- Bloomberg – Bond Traders’ Inflation Bets Have New Life, Just in Time for Fed

BlackRock, GSAM warn against complacency on yields, inflation

Bond traders demonstrated this week that for all the doubts about the Trump trade, wagers on quicker inflation still have life. Look no further than the U.S. 10-year breakeven rate. It climbed the most on a weekly basis this year, rising back toward 2 percent, suggesting the market is starting to hop back on the inflation bandwagon. The shift is taking place just in time for the Federal Reserve’s May 3 policy announcement. While traders see little chance of a hike this week, an increase is seen as much more likely in June, and is fully priced in by September, futures show. The focus this week may be on Fed officials’ assessment of the economic outlook after Trump administration fiscal initiatives that traders were betting on stalled.

Comment

Our recent analysis of equity funds shows managers should be begging for higher yields and a steeper yield curve. These conditions have historically fostered a favorable environment. The period of ultra-low interest rates have led to underperformance and a shunning of the industry as a whole.

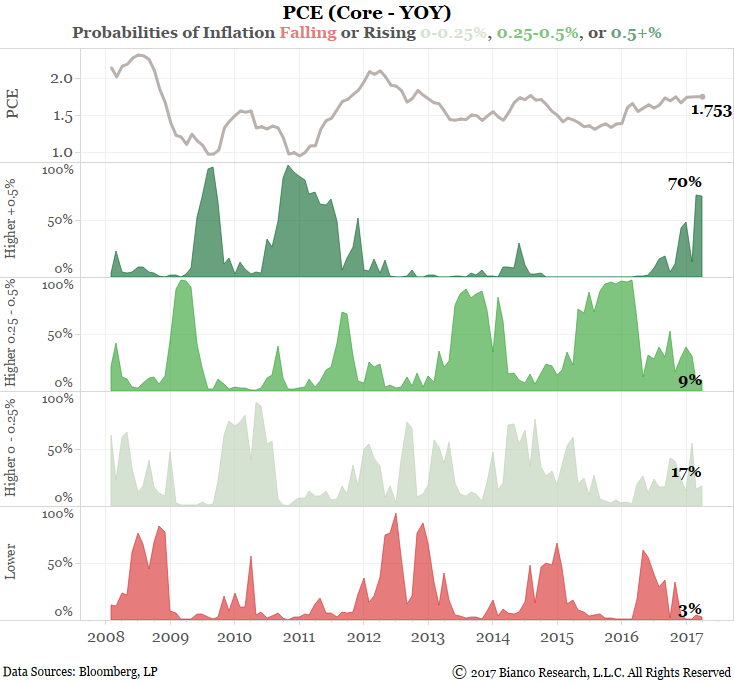

Both equity and bond fund managers should welcome inflation, which we expect to rise over the next 12 months. Inflation expectations are beginning to rebound after ‘Trump reflation’ waned. We put the odds of core PCE rising by more than 50 bps at 70%. The probability of inflation falling over this time period is a paltry 3%.

Conclusion

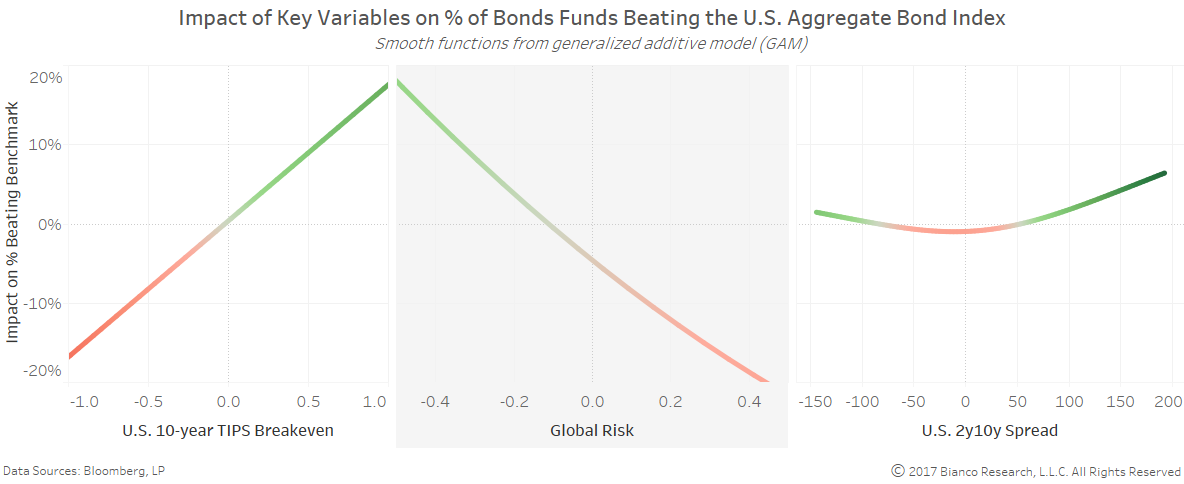

The likelihood of rising inflation and dampened global risks bode well for active bond fund managers. Returns may suffer, however these conditions favor active funds capable of going off index or dynamically adjusting duration, yield curve exposure, and volatility. Unlike their equity brethren, bond funds (U.S. Treasury and credit focused) are meeting expectations given changes in key variables.

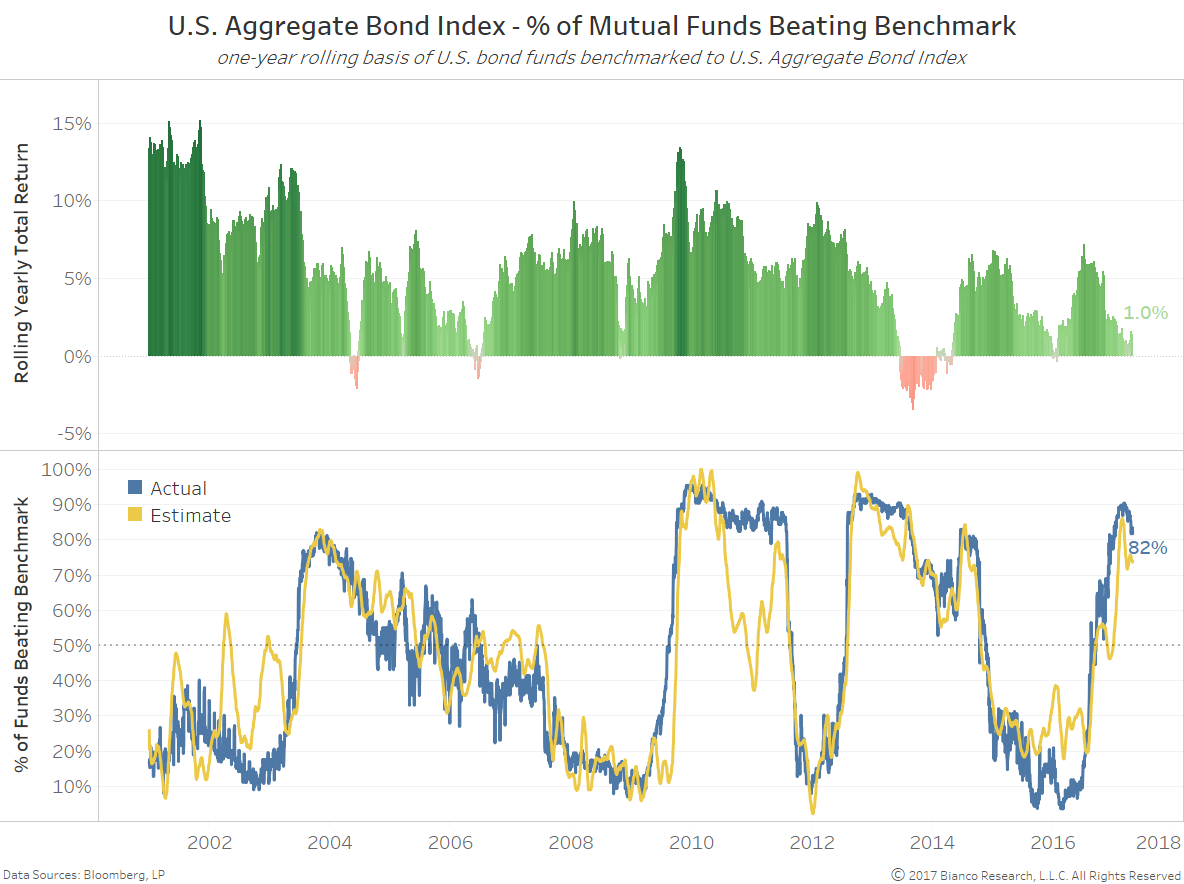

The chart below shows the rolling one-year returns for the U.S. Aggregate Bond Index in the top panel and the percentage of U.S. fixed income mutual funds beating this benchmark in the bottom panel. These funds have produced lower returns with U.S. Treasury yields higher on a year-over-year basis, however a very healthy 82% are outperforming. This stands in contrast to equity funds still lagging the S&P 500.

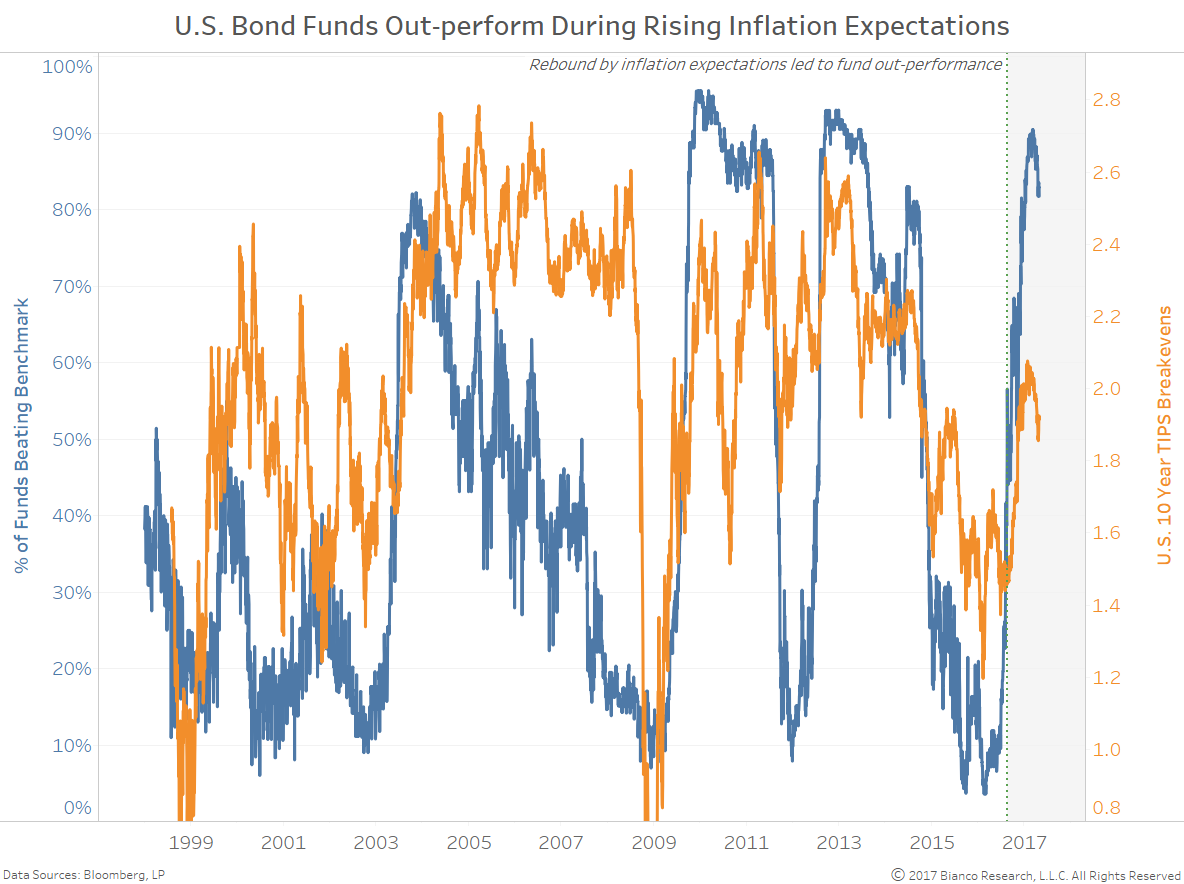

So why are bond funds doing so well? The quick answer is improved inflation expectations.

We can explain 77% of the variation in the fund beat rate using: 1) U.S. 10-year note yields, 2) U.S. 2y10y spread, 3) Fed funds futures, 4) U.S. 10-year TIPS breakevens, 5) bond liquidity, 6) benchmark returns, 7) global implied volatility, and the Chicago Fed Nat’l Activity Index.