- CNBC – Fed looks to runs repo Tuesday amid worries about keeping its benchmark rate in check

The Federal Reserve was conducting a repurchase operation involving $75 billion worth of various debt instruments as it seeks to control the level of its benchmark interest rate…An effort Tuesday morning to run a 15-minute operation had to be postponed due to technical difficulties but had resumed around 10 am…Market experts indicated that aside from Tuesday’s operations, which should quell market disruptions over the short term, the Fed will need to explore further avenues, which could include more quantitative easing just a month after the central bank halted its balance sheet reduction…“There are likely a bunch of technical factors at work here but it underlines our view that the Fed has reduced the level of reserves enough / too much and will need to start growing its balance sheet again soon, while potentially also adding open market operations and eventually putting in place a repo facility to provide a backstop for funding markets when funding pressures get too tight,” said Krishna Guha, head of global policy and central banking strategy at Evercore ISI.

- The Wall Street Journal – Fed’s Repo Rescue Leaves Many Searching for Answers

A spike Tuesday in short-term funding costs threw a spotlight on a market that has been a sore subject for bankers, investors and regulators alike since the 2008 financial crisis. Borrowers in the market for repurchase, or repo, agreements paid as much as 10% in morning trading, versus recent rates of just over 2%. The surge spurred the Federal Reserve Bank of New York to pour billions of dollars into the financial system to bring rates back down…The New York Fed said late Tuesday it would repeat its $75 billion repurchase Wednesday morning, but many in the market were looking beyond that decision. “The market will be waiting to see if the Fed makes this a more permanent part of the playbook,” said Beth Hammack, Goldman’s treasurer.

- FT Alphaville – Lookout, there’s a dollar crunch!

Alphaville has one highly speculative theory, which we invite more informed readers to scrutinise and debunk if needs be. (Although, our readers never require much invitation.) We previously argued Monday’s oil price spike constituted a pretty unprecedented state of affairs and could conceivably lead to a lot of fallout for those caught on the wrong side of the move — evidence of which would only come to light in the days to come. So one theory is that a dash to post variation margin at the respective commodity exchanges (and in cleared bilateral markets as well) is in some ways feeding through to a funding shortfall in repo markets. As we noted previously, a lot of the buyside were likely caught short due to the seemingly popular theory that the trade war would lead to a slowdown in oil demand. Even if such funds closed down their positions entirely, yesterday’s move was so large it is more than likely initial margins might have been blown through entirely, leaving many exposed to raising the difference owed to the exchanges elsewhere (under legal obligation). But the other bigger theory is that the strikes have taken out approximately $400m in daily dollar cash income for the Saudi government. That income equals dollar liquidity the Saudis suddenly no longer have access to. Their dollar spending commitments, however, go unchanged. If commitments to pay salaries and suppliers can’t be met by (what were until now fairly predictable) cash injections from oil sales, the only other option for the Saudis is to start liquefying their dollar asset reserves . . . and that, very likely, is something to be conducted through the repo markets directly. In which case repo markets may be moving in anticipation of Saudi liquidity operations — in the context of a market that’s already being over supplied in terms of safe government bond assets relative to available bank reserve liquidity — or as a result of it already taking place.

- The Financial Times – Why did the repo market’s wheels stop turning?

September 15 is tax day for companies in America. Some companies prepare by pooling the cash they need and placing it into money market funds — short-term investments that use the repo market to lend out cash for a brief period, earning a small return. Now tax day has passed, that cash has been yanked from the market, reducing the supply of dollars. At the same time, roughly $54bn of Treasury securities have flowed into the market due to the settlement of a host of previously auctioned debt. This has created a wave of demand from people wanting to borrow cash to finance the purchase of these Treasuries…analysts say these two things alone should not cause the deep cracks in the repo market that we have seen this week. The underlying issue is more structural. The Fed has been reducing the size of its balance sheet, letting the Treasuries and mortgage bonds it bought following the financial crisis roll off. In turn, that reduces the amount of cash reserves banks held at the Fed. In 2014, banks held $2.9tn in “excess reserves” at the Fed. Since then, that number has dropped to about $1.3tn, where it has hovered all summer. Fewer cash reserves means less money available at the banks to cover short-term funding stress.

Summary

Comment

The funding markets are broken. The good news is they can be fixed.

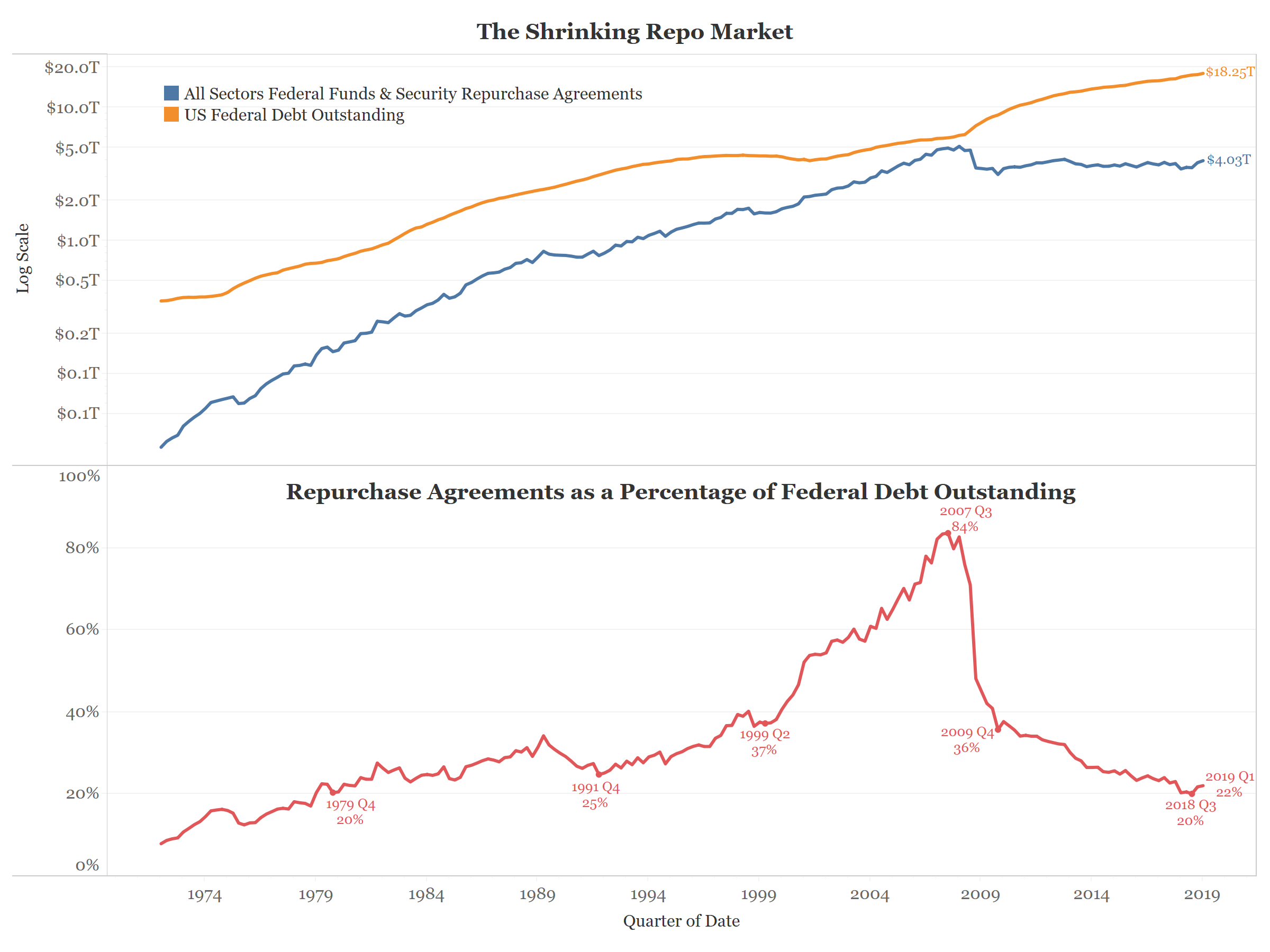

The basic problem is the funding markets are too small. As the chart below shows, the repo market, which peaked at 84% the size of the Treasury market in 2007, is now just 22% the size of the Treasury market.

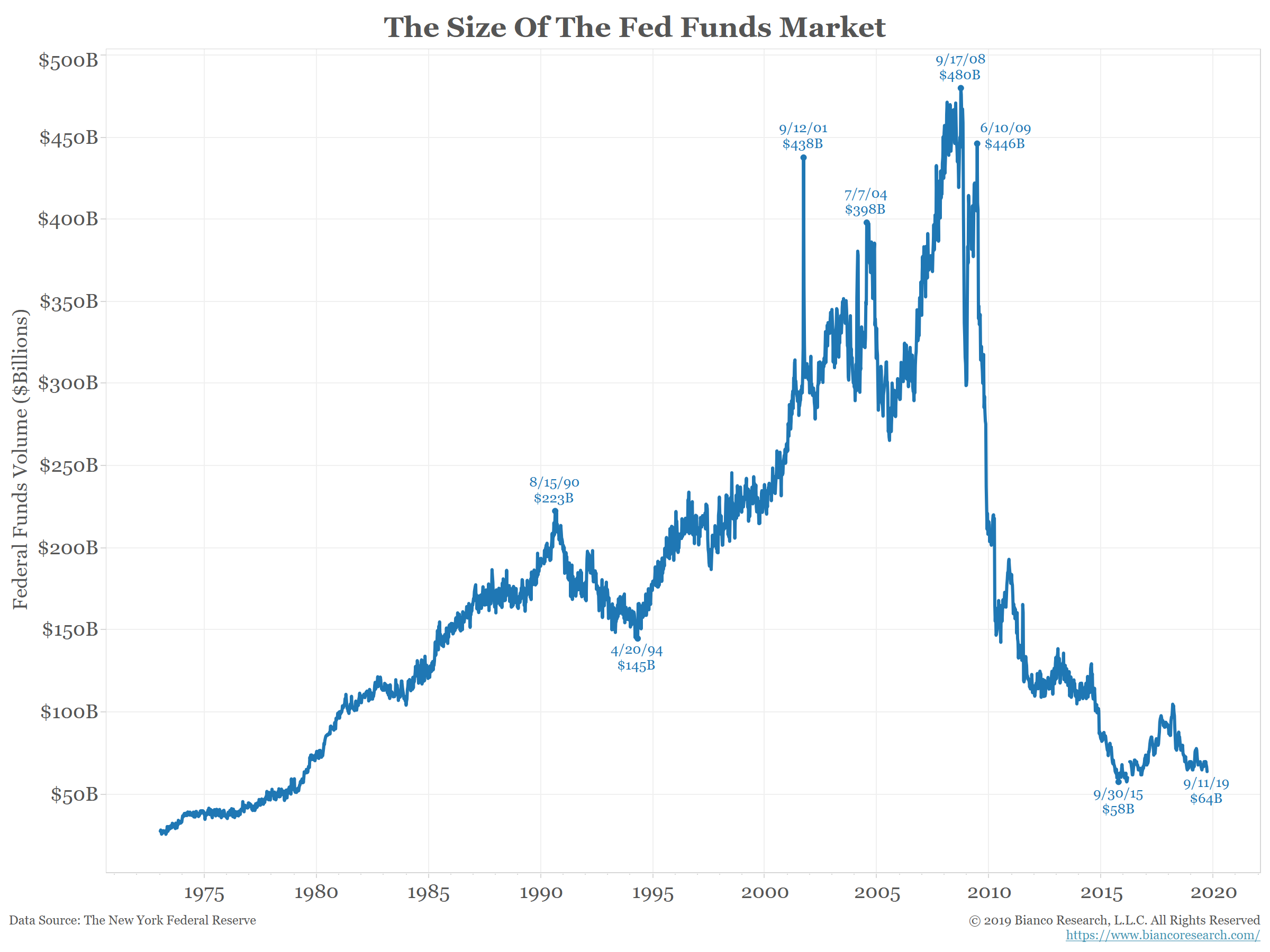

This has led to a closely related market, the fed funds market, to shrink in a similar fashion. The next chart shows the daily volume in the fed funds market is also near a 40-year low.

Many factors led to this point. Dodd-Frank and the Volcker Rule increased capital requirements and made trading more expensive. Rules on Liquidity Coverage Ratios (LCR) and High-Quality Liquid Assets (HQLA) further restrict banks’ ability to lend in the funding markets.

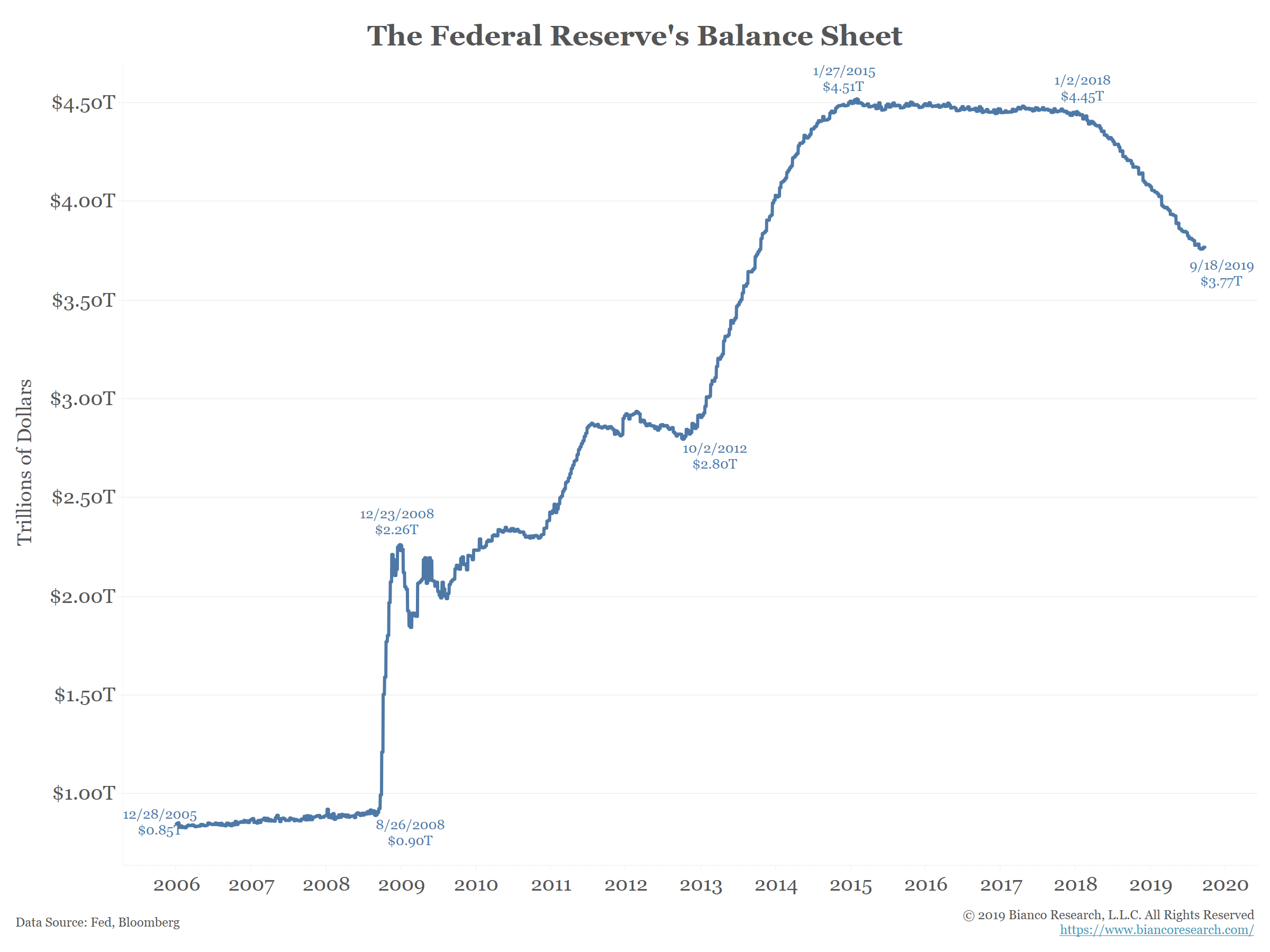

The result was a pullback in the amount of funds available. Initially, from 2009 to 2017, this was offset by the Fed’s increasing balance sheet.

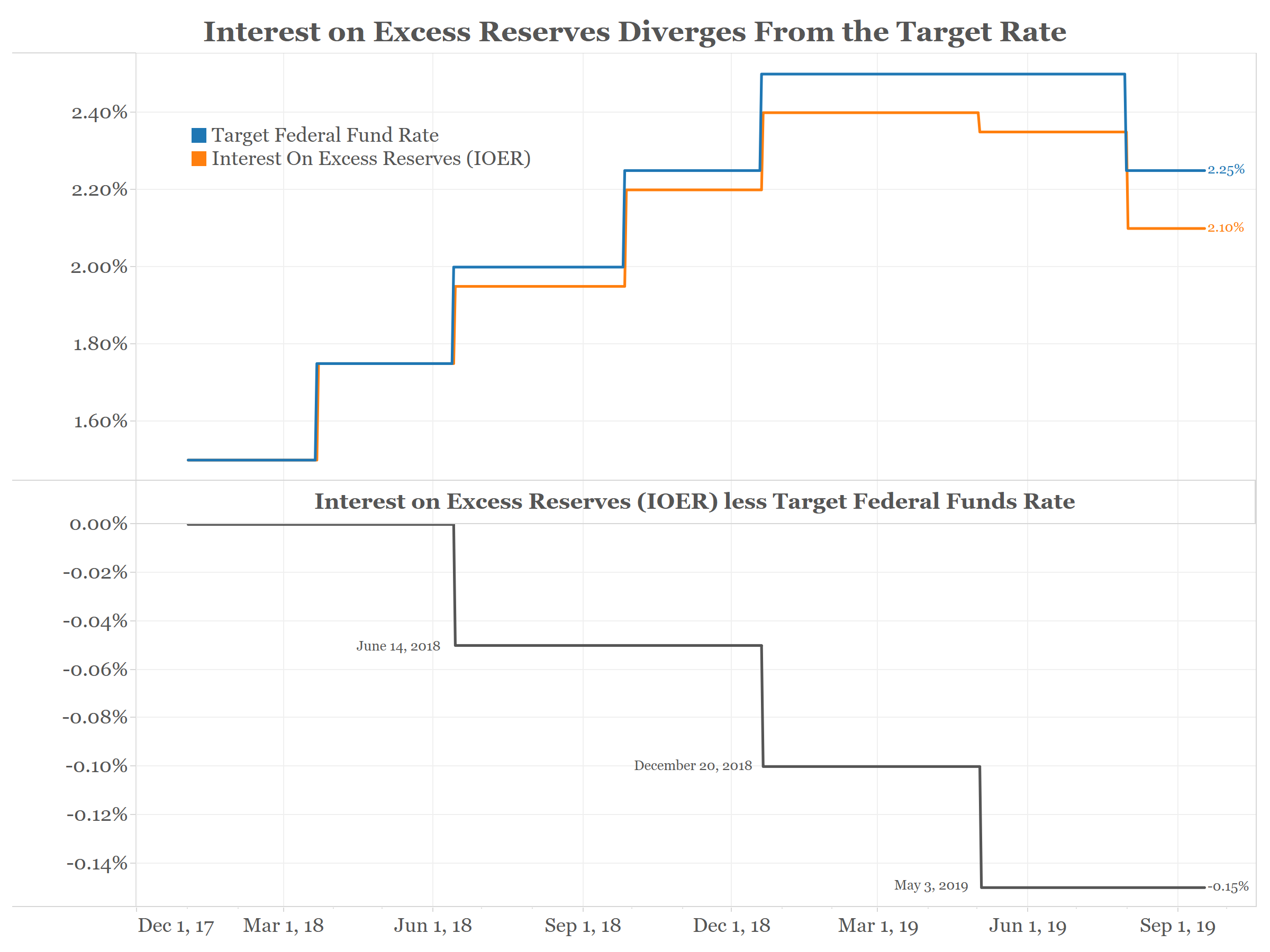

But, starting in 2018, the Federal Reserve started reducing its balance sheet. This is why all the problems started.

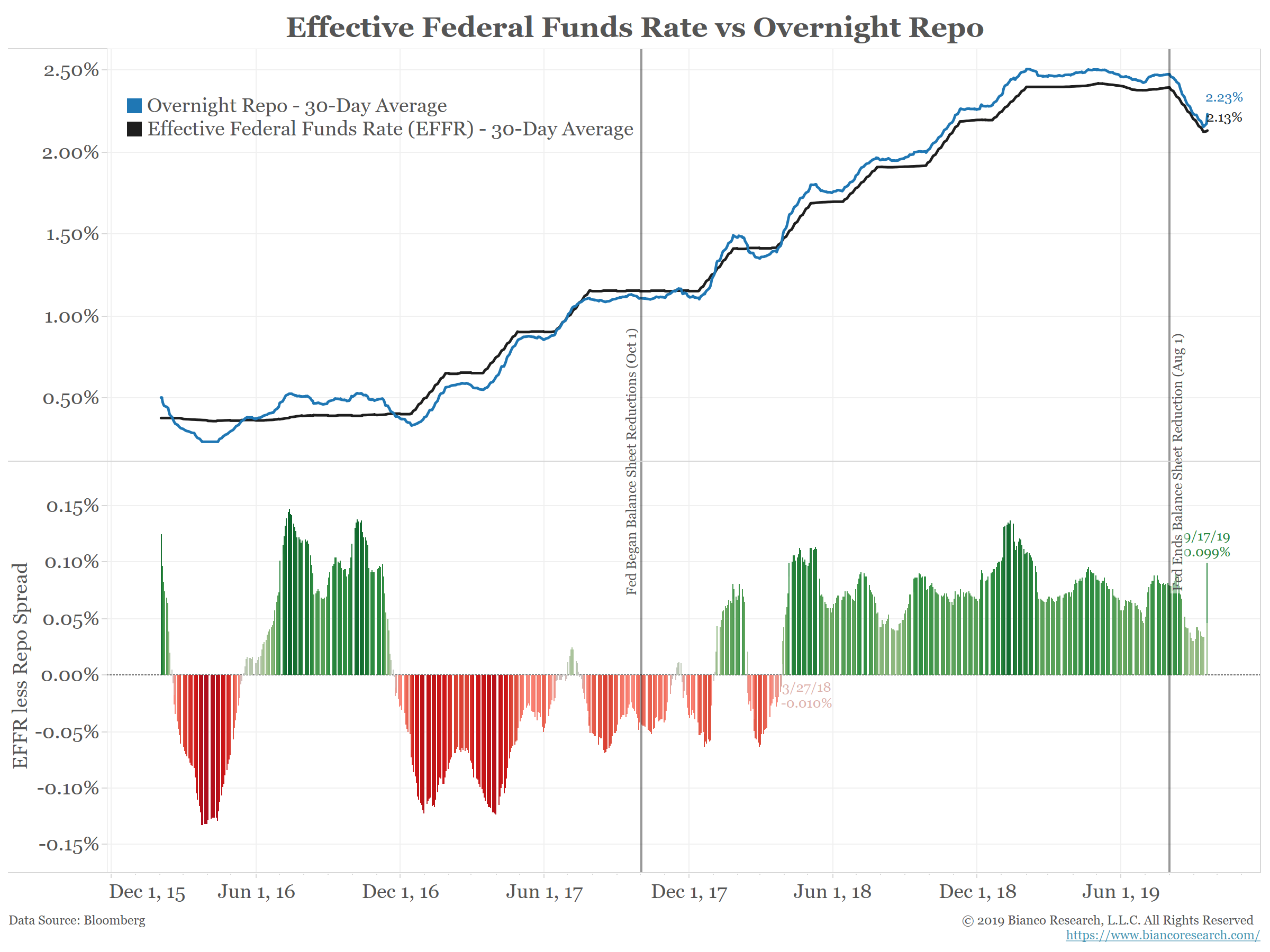

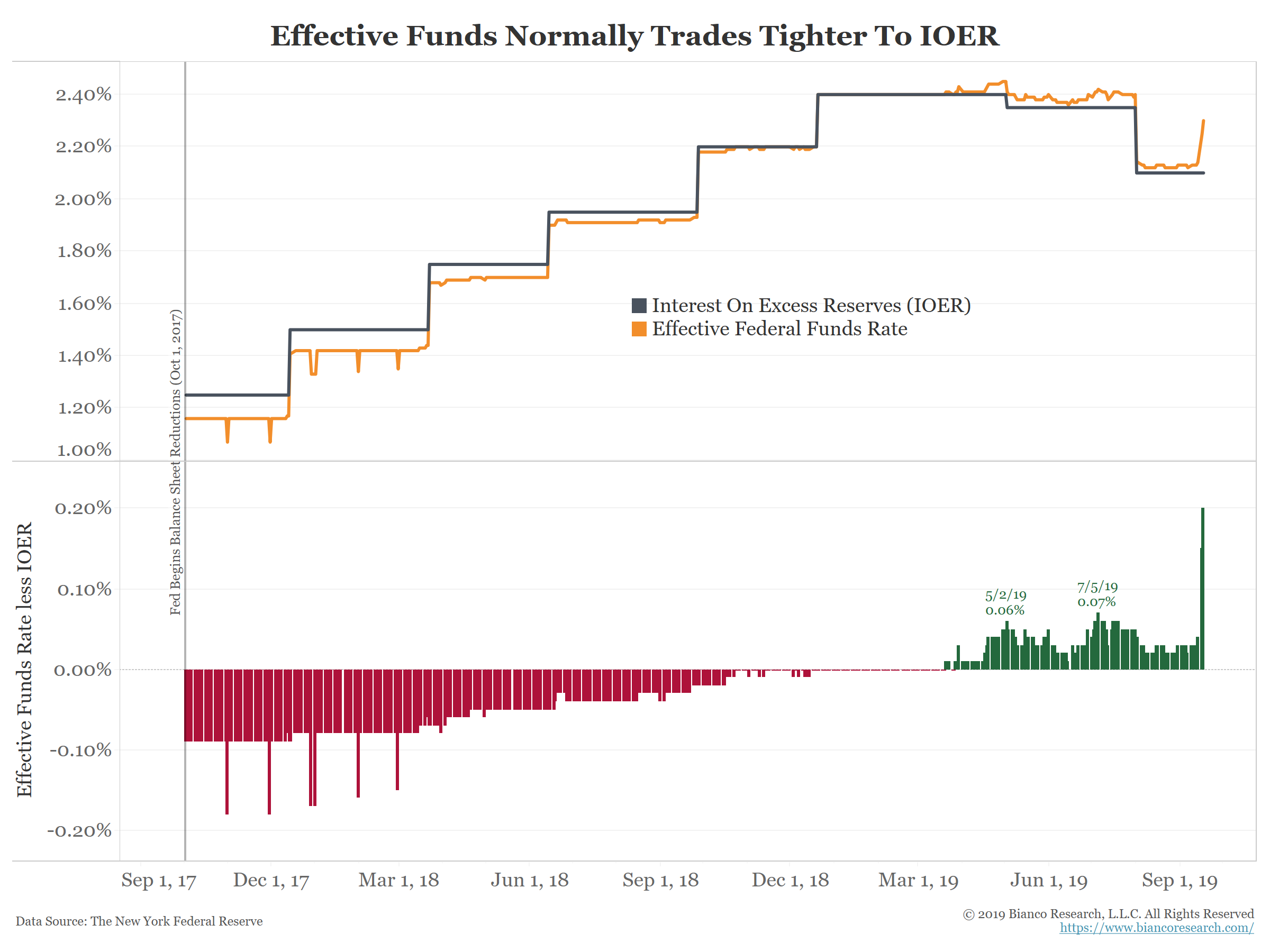

At first, the spread between overnight repo (blue line) and the effective funds rate (black line) moved from a discount to a premium (bottom panel). This happened right after the Fed started reducing its balance sheet (left vertical line).

As the Fed began reducing its balance sheet, the funding markets shrunk too much. The warnings signs were there, but they were ignored.

This week’s combination of a large quarterly corporate tax payment, crude oil margin calls and additional T-bill issuance reduced cash balances and left the funding markets tight. A healthy funding market could have handled this with little disruption, but this is not a healthy market.

The Fed might insist QT is like “watching paint dry,” but it left the funding markets too small and too illiquid to meet the markets’ needs.

The Fix

There is either not enough cash in the market or too much collateral that needs to be financed. The Fed has fixed this problem by adding repo to the market to the tune of $53 billion yesterday and $75 billion today.

These are temporary fixes. Maybe tomorrow a repo facility will not be needed, or maybe it will need to be even larger. This stress has been building for years. Now that the Fed needs to inject repos, it is not going to reserve course.

To permanently fix this issue, the Fed could make these repo facilities permanent via the New York Fed’s desk. This way banks would have the ability to get cash from the Fed every day, whether it is needed or not.

The alternative fix would involve expanding the balance sheet. This would functionally be the same thing as QE, but its purpose would be to supply the market with reserves rather than stimulating the markets.

Conclusion

The funding markets suffered from years of rule changes and balance sheet reductions. While the Fed could fix this with a permanent repo facility, this is not a great solution in the long run as it would be replacing the private sector’s function of allocating capital. Government substitutes of this sort often backfire and create perverse incentives. For the time being, however, the funding markets are too important to allow to falter as they have the past couple days.