Originally posted on February 14, 2018. Sign up for a free trial at the bottom of this page to read our current research.

- Bloomberg – Credit Markets Are Stuck Playing Game of Dealers’ Choice

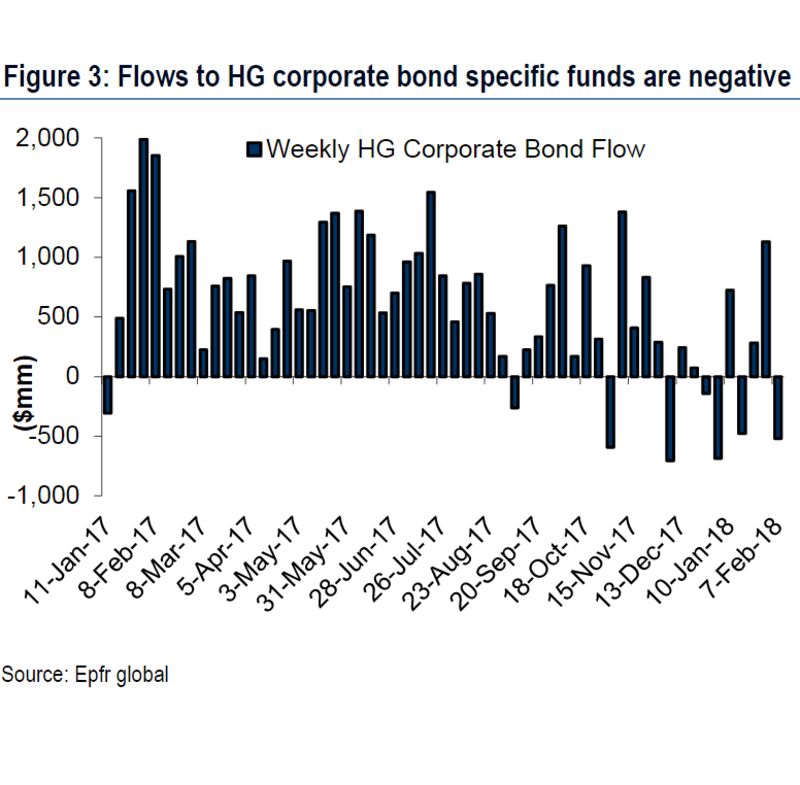

Willingness to buy debt ‘clearly being tested,’ BofA SaysIn credit markets, it’s dealers’ choice — for now. That means credit spreads are in the hands of market makers as selling pressure in investment-grade bonds refuses to fade, according to Bank of America Merrill Lynch. Dealers bought a net $1.2 billion of corporate bonds on Monday after weekly flows to high-grade funds turned negative, write a team led by Hans Mikkelsen. Record weekly outflows from iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) are a double whammy of risk aversion and diminished appetite for duration, as this product tends to hold longer-dated debt. Dealers absorbed an estimated $5 billion in investment grade bonds last week, according to Bloomberg Trace data. Up until that time, dealers were net sellers to clients and affiliates to the tune of about $6 billion in 2018.

Summary

ETF investors’ interest in pure corporate bond funds began to fade weeks ago. Now jitters that were safely confined to equities have spread to credit markets. One-way investor flows and severely constrained dealer balance sheets are precisely the scenario corporate liquidity doomsayers warned about. Continued net outflows from U.S. corporate bonds could worsen the gap between the liquidity credit investors expect and the reality the market provides.

Comment

We first highlighted a shift in ETF investor preferences away from pure corporate bond ETFs on January 30. At that time, U.S. investment grade and high yield funds had seen three consecutive weeks of net outflows. Net outflows have accelerated since, especially among high yield funds.

The chart below shows net 20-day outflows (weekly bars) for U.S. corporate bond ETFs by strategy. Pure investment grade corporate funds (light orange) and high yield funds (dark orange) saw a shift begin in December when 20-day inflows began to wane. Net inflows swung to net outflows in mid-January. Net 20-day outflows for high yield funds now exceed $7.4 billion.

The corporate desk at our affiliate Arbor Research and Trading warned of deteriorating dealer willingness to support one-way flows on Friday. We highlighted their concerns in our weekly U.S. credit update on Monday:

As the week came to a close, the biggest thing to note, aside from increased volatility and spread widening, was the widening of bid/ask spreads. The liquidity that many accounts had taken for granted for almost as long as we can recall is going to be significantly reduced until the market settles down and flows become more balanced. Dealers were buying 1.38x more bonds than they were selling to clients during Friday’s session. To illustrate the point about how these client sale flows accelerated as the week progressed, dealers only bought 1.03x more bonds than they sold by the time Friday’s session came to a close.

The next chart highlights how total returns for U.S. investment grade and high yield indices continued to deteriorate after Treasuries found some footing. Sharp losses in risk markets finally triggered a bid for Treasuries just as jitters began to spread to previously tranquil credit markets.

Despite seeing less severe net outflows, investment grade has underperformed high yield, but that isn’t unusual. The next chart shows 5-day changes in the Bloomberg Barclays U.S. Treasury total return index (x-axis) and the spread between 5-day changes in the Bloomberg Barclays U.S. high yield and investment grade indices (y-axis). This includes data back to 2009 and shows the degree of high yield outperformance is actually lower than we might expect.

The scatter plots below show the same 5-day changes in the Treasury total return index on the x-axis and 5-day changes or the U.S. investment grade and U.S. high yield indices (y-axis). Investment grade performance has a tight linear relationship with Treasury performance and the last week’s move is right on expectations.

While high yield has a looser correlation to Treasury performance, it also tends to see gains when Treasuries are seeing losses. The severity of net outflows in high yield is dragging down high yield performance. With dealer appetites for balance sheet risk constrained, any acceleration in investment grade outflows could knock performance out of line there.

Conclusion

We have all been warned about the dangers of shrinking dealer balance sheets and risk appetites when investor flows become one-sided. High yield outflows are at their highest in years and rising treasury yields threaten similar outflows in investment-grade corporates. This will be the biggest test yet for how well the leaner balance sheet environment meets credit investors’ liquidity expectations.