<Click on chart for larger image>

- Real Time Economics (WSJ Blog) – NY Fed Plumbs Balance Between Reverse Repos, Market Stability

A report released on Friday by the Federal Reserve Bank of New York highlights the balancing act the central bank faces as it prepares to deploy a new tool it hopes will provide better control over short-term interest rates…Some officials have become concerned the tool could pose a risk to financial stability. The main fear is that by providing a safe place to park money during times of stress, reverse repos could drain money out of private asset markets. At the same time, some officials have worried the reverse repo program could cause some private financing markets to whither, displaced by a central bank taking in short-term cash. The Fed has already addressed some of those concerns. It has imposed total and firm-level borrowing caps, and it has signaled that the reverse repo program will be temporary. The paper’s authors conclude that a sizeable aggregate borrowing cap that shrinks over time could be worthwhile. Such a regime would give the Fed control over rates while signaling the supplemental nature of the program. The current overnight limit is $300 billion, periodically augmented by multiday term reverse repos. The authors downplayed the risk of financial stress by noting it is unlikely the central bank would begin raising interest rates when markets are unsettled. - The Grumpy Economists – John Cochrane: Liftoff Levers

With that background, maybe the whole section on “liftoff tools” makes more sense. So, the Fed opens up reserves to one and all, and stands ready to take trillions. What’s the problem?A couple of participants expressed continued concerns about the potential risks to financial stability associated with a large ON RRP facility and the possible effect of such a facility on patterns of financial intermediation.

I don’t get this at all. I gather the story is something like, if interest paying reserves are available, then funds might in a new crisis want to dump all their assets and move to interest paying reserves. But they can just as well dump assets and buy cash or treasuries too. The existence of interest paying reserves open to non-bank institutions just makes very little difference. It seems to me exactly the opposite. Every dollar invested in interest-paying reserves at the Fed is a dollar not invested in run-prone, financial-crisis-prone, overnight private lending, like the overnight paper Lehman was using at 30:1 leverage the night before it failed. More ON RRP means more financial stability. If anyone knows a coherent explanation of how offering the most perfect narrow banking in the world (interest paying reserves backed by Treasuries) is bad for financial stability, I’d like to hear it. Are there speeches or papers by the “participants” I don’t know about?

Comment

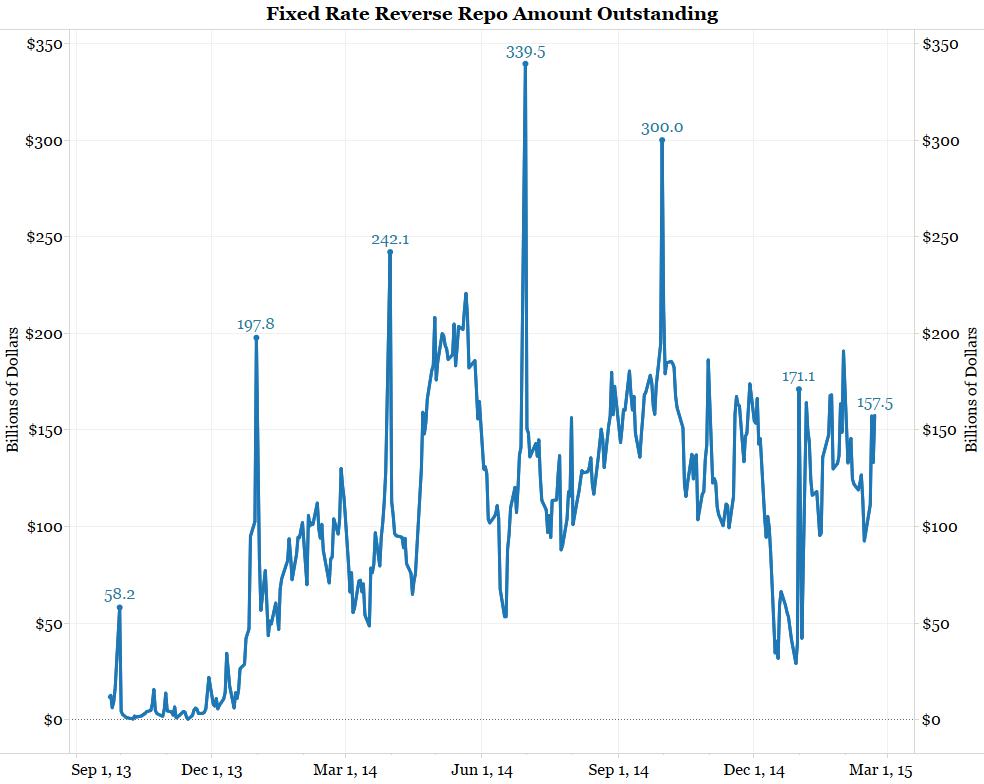

In the first half of Cochrane’s post, he makes a similar case to what we have said before (here and here). The fed funds market essentially does not exist, so the Fed will use reverse repos (RRP, chart above) and interest on excess reserves (IOER) to influence the target fed funds rate. He goes on to say this is really tricky:

What if the Fed announces the long-awaited interest rate rise, the Fed starts paying banks 50 bp on reserves and.. nothing happens. Deposit rates stay at zero, treasury rates stay at zero. Congress notices “the Fed paying big banks billions of dollars to sit on money and not lend it out to needy businesses and households.” Mostly foreign big banks by the way. Nightmare scenario for the Fed.

However, in the highlighted passage above Cochrane thinks one way to avoid this scenario is to make the RRP and IOER markets so large they will overwhelm the target fed funds market and force rates higher. As the highlighted part of the first story points out, many (including us) worry that a very large RRP market poses a risk to financial stability. Cochrane dismisses this concern. Here is how we outlined the concern:

Even though Cochrane is a well-respected University of Chicago economist and an influential voice to Fed officials, the Fed disagrees with his assessment. As the first story states, the Fed is imposing a cap on the total size of RRP because they take financial stability issues seriously. We agree with the Fed on this front. However, we also agree with Cochrane on his first point – without a huge RRP market, the Fed might not be able to influence short-term interest rates. They may simply end up paying banks more without affecting short-term rates.

These are very important issues that need to be addressed. Unfortunately we hold out little hope anyone will ask Yellen about this tomorrow.