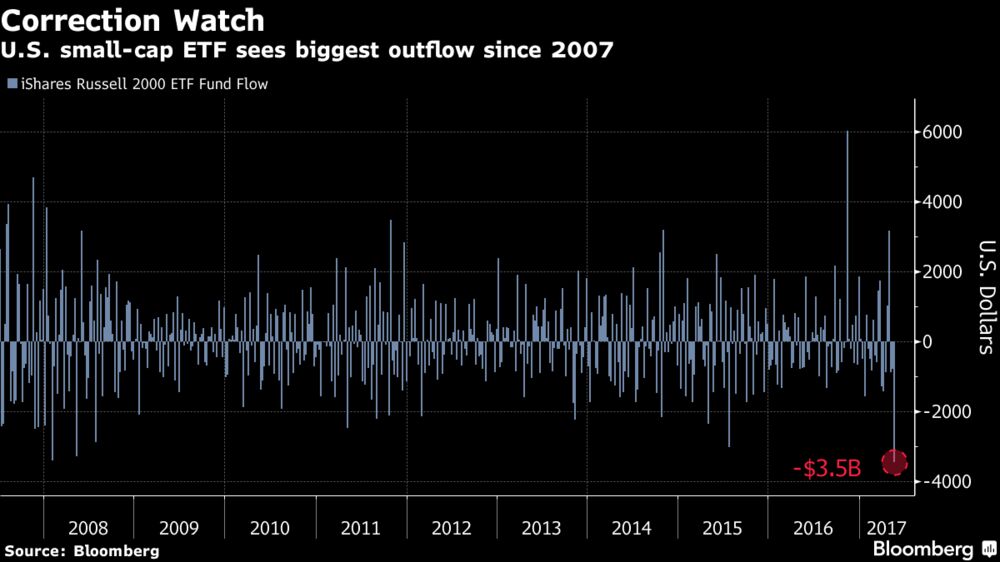

- Bloomberg – Investors Just Pulled the Most Cash From Small Caps in a Decade

Pain in smaller stocks has some readying for selloff

Investors pulled $3.5 billion from the biggest exchange-traded fund that tracks the Russell 2000 Index last week, spooked by the steepest selloff in the domestically focused stocks since before Donald Trump’s surprise election win. The biggest outflow in 10 years comes less than a month after small caps roared to an all-time high on speculation Trump administration policies would supercharge growth in the world’s largest economy.

Comment

The last time Bloomberg noted a similar mass exodus by U.S. small cap equity ETF investors was on April 4. Net 5-day flows bottomed on April 7 at -$3.18 billion. We published an update on small caps and the reflation trade on April 12 when it seemed the tide had turned. The Russell 2000 dipped by another 1% before rallying 5.5% through April 26.

This time it appears as if net flows may have already bottomed. The top panel of the chart below shows total assets in U.S. small cap equity ETFs have fallen 2.5% since May 15 and 5% since the April 26 peak. The bottom panel shows 5-day net flows for small cap ETFs. 5-day net flows bottomed on Friday (May 19) with $3.46 billion leaving small cap ETFs in the prior week. Total net flows for the past 5 days were -$1.92 billion.

Though slightly larger in magnitude than recent outflows, we think the Bloomberg story overstates the severity of the outflows.

Performance for U.S. small cap ETFs has been strong. On average, small cap ETFs are +4.7%. They are up 6.6% since Trump’s election. Small cap ETF investors are likely to continue the dip buying behavior as long as the post-election investments are profitable.