Longer-term inflation expectations appear to remain well anchored, as reflected in a broad range of surveys of households, businesses, and forecasters, as well as measures from financial markets. – Federal Reserve Chairman Jerome Powell, January 29, 2025 Press Conference.

Summary

Comment

The quote above is from Powell’s last press conference, less than two weeks ago. He repeats the sentiment that inflation expectations remain anchored at every press conference. The problem is it is not true.

Households

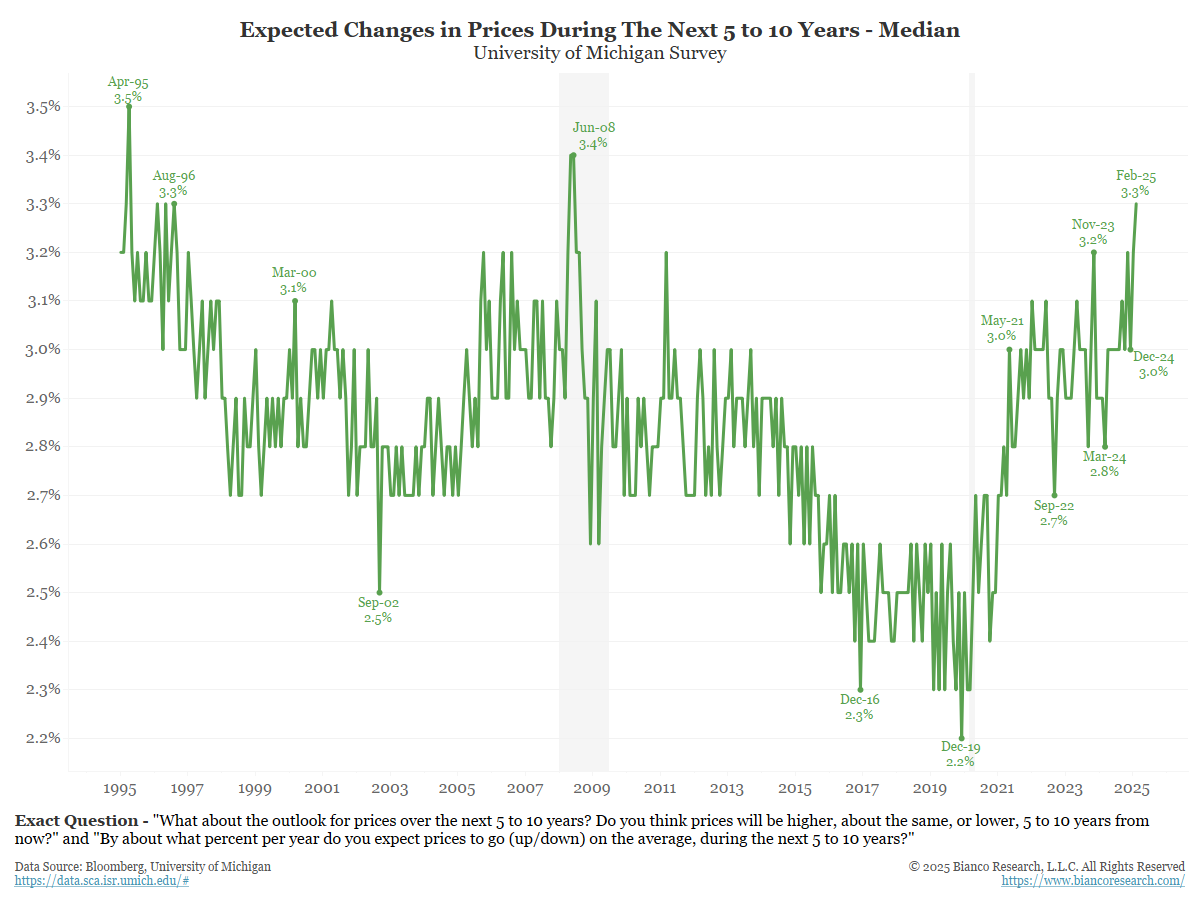

Powell said a survey of households shows inflation is well anchored. The most influential of these surveys is the University of Michigan’s survey of inflation five years ahead.

The median household estimates inflation will be 3.3% during the next five to ten years – a 16-year high.

In June 2008, crude oil was at an all-time high of $145, compared to $70 today. This all-time high undoubtedly skewed inflation expectations higher in 2008, making today’s measure all the more concerning.

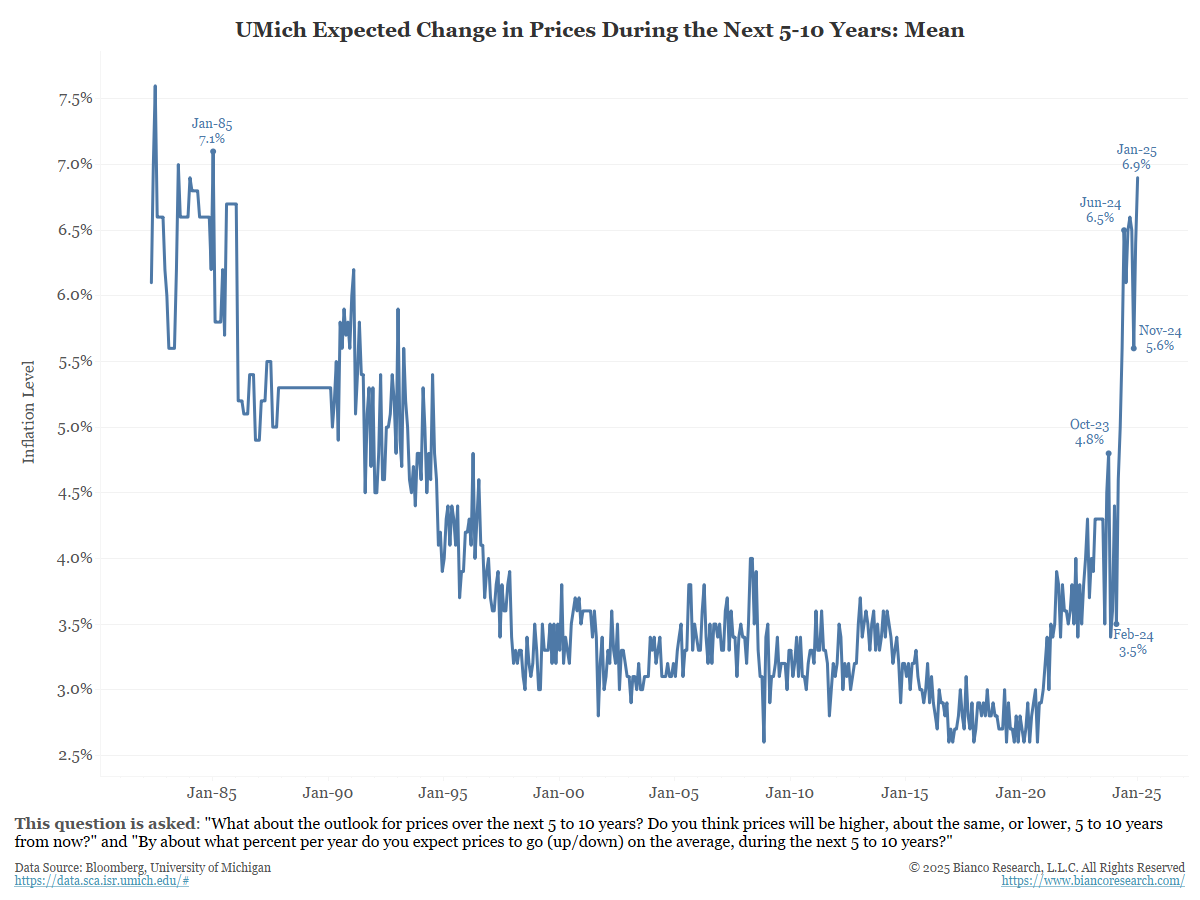

The chart above shows the median response to the survey. If we switch to the mean (average), households’ view of inflation becomes more worrisome. It jumped to 6.9%, a 40-year high.

Note that CPI inflation averaged 7.1% in the 1970s.

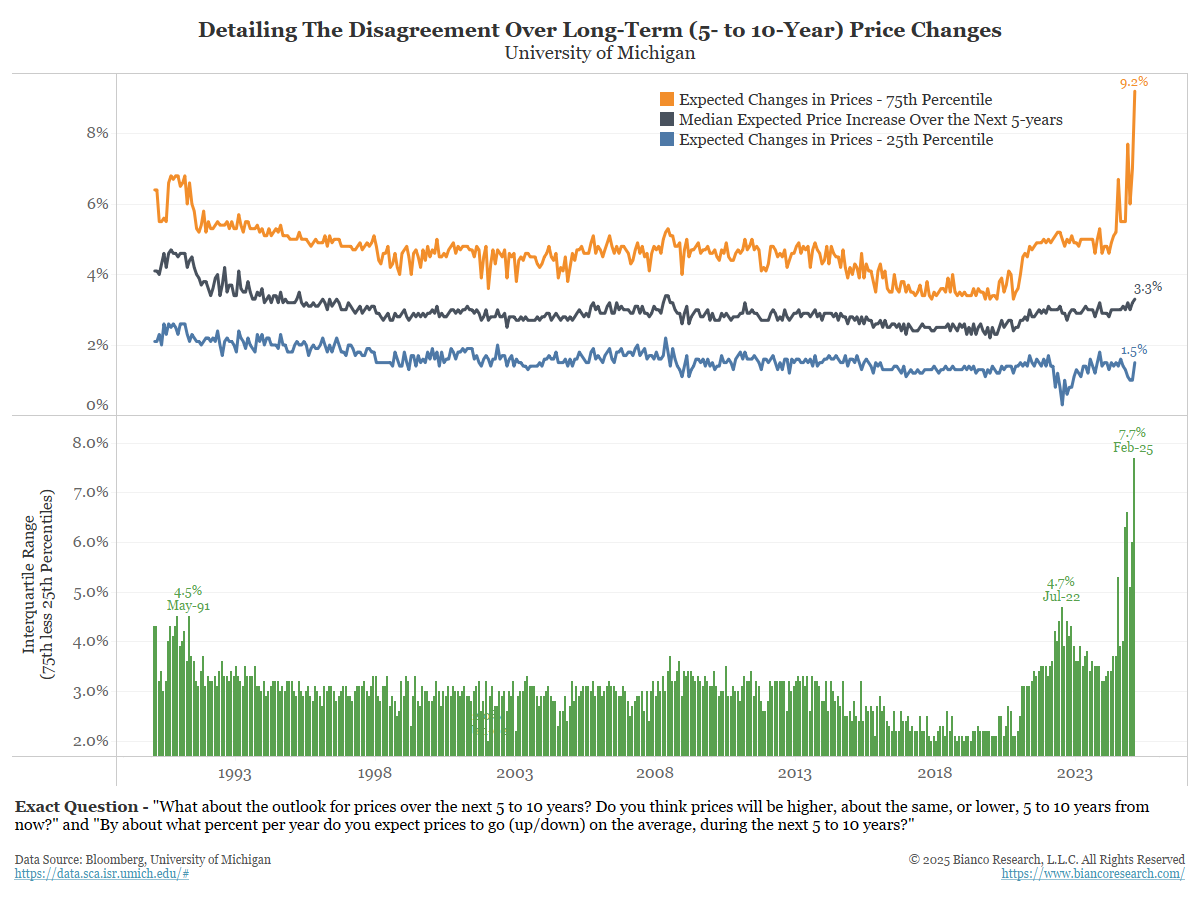

Why are the mean and median diverging so much? A segment of the population thinks we are about to have hyperinflation.

The orange line below shows 25% of the households surveyed think inflation will return to its June 2022 high of 9%.

This would be the very definition of unanchored inflation.

Businesses

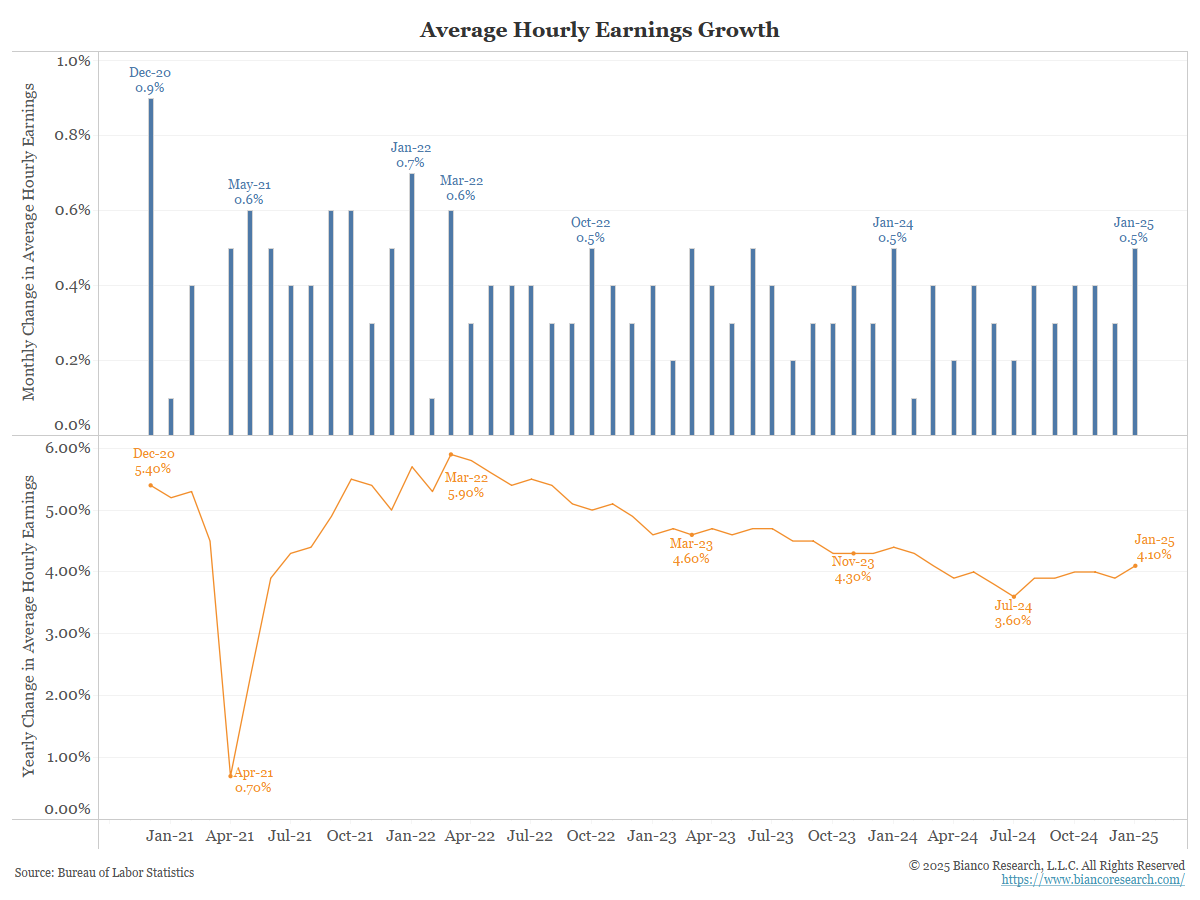

The chart below shows wage growth, as measured by the February employment report released on Friday.

In February wages grew 0.5% (blue). They grew 4.1% year-over-year (orange). The last time monthly wage growth was higher was in March 2022.

If wages are growing more than 4%, then inflation can stay at 4% or slightly below it, much higher than the Fed’s target of 2%.

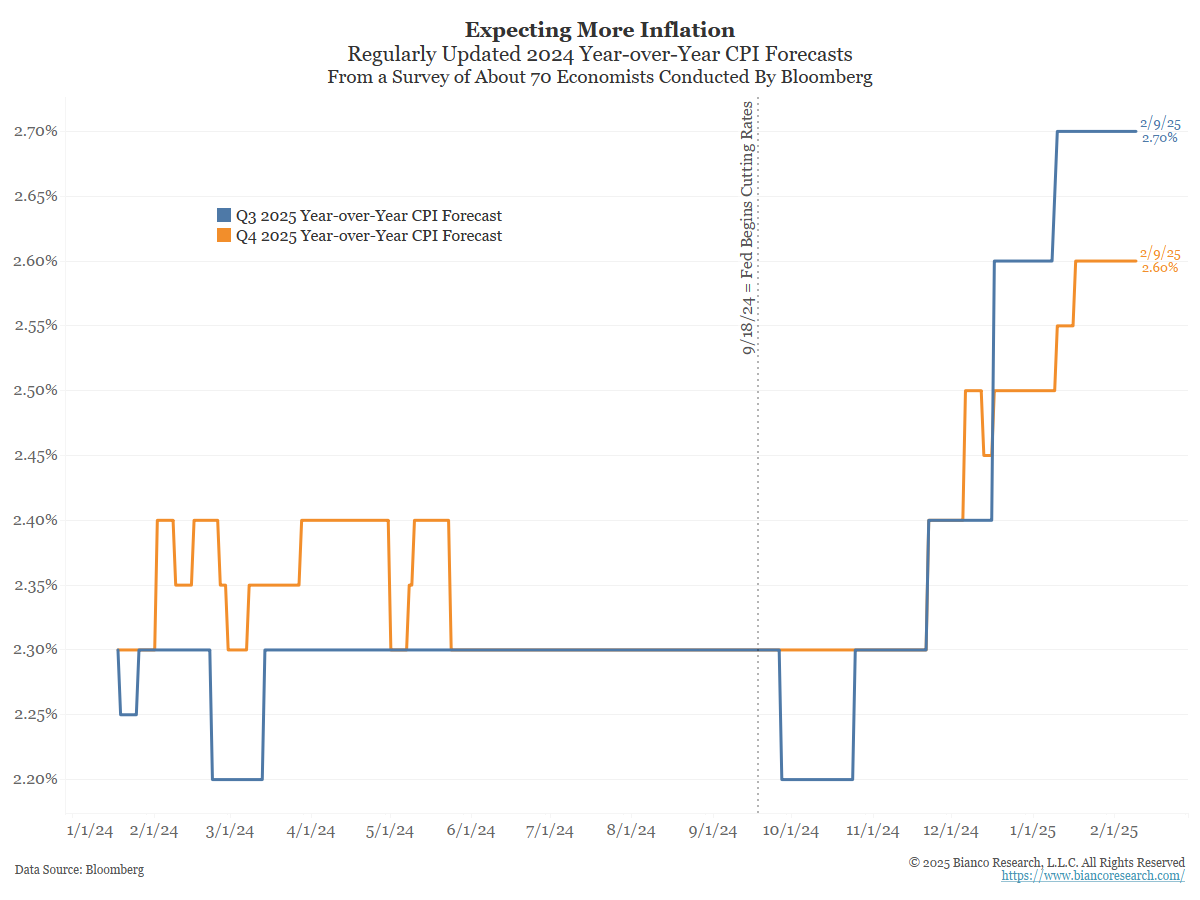

Forecasts

Bloomberg regularly asks forecasters their opinions about inflation. The chart below shows the Q3 2025 (blue) and Q4 2025 (orange) forecasts. They are going up.

Financial Markets

Powell also said the following in his January 29 presser:

QUESTION: Simon Rabinovitch with the Economist. Thank you.

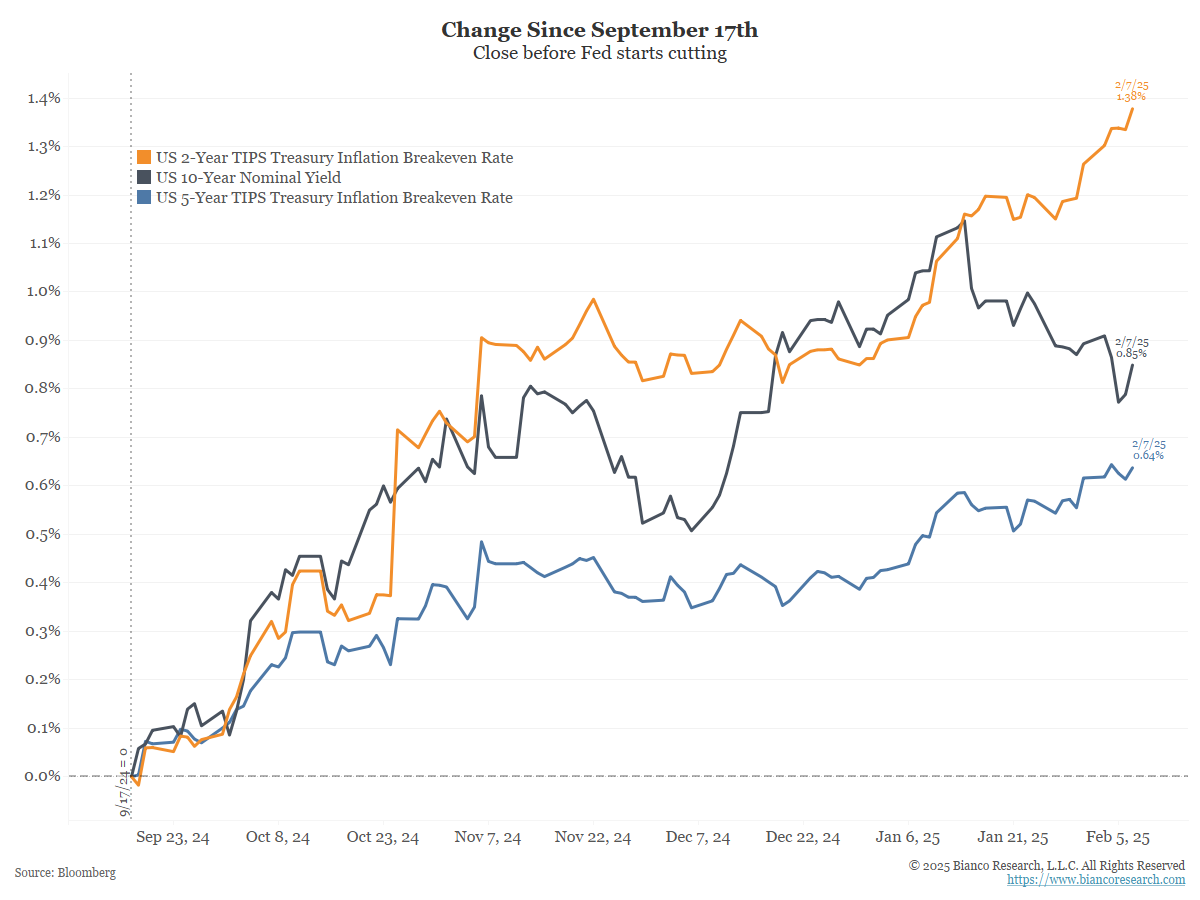

You mentioned in your remarks that activity in the housing sector seems to have stabilized. At the same time, since your first rate cut in September, long-term mortgage rates have gone up by a full percentage point, back above 7 percent.

I’m wondering, kind of looking forward, do you think — are you confident that activity will remain stable given how elevated mortgage rates are? How does it fit into your broader thinking about the economy?

POWELL: So, as you know, as we’ve reduced our policy rate 100 basis points, longer rates have gone up not because of expectations, not principally because of expectations about our policy or about inflation, it’s more a term premium story, so.

And, you know, its long rates that matter for housing. So, I don’t think — I think these higher rates are going to — they’ll probably hold back housing activities to some extent, if they’re persistent. We’ll have to see how long they persist.

So, you know, we are — we control an overnight rate. Generally, it propagates through the whole family of asset prices, including interest rates. But in this particular case, it’s all happened at a time when, for reasons unrelated to our policy, longer rates have moved up.

We addressed this the day after, noting that it was incorrect. The term premium is the extra yield gained by holding the 10-year yield rather than buying a string of shorter-term maturities over the same longer-term period.

The problem with term premiums is that it is impossible to determine what is driving this increase. While other models attempt to estimate this, they are highly subjective and have significant error rates.

Powell’s matter-of-fact statement that this increase in term premium is not due to rising inflation expectations is not knowable. Concluding this while setting monetary policy is not wise.

But if we turn to the chart below, most of the rise in long-term yields at the 2-year and 5-year inflation breakeven tenors suggests the market is indeed worried about inflation.

Market Reaction

There are no measures of inflation expectations that are “well anchored.” In fact, as a group, they are worse than in June 2022, when inflation was 9%.

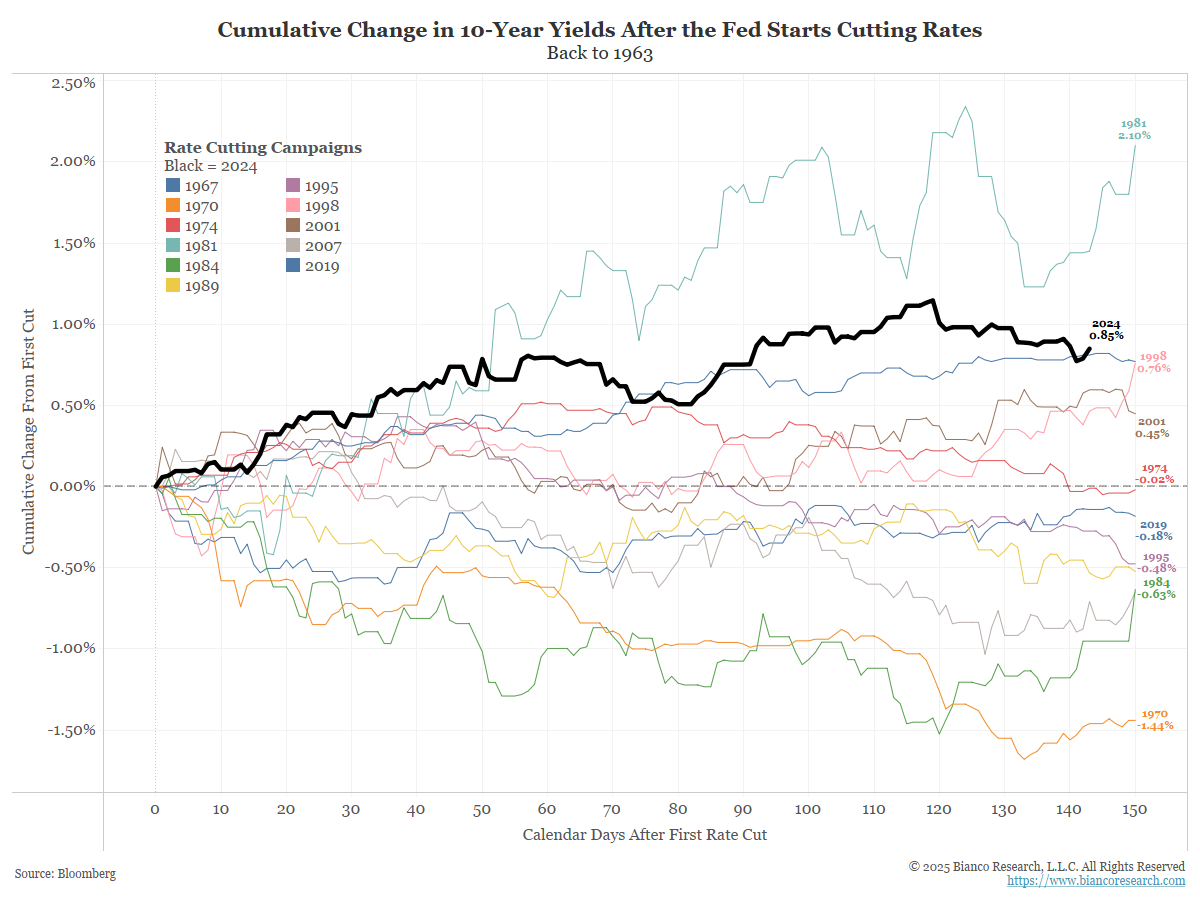

The following chart shows the rise in long-term yields in 20204 (black) has been larger than other rate-cutting cycles, save 1981(blue). Restated, this is the second biggest rise in yields during a rate cutting cycle outside the May 1981 rate cuts that started at 20%!

Conclusion

It seems pretty clear the market is rejecting the Fed’s dovish talk. It sees these moves as unnecessary at best or raising inflation expectations at worst. It does not see them as appropriate.

Inflation expectations are rising despite the Fed’s insistence otherwise. So, the more the Fed talks future rate cuts, the worse the bond market’s reaction will be.