Summary

Comment

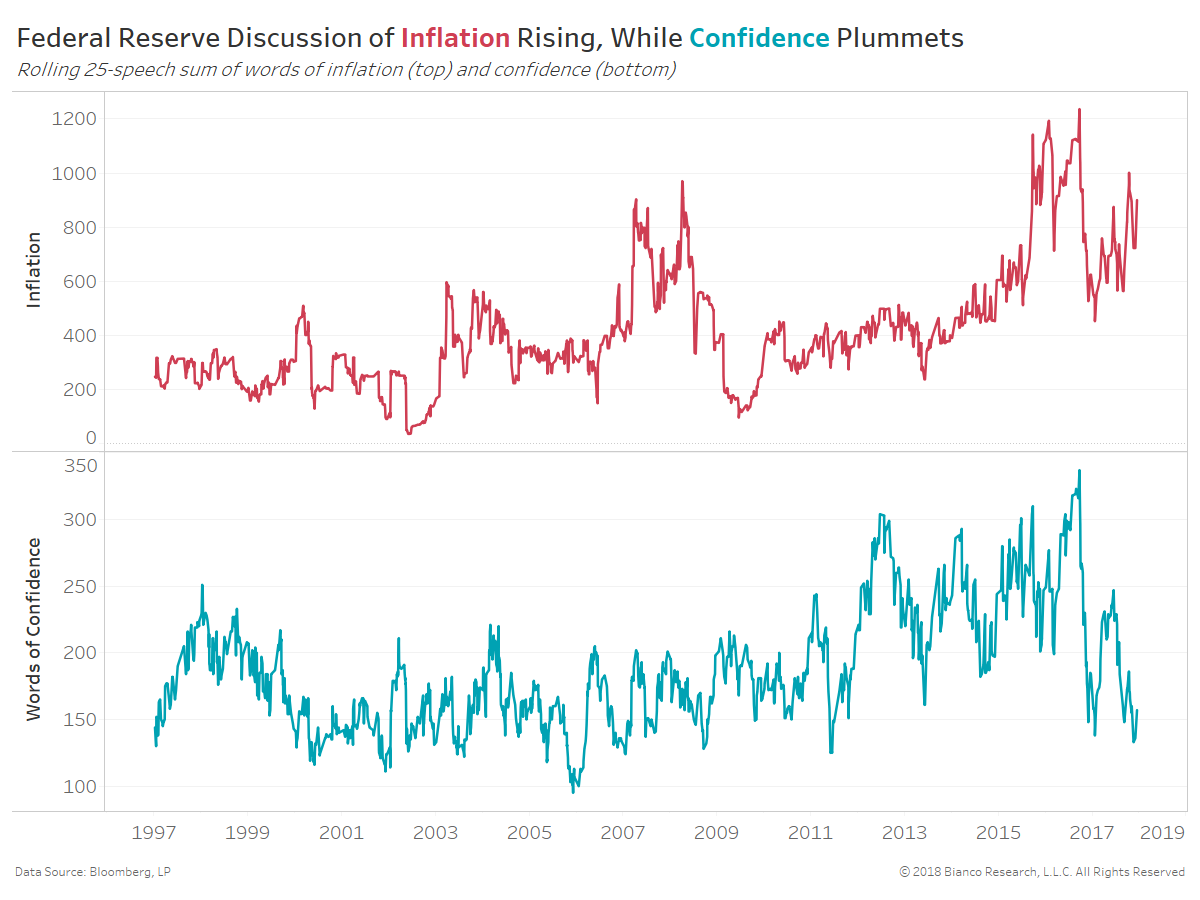

Unfortunately, confidence is near post-crisis lows while inflation has been the hot topic ever since Yellen et al lobbied for the first hike in December 2015. The chart below shows the rolling sum of words concerning “inflation” in the top panel and “confidence” in the bottom panel.

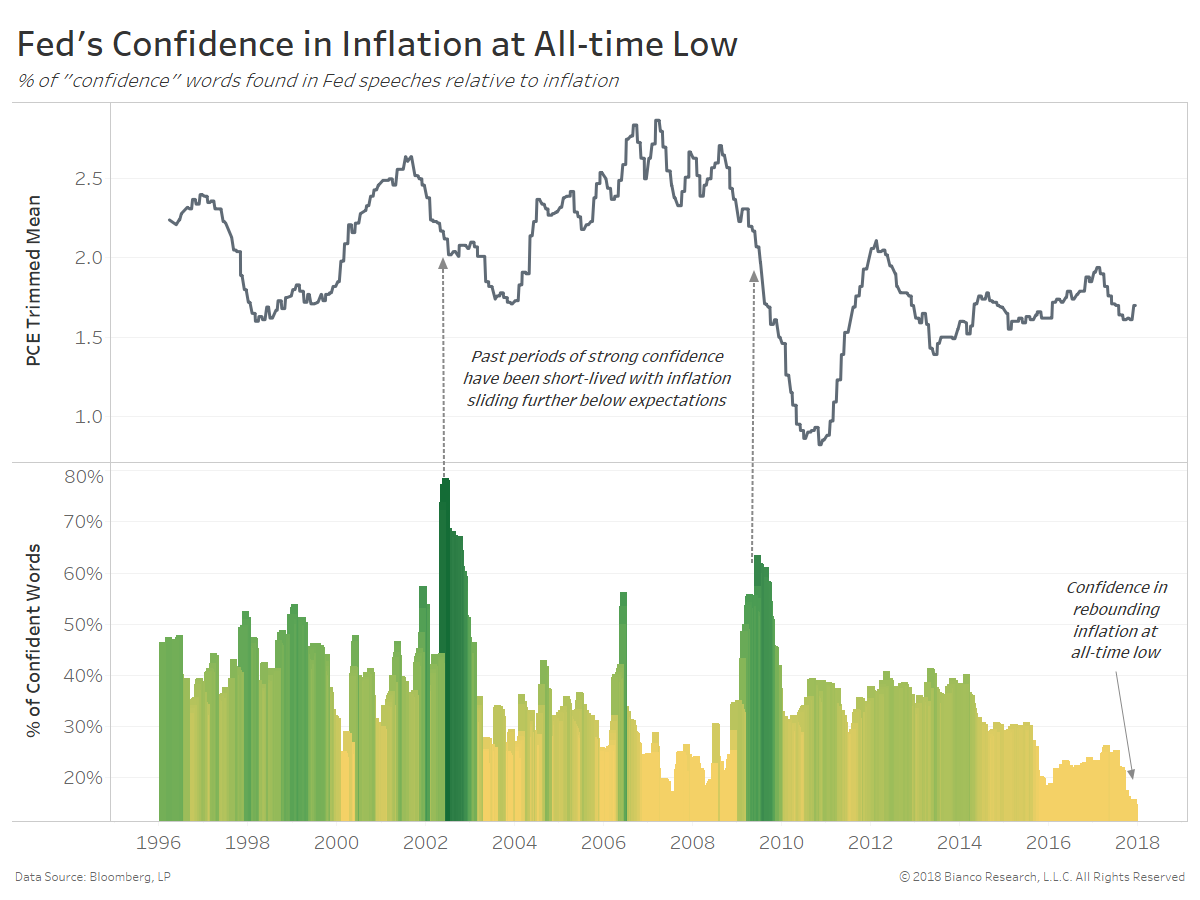

A complete re-think of models used to forecast inflation and wage growth were fervently discussed by not only markets, but many Fed officials. Persistently sub-2.0% core inflation has pushed numerous officials to consider new models (away from the Phillips curve) and alternative targets.

The next chart shows the percentage of “confident” words relative to “inflation.” Past bursts in confidence after declining core inflation (top panel) in 2002 and 2009 were short-lived, likely leaving a lasting impact on the psyche of Fed officials.

Inflation expectations as determined by TIPS breakevens have rebounded significantly, which may boost the Fed’s confidence in the months to come.

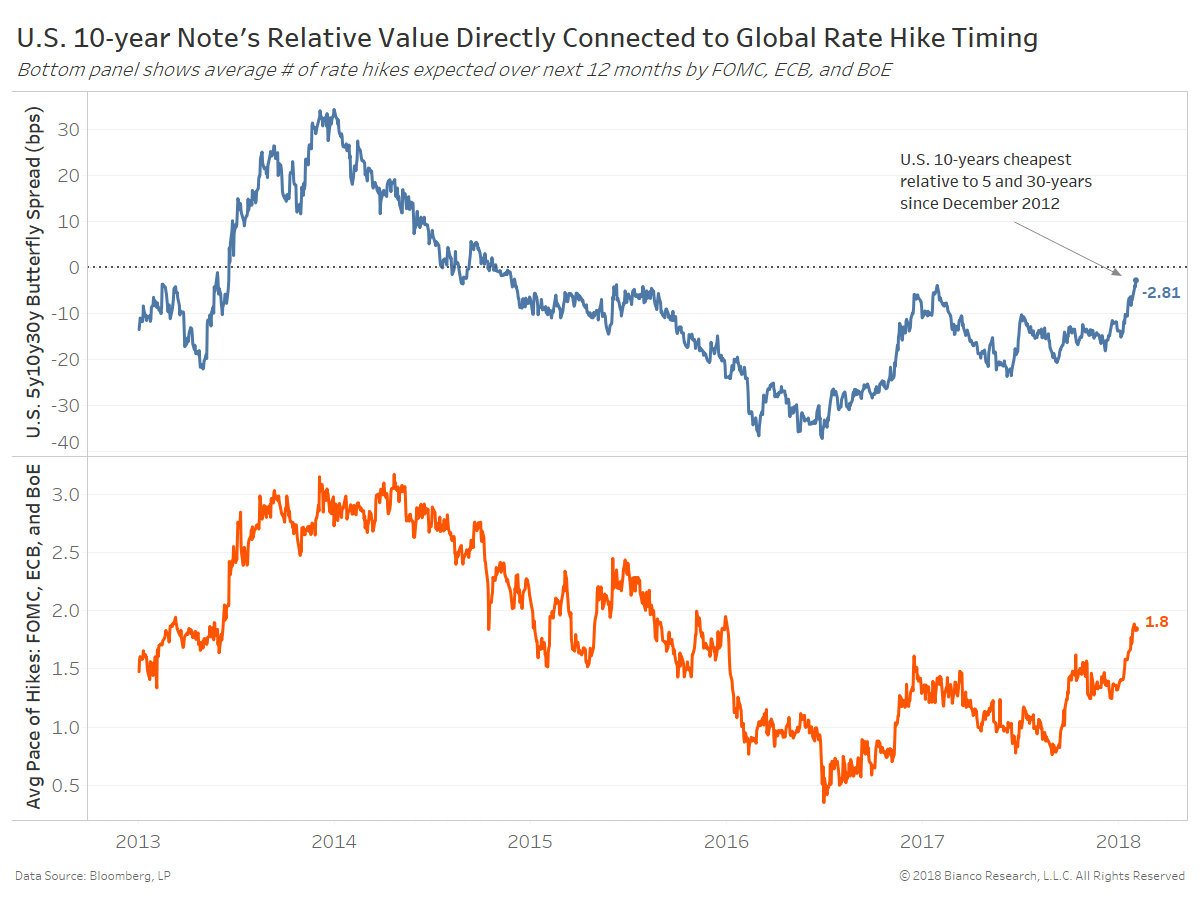

The pace of tightening expected by financial markets has jumped to over 2.5 hikes in 2018, just shy of the Fed’s estimated three hikes. Not only are TIPS breakevens widening, but nominal U.S. 10-year notes have reached their cheapest relative to 5-year notes and 30-year bonds.

The top panel shows the U.S. 5y10y30y butterfly spread and the bottom panel the average pace of rate hikes for the next 12 months by the Fed, ECB, and BoE. The 10-year’s relative value is directly tied to global rate hike timing with an r^2 of 0.78.

The markets’ perspective on rate hikes via butterfly spreads like below and TIPS breakevens may be the most critical drivers of central bank policy moving forward. If the Federal Reserve is questioning their own models, then market-based measures will likely carry greater weight.