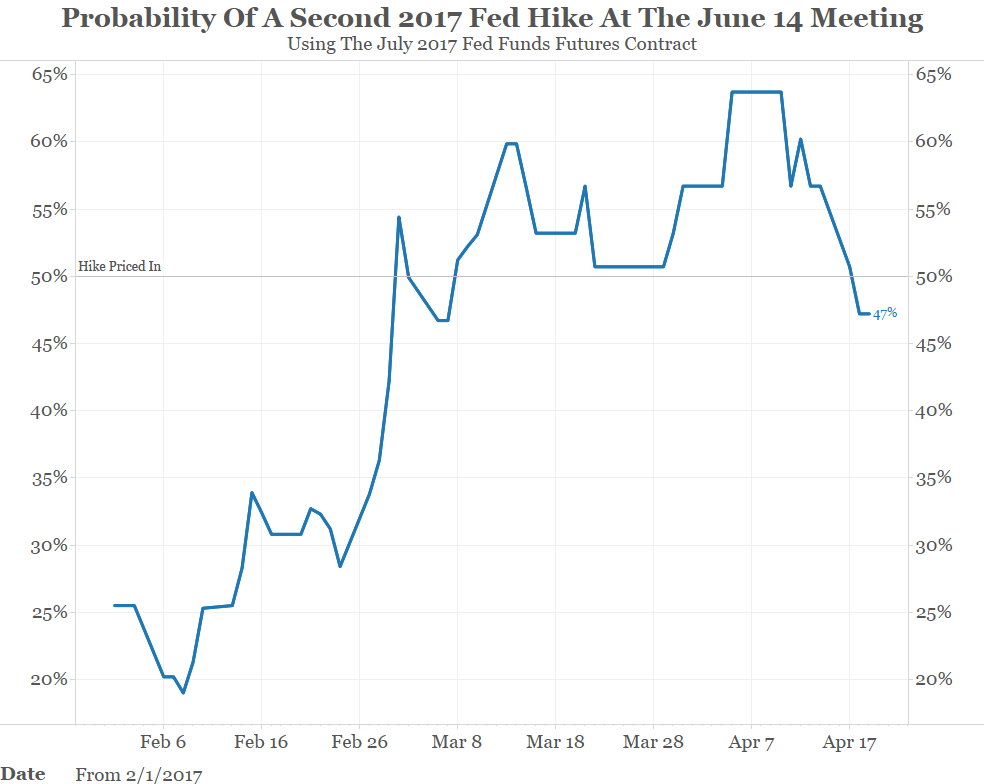

- Bloomberg Business – Fed June Hike Odds Below 50% After Inflation Expectations Tumble

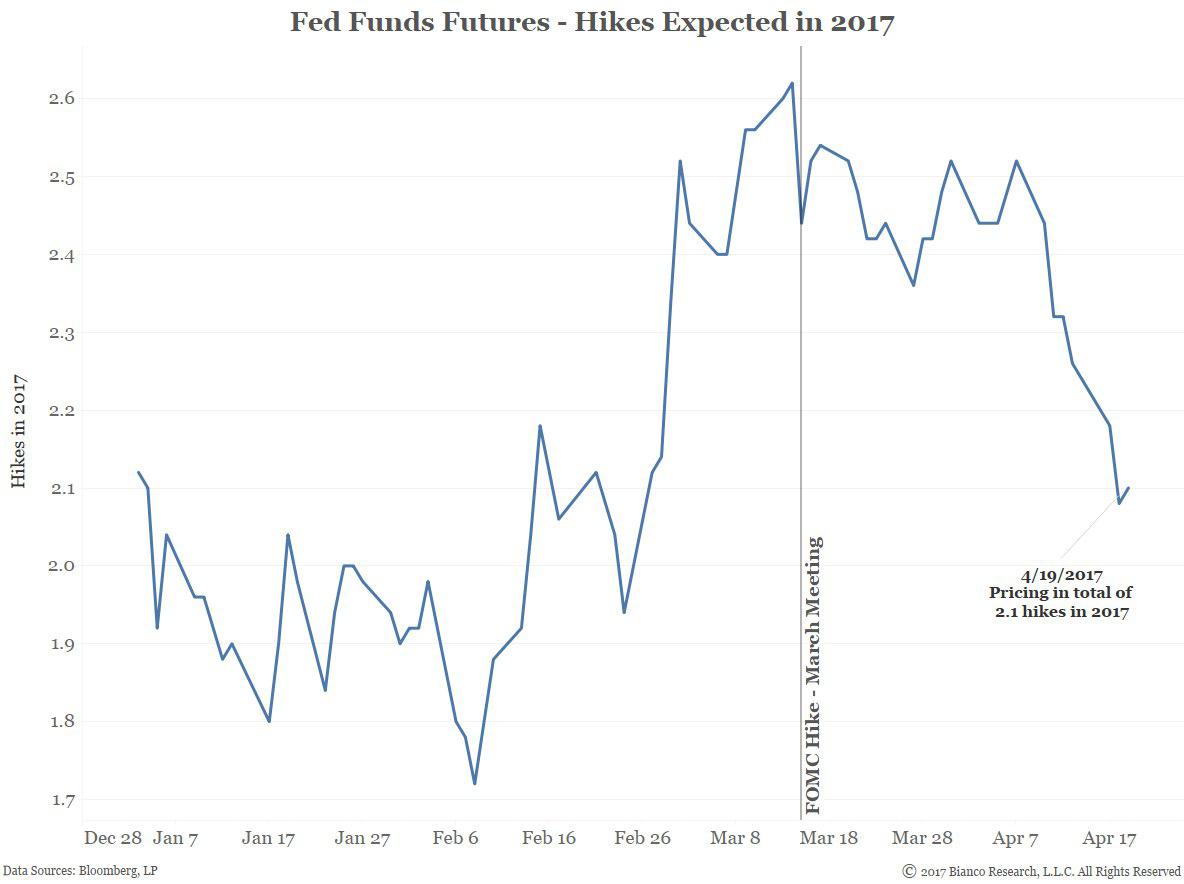

Traders are pulling back from bets the Federal Reserve will raise interest rates in June as inflation expectations crumble. The odds of a hike have fallen back to about 44 percent from more than 60 percent earlier this month, based on a gauge compiled by Bloomberg. Yields on federal funds futures contracts for June and July are retreating as investors scale back forecasts for a move. Two-year Treasuries, among the most sensitive to Fed policy expectations, are poised for their first two-month rally in a year. Investors are questioning the strength of the U.S. economy and the Fed’s plan to raise rates three times in 2017 after a weaker-than-expected March jobs gain and a surprise monthly drop in consumer prices. They’re also voicing disappointment that President Donald Trump’s proposed tax cuts and infrastructure spending plans have yet to materialize.

Comment

The chart above shows the odds of a rate hike at the June FOMC meeting are now under 50% (the odds of a hike at the May 3rd FOMC meeting are just 13%). While several Fed officials have talked about the virtues of reducing the balance sheet, the market simply thinks the Fed will be forced to move at a much slower pace. The markets remain calm because they aren’t buying what the Fed is selling, not because they have accepted a reduced balance sheet.

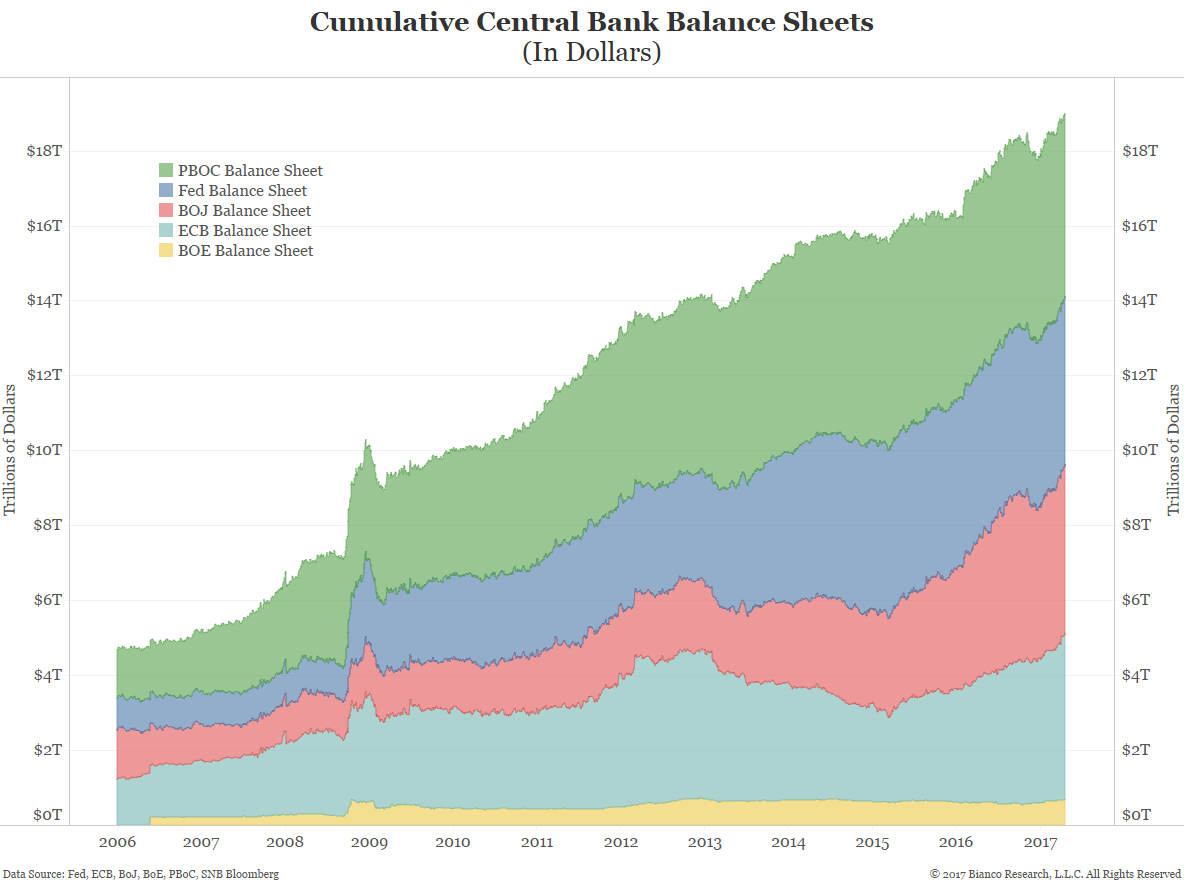

- Bloomberg Business – Markets Start to Ponder the $13 Trillion Gorilla in the Room

Fed officials discuss when to start reducing asset holdings

After heading into the uncharted territory of quantitative easing, the world’s central banks are starting to plan their course through the uncharted waters of quantitative tightening. How the Federal Reserve, European Central Bank and — eventually — the Bank of Japan handle the transition could make the difference between a global rerun of the 2013 “taper tantrum,” or the near undetectable market response to China’s run-down of U.S. Treasuries in recent years. Combined, the balance sheets of the three now total about $13 trillion, equating to greater than either China’s or the euro region’s economy. Former Fed Chair Ben S. Bernanke — who triggered the 2013 sell-off in risk assets with his quip on tapering asset purchases — has argued for a pre-set strategy to shrink the balance sheet. Current Vice Chairman Stanley Fischer says he doesn’t see a replay of the 2013 tantrum, but the best laid plans of central bankers would soon go awry if markets can’t digest the great unwinding.

Yesterday we highlighted Vice-Chairman Stan Fischer’s comment that the markets have accepted the idea of a reduced balance sheet. We disagreed and said:

Has it occurred to Fed officials that they have a credibility problem and the market does not believe them? Recall it was Fischer that said four hikes were “in the ballpark” for 2016. Obviously, this turned out to be off base.