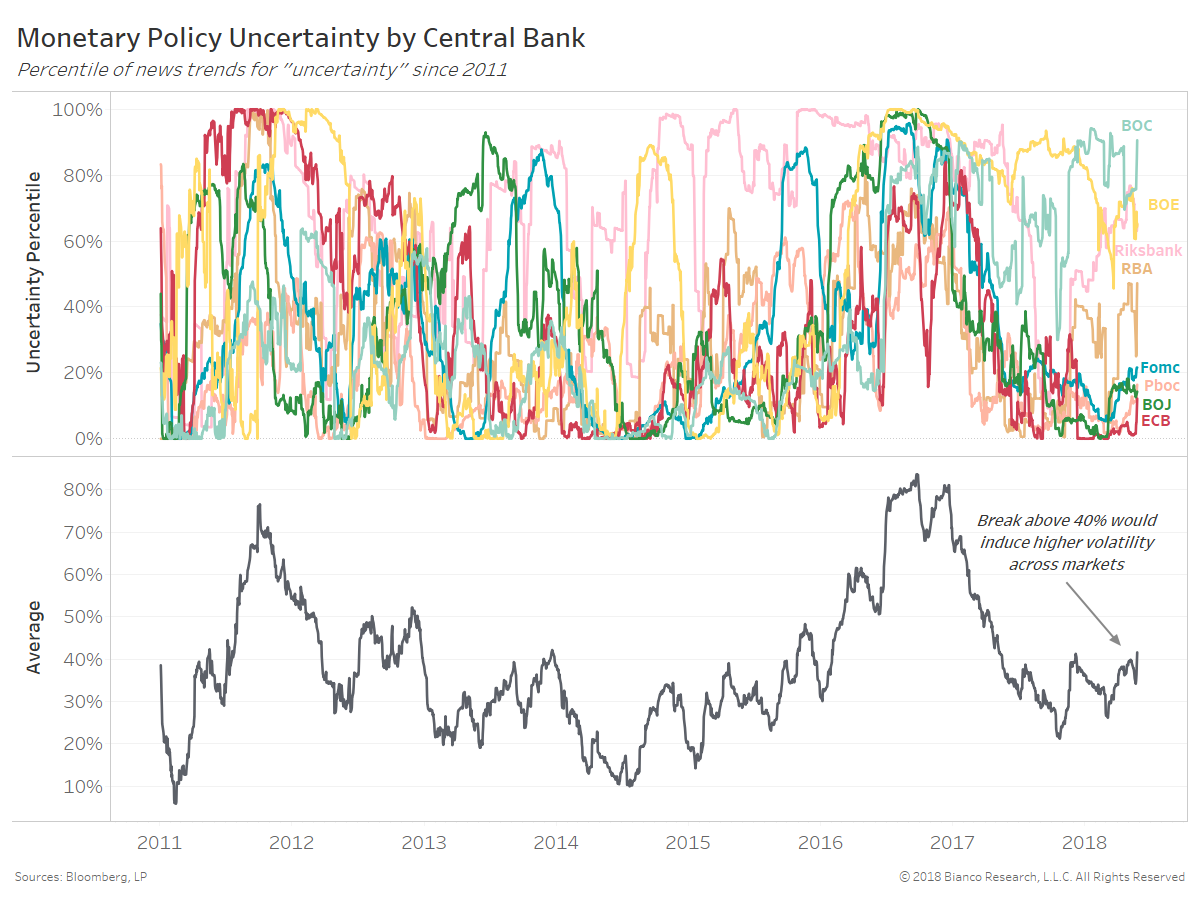

The top panel in the chart below shows news trends of “uncertainty” for each central bank. We calculate percentiles of news trends, meaning higher toward 100% implies greater uncertainty.

The bottom panel shows the average percentile across all central banks currently rising toward 40%, which we believe is a key hurdle.

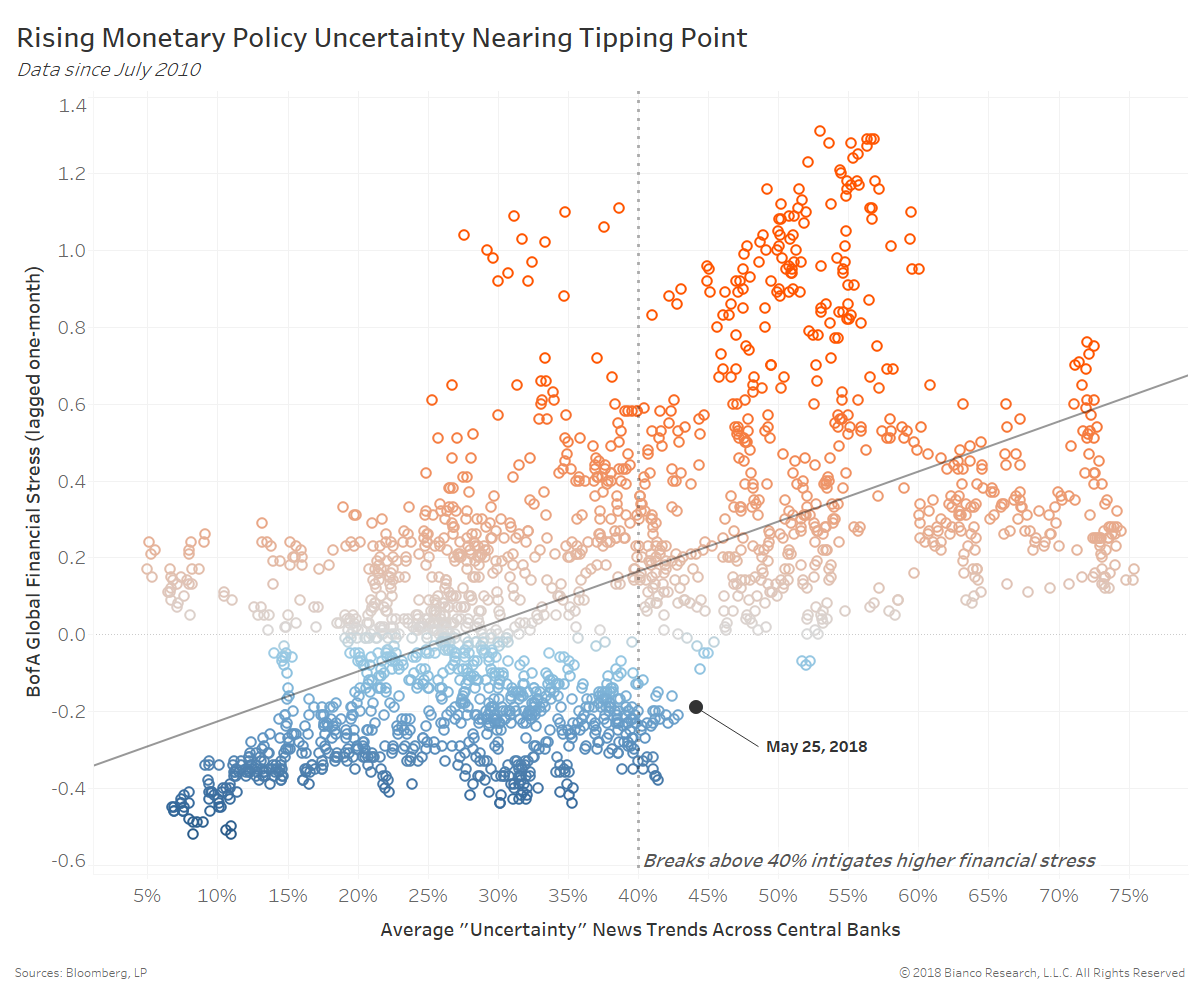

The scatterplot below shows the average uncertainty across central banks versus BofA’s Global Financial Stress index lagged one month. We convert news trends for each central bank into percentiles based on history with higher percentiles reflecting higher uncertainty.

The average central bank uncertainty as a percentile of history has risen to near 40%. The relationship to global financial stress takes a very bearish turn at just above 40%, meaning risk assets suffer and volatility rises. The dotted vertical line marks this critical threshold.

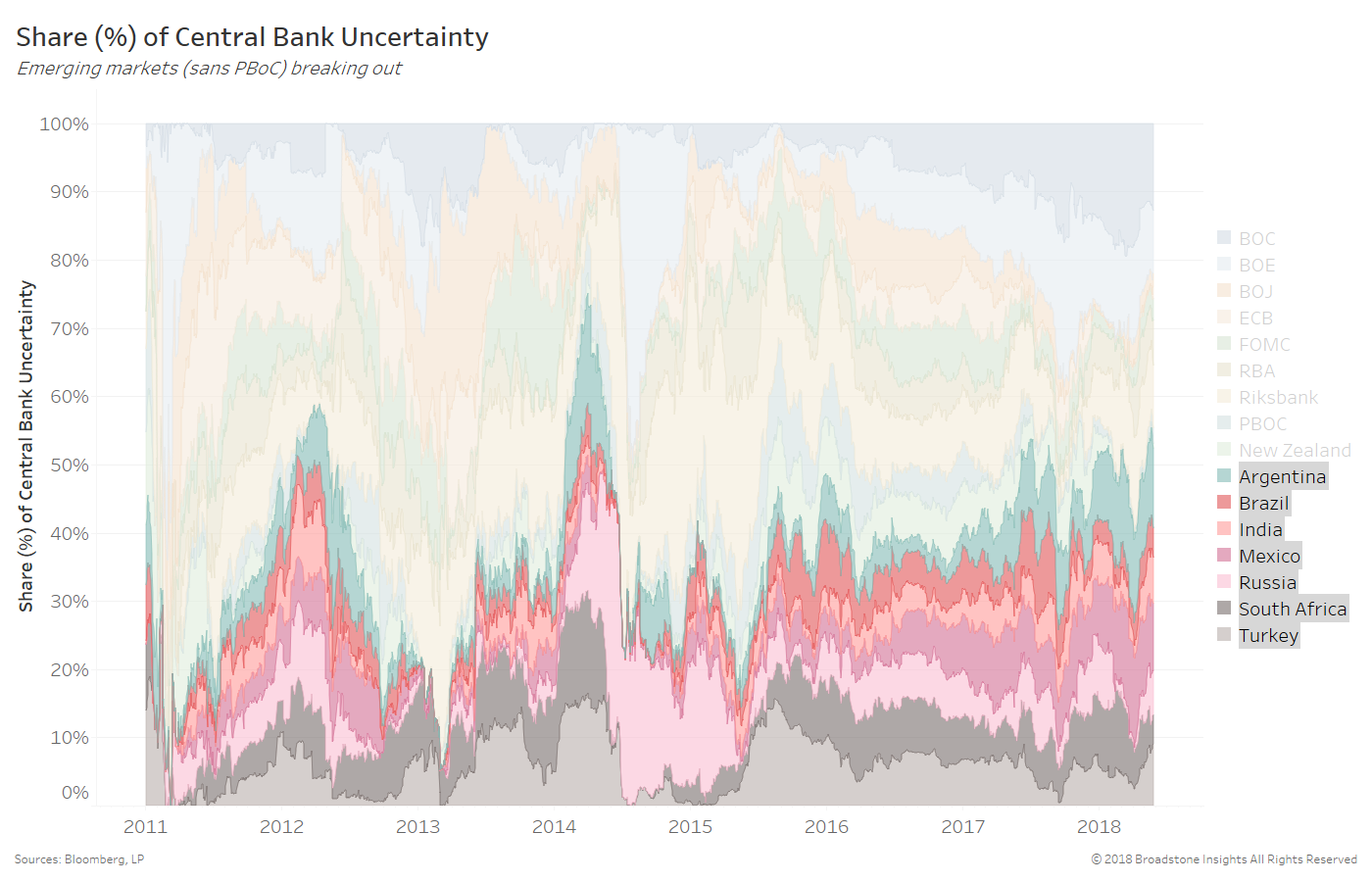

The chart below shows the share of news trends concerning ‘uncertainty’ for each central bank. This analysis sums the frequencies of stories on a rolling three-month window with both words of ‘uncertainty’ and the central bank’s name.

We have highlighted emerging market central banks sans the PBoC, which have broken to a new high of 55%. The last episode of emerging market central banks producing the lion’s share of uncertainty in May 2014 was followed by plummeting currencies near -16% through January 2016.

Turkey may be on hold through the June 24th election, but tightening policy will likely recommence shortly thereafter. Tensions continue to boil over in Argentina with large business owners contesting the central bank’s abrupt rise in benchmark rates to 40%.

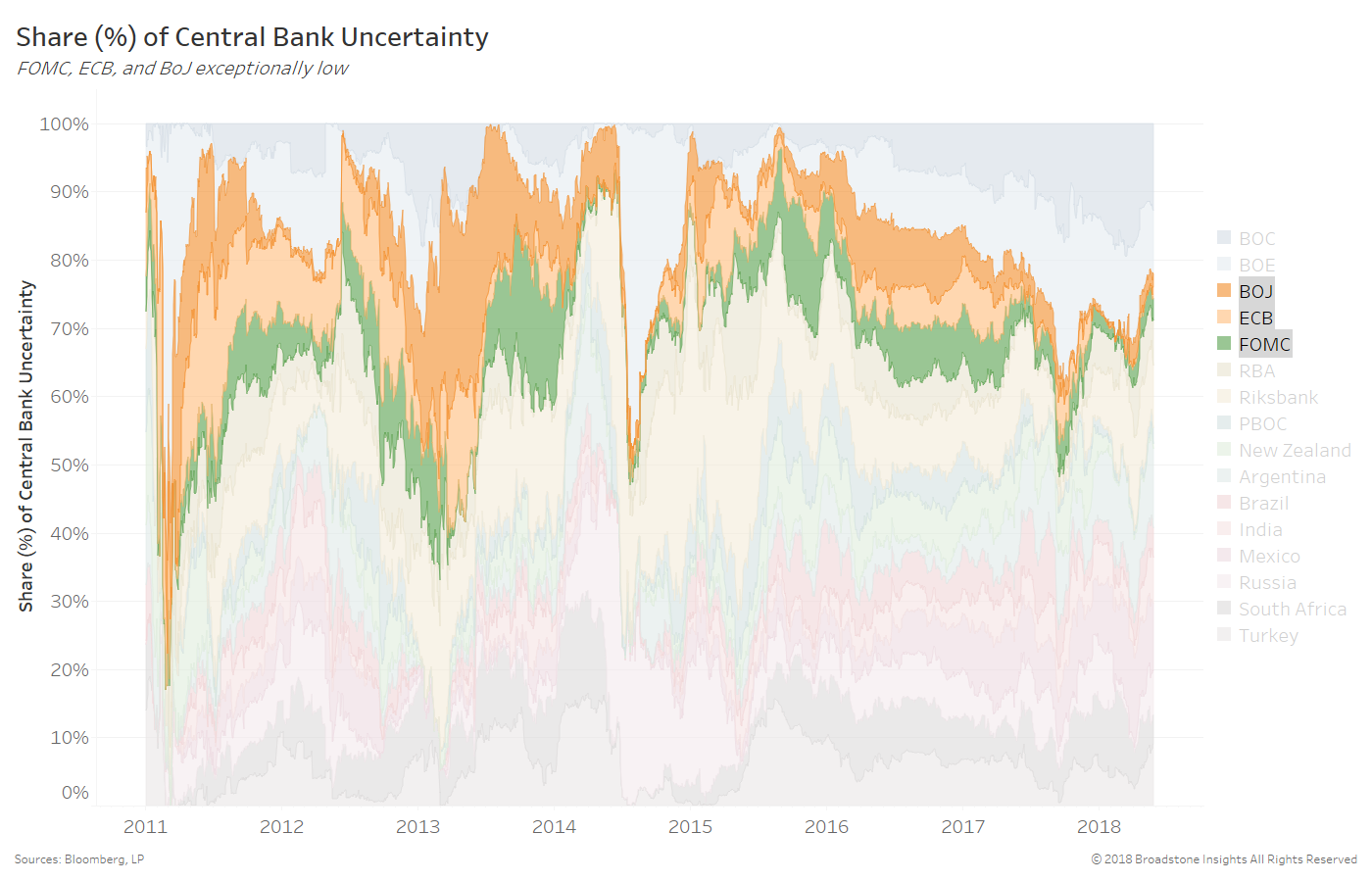

The seas are much calmer across the key central bank of the U.S., Eurozone, and Japan. In fact, the seas are as flat as glass. The next chart shows the same share of uncertainty news trends, but this time we have highlighted the FOMC, ECB, and BoJ. These central banks are a minuscule 5.8% of the global total, meaning uncertainty cannot really get any lower.

Mester, a devoted hawk, just recently indicated inflation will not likely overshoot, reflecting a comfortability with current policy. Draghi and the ECB may have room to push out rate hikes given slowing Eurozone growth.