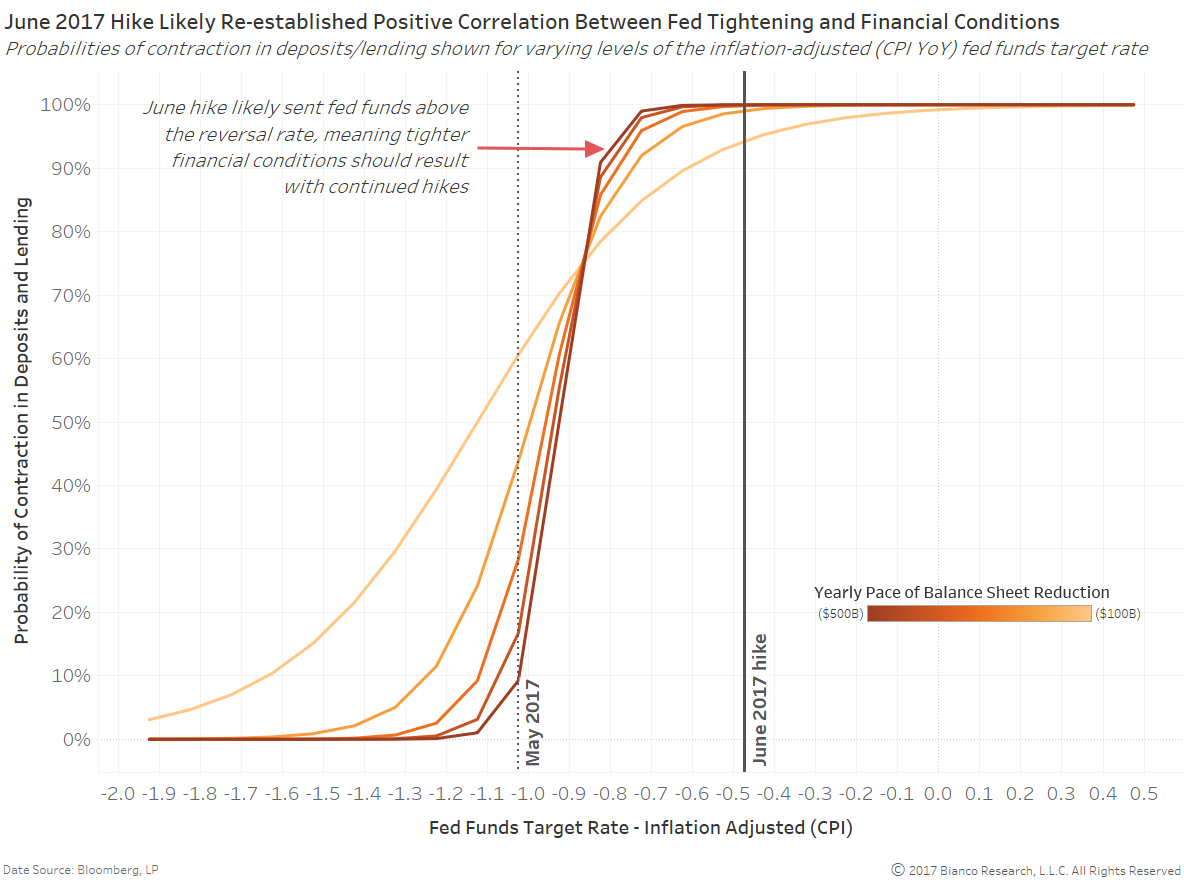

The next chart shows the probability of a contraction based on the level of the Fed Funds target rate. We believe that we are near or past the reversal rate where additional rate hikes will tighten financial conditions.

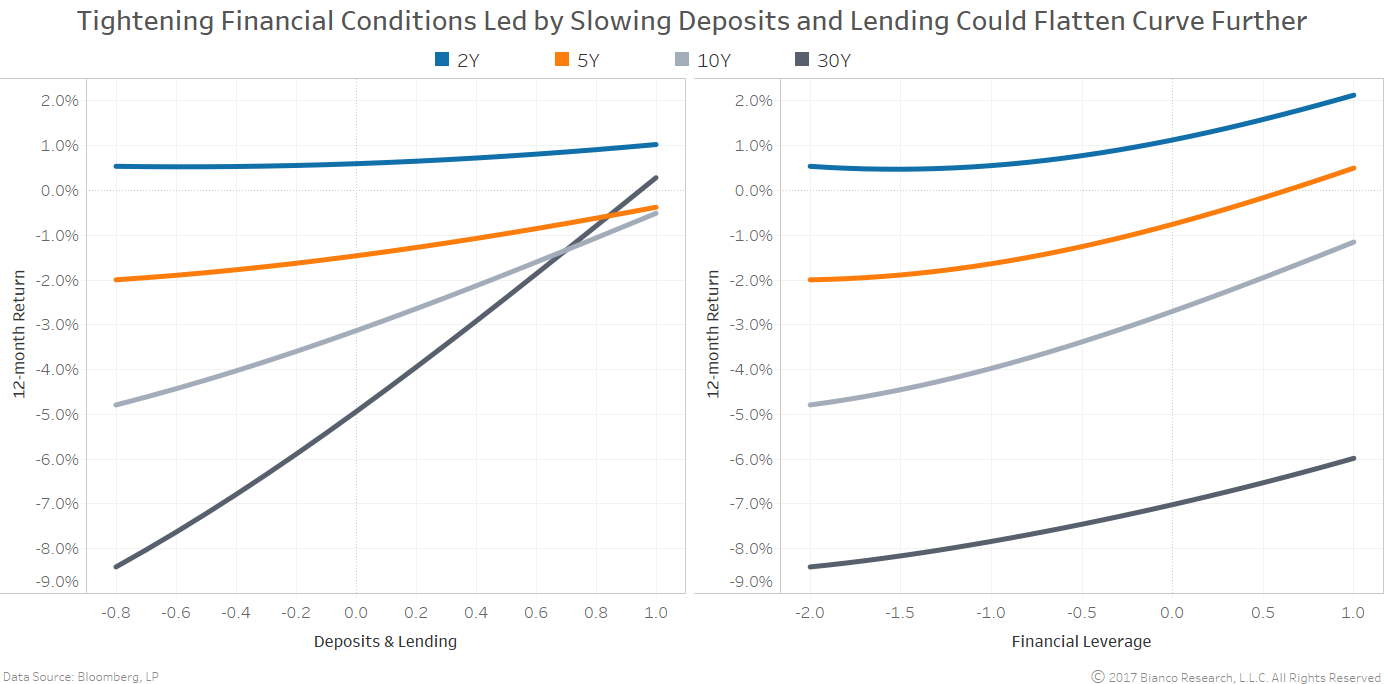

What can we expect if this happens?

The chart below shows estimated 12-month returns by increasingly tighter deposits and lending conditions (left panel) or financial leverage (right panel). U.S. 30-year bonds are most heavily impacted (bullishly) by tightening deposits and lending conditions (dark grey line, left panel).

A lack of inflation coupled with credit contraction could create a scenario capable of further flattening the U.S. Treasury yield curve.

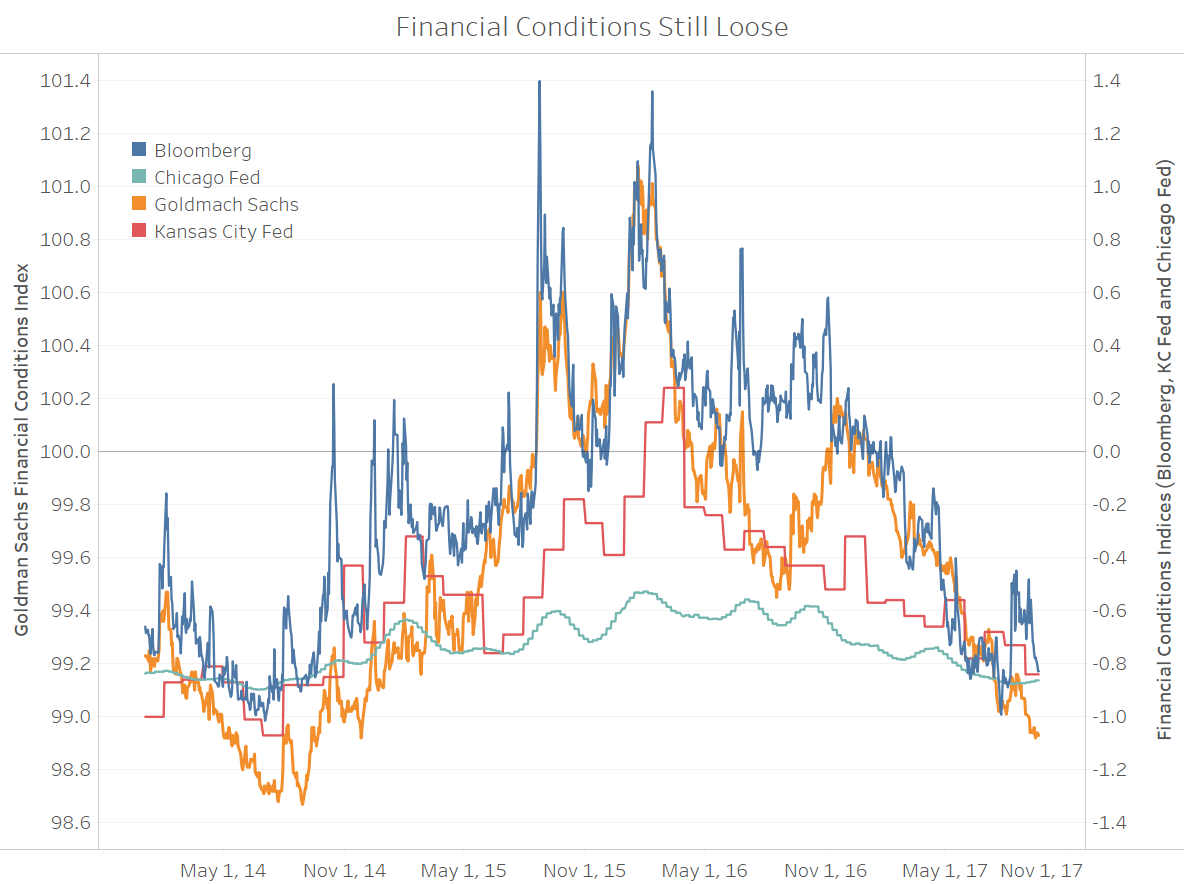

The chart below shows the Goldman Sachs U.S. Financial Conditions Index with bands indicating prior Fed tightening campaigns. The sustained loosening of financial conditions is unique to this tightening campaign. Driven in large part by persistently strong equity market returns and a weakening dollar, this behavior has confounded markets and Fed officials.

Our own measures of credit conditions, highlighted on September 6, are in agreement. The chart below shows two measures of financial conditions, deposits, and lending (light blue) and financial leverage (red). We view levels below the gray shaded area as too expansionary. Warning signs are already flashing for financial leverage while deposits and lending are approaching the lower band of acceptable. This could easily steer the Fed toward continued tightening despite inflation data that is expected to remain weak in the near term.

We have argued that the Fed should discount loose financial conditions, heavily influenced by strong equity markets and the weak U.S. dollar, and be mindful of the signals from the treasury curve. While still at 80 bps, the 2y10y spread is testing key lows.

We discussed on September 6 how the neutral rate has fallen and may be well below where many Fed officials believe. Upcoming changes in the FOMC are at play here as well. The unexpected departure of Stanley Fischer in October will place more influence in the hands of remaining experienced officials. Thomson Reuters has a graphic showing the hawkish versus dovish views of each member, ranked by their perceived influence. William Dudley, proponent of financial conditions as a policy guide, and Lael Brainard, who views a falling neutral rate as a important risk, are presented as the second and third most influential behind Yellen. Each will be vying for support for their views among new officials.

The next chart is one we have shown several times. This shows the probabilities of a contraction in deposits and lending growth at varied levels of core inflation. Economic conditions are held constant. We believe the June hike likely sent the fed funds rate above the reversal rate, a point where tightening will begin to impact financial conditions. Without stronger economic growth, further tightening will likely induce a contraction in lending growth.