Questions/Answers

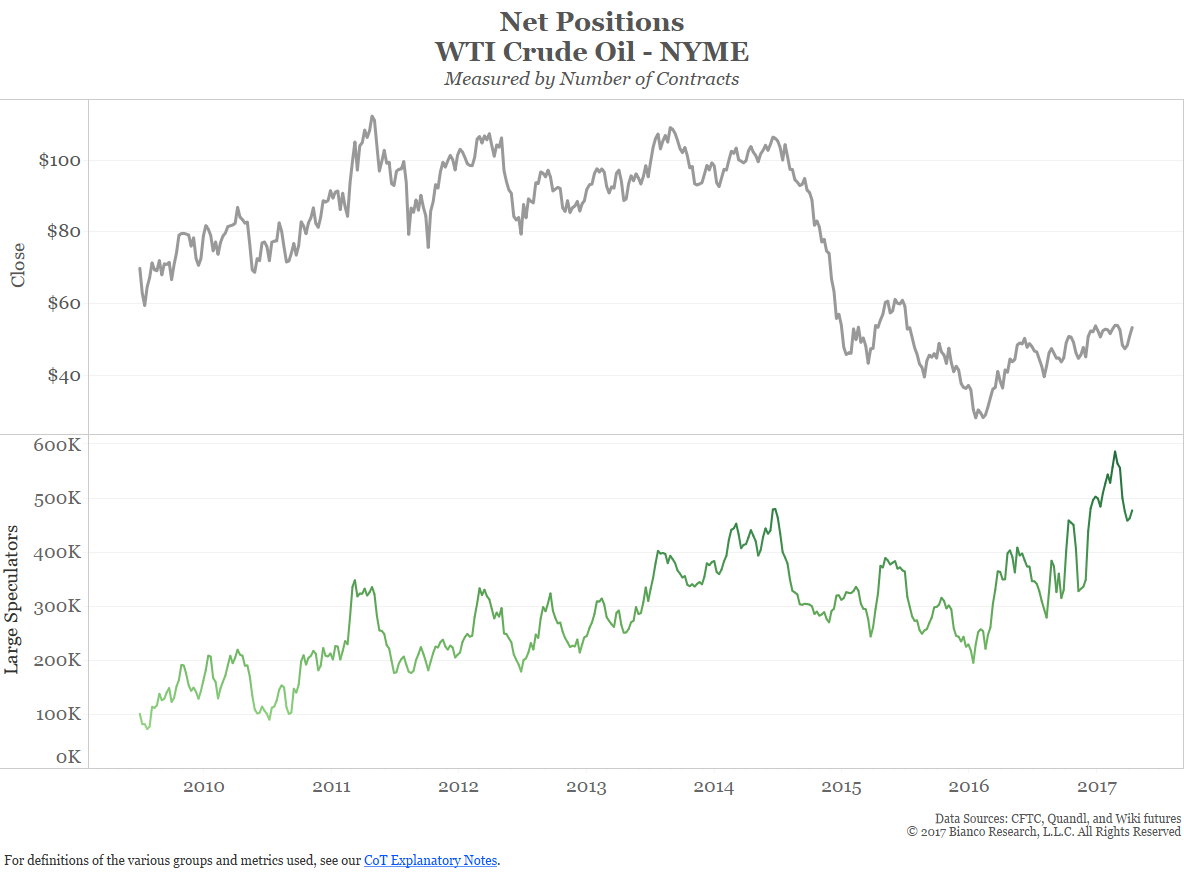

So I’ve often argued that the first move in crude oil is going to be $40. Looked like we were on our way about a month ago and then we came back into this $50 range one more time. I still think we got to get rid of this long base in crude oil. We still got to get rid of it. I still think that the price of crude oil is going to head lower as we move forward from here and so I don’t think you’re going to see that surge and that feeds into, when I’m into the Q&A as well too, that feeds into the piece that we talked about yesterday as well as I scroll back up.

Excuse me for going really fast here. The climbing commodity prices become a slippery slope for world growth. This chart here basically shows you the correlations between commodity prices and your GDP growth and you’ll notice if you look at the chart that the deeper the blue, the more correlated your GDP is to world growth. So Russia is, Canada is, Venezuela is, Norway is, and the more negative it is. Well, China and India aren’t because they’re not big commodity producers, but in general, what we go through and talk about in this piece here is commodity prices have peaked and they’re starting back down. The positioning in commodities, and this is the total positioning in commodities, was very long and they’re getting out. The idea here is that they’re going to struggle and that’s going to be a problem for emerging markets as we move forward from here. So the crude oil call is the same way with it.

Todd asks: “Now with your target as two and a quarter on 10s, to get to three from here, does that mean the market needs further confidence in Trump’s agenda or an uptake in the data?”

Answer: Yeah, I think that that’s fair. That if we go to two and a quarter on the 10-year by summer, what gets us to three next year is a belief, that’s the keyword, belief, that inflation is going to come back. Doesn’t mean we actually have to have it. We just have to have a belief it’s going to come back. What could get us a belief that inflation is coming back? An uptake in commodities, a rebelief in the Trump agenda. Let me define the Trump agenda. I know we live in a polarized world. I say Trump agenda and half the crowd repels in horror. The Trump agenda is narrowly defined here as cutting taxes, cutting regulations, and being business-friendly and the problem is that agenda is in doubt right now. So maybe it reemerges. This isn’t going to be next week, Trump’s going to hit 100 days of being president. That’s it, we’re not going to cut taxes. He might as well just quit. That’s it. It’s all over with. He’s got three and three quarter more years to reassert that agenda.

So yes, I do think that that agenda could be reasserted and that if he does reassert it, you will actually see a surge in the hard data, but we don’t have the hard data moving just yet as well too. Then you go on to say, the Trump agenda looks … Yeah, so let me read the second half of your question, “Trumps agenda or an uptake in data? If the political gridlock continues, Trump agenda looks less likely and hard data doesn’t converge with the survey data, would your ten-year ratings change at all? ”

Let me just be a little technical here. The political gridlock is within the Republican party. The Democrats don’t have the ability to stop them from raising taxes or cutting regulations or fostering a more pro-business-friendly environment. It’s all up to the Republicans to decide that they want to do this and it doesn’t really need to be a whole lot of wheeling and dealing with the Democrats. So keep in mind that the political gridlock is an unforced error on themselves. They can always at any moment decide they want to stop doing this and they want to move forward with this and that’s why I think that it can end real fast.

It can end real fast as well too as far as the political gridlock, but if it doesn’t you’re right. I would change my 10-year yield forecast and I think we’d go to two, two and a quarter and possible stay there, but for right now I think we’re going to go there. I think that in the second half of the year, late summer, early fall conference calls and stuff, I think we’ll be talking about a surge in interest rates and at that point I think it’ll be surging of interest rates without the giant short in the bond market, that that’s gone because everybody couldn’t take the pain anymore.

Geoffrey asks: “At one time, you thought relative rent levels would shift inflation up. How did this play out?” Rents and housing costs have gone up. Did rents have a lower impact on housing than thought?

Answer: You’re right. We used to talk a lot about that within core inflation that the biggest component within core inflation is a thing called owners equivalent rent or OER. That is what the word says. It is taking house prices, converting it to if you rented your house, what would the rent be and how does it change over time and that that is inflation. In other words, the reason they use OER is they’re trying to separate from your house, your house is both a financial asset and a physical asset

So if your house goes up in price because of a wealth effect and that home prices are going up, that’s not inflation, but if your house goes up in price because of inflation, then your rent would go up if you owner equivalent rented your house. So that’s what they’re trying to do with that number. The thing that’s interesting about that is it’s 40. Four zero percent of core CPI and it’s more like 20ish, 25ish percent of core PCE. PCE and CPI, use exactly the same inputs, just weighed up differently. It is a single measure. It is single measure. It’s not a measure of lots of different things averaged together and it’s produced by the BLS through a computer algorithm.

It is not something that they go out and they knock on your door and say, “Okay, Jim, if you were to rent your house today, what do you think you would ask for in terms of the rental price for your house?” Well I don’t live in a neighborhood where we rent houses and I wouldn’t rent my house. So I couldn’t even hazard a guess as to what they would be. They’d do that and so that’s what they’re trying to do.

So what I’ve argued in the past was owner’s equivalent rent is a big driver of core inflation and over the last couple of years, OER has rebounded and has been one of the big drivers of core inflation higher. That’s what we’ve seen happen. So I think that as we move forward from here, if there’s a possibility that we’re finally going to see inflation move above that 2% target that the Fed has had, OER is going to be a big player of it. It has been and I think it will continue to be. This is actually a good topic for me to discuss tomorrow in Newsclips. So I’ll try to trot out all those charts and re-update everything and I’ll put it out in Newsclips as well too

Derrick asks: “Do you feel actively managed U.S. equity strategies, with as a group if underperformed their benchmark for years, will ever stage a comeback? If so, what would you expect the catalyst to be?”

Answer: Yes. They will stage a comeback and the catalyst is fairly straightforward, a bear market. An index, keep in mind, is always fully invested and most indexes are price weighted or market cap weighted, which tend to be priced. What tends to happen with the indexes and here’s a good example of this. I’m going to type in the word Netflix on our search engine. What happens with the indexes is that the stocks that drive everything higher tend to be the big capped stocks. Big capped stocks by their nature tend to be overvalued and most people that have passed the CFA and manage money have learned that you don’t buy these kind of stocks.

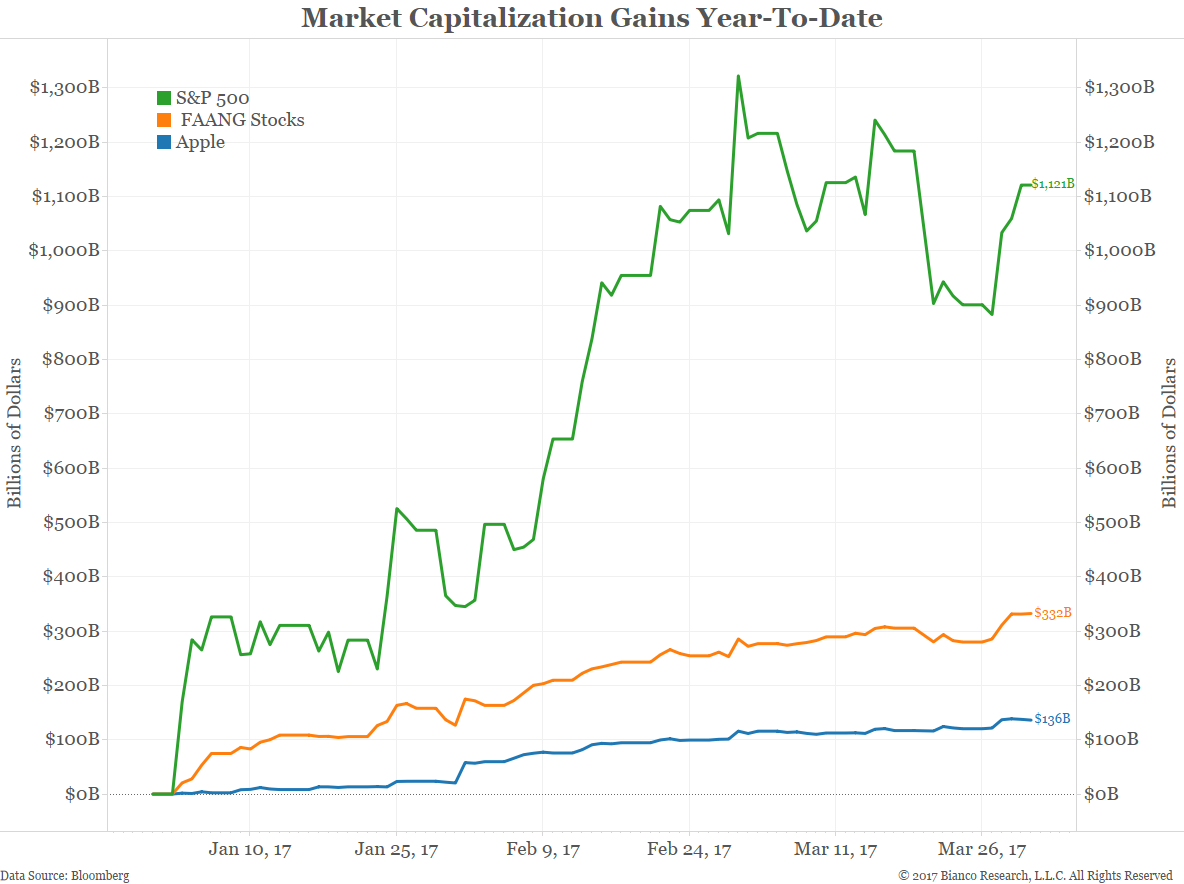

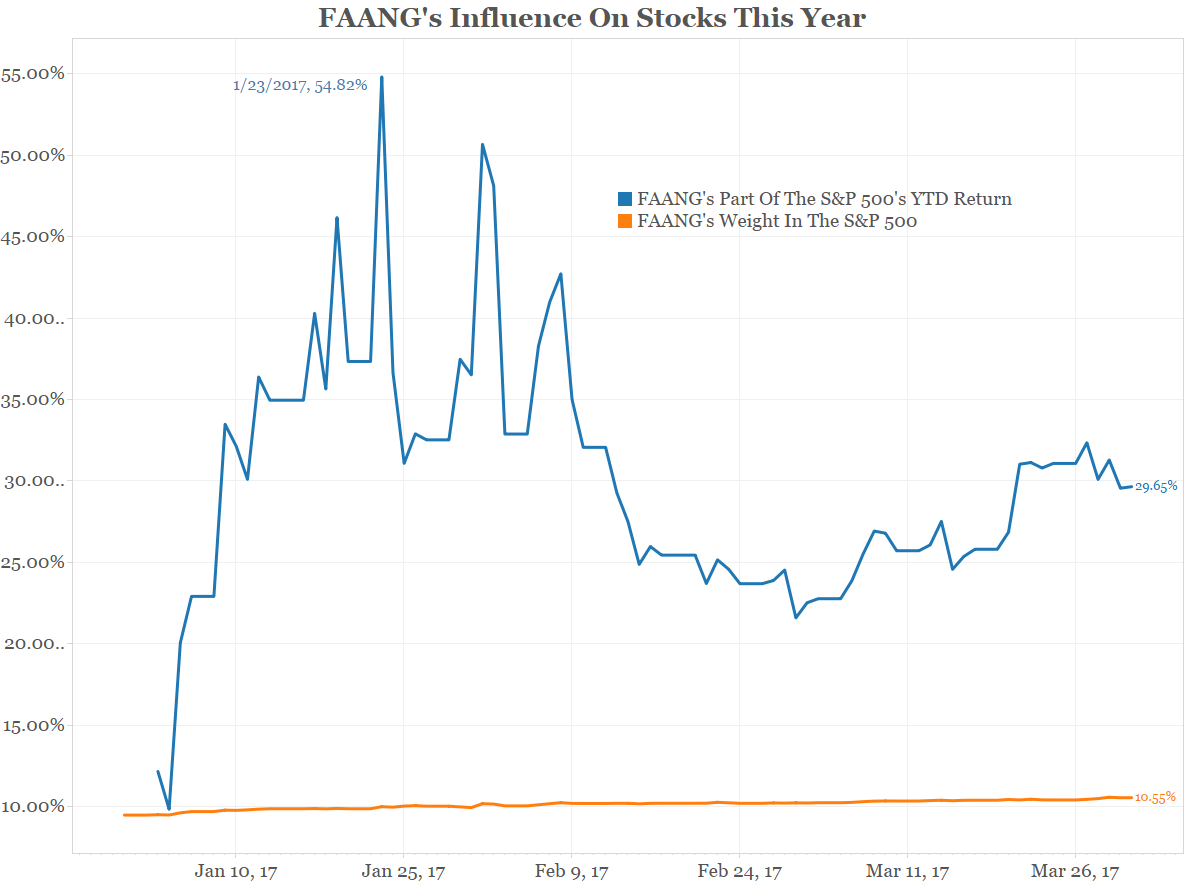

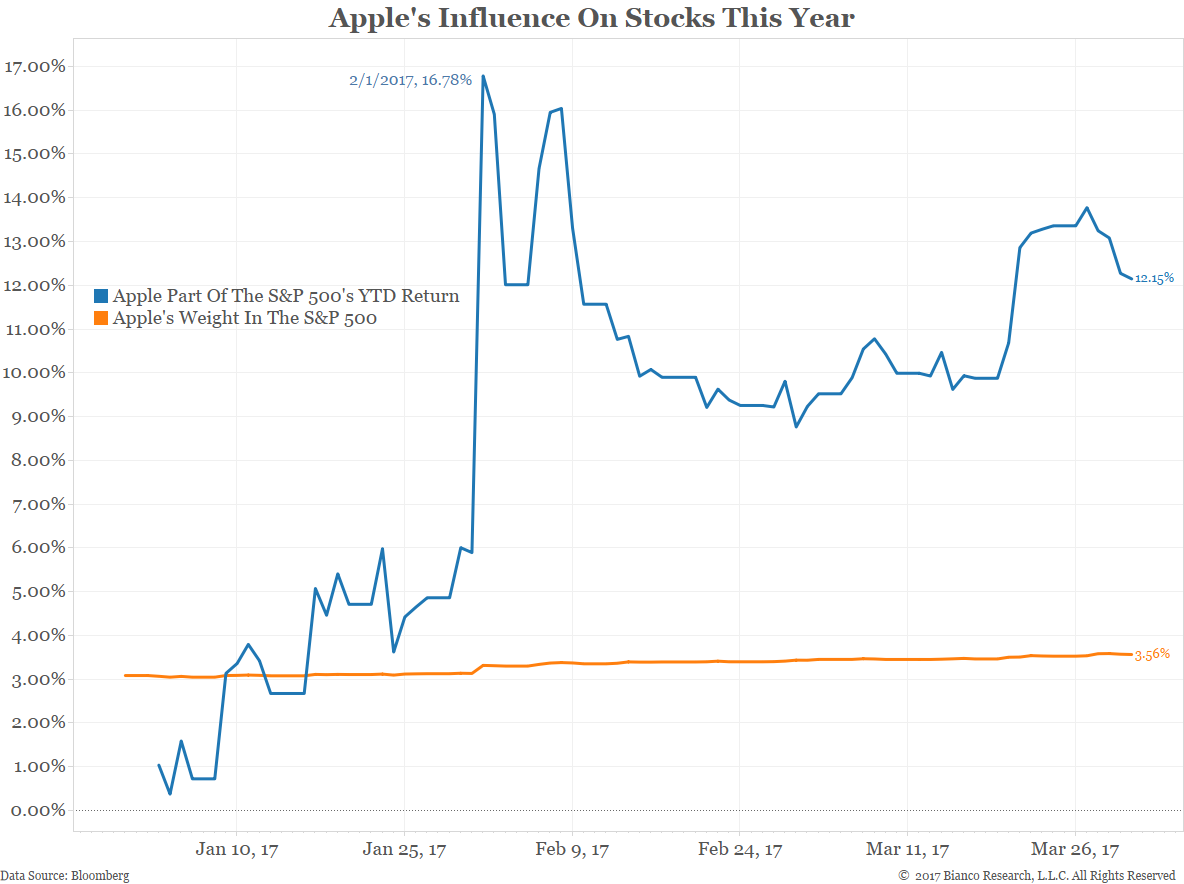

So on April 3rd, I typed in the word Netflix, we talked about the FANG stocks and in this case, we talked about Facebook, Amazon, Apple, so we’ve got two A’s in there, Netflix and Google. I kept the G for Google even though it’s technically alphabet because the acronym works. We pointed out that in the first quarter, these stocks had tremendous gains and you can see on an annualized basis, well over 100% for most of them and even Google, which lags and still way up more than the overall market.

The problem is if you look at most of their metrics on valuation and you passed CFA Level III, you wouldn’t touch these stocks because they’re all very highly overvalued and because they’re so big market caps, their influence grows and grows and grows as the market goes up. So there in lies the problem with active managers.

Now, I could write the same thing about the bond market. In the bond market, if you’re a global bond manager, the second largest weighting in your index is Japan. If you were to ask, what country has the worst fundamental sovereign debt, it’s Japan, but the only way to really outperform is you got to get that Japan bet right because it’s such a big part of a global bond index. I can keep going on and on with a lot of this as well too. So it becomes very narrowly focused.

So the first question is what would cause equity managers to outperform? The answer is, you got to get the FAANG stock call right. Now, the opposite works. If all these stocks have a terrible quarter like they did in the fourth quarter and you underweight them, then you outperform and there was a lot of stories in January. Hey, the equity guys had a pretty good fourth quarter. They really understand Trump. They’re going to turn the corner. No, the FANG stocks did bad because everybody thought after the election because Silicon Valley so hated Trump and was so anti-Trump that Trump was going to punish them, that their stocks slumped right after the election and since most managers are not overweighted these stocks, the stocks that they were underweighted took the indexes down and they outperformed, but then the reverse happened in the first quarter as well too.

So you go to get that call right. After that, if we have a bear market, the index is fully invested. Most managers are not. The index is highly weighted in these overvalued stocks. They get crushed worse than all of the other stocks, they outperform. Now what’s different about this cycle than any other cycle. Look, if this was 1974 and I was a friend of an overhead and had a meeting and we were talking about this, just trying to downgrade the technology to that period, exactly the same thing was true. The only difference is that technology has brought down the cost of creating an index to practically zero. So we could create thousands and thousands of ETS, sliced and diced every possible way you can imagine and probably 100 you never even thought of.

If you actually went and looked at the list of ETFs, you would not believe the number of ways that they’ve sliced and diced them up. Think She, S-H-E. All companies that have women CEOs. There’s actually an index of women CEOs and there’s actually an ETF. Now, I’m not trying to be sexist here, I’m just trying to say, wow, we’re really cutting this down and there’s all kind of things like that as well too. So that’s become cheap. So that the alternative is, the hell with the active manager. I can buy an index for practically nothing, has become into the frame of possibility and that’s what they have to compete with right now is those people as well.

So, yes, they will outperform in a bear market. Other than that, I read an interesting story. It was in the FT about two weeks ago, that basically said, maybe what active managers need to do is they need to rethink the role of an active manager and that currently, the role of an active manager is 80% of my portfolio looks like the index and then I tweak a little bit around the edges. I’ll overweight it a couple of sectors here, underweight it a couple of sectors there and then in this low cost index environment that’s just not going to work. Maybe what you need to be as a manager is a lot more out of index betting. Your beta maybe should be two or three times the index. You should just be making extreme bets on the market and people should understand that that’s what you do. That’s your value added.

When I win, I win big. When I lose, I lose big. You invest with me according to that schedule. That’s an idea that was thrown out there. There’s a place for bond managers as well too, but this 80% on the index and I overweight a couple things here and underweight a couple things there, when you’re done taking your fee versus practically taking no fee in an ETF, that’s going to be a problem. I think that that’s where the industry is right now, but a bear market will definitely bring it back.

That’s why I’ve often said that the interesting thing about it is that most active equity managers really bullish and they go on CNBC or Fox Business or Bloomberg and they’ve got that big smile on their face. Really bullish, start singing God Bless America, and the best thing to have in your business is a bear market because you will outperform the indexes. That will make a case for why an active manager is relevant and you’re out here telling me that stocks are never going to go down again, they’re going to keep going up. Well then I’ll take all my money away from you and I’ll put it in spiders and let them take the four basis points a year they take or whatever the low fee is and they’ll outperform you because they’ll all have a weighting in the FANG stocks that you’ll never approach and they’ll keep going and going.

So that’s the thing is that the industry has to evolve. That would be my guess. “On a global basis, do you have a view regarding the asset class segments, which are presently the most under or over valued right now?” I think that the most undervalued asset class, I’d have to get back to you on that one. I don’t want to start just pushing out just random names right now because I’ll forget some along the way, but I will say this, I think commodities are struggling and they’re going to probably go down. That’s probably going to hurt emerging. I think that sovereign yields will probably head lower from here, especially U.S. yields will head lower from here. I think that general develop market risk, markets like the S&P 500, the European stocks. I think will continue to pause as we decide what the next step will be from here as we go forward from here.

That’s it. I think I’ve got for this. Thank you. Hope you like the new format. Please shoot us any comments or criticisms about it. It is in flux. We are changing it. We are trying to make it simpler for everybody. The same analysis, just different way to deliver it. Feedback is always welcome.

Thanks and we’ll talk to you again at the next call.

End

Mark asks: “Updating our outlook for crude oil for the end of the year?”

Answer: I hinted at that a little bit before. The consensus opinion and I had this in Newsclips yesterday. As a matter of fact, one of the things I can do if I did this properly is I can go to Newsclips yesterday, if you’re on the webcast and I can show it to you. This is one of the reasons that I wanted to show this as well too is it gives me a little bit more of a freeform to go there as well too. We had a story yesterday in Newsclips, as I try and find it, that the price of crude oil is going to go to … Here it is, “Speculators’ big bet on crude oil. Citibank sees oil surging $10 as OPEC compacts, roaring U.S. sales. Undaunted by oil bus, financiers pour billions of dollars into U.S. sales.” That’s a Reuters’ story as well too.As I pointed out in looking at this chart that you’re looking at right here, which is the price of crude oil and the net position of the speculators, Citibank coming out and saying, “$10 surge in crude oil by the end of the year.” Congratulations. Everybody’s positioned for it. You’ve now told all of your customers, “Get ready for a $10 movement in crude oil.” I don’t have to do a trade, because I’m already there. That’s essentially what I’m trying to point out in a cynical way is that is the position in the market and that position has not been working for five months because we’re 50 bucks now in crude oil. We were 50 buck the day that OPEC announced its cut the day after Thanksgiving in November and that I don’t think we’re going to do it until we get rid of this short base.