Summary

Comment

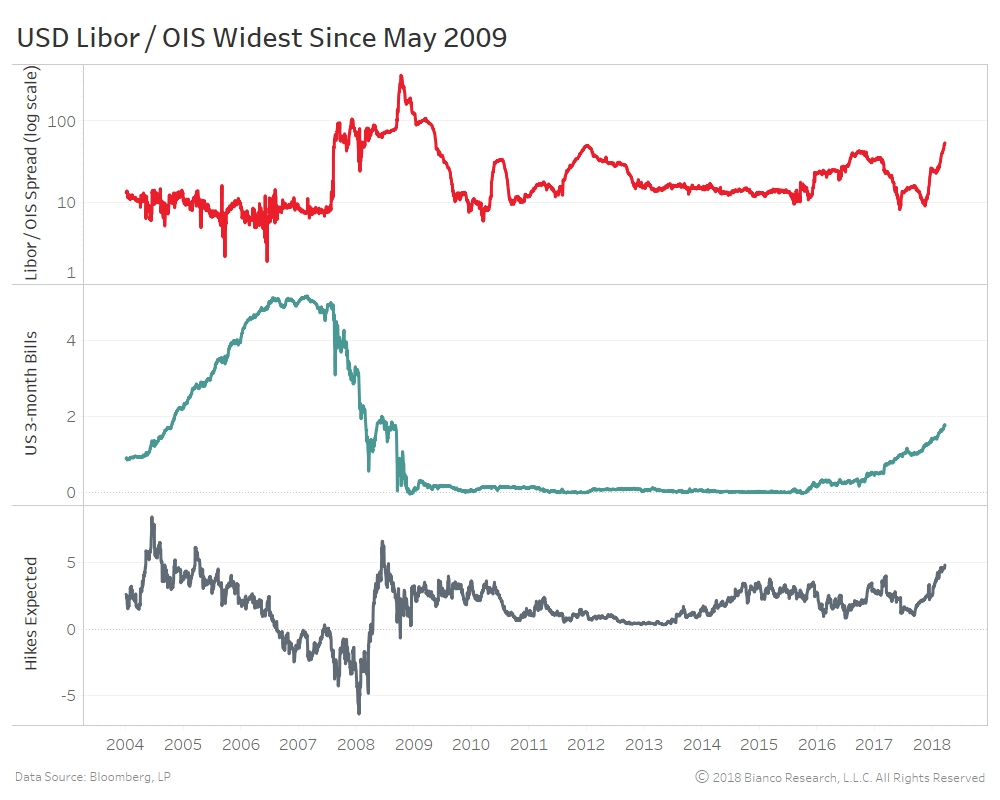

The U.S. Libor / OIS spread has reached its widest since May 2009 at 55.5 bps. The chart below shows this spread (red) along with U.S. three-month bills (blue) and rate hike expectations for the 12 months ahead (gray).

The rise in short-end yields on the heels of an increasing hawkish Federal Reserve has not always shown a strong connection to the Libor / OIS spread.

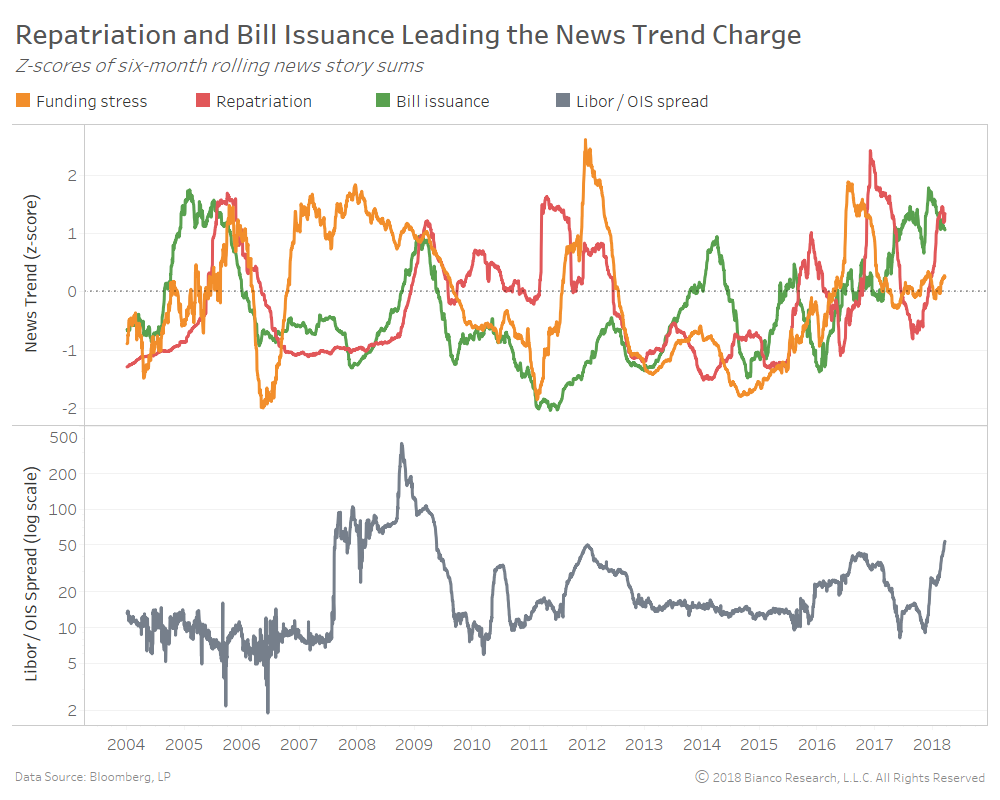

This story includes many moving parts, namely bursting Treasury bill issuance and repatriation by U.S. companies of foreign holdings. The chart below shows news trends as one-year rolling z-scores (standard deviations from average) for funding stress (orange), repatriation (red), and bill issuance (green).

Anticipation of rising bill issuance and continued flows back to the U.S. from overseas are dominating the news wire. The tax plan offers incentives for repatriation, which is impacting dollar funding and shifting demand to very short-term assets.

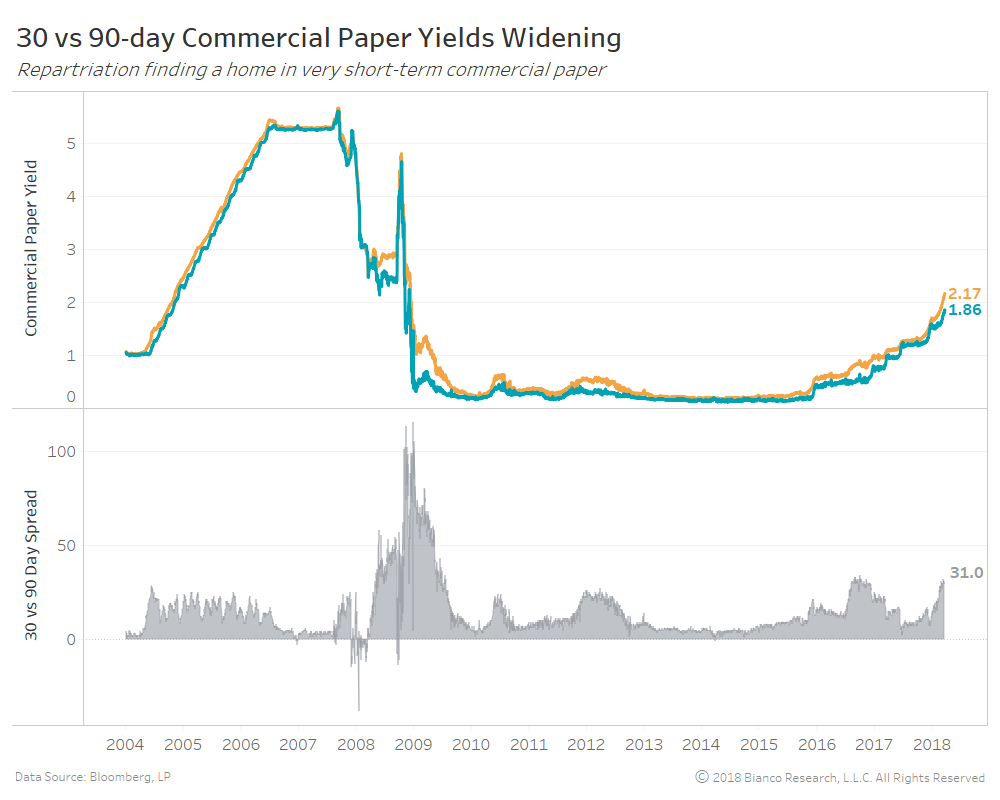

The spread between 30 and 90-day commercial paper yields is nearing its widest post-crisis at 31.0 bps. A defensive shift has assets flowing to 30 over 90-day paper. Again, repatriation and also the hawkish bent of Powell et al are key drivers.

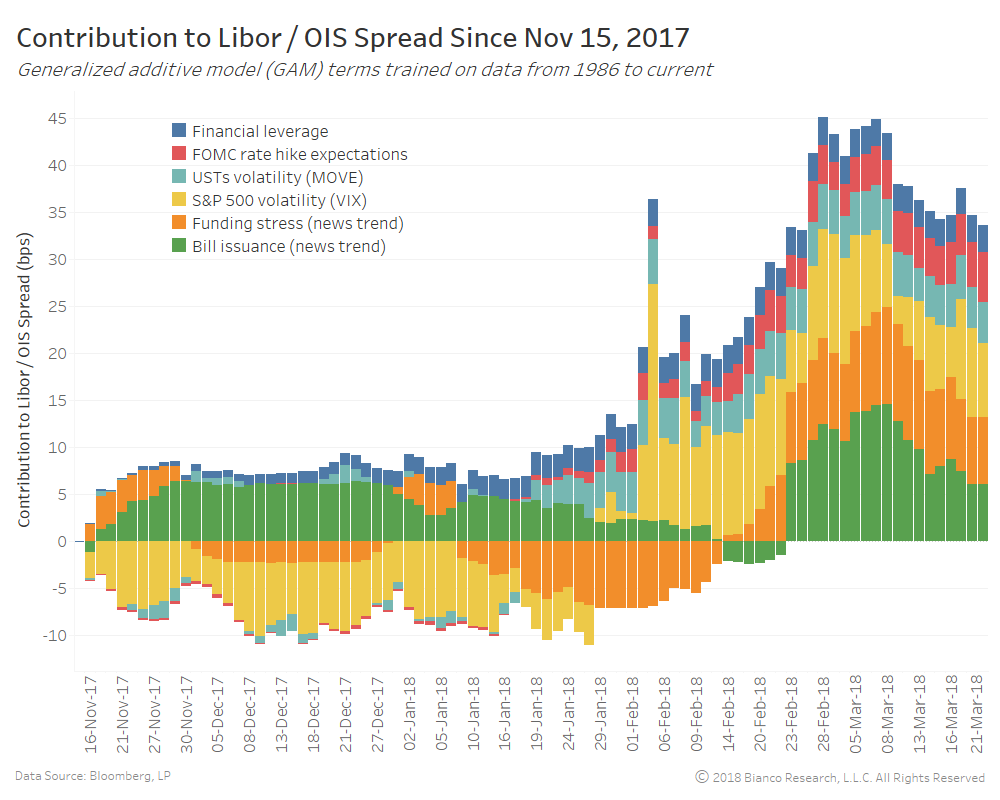

The chart below shows the impact of these key factors on the change in the Libor / OIS spread since November 15, 2017:

- Financial leverage

- FOMC rate hike expectations

- USTs implied volatility (MOVE)

- S&P 500 implied volatility (S&P 500)

- Funding/credit stress (news trend)

- Bill issuance (news trend)

These variables explain 65% of the variation in the Libor / OIS spread since 1986. Note we use the Libor / three-month bill spread as a proxy prior to 2002.

Rate hike timing is offering a very modest boost, while bill issuance, equity volatility, and funding stress dominate recent widening. We expect the impact of bill issuance to dwindle moving forward (becomes priced in), making the market’s perception of potential funding stress and volatility the key drivers.

Fund stress has yet to rear its head with news trends quite low and high yield OAS very tight. Our theory is the Federal Reserve’s hopes for three-plus hikes in the year ahead would indeed tighten financial conditions. Inflation and wage growth failing to rebound would keep the reversal rate (or r*) near 150 – 175 bps. Taking the target rate above this range greatly boosts the probabilities both deposit/lending growth and financial leverage will contract.

For now, markets are buying the Fed’s inflation hopes, just see widening TIPS breakevens. However a failure for inflation and wages to ‘put up’ will have markets screaming ‘shut up.’