- Business Insider – GOLDMAN SACHS: There’s a danger lurking behind investing in hugely profitable companies loaded with cash

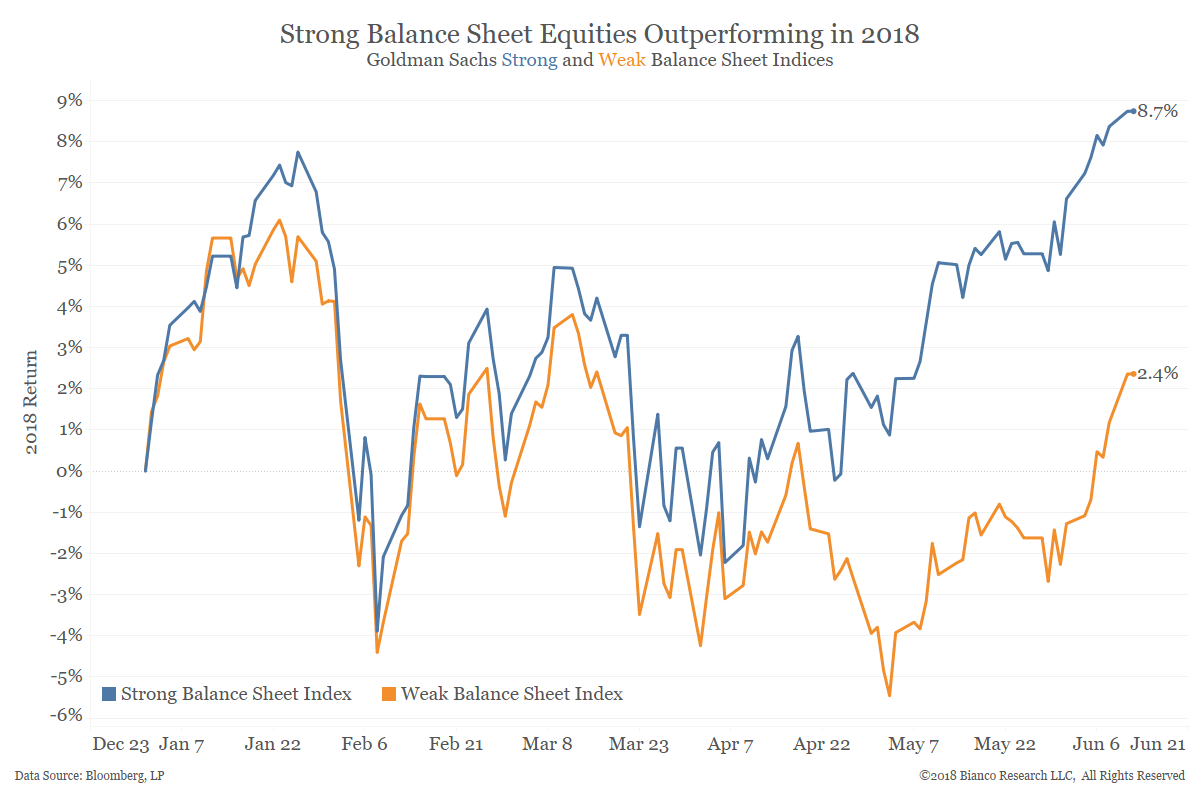

Many of the strong companies are also growth stocks, putting them at risk of faltering if investors turn more defensiveCompanies with plenty of cash and not as much debt are crushing it. Goldman Sachs’ basket of stocks with strong balance sheets has outperformed its selection of cash-strapped companies by 8% this year, the bank’s equity strategists said in a note on Friday. That’s also a better performance than the S&P 500, which has gained 4.02% this year. The firm again recommended buying its basket of strong-balance-sheet stocks, but highlighted a risk that could work against them. Many of the companies with the strongest balance sheets also have the strongest earnings growth. They include big names like Facebook and Alphabet that led the market higher last year, as momentum-driven investors looked to profit from their upward trend.

Summary

Strong balance sheet stocks won’t save your portfolio if financial conditions in the U.S. continue to tighten. Past tightening in financial conditions has dented performance across equities and credit markets.

Comment

The unique loosening of financial conditions in the U.S. as the Fed normalizes policy is beginning to reverse itself. The chart below shows the Goldman Sachs U.S. Financial Conditions Index with shaded bands reflecting Fed tightening campaigns. The index has risen after falling to multi-decade lows. The problem for borrowers and investors is that a return to historically normal conditions means further tightening ahead, nearly a full point to reach the average since 1990.

Despite the attractive theory that companies with lower debt ratios will outperform, we see very little evidence that this has been true over time. The Business Insider story above highlights one of the key reasons why this might be the case. Goldman notes that there is substantial overlap between low debt, strong earnings companies, and high growth (technology) stocks. A broad slowdown in the economy is likely to dent growth and momentum stocks.

The charts below show the relationship between changes in Goldman’s U.S. Financial Conditions Index and the performance of strong (left) and weak (right) balance sheets. The x-axis shows changes in the financial conditions in 0.5 point bins. The marks are shaded to reflect tighter (orange) or looser (blue) changes in conditions. The y-axis shows standardized changes for the equity indices.

If you’re thinking they look mostly the same, we agree. On average, the performance of the two indices is nearly equal. The distribution of returns for the weak balance sheet is wider, and it appears that the weak balance sheet index has underperformed when financial conditions tighten slowly. When conditions tighten at anything more than a crawl, there is no safe harbor in strong balance sheets.

The scene is much the same for U.S. credit markets. The last chart shows average 3-month changes for Bloomberg Barclays total return indices for U.S. Treasuries and a range of U.S. credit markets. Performance across both safe and risky assets, and across industries within investment grade credits, uniformly deteriorates as financial conditions tighten. Utilities tend to outperform their industrial and financial peers. Both high yield and leveraged loans are especially exposed if financial conditions tighten quickly. U.S. Treasuries offer the only source of positive performance as the pace of tightening increases.

Conclusion

The lure of investing in equities with strong balance sheets is simple enough, but the prevalence of growth and momentum stocks in Goldman’s Strong Balance Sheet Index is a hidden risk. On average, strong balance sheet equities have not outperformed their weaker peers when financial conditions tighten. U.S. Treasuries have been the only safe harbor when financial conditions tighten quickly.