Comment

The NFIB’s Uncertainty Index reported today for March remains well above its highest since prior to Trump’s election. However, the bond markets’ lack of volatility may be more a result of increased certainty over future growth. The arrival of Trump greatly raised the dispersion of growth expectations by economists, consumers, and business. But these expectations have steadily moderated throughout 2017.

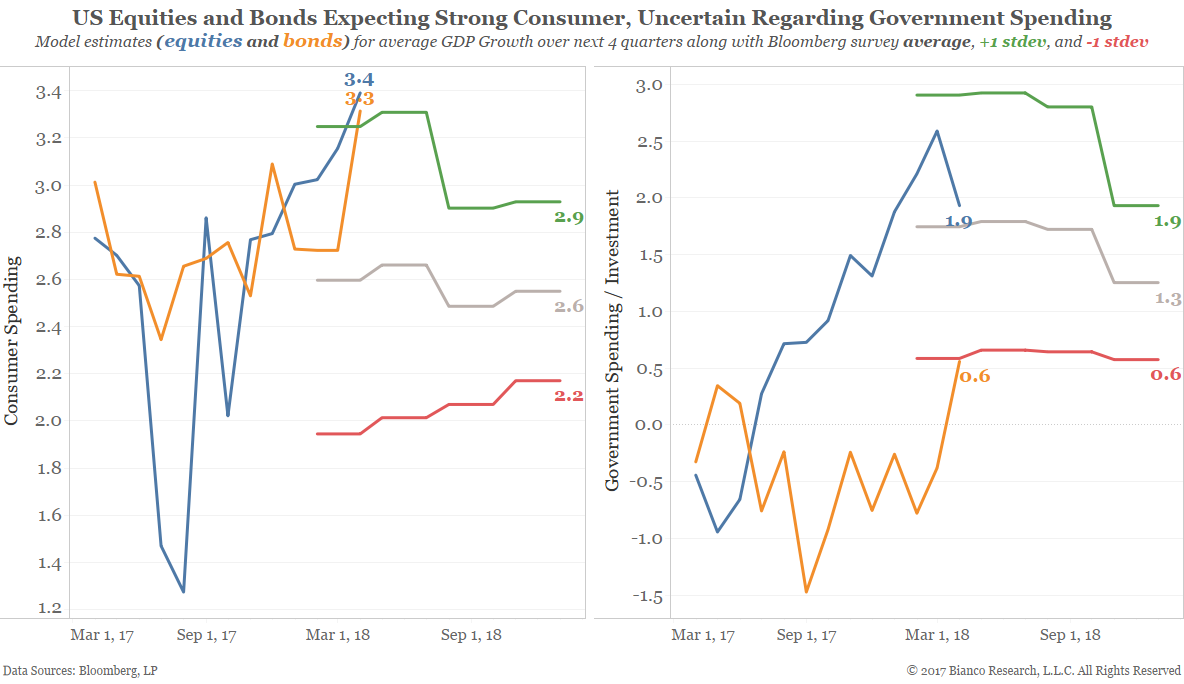

We have built models designed to indicate expected growth in consumer and government spending components of GDP. We forecast four-quarter averages of QoQ growth to avoid seasonality noise. The chart below shows expectations for sub-industries of the S&P 500 (blue line) and U.S. fixed income (orange line). Bloomberg’s median and +/- 1 standard deviation are shown for comparison. Fixed income includes U.S. Treasury, investment grade, high yield, and mortgage bonds.

Both equity and fixed income markets are expecting rock solid consumer spending near 3.3 to 3.4%, above the highest economist’s estimate. However, bonds are not yet buying into improved government spending like equities. U.S. fixed income expects government spending to average 0.6%, well below equities at 1.9%.

The chart below shows an index for the ranges (maximum – minimum) of major economic data (blue line) along with 40-day changes in U.S. 10-year note term premium (orange line). The bond’s markets measure of uncertainty, term premium, leads economists’ forecasts ranges.

The ranges of economists’ forecasts for major economic data are narrowing, in contrast, to still elevated uncertainty found in consumer and business surveys. The bond market’s uncertainty over future growth is falling as reflected in dwindling term premiums. Unlike the equity market, the bond market is not exactly a believer in an ultra-rosy outlook including stimulative government spending.

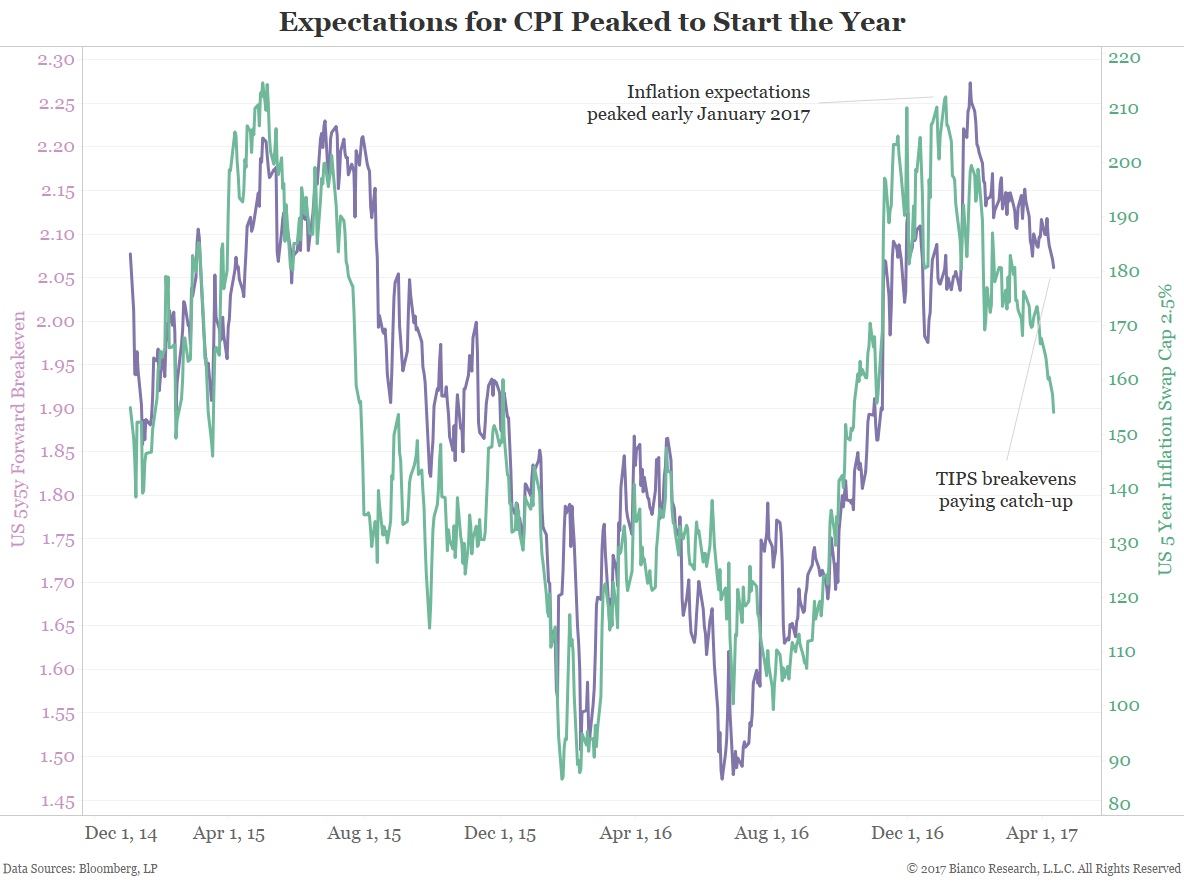

In addition, the bond market has greatly tempered inflation expectations. The chart below shows U.S. 5y5y forward breakevens and U.S. 5-year inflation swap caps (2.5%). Options markets on CPI show inflation expectations peaking to start 2017 with TIPS breakevens finally playing catch-up.

However, one ray of light for bond bears, which we know there are a lot of them, is an FOMC allowing inflation to run above its 2% target. Our forecast for core PCE (YoY), the FOMC’s preferred inflation measure, expects inflation to run above 2% at an 81% probability within the next 12 months.

The chart below shows probabilities of core PCE YoY rising greater than 50 bps, rising 25-50 bps, rising 0-25 bps, and falling. Major economic data releases are used by a model for classification to each of these possible inflation growth rates. The NFIB’s small business surveys are a major component.

We believe falling market-based inflation expectations will soon run their course. How much they recover depends on the FOMC’s pace of tightening, consumer spending rebound, and Trump policies.

Conclusion

- Equity and bond markets are not in agreement regarding GDP growth, specifically the government spending component. Bonds are not believers in an ultra-rosy growth outlook.

- High uncertainty in consumer and business surveys are not being matched by the bond market. Term premiums are falling along with economists’ forecast ranges.

- Inflation will remain on center stage as continued growth in core measures are likely. The decline in market-based inflation expectations will soon run its course.