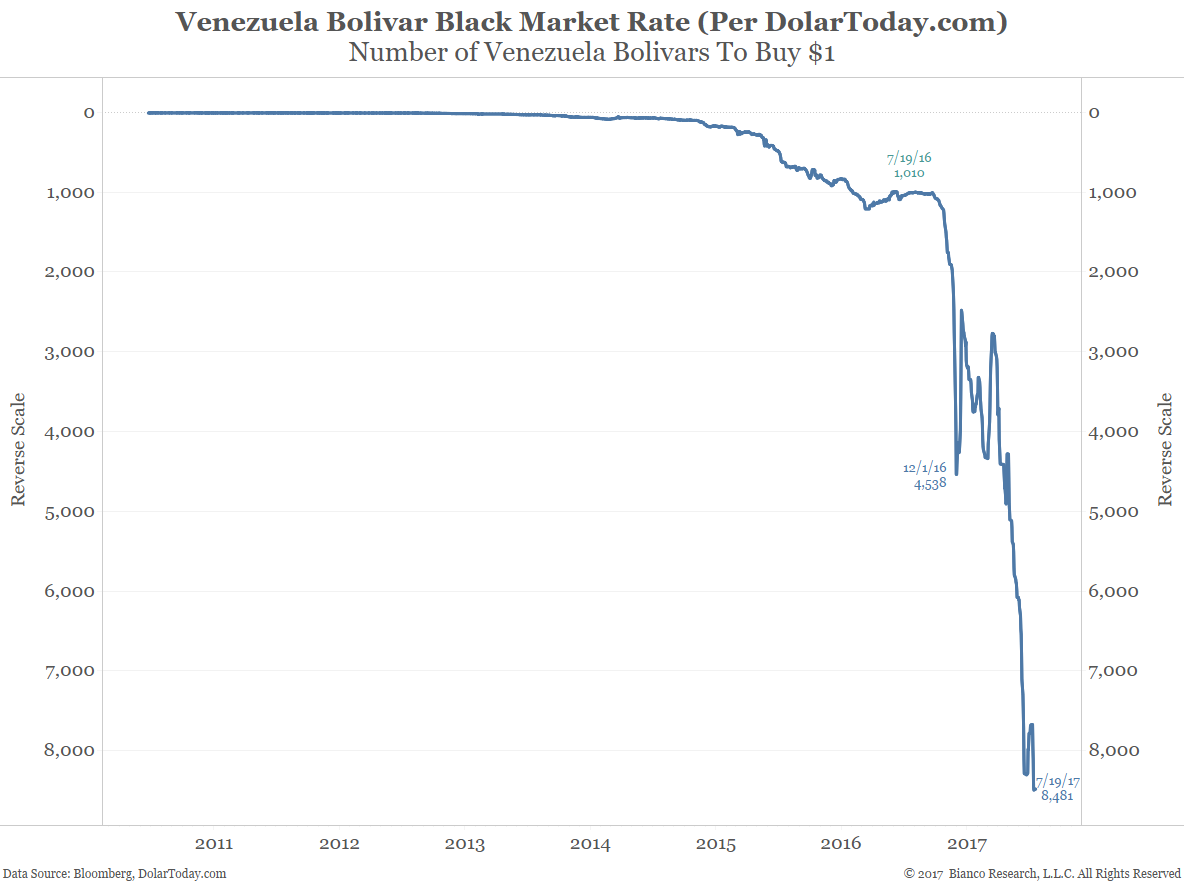

The black market rate of Venezuela’s currency continues to collapse resulting in hyperinflation and a worsening situation in the country. Note that in the last year the black market rate went from 1,010 Bolivars to buy a dollar to 8,481 Bolivars today. A drop of 88%.

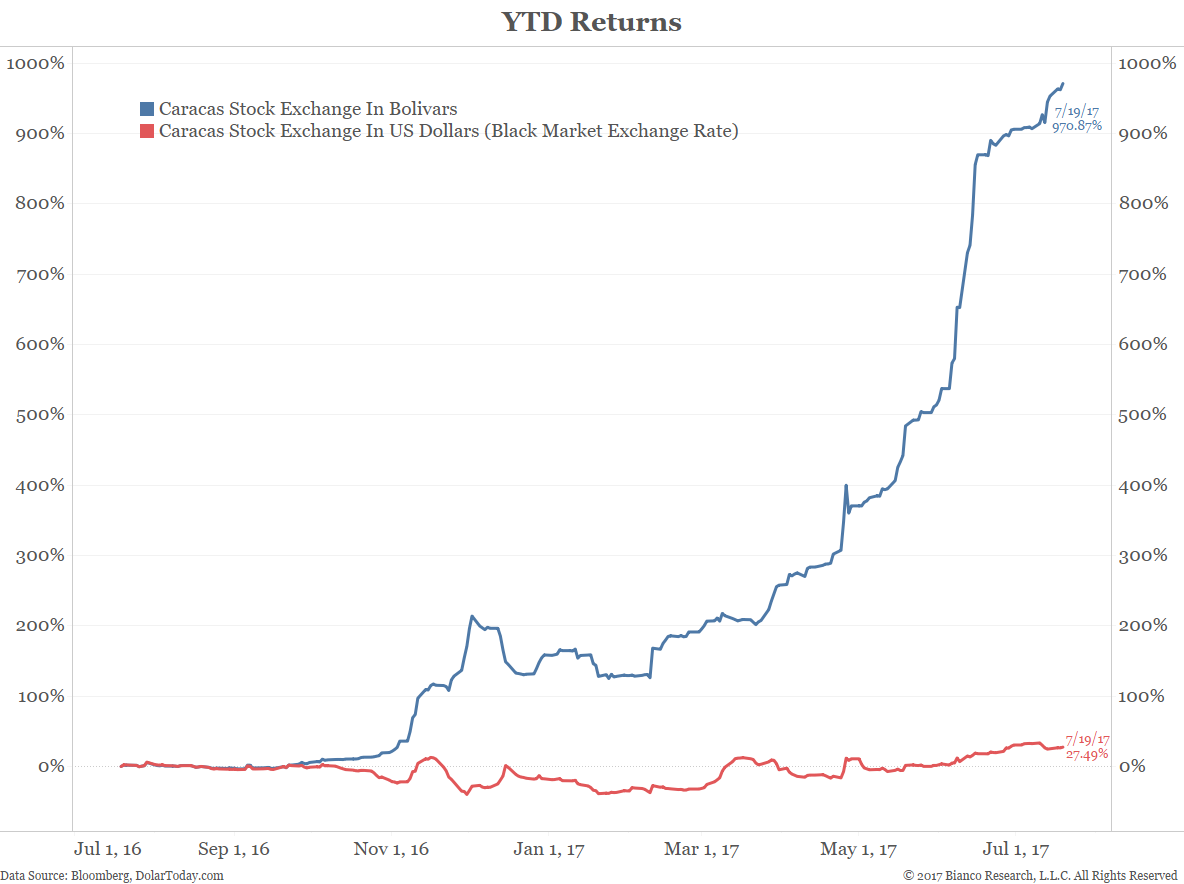

At this rate of currency depreciation over the last year, prices in Venezuela would need to rise 833% in the last year to keep pace with inflation. This is not happening with wages. But, as the next chart shows, the Venezuelan stock market is keeping pace with this hyperinflation rate (for now). It went up by 970% in the last year (blue) leading to a 27% currency adjusted rate (red now). Venezuela’s stock market has 15 liquid stocks with Mercantil Servicios Financieros, C.A. and Banco Provincial, S.A. account for 85% of their stock market’s capitalization. Mercantil Servicios is a junk rated credit and Banco Provincial is no longer rated.