- The Financial Times – The long wait for a productivity resurgence

Improvement in living standards depends almost entirely on rising output per worker

You can see the computer age everywhere but in the productivity statistics.” Today, we could repeat this celebrated 1987 statement by Robert Solow, Nobel laureate founder of modern growth theory, with the substitution of “technology” for “computer”. We live in an age judged to be one of exciting technological change, but our national accounts tell us that productivity is almost stagnant. Is the slowdown or the innovation an illusion? If not, what might explain the puzzle? The slowdown, if true, matters. As Paul Krugman, also a Nobel laureate, argued, “Productivity isn’t everything, but in the long run it is almost everything.” Improvements in standards of living depend almost entirely on rising output per worker.

Summary

Comment

Languishing productivity and wage growth remain the most confounding economic mysteries of the past decade. U.S. Treasury investors have become comfortably numb with little fear of rampant inflation or an upside surprise by productivity.

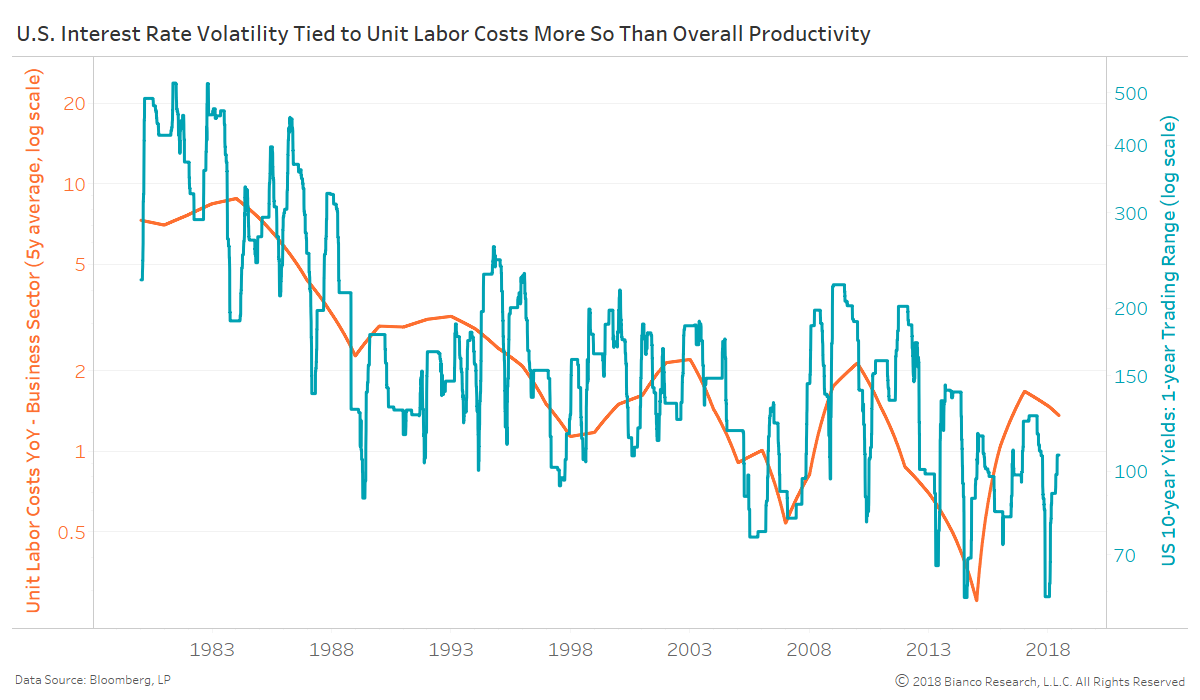

The chart below shows unit labor costs (orange) along with the U.S. 10-year note’s trading range in yield over the previous year (blue). Lower and lower wages have prompted tighter and tighter trading ranges. Term premium and implied volatility have little reason to rise.

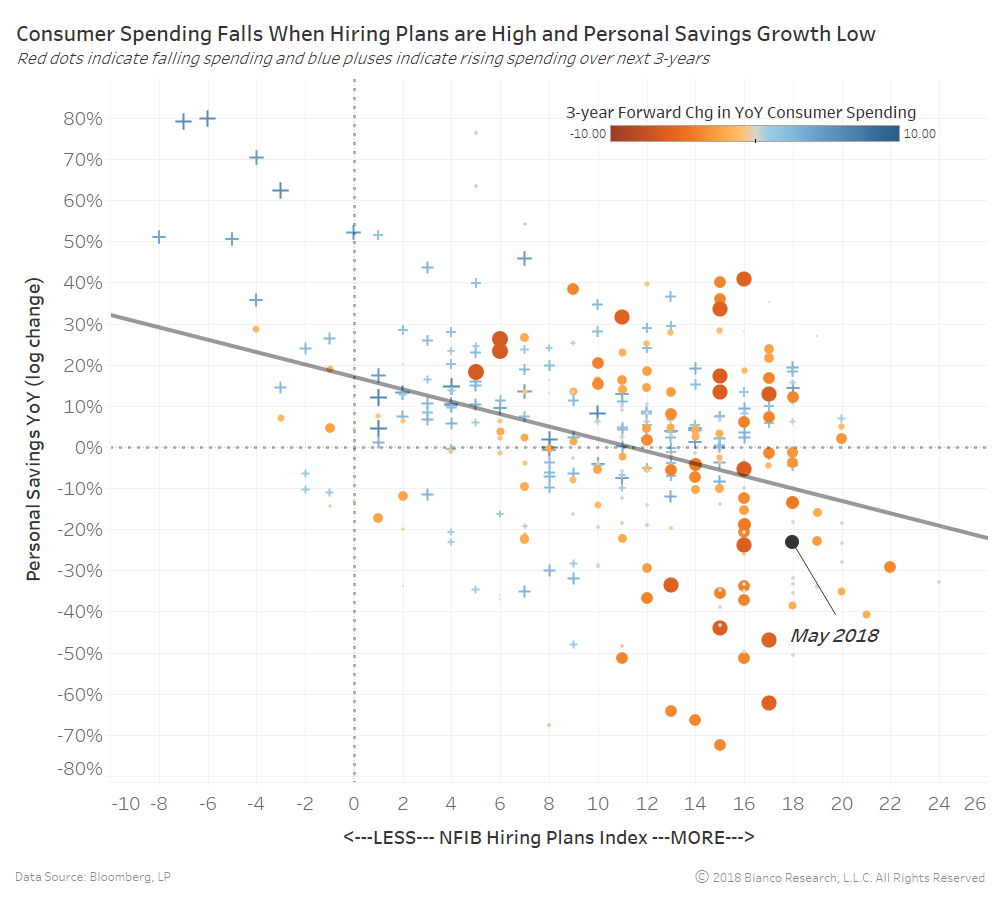

The consumer has yet to fulfill exceptionally rosy surveys by spending at greater rates. The scatterplot below shows the NFIB’s small business hiring plans index (x-axis) versus personal savings year-over-year (y-axis). Larger red dots indicate declines in the rate of consumer spending over the ensuing three years, while larger blue pluses indicate improvements.

Strong hiring plans coupled with low savings rates have not been a good recipe for strong spending. Wage growth and inflation have become more synonymous with tech-heavy metros like Raleigh, Atlanta, DC, and San Francisco, leaving much of the country still wanting.

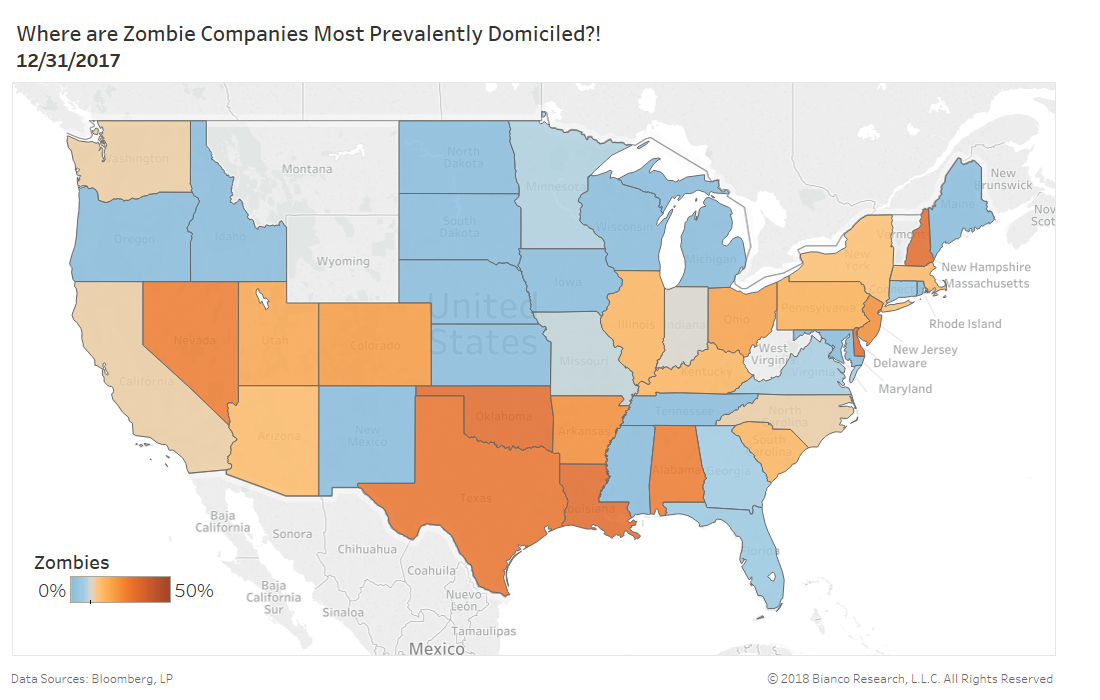

Many metros away from these tech-heavy centers are housing unproductive companies subsisting due to low costs of funding. The next map shows the prevalence of so-called zombie companies unable to produce earnings over and beyond dollars paid on interest expenses. Darker orange shading indicates higher percentages of zombie companies.

U.S. Treasury yields are not swiftly rising because productivity and wage growth are not widespread. The more concentrated productivity becomes, the longer this phenomenon can likely persist. These zombie companies may have a longer life than anyone expected.

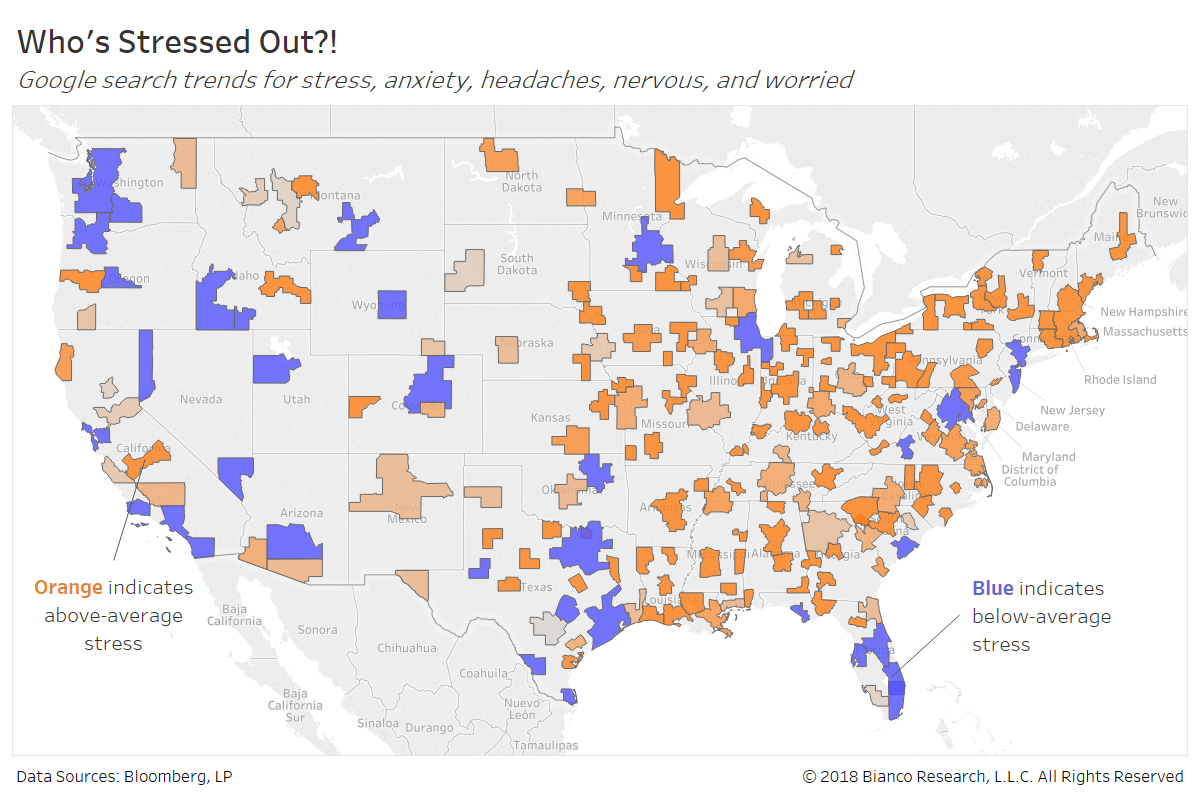

The prevalence of unproductive companies and a lack of opportunity for less-educated/trained employees are producing greater stress for consumers. The next map shows an average of the current Google search trends for stress, anxiety, headaches, nervous, and worried. Blue metros indicate below-average stress, while darker red indicate increasingly above-average stress.

The concentration of productivity and wage growth to tech-heavy metros is leaving the remainder in quite the pickle.

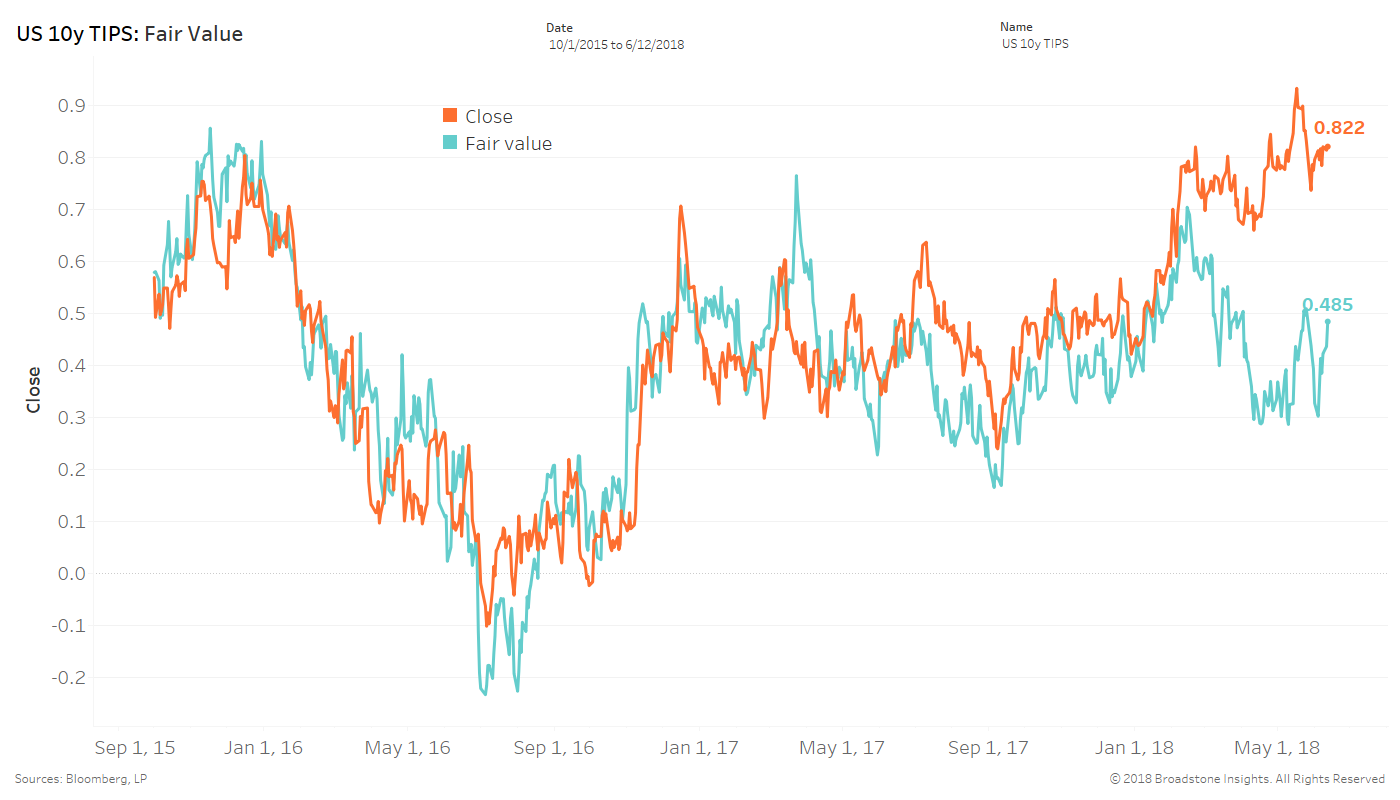

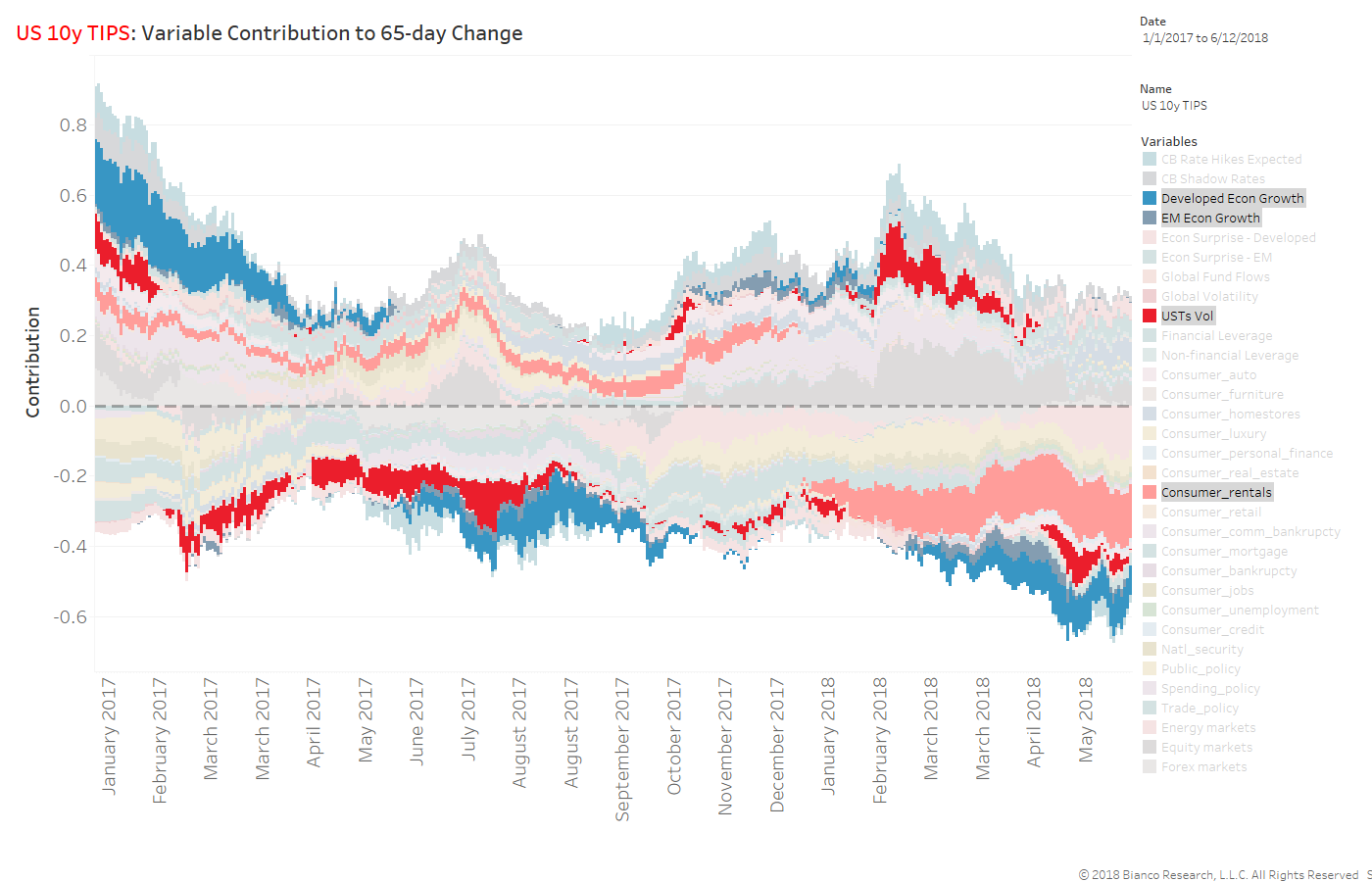

The last chart shows the contributions to our fair value estimate by each set of variables. This model blends traditional economic measures with the more real-time assessment of the consumer via Google search trends for consumer spending behavior and concern over economic/government policies.

We have highlighted the downward contribution by slowing developed and emerging market growth, low U.S. Treasury implied volatility, and waning rental markets.