart below plots the progression of this virus to SARS in 2003 and the swine flu in 2009.

Note that day 1 in the chart below begins when published data starts reporting. This is why the charts do not start at zero or one (they pick up those early cases on day 1 of reporting). So it compares day 15 of reporting, not day 15 after the first known case.

The published data shows that coronavirus infections (red) have already surpassed the 60-day reporting total for SARS in 2003 (blue) and has grown at a faster rate than the 2009 swine flu (orange).

So based on available data, this is the fastest growth of the three.

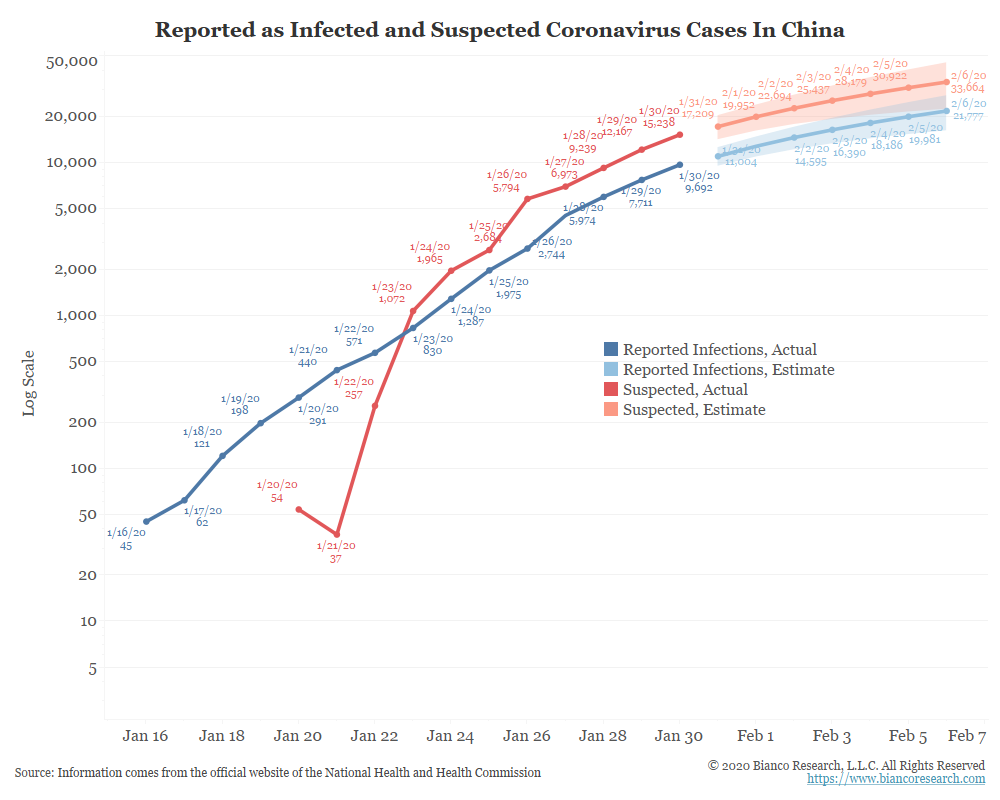

The following chart plots both the reported infection rate (blue) and the “suspected” infection rate (red). Also shown in the lighter colors is a simple polynomial regression to plot potential growth rates over the next seven days (to February 6). To be clear, these are not forecasts. We are not virologists and don’t pretend to know how this virus will spread in the future. It is simply meant to highlight the exponential, rather than linear, growth rate that is typical in the early stages of a virus. This is why it is so critical to take action quickly in these outbreaks.

This also highlights why it is so difficult to assess the impact on the global economy. If the coronavirus stops spreading soon, perhaps some of the recent Wall Street forecasts will prove accurate. If not, the hit to global growth could be much worse.

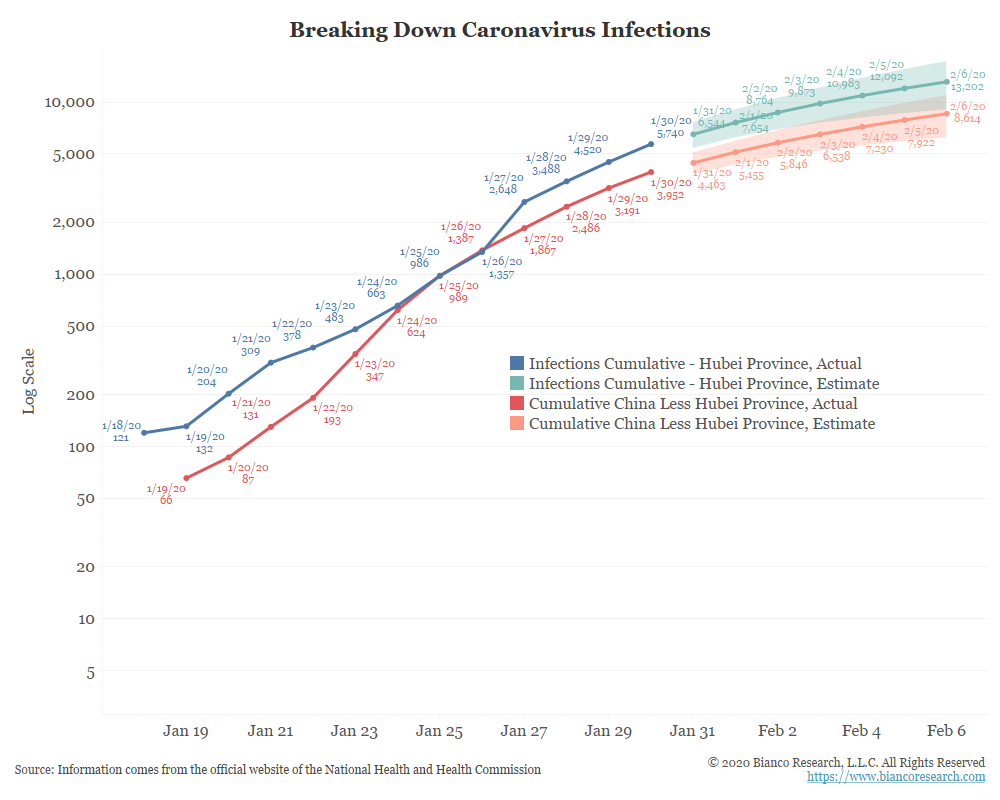

Lastly, the chart below breaks down the number of reported infections by the Hubei province (where Wuhan is located) in blue and the rest of China excluding the Hubei province, in red.

Currently, 5,740 reported infections have come from the Hubei province, which has 50 million under quarantine via heavy travel restrictions. But, 3,952 reported infections have come from outside the Hubei province, which has much lighter quarantine restrictions. These figures will also bear watching, as infections outside Hubei could lead to stricter travel restrictions and a larger hit to economic growth.

Conclusion

The coronavirus is a human tragedy. We never want to forget that. But we are tasked with assessing its economic implications. The fact that China is the second-largest economy in the world and a critical cog in the global supply chain makes this a very important economic story.

Economists’ estimates currently show the coronavirus will have a smaller impact than SARS did in 2003. Many of these forecasts are predicated on the virus slowing in the next week or two.

While we make no predictions regarding when this virus will subside, the charts above offer simple metrics to compare to past outbreaks. For now, many are hoping for the best and assuming any economic impact will be minimal. Because of the exponential growth rate of these types of outbreaks, it is nearly impossible to asses the true economic impact until the growth rate begins to subside.