The New Retail Trader

Earlier this year, we presented the argument that retail traders have become a significantly more dominant force in markets than in previous cycles. (The Rise of the Retail Trader)

In the past, professional investors dominated the trading market, and most volume originated from large asset management or institutional investment firms. This was largely the case before the pandemic. But after what is now known as ‘meme stock mania,’ the retail investor began to have an outsized impact.

Shifting from ‘set-it-and-forget-it’ investment products to momentum and speculation tools, retail traders now speculate with options, and they crowdsource due diligence.

Retail investors are more likely to buy dips than professional money managers or other market participants because they hold the assumption that, regardless of whatever calamity might be impacting markets at the moment, the S&P 500 will invariably be higher in a year or three or five.

Retail Investors in the Driver’s Seat

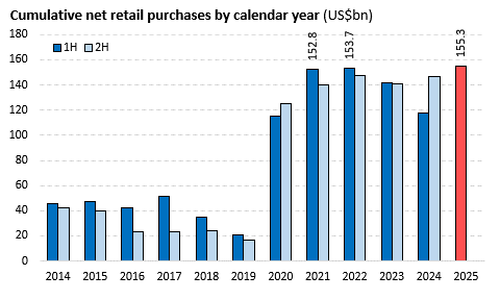

The retail group’s influence on markets continues to grow. Even as Trump unleashed a storm of volatility and markets nearly entered bear market territory in April, retail flows into stocks and ETFs reached a record high in the first half of the year, according to Vanda.

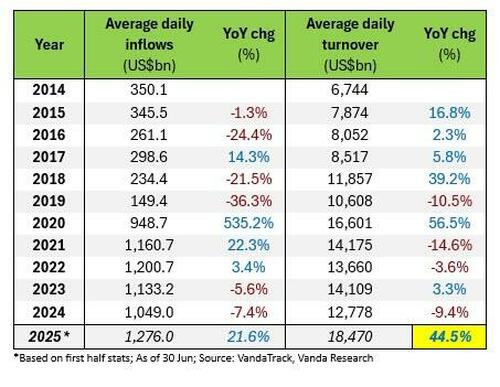

Retail investors are not only buying; they are also churning their positions at much higher levels. The table below (again from Vanda) shows daily flows on the left and turnover on the right.

Note that the average daily turnover so far in 2025 is 44.5% higher than in 2024. The only year since 2015 with a higher change in turnover was 2020.

Restated, retail investors are not just seeing markets fall and submitting buy orders; they are actively trading these markets.

To add another metric to retail trading, the following post from ZeroHedge shows that penny stock (stocks under $1) volume accounted for more than 47% of total market volume in early June.

Retail has gone full tilt, trading more aggressively than during the post-stimmy meme stonk euphoria.

Pennystocks just hit a record 47.4% of total market volume pic.twitter.com/NfdDzODJVY

— zerohedge (@zerohedge) June 16, 2025

We can reasonably assume that large money managers are not participating in penny stock trading at that level, which suggests that the retail crowd is driving the market as well.

When we put this together, we see the retail crowd successfully piling into equities. At the same time, professional money managers have been skeptical of an economic downturn, a resurgence of inflation, or a geopolitical crisis.

Retail Strategies Are Winning in 2025

You wouldn’t expect retail investors to engage in strategies like covered call or protective put buying.

The driving force behind retail investing in the 2020s is speculation. That could mean one of three things: buying the dips on large indices, expecting a reversal from down periods, buying single stocks in hopes of a major rally, or using bullish options strategies.

Buy the Dip

While buying dips isn’t necessarily a speculative strategy in itself, retail investors often engage in this practice without considering fundamentals or any genuine justification. The investment thesis is often as simple: markets are down significantly, markets always recover, so I should buy now and wait for them to rise again.

As the following story from The Financial Times points out, this has been a winning strategy in 2025.

- Financial Times – Retail investors reap big gains from ‘buying the dip’ in US stocks

Vanda’s senior vice-president of research Marco Iachini said “retail investors remain a major force in the market” and that their “dip-buying bias is fully intact”.

Single Stocks

Again, buying individual names is not a speculative strategy in itself, but the retail crowd is often fixated on non-profitable, small-cap companies that fundamental investors wouldn’t dare touch.

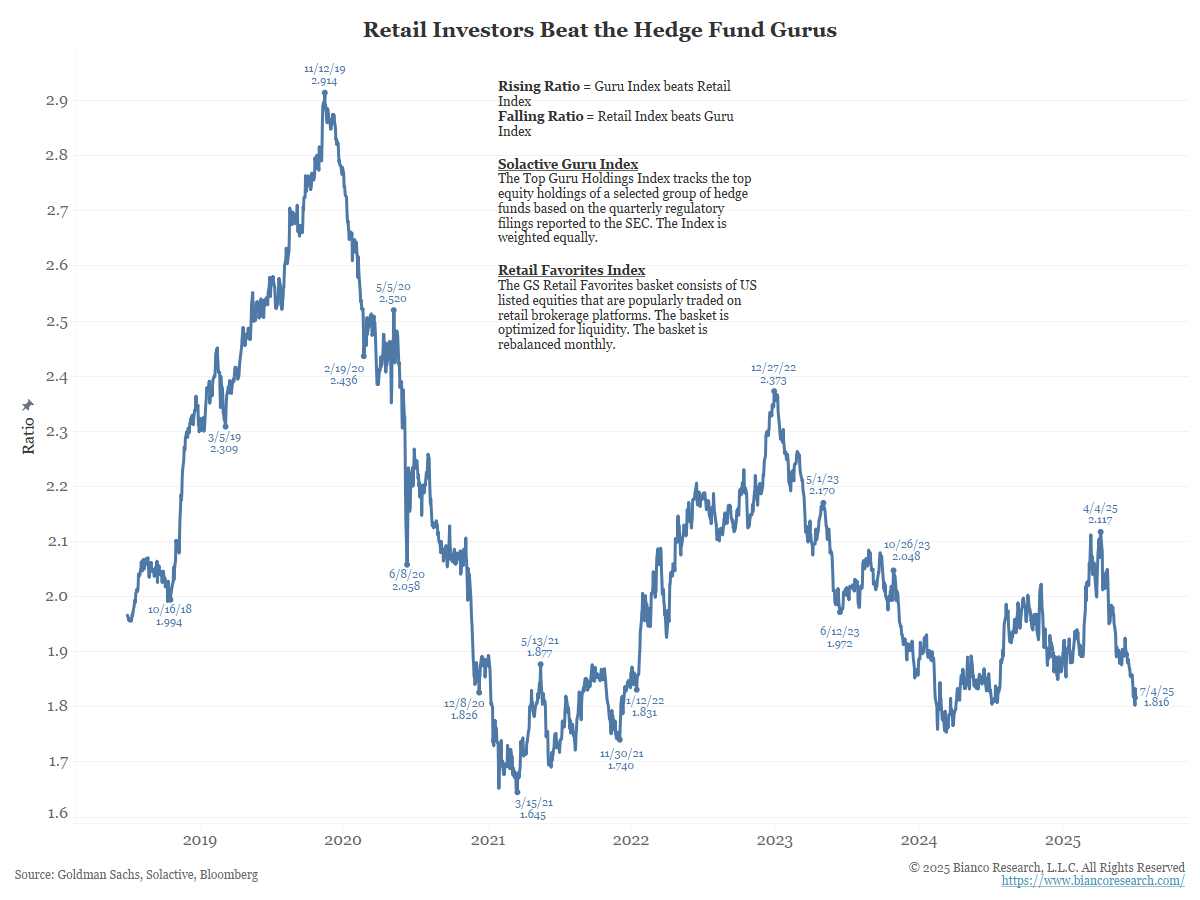

Take the next chart as an example. It shows the ratio of Goldman Sachs’ Retail Favorite Index to the Solactive Guru Index. In essence, this is a measure of retail investors’ stock picks compared to those of hedge funds. A falling line indicates that retail picks are outperforming their hedge fund counterparts.

Hedge funds often hold stocks they view as having strong upside for their portfolio, while retail investors tend to hold speculative stocks that they hope will more than double in one month.

The next story from the Wall Street Journal shows exactly that.

- Wall Street Journal – Meme Stocks and YOLO Bets Are Back and Fueling the Market’s Rally

“We’re not yet seeing a full-fledged ‘flight-to-crap,’ but it is clear that the motivation behind many of these stocks’ activity is something other than disciplined considerations of discounted cash flows,” said Steve Sosnick, chief strategist at Interactive Brokers.

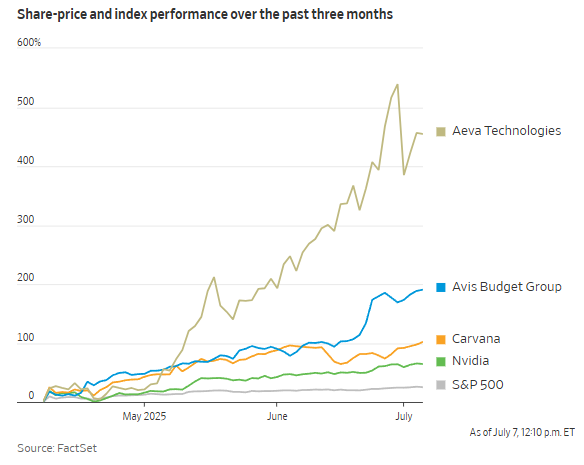

The chart below shows the returns since April 8th of the largest held retail stocks.

Aeva Technologies, a retail favorite, is an unprofitable tech company that has returned 457% since the April market bottom.

That is just a taste of the fervor the retail crowd brings to single-stock investments.

Bullish Options Strategies

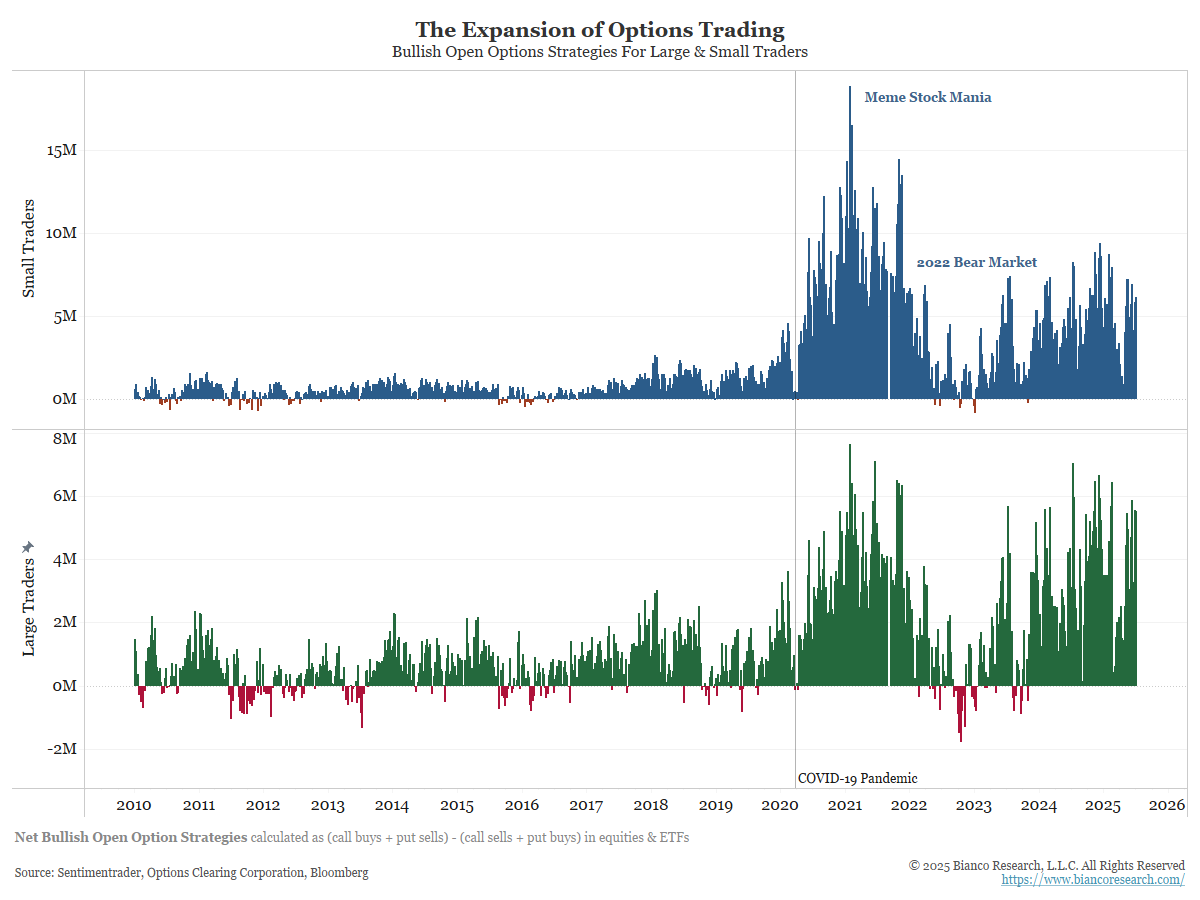

Institutional and professional investors use options for several reasons, including hedging and adjusting market exposure. On the retail side, options are mainly a tool of speculation.

Small traders rarely used options before 2020. By January 2021, small traders held more bullish option positions than their larger counterparts, and although volume is still well below the 2021 highs, it remains significantly above pre-pandemic levels.

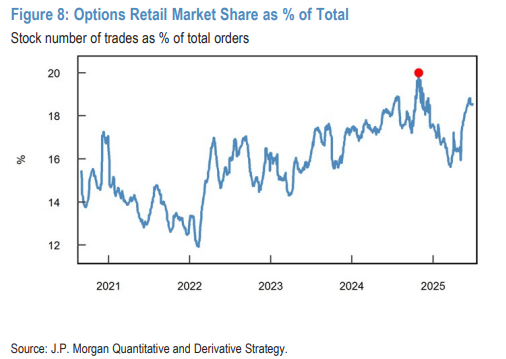

Retail investors now account for 18% of all options volume.

This would be an impressive feat in itself, but we must also consider the surge in options volume.

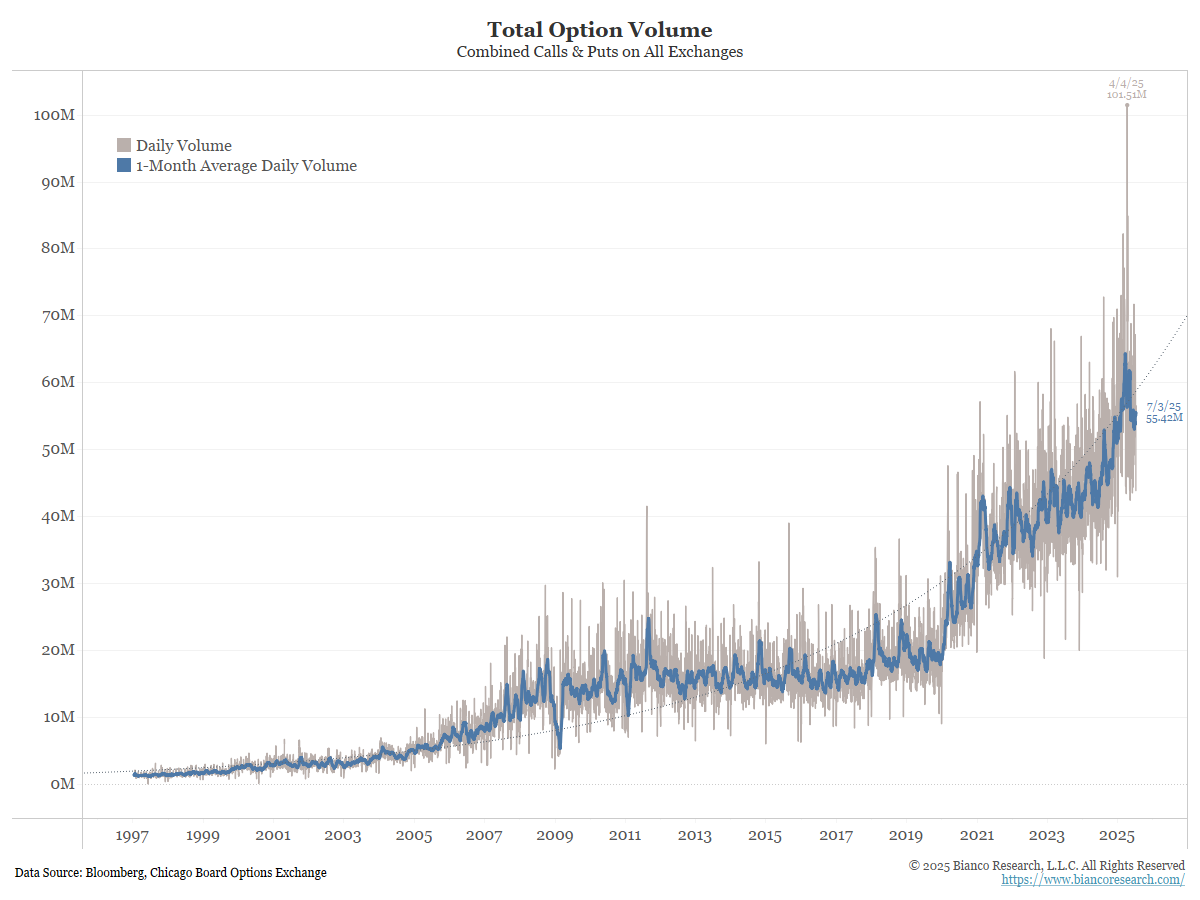

The chart below shows the total combined options volume (calls and puts) on all exchanges.

The blue line represents a 1-month moving average. Options trading volume is near the highest it’s ever been and seems to be on a trend higher.

Combining the surge in volume with the increasing share of retail trading in the options market means Wall Street must contend with a new speculative force that has the potential to impact market movements significantly.

All in all, retail traders have become market participants that must be accounted for. With the proliferation of low-cost trading vehicles, easy-to-use self-directed brokerage accounts, and YouTube University, everyday investors are taking up a larger share of market activity, albeit with much higher levels of risk.