- Bloomberg – King Cash Threatens the Reign of Credit Markets From U.S. to Europe

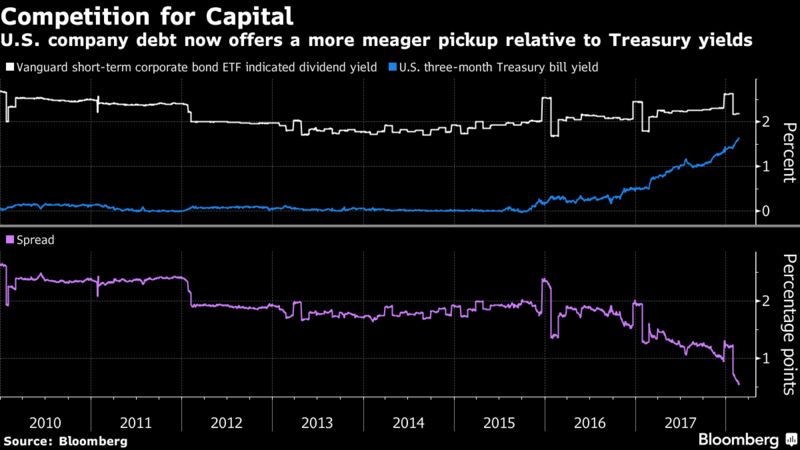

Higher rates on U.S. risk-free curb appeal of high grade: CitiInvestors reaching for yield are now finding it’s less of a stretch. Global credit markets are on the cusp of a post-crisis regime shift as higher rates on short-dated U.S. Treasuries challenge the investment case for high-grade corporate bonds — on both sides of the Atlantic. Consider this: The Vanguard short-term corporate bond exchange-traded fund, which holds U.S. investment grade debt with a maturity of less than five years, now has an indicated dividend yield only 0.54 percentage point above that of the three-month Treasury bill. That represents a tiny pickup compared with a whopping 2 percentage points in early 2017.

- Morningstar – Bond Market Activity Returns to Normal

Although credit spreads in the corporate bond markets widened slightly at the end of last week, activity across the fixed-income markets was generally back to normal after a wild ride in early February. Changes in interest rates and credit spreads were muted, and the decrease in volatility led to a reopening of the window to the new issue marketplace. The average spread of the Morningstar Corporate Bond Index (our proxy for the investment-grade bond market) widened 2 basis points to end the week at +100. In the high-yield market, the average spread of the BofA Merrill Lynch High Yield Master Index also widened slightly, by 8 basis points to +358.

Summary

Long running fears of higher rates have had many investors taking shelter in shorter duration credits. That has been beneficial so far in 2018 as Treasury yields finally moved materially higher. But higher yields and wider spreads may be appealing enough for some credit market investors to begin extending duration.

Comment

The chart below shows why the short duration trade has been favored by those expecting rates to move higher. The panels show year-to-date total return (y-axis) by duration (x-axis) for each sector, excluding utilities, in the Bloomberg Barclays industrial index. We limited this to issues of $750 million or larger.

Investors who hunkered down at the short end of the curve have been spared the worst of the total return losses so far this year. There are some exceptions among energy and communications where rising oil prices and M&A activity are driving performance. But for the most part, the benefits of shorter duration have offset the lost yield.

Spread performance is telling a different story, however, and perhaps illustrating some shifting preferences among credit investors. The next chart shows the 1-month change in spread to benchmark Treasury (y-axis) versus duration (x-axis) for each of the sectors above. The trend lines help highlight how spreads have been more resilient and even tightened farther out the curve.

This preference for longer duration has been especially strong for basic materials, communications, technology and financials. Longer duration financial issues are sparse, which likely fuels some of this premium.

The combination of sharply wider spreads for medium duration bonds and our expectation for falling Treasury yields over the next month might entice some buyers to begin extending duration a bit. The last chart shows spread to benchmark Treasuries by duration for four of the sectors which have seen the most spread widening in short-to-medium duration issues. Shading indicates the 1-month change in spread for each issue, with shades of orange showing larger widening moves. Those looking to pick up yield might find some value in consumer and energy sectors without having to stray too far out the curve.

Conclusion

On the heels of the sharp rise in Treasury yields and a shakeout in investment grade corporate bonds, opportunistic investors may have found some reasons to move out the curve. We’ve seen preference for longer duration in utilities and investment grade credits in general in recent weeks. Here we showed longer duration spread performance has been superior over the past month. Even with central banks expected to continue pushing short term rates higher, the outlook for Treasuries is brighter for the next month. This might be enough to entice more investors to move away from the short duration stance.