<Click on chart for a larger version, see page 13>

Comment A few weeks ago we discussed why the market thinks Freddie is insolvent:

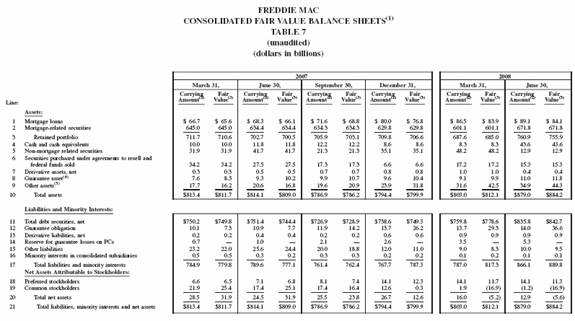

We believe the answer lies in Fannie and Freddie’s financial statements themselves. Recall that both Fannie and Freddie were involved in an accounting scandal. As part of the settlement with their regulator OFHEO, they were required to present a “fair value” balance sheet (a balance sheet marked at market prices and not at their “model prices”). Above we show these balance sheets and link to their financial statements.

Freddie Mac’s fair value balance sheet shows a negative equity position for the second quarter in a row. As of June 30, “net assets” were -$5.6 billion, down from -$5.2 billion on March 31.

Mention the fair value balance sheet and the company will point to the pages of notes in their financial statement showing you why this is a meaningless indicator (linked above). They will point out that this is an inherently volatile measure. This is all true.

However, when the fair value balance starts to trend, as it is now and heading into negative territory, it tends to be a leading indicator of where its regulatory capital measures are going. Freddie has been very quiet in the idea that the fair value balance is telling us what is to come.

Tangible Book Value

A second measure of Freddie’s insolvency is their “Tangible Book Value.” This can be found here (page 2) in their Consolidated Balance Sheet. This measure shows net assets of $12.9 billion (this is also shown in the fair value balance sheet above under “Carrying Amount”). However, Freddie Mac is also carrying a “Deferred Tax Asset” of $18.399 billion. This means they can save $18.399 billion in taxes once they start making money again. Take this out of the equation and that gives a negative Tangible Book Value as of June 30.

-

The New York Times – Freddie Mac’s Big Loss Dims Hopes of Turnaround

The gloom over the nation’s housing market deepened on Wednesday as Freddie Mac, the big mortgage finance company, reported a gaping quarterly loss and predicted that home prices would fall further than previously projected. The announcement disappointed those hoping that the housing market might be bottoming out and heightened worries that the government could be forced to rescue Freddie Mac and the other mortgage finance giant, Fannie Mae. The news also signaled that mortgage rates were likely to rise. In filings with the Securities and Exchange Commission, Freddie Mac said that “there is a significant possibility that continued adverse developments” could cause the company to fall below government-mandated capital levels. In an interview, the company’s chief financial officer, Anthony S. Piszel, said that warning did not imply the company believed that risk was likely or imminent. -

Marketbeat (WSJ Blog) – Freddie Mac to Market: We Matter

“I think we — virtually everyone, including our critics, would say that this would be an extremely ugly mortgage market, if you were looking at a mortgage market now that — that didn’t have the GSEs,” Mr. Syron said. He added that the GSEs, in economic periods such as this, must “grow quickly for the economy,” saying that it is going to be “very important that the GSEs operate in a market where there is capital flexibility.” However, the unrestrained growth of the GSEs in recent years has arguably been behind much of the current mess. “It’s kind of a two-fold argument,” says James Bianco, president of Bianco Research in Chicago. “It’s like the heroin addict who says, ‘Do you know how bad it’s going to be when I stop taking this stuff?’ Yes, but do you know how bad it is now? Sure, it would be very bad if we tried to extricate Fannie and Freddie from this situation but they’ve also made this situation bad too.” -

The Wall Street Journal – Freddie Needs Equity Lift

For all the mortgage giant’s talk since May that it would raise $5.5 billion in additional capital, nothing has happened. Instead, Freddie’s balance sheet has worsened. It is now in the unenviable position of having negative equity attributable to common shareholders of $1.2 billion, when calculated using generally accepted accounting principles. So shareholders would wind up with nothing if Freddie sold its assets and paid down its debt. Yet, the firm and Chief Executive Richard Syron focus on measures of regulatory capital. On that basis, Freddie had what it calls core capital of about $37 billion at the end of the second quarter. But that is either blinding the firm to its dire straits or serving as a fig leaf for its refusal to bolster its balance sheet — something it can seemingly get away with because of increasingly explicit government backing.

Comment Freddie Mac has been trying to raise capital since May. During that process they got an explicit guarantee from the U.S. Treasury. So, where is the capital? It took Merrill 18 hours to do their capital raise (from the close on July 28 to the open on July 29). Is anyone really buying that Freddie is in no hurry and waiting for better markets?

The uncomfortable answer is they cannot raise money and are still desperately trying. If this goes on long enough, Freddie Mac will be forced to sell a preferred stock issue to the U.S. Treasury. Stay tuned, this is about to get interesting.