- Barron’s – This Bond Bear Market Doesn’t Look Too Fierce

Investors may be rattled, but falling prices probably won’t stop them from buying new Treasuries.The bond bear market has finally arrived, according to Bill Gross. The 73-year-old Pimco co-founder, who helped invent modern bond trading, tweeted on Jan. 9, “Bond bear market confirmed today,” citing “25 year long-term trendlines broken in 5yr and 10yr maturity Treasuries.” Bond investors are rattled, as 2018 has kicked off with dropping prices and rising yields, with the rate on the 10-year U.S. government note climbing to nearly 2.6%—the level Gross has designated as the threshold marking the end. “Bonds, like men, are in a bear market,” he reiterated in a market commentary, referencing the recent spate of sexual-harassment allegations.

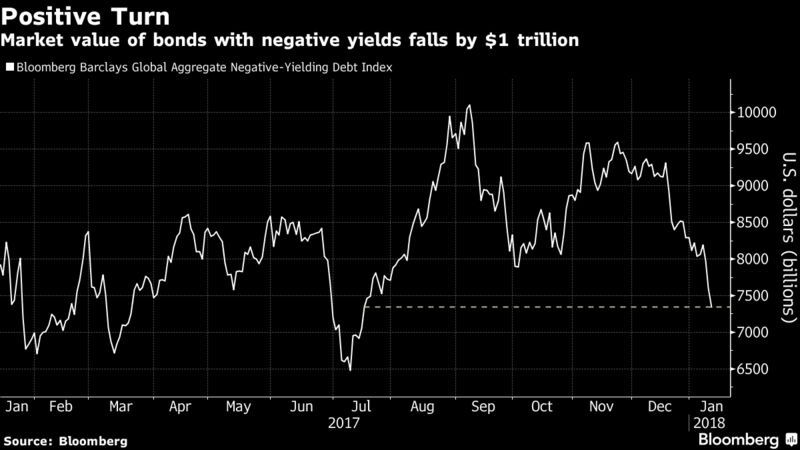

- Bloomberg.com – $1 Trillion in Bonds Have Left the Negative-Yield Zone This Year

Inventory of sub-zero debt falls to lowest since July

Positive yields reflect inflation expectations, QE unwindingAs the global bond market comes to terms with the unwinding of quantitative easing from the U.S. to Europe, it’s cutting inventory of the assets that bear the hallmark of a decade of distortion: negative-yielding debt. In the first eight trading sessions of the year, the pool of bonds with sub-zero yields has shrunk by about $1 trillion to $7.3 trillion, the smallest since July, signaling an uptick in growth and inflation prospects that’s helping to normalize bond markets around the world.