- S&P Global Platts – US shale oil rebound shakes OPEC

Even with oil prices hovering around the $50/b mark, the US rig count has increased rapidly while E&P companies continue to record substantial reductions in well drilling costs. The increase in new well oil production per rig demonstrates the extraordinary gains the shale drillers have made. In April 2014, new well oil production per rig on the Bakken was recorded at 492 barrels and on the Eagle Ford at 463 barrels. In April this year, the figures are 1,067 barrels and 1,448 barrels, respectively. Moreover, US E&P companies remain confident they can continue to eke further efficiencies out of their seemingly ever-evolving factory-mode production processes. - ETF.COM (April 24 2017) – Energy ETFs A Bargain If Citi’s $60 Oil Call Is Right

The cartel meets on May 25 to discuss whether to extend the temporary production curbs put in place at the start of the year. Those curbs―a six-month output reduction of 1.2 million barrels per day from OPEC countries and 558,000 barrels per day from a group of non-OPEC countries―were aimed at reducing the enormous glut of inventories that had accumulated during the oil bust of the last couple of years. Key OPEC sources recently suggested that the cuts are likely to be extended. Kuwait’s oil minister, who expects the supply agreement to be renewed for another six months, said that he is satisfied with the compliance from OPEC and non-OPEC countries. - Mainstay Investments – High-Yield Default Rates Drop

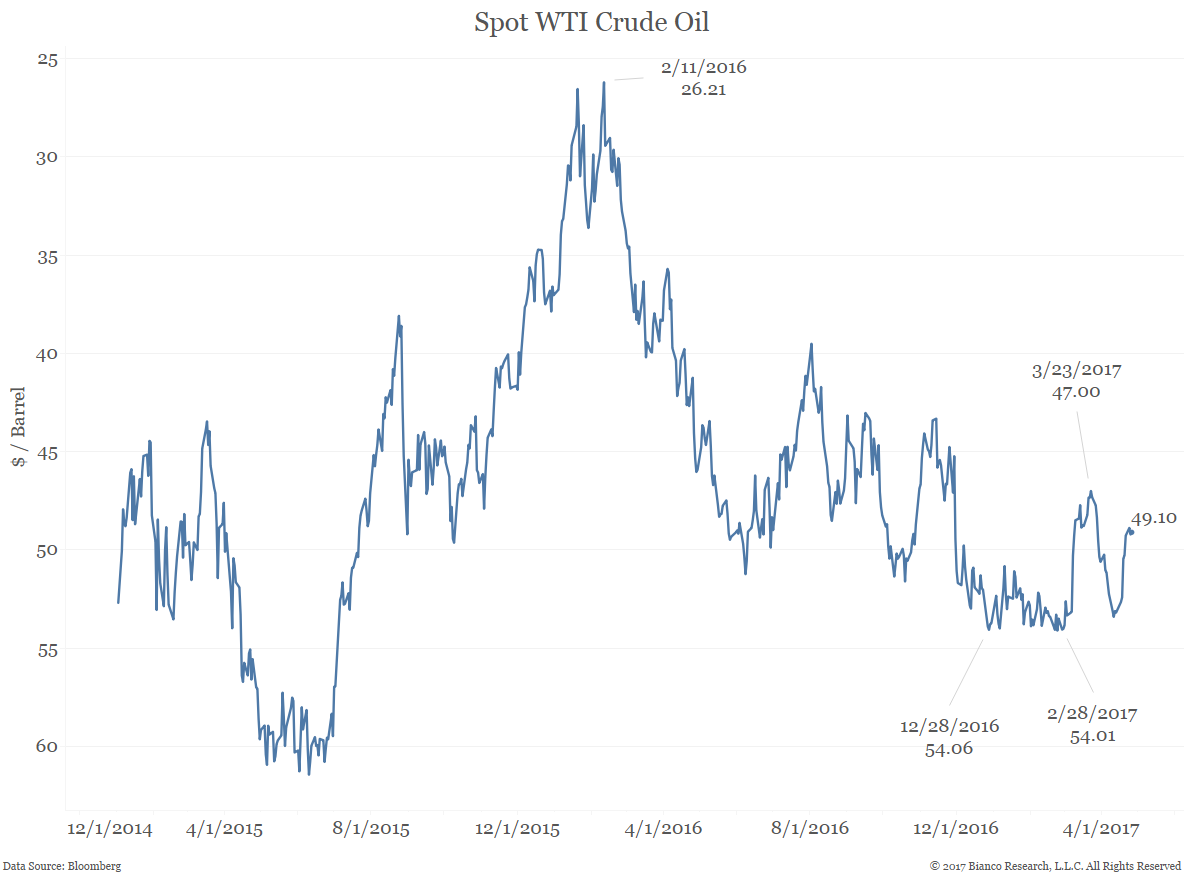

High-yield default rates are moving lower, according to Moody’s. A growing economy, a recovery in profits, and oil prices well above winter 2016 levels have supported a spread environment, somewhat reminiscent of the growing economies of the mid-1990s and mid-2000s, although spreads were tighter then. Moody’s trailing 12-month global speculative-grade default rate fell to 3.8% in March, down from its recent peak, and is projected to average 2.5% in the fourth quarter by the research and ratings firm. The trailing 12-month U.S. speculative-grade default rate fell to 4.7% in March and is projected to average 3.1%.

Comment

We’ve highlighted the rising correlations between risk markets and crude oil since early March, most recently on April 11. The chart below shows rolling 45-day correlations between spot crude oil and the S&P 500 (blue line) and high yield ETF HYG (orange line). Correlations have eased a bit since our last update, but high yield markets continue to monitor energy markets closely.

Even with oil unable to hold above $50, U.S. energy firms’ cost reduction efforts mean sustained prices above $40 can be profitable. Energy firms are sitting on thousands of drilled but uncompleted wells in shale oil regions. With average breakeven rates for existing wells in the $20s in key regions like the Permian basin, current prices provide enough incentive for producers to bring these wells online and begin pumping oil. The longer prices stay above breakeven rates, the more production U.S. tight oil producers can hedge.

The result is a more secure environment for high yield energy borrowers, and investors who took more risk in U.S. energy debt have been rewarded since Trump took office. The next chart shows cumulative total returns for Bloomberg’s U.S. high yield and investment grade energy indices. High yield has outperformed investment grade by 6% in the first 100 days of Trump’s administration.

ETF investors have taken note. Despite seeing a surge of outflows in March as rising U.S. production caught markets off guard, U.S. high yield ETFs have seen renewed interest from investors. Net inflows for the past 20 days have exceeded $2 billion. Investment grade fixed income ETFs were preferred by investors during high yield’s drawdown, but interest has waned in the last month. Net 20-day flows are just $614 million. Meanwhile high yield ETFs have, on average, outperformed investment grade ETFs by 2.8% since November 8 2016.

Conclusion

U.S. tight oil producers are taking advantage of idle, drilled wells ready to begin production with breakeven rates well below current prices. The ability to hedge production through the end of 2017 and even into 2018 will further solidify many high yield borrowers in the energy sector. It will also serve to reduce OPEC’s leverage as they meet next month to decide on an extension of production cuts.

With potential declines in oil prices less likely to dent high yield borrowers in the energy sector, any pullbacks on OPEC supply news in the next few months may be a buying opportunity. The real risk is the longer term question of whether U.S. shale oil producers have the discipline to ramp up production without sending prices below breakeven levels.