- Bloomberg Graphics – OPEC Reality: Saudis Delivered, Non-OPEC Didn’t.

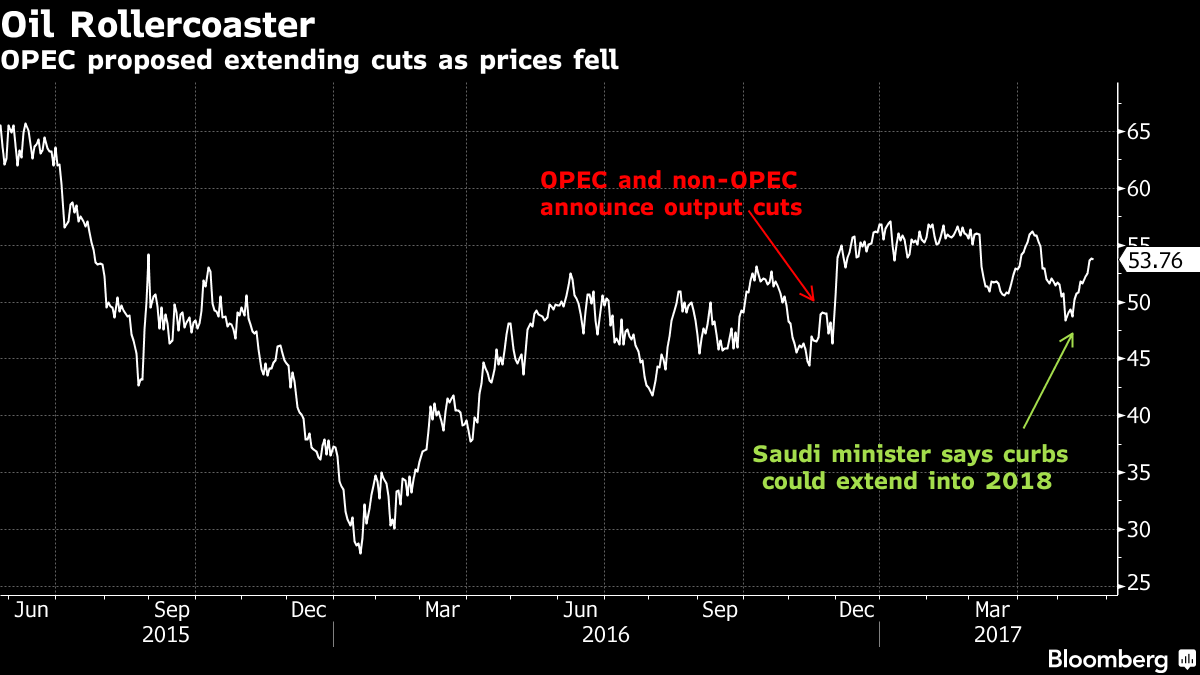

Just under a week from now, the Organization of Petroleum Exporting Countries will meet in Vienna to decide whether to extend the first oil production curbs in eight years in order to eliminate a glut. The group will evaluate data, described below, that highlights two key details: First, Saudi Arabia is shouldering much of the burden. Second, non-member producers – who pledged reductions of their own – haven’t delivered in full.

- Bloomberg – OPEC Wants to Carry on Pumping Less and Earning More

Production cuts produce higher petrodollar revenues, IEA saysAt first glance, OPEC’s cuts haven’t worked — global oil inventories remain well above normal levels. But the policy’s made a difference where it really counts: juicing the coffers of finance ministries from Baghdad to Caracas. The resurgent flow of petrodollars explains why Saudi Arabia and Russia have largely convinced everyone else in the deal to extend the production cuts another nine months to the end of March 2018.

- Wall Street Journal – Why OPEC Plans Oil Cuts Into 2018: Aramco’s Coming IPO

Saudi Arabia is pushing the OPEC oil cartel and other big producers gathered here this week to extend crude production cuts for another nine months. The reason: the timing of the blockbuster IPO of Saudi Arabian Oil Co., people familiar with the matter said. The Saudis want higher oil prices well into 2018 to support the initial public offering of their state-owned oil company, Aramco, people familiar with the matter said. The initial offering of 5% of the company is being timed for some time in 2018 and has been billed as the biggest ever, with valuations reaching over $2 trillion.

- Bloomberg – OPEC Close to Agreement to Extend Oil-Supply Cuts for 9 Months

Other proposals will be discussed including even longer curbsOPEC and its allies were close to an agreement to extend their oil-production cuts for another nine months as they seek to prop up prices and revive their economies. While ministers gathering in Vienna still planned to discuss other options — a shorter deal for six months or curbs lasting for the whole of next year — consensus was building around an agreement that runs through March 2018.

Comment

We have written quite a bit on the U.S. shale oil production side of the global oil market drama and did a Net Positions (webcast) on this subject last week reviewing our expectations for U.S. production. But with the OPEC meeting finally coming tomorrow, it is time to shift focus to the potential weaknesses in the planned extension.

Expectations for this meeting have been set quite high as the Saudis and Russians publicly agreed to extend production cuts well in advance of the formal decision. Whispers of deeper cuts in production of a longer extension have been floated as well. As the largest producer and largest exporter of crude oil respectively, Russia and Saudi Arabia have made as much noise as possible in an attempt to regain control of the narrative. But U.S. shale oil producers are not the only risk in their hopes for a drawdown in global oil supplies.

The Bloomberg Graphics story above includes the visualization below. The squares are sized to production cut targets with shaded squares indicating if they were met (orange) or not (yellow). The top row is OPEC producers led by Saudi Arabia. The bottom row is non-OPEC producers led by Russia. Compliance among non-OPEC producers has faltered. Russia has yet to be in compliance with its agreed cuts and smaller producers have followed suit. Malaysia, Kazakhstan and South Sudan have increased production since the cuts.

The Saudis have earned more excess revenue since the production cuts despite cutting production by more than they agreed. Non-OPEC producers have happily continued pumping oil to sell at higher prices. Despite any public agreements, real declines in global inventories will continue to face headwinds if non-OPEC compliance keeps eroding.

The Wall Street Journal story above highlights the Saudis big incentive to keep oil prices high ahead of its planned IPO for Saudi Aramco. It strikes us that this is a major benefit of higher prices that is accruing only to the Saudis. Will they have to give ground to other key producers who sense this imbalance? Iran is another risk factor in achieving a balanced market and may see an opportunity in the vulnerable IPO.

Conclusion

U.S. tight oil production is not the only threat OPEC faces in its push for meaningful cuts in global oil production. Non-OPEC compliance with production cuts could be a growing problem and the pending IPO will leave the Saudis potentially vulnerable as they try to defend higher oil prices for another nine months.