Summary

Comment

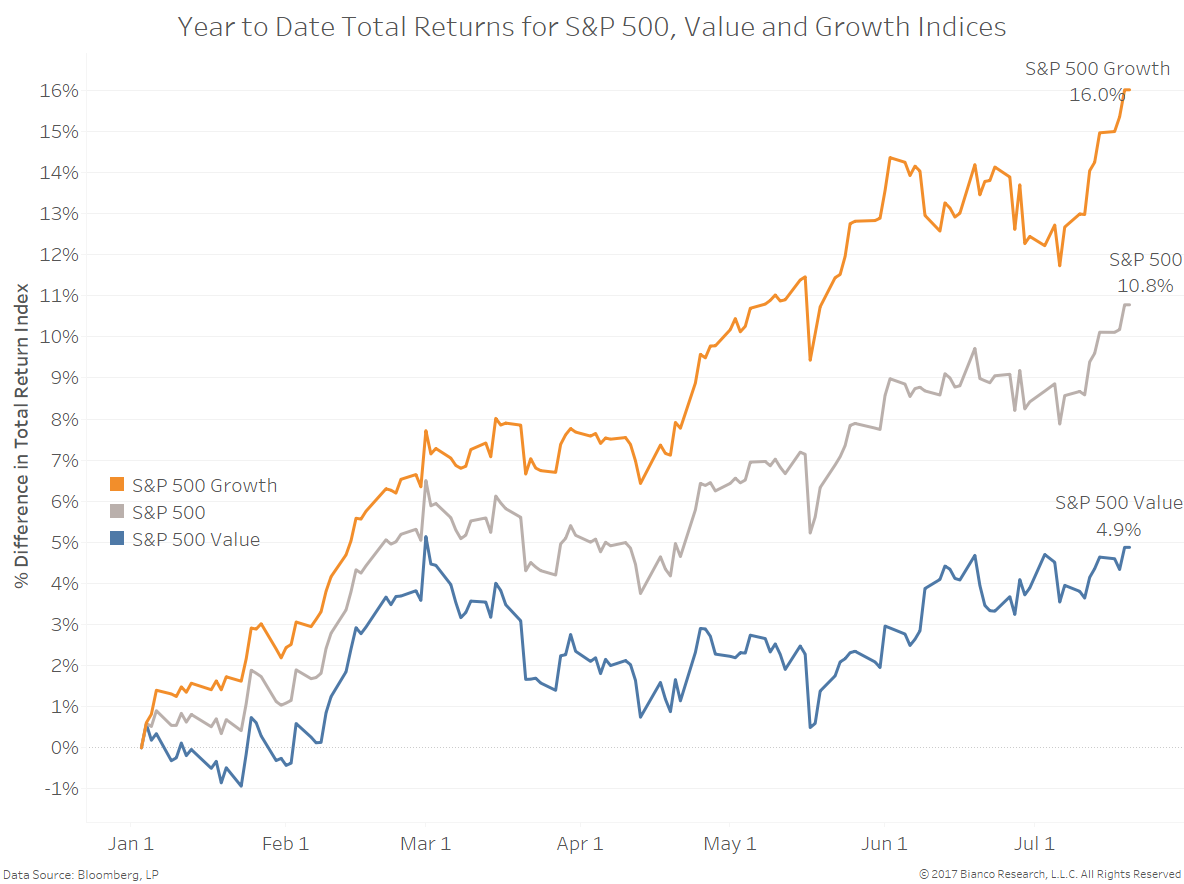

A client inquiry regarding the performance of value versus growth equities in the U.S. led us to an interesting discovery. The chart below shows a clear divergence in returns this year for growth versus value equities in S&P 500.

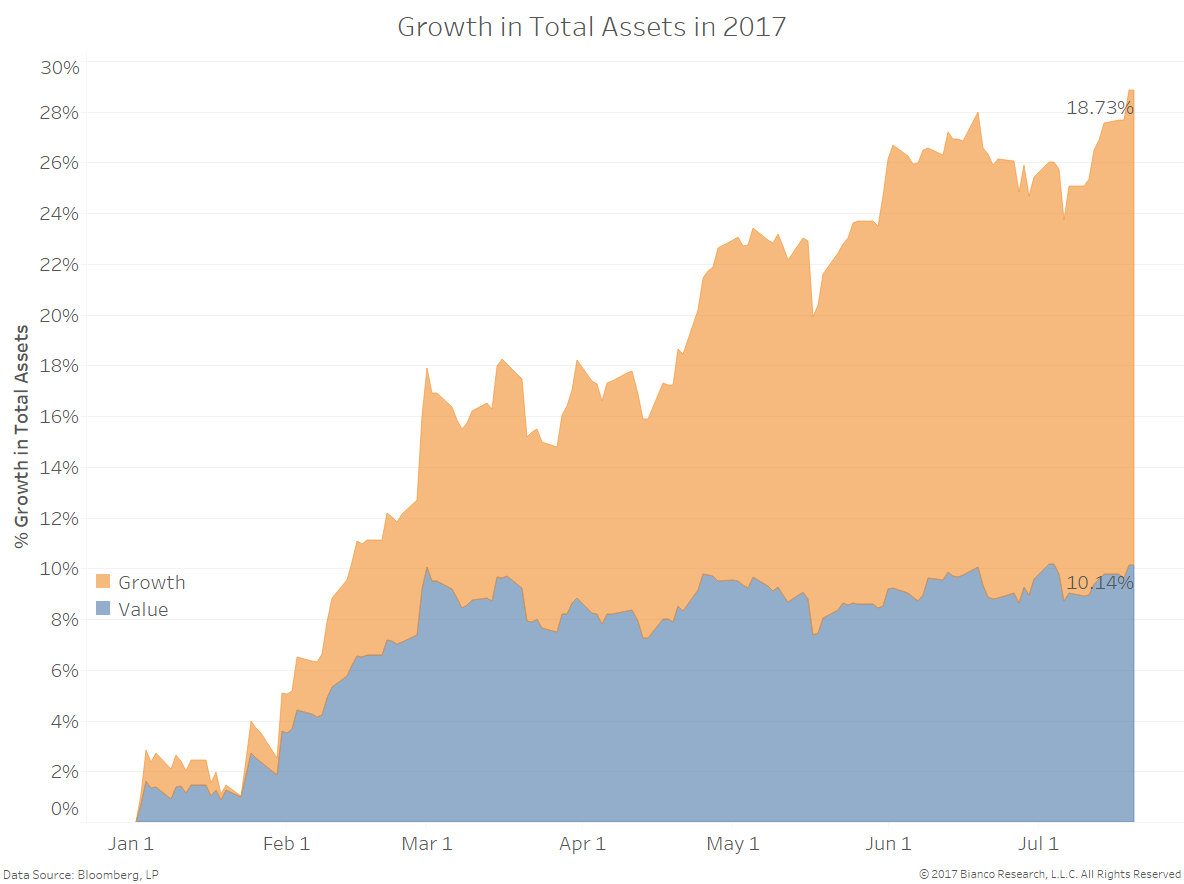

We typically see returns in ETFs track underlying indices fairly closely. But this appears to be a case where broad ETF definitions can give misleading impressions about performance characteristics. The next chart shows that although the faster price appreciation has driven total assets in U.S. growth ETfs higher, U.S. value ETFs have also seen year to date growth exceed 10%.

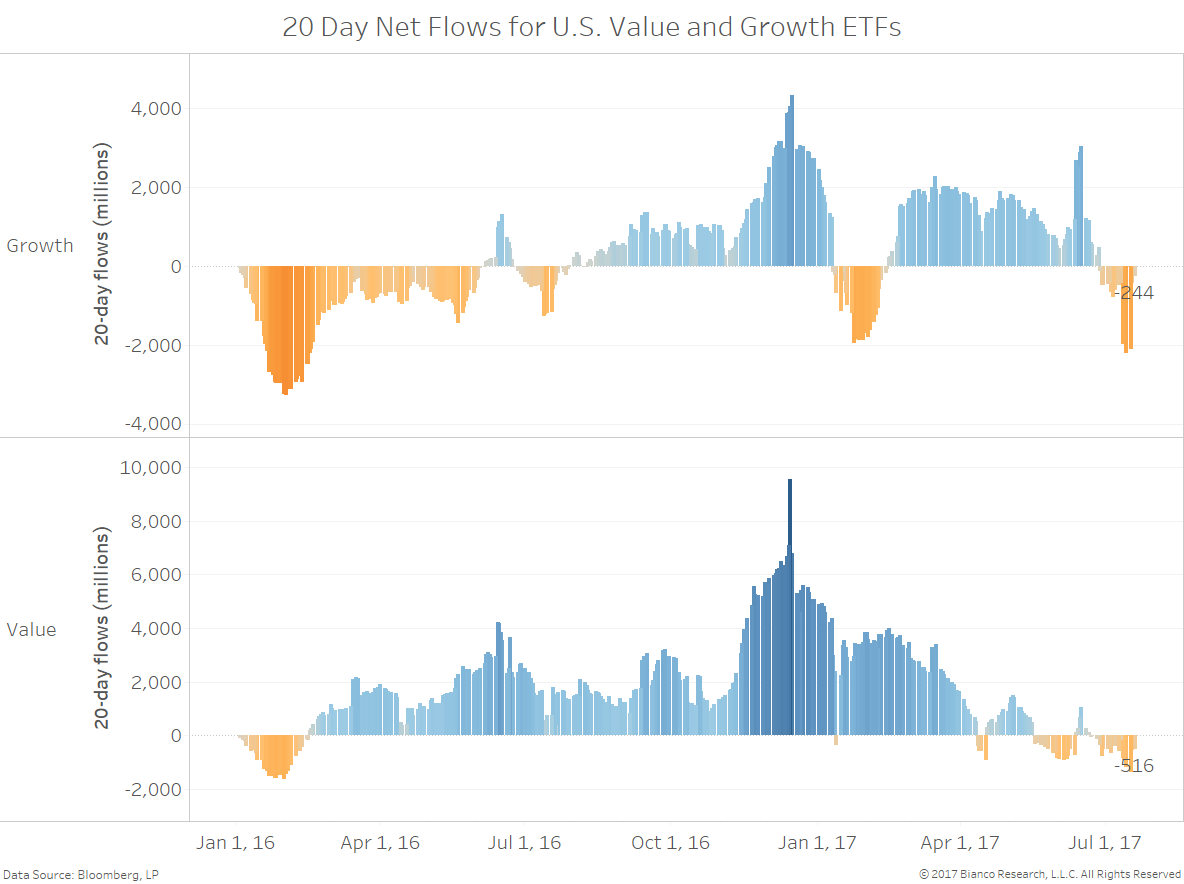

Looking at net 20-day flows into value and growth ETFs shows surprisingly similar flows given the wide disparity in performance. We had expected to see year to date underperformance drive move value investors out of the strategy.

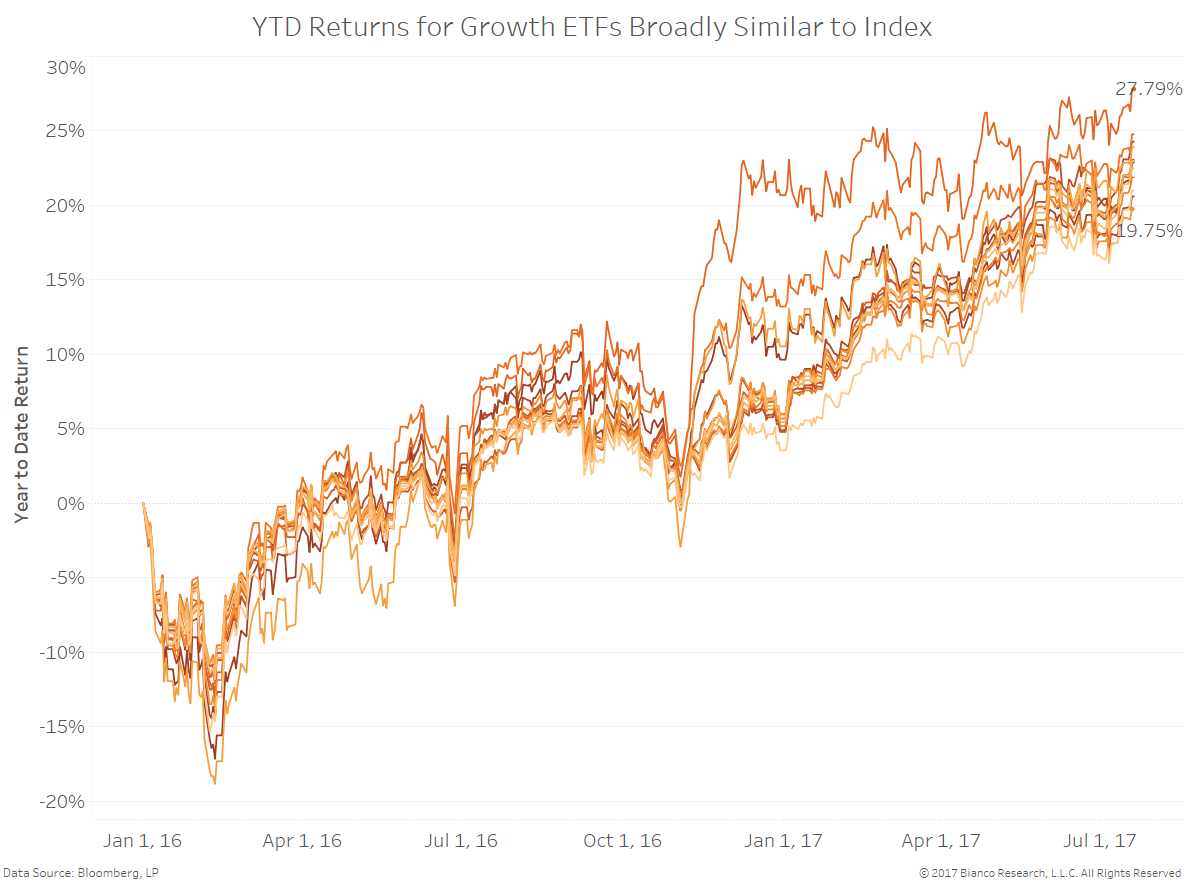

Now there is enough variety in the ETF space for broad definitions like value and growth strategies to include a range of different return profiles. But there appears to be much greater variation among value ETFs than their growth focused competitors.

The chart below shows YTD returns for all U.S. growth equity ETFs. These range from 19-28%, reasonably close to the S&P 500 Growth Index total return of 16%.

The universe of U.S. value ETF returns has a much wider dispersion, and much less resemblance to the S&P 500 Value Index. Year to date returns range from 18-37%, well above the 4.9% return of the index. Most of the variation is explained by exposure to small caps. The best performing funds focus on small caps or value sector of the Russell 2000.

Still, the fact that none of these ETFs are within 12% of the total return for a widely used, if large cap specific, benchmark value index illustrates how widely performance can vary within a defined space. The outperformance of small cap value ETFs is helping maintain investor interest in value ETFs even as larger cap value stocks are under-performing.

Conclusion

The underperformance of large cap value stocks does not paint a complete picture of the value space in U.S. equities. Small cap value stocks are outperforming and helping drive superior performance in the value ETF space. Given the high concentration of stock market performance in a handful of large cap technology names, the strong performance of small cap value may offer some under-appreciated diversification opportunities.