Summary

Comment

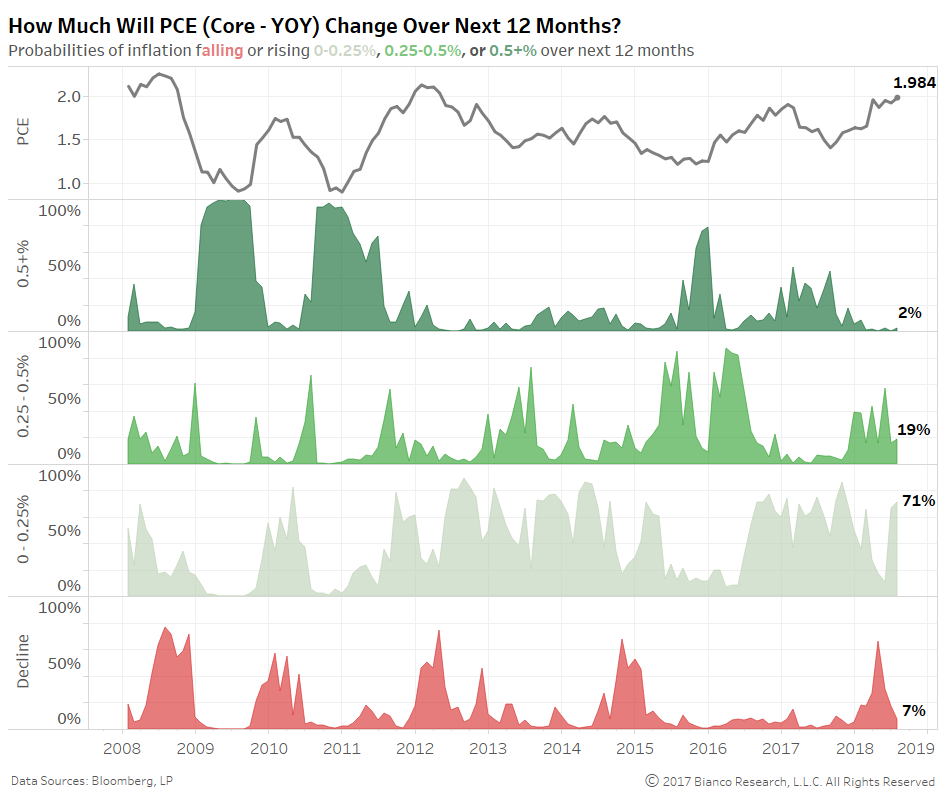

Core PCE year-over-year is just ticks away from hitting the targeted 2.0% year-over-year. Yes, the Federal Reserve indicated its goal is headline PCE, but most officials more widely discuss core and trimmed mean readings.

We pull together major economic and survey indicators to produce probabilities inflation will either rise 0.5+%, 0.25-0.5%, 0-0.25%, or decline over the ensuing 12 months. We are using the historical recipes known to generate inflation to produce a near-term outlook.

Most notably, the probabilities of core inflation rising another 0.5+% have retreated to a paltry 2%. This outlook is heavily favoring a meager rise of 0-0.25% through July 2019. The Fed can rest assured the probability of a decline has subsided to just 7%.

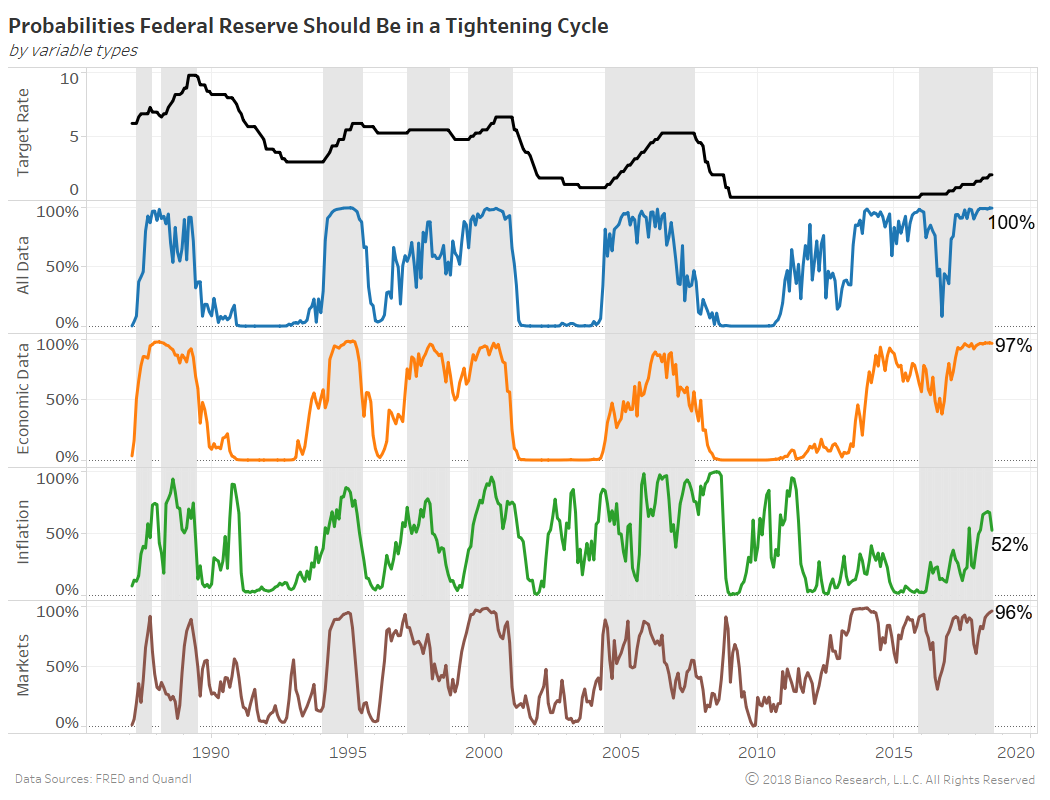

We routinely run an exercise testing whether or not the Fed should still be tightening by raising rates. The next chart shows this model generating probabilities current economic and inflation growth are similar to past tightening cycles (i.e. classification).

The three main inputs are:

- Economic data releases – nonfarm payrolls, industrial production, unemployment and more

- Inflation data releases – core and headline CPI, PPI, and PCE

- Markets – S&P 500, U.S. Treasuries, U.S. high yield, U.S. dollar, gold, and WTI crude oil

Economic data and financial markets fit the tightening narrative by early 2014 with probabilities nearing 100%. However languishing inflation refused to show 50+% probabilities of a tightening cycle until February 2018. Maintaining 2.0% core inflation is needed to keep these probabilities above 50%, otherwise the Fed is missing a key component in its quest to normalize policy.

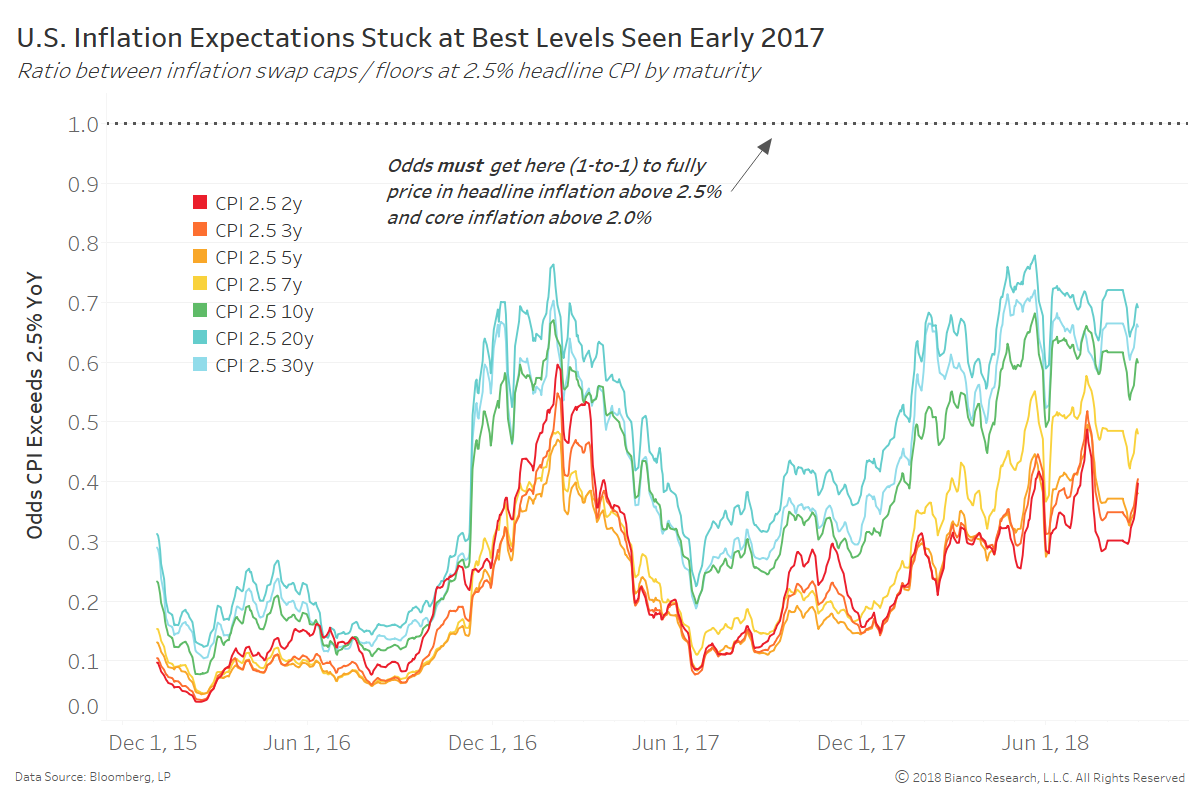

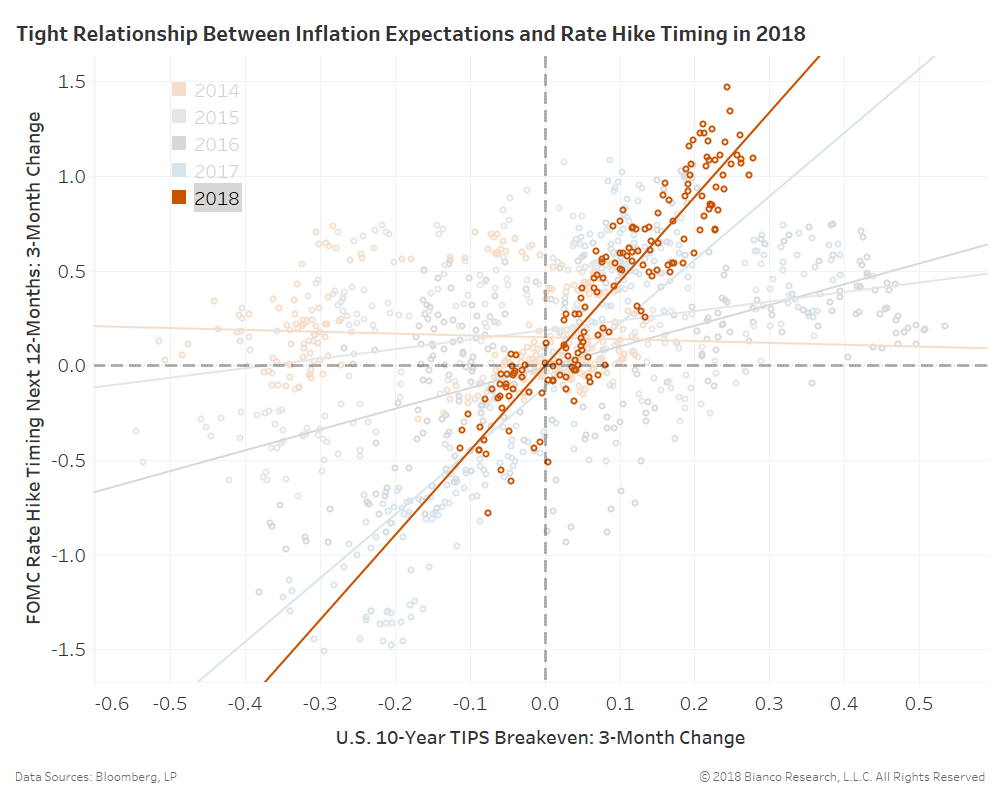

The Fed will be put to the test in early 2019 with investors less than enthusiastic over inflation. Three-month changes in U.S. 10-year TIPS breakevens (x-axis) and FOMC rate hike timing for the next twelve months (y-axis) have had a very tight relationship in 2018 (r^2 = 0.86). Each year since 2013 this relationship has become increasingly tighter and positive.

Markets are pricing in just greater than two hikes for the next twelve months. A hike in September will likely be followed by another in December 2018. But, a lack of rebound in inflation expectations would mean the Fed is ‘going it alone’ with more hikes in 2019. The de facto Fed chair has been inflation expectations in 2017 and 2018. Will the great showdown between markets and the Fed take place or will one side finally have to give?