Comment

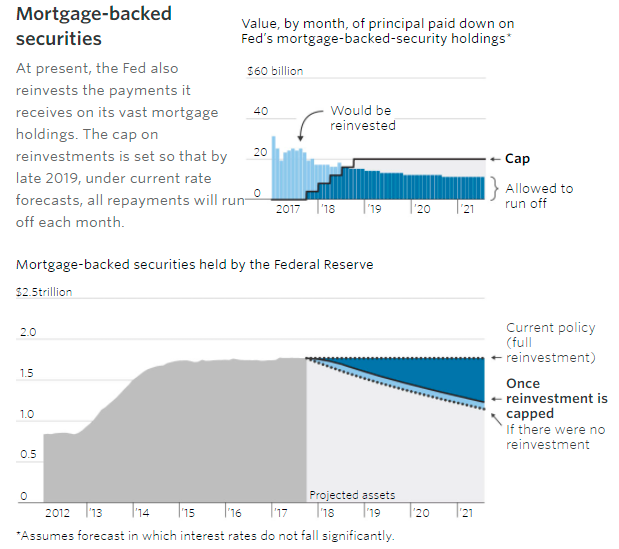

Estimating the reinvestment of agency MBS is more complex. Mortgage prepayments will vary with the level and path of interest rates, as well as the pace of home sales. The graphic below is from the Wall Street Journal and reflects the expected path of reinvestment given current rate forecasts.

As long as interest rates do not fall sharply, reinvestment of MBS proceeds would end in late 2018 as prepayments fall below the cap. A sharp drop in interest rates would see prepayments rise as consumer refinanced mortgages. That would result in larger sums being reinvested in earlier months.

The interactive chart below shows maturing Treasuries by month, along with the evolution of the cap on reinvestment. Mouse over the bars for each month to see the amount to be reinvested.

The Fed will continue reinvesting Treasury proceeds each month until through August of 2018. Reinvestment will then occur almost exclusively during February, May, August and November.

Though the final size of the balance sheet has yet to be determined, the Fed has estimated that normalization will occur sometime in 2021-2022.